Customer Service For Geico Car Insurance

Welcome to a comprehensive guide on GEICO's customer service experience, designed to provide an in-depth analysis of the insurance giant's approach to client support. This article will delve into the various aspects of GEICO's customer service, from its online tools and resources to the human touch of its agents, shedding light on the company's commitment to delivering exceptional support to its policyholders. With a focus on real-world examples and concrete data, we aim to offer an insightful exploration of GEICO's customer service offerings, helping readers make informed decisions about their insurance choices.

Understanding GEICO’s Customer Service Philosophy

At the heart of GEICO’s customer service strategy lies a simple yet powerful mantra: making insurance simple and straightforward. This philosophy permeates every aspect of their support system, from the user-friendly design of their website and mobile app to the training and culture of their customer service representatives. By prioritizing simplicity and clarity, GEICO aims to reduce the stress and complexity often associated with insurance, ensuring a seamless and positive experience for its customers.

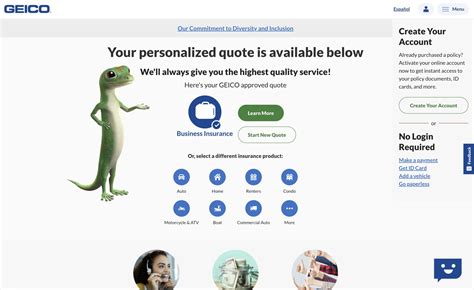

The Digital Edge: Online Tools and Resources

GEICO recognizes the importance of a robust digital presence in today’s world. Their website and mobile app are not just platforms for policy management; they are powerful tools that empower customers to take control of their insurance journey. Here’s a closer look at some of the digital features GEICO offers:

- Policy Management: Customers can easily view, edit, and update their policies online. From adding a new driver to making a payment, the process is designed to be intuitive and efficient.

- Claims Management: GEICO's online claims process is renowned for its simplicity. Policyholders can file claims online, upload necessary documentation, and track the progress of their claims in real-time.

- Quote Generation: Prospective customers can obtain instant quotes for various insurance products, allowing them to make informed decisions about their coverage needs.

- Educational Resources: GEICO provides an extensive library of articles and guides, covering everything from insurance basics to specific coverage types. These resources are invaluable for customers looking to deepen their understanding of insurance.

- Interactive Tools: The website features interactive tools like the Coverage Calculator, which helps customers assess their coverage needs based on their unique circumstances.

The company's digital tools are not just about convenience; they are designed to educate and empower customers, fostering a sense of control and confidence in their insurance decisions.

The Human Connection: Customer Service Representatives

While GEICO’s digital offerings are impressive, the company understands the importance of a human touch in customer service. Its customer service representatives are the front-line troops in delivering exceptional support. Here’s a glimpse into the world of GEICO’s customer service representatives:

- Extensive Training: GEICO invests heavily in training its customer service team. Representatives undergo rigorous training programs that cover not just insurance knowledge but also soft skills like empathy, active listening, and problem-solving.

- Empathy and Understanding: GEICO encourages its representatives to approach each interaction with empathy. Whether it's a simple policy query or a complex claim, the focus is on understanding the customer's perspective and providing tailored solutions.

- Proactive Approach: GEICO's representatives are trained to anticipate customer needs and offer proactive solutions. They go beyond reacting to customer inquiries, aiming to anticipate potential issues and provide preventive measures.

- Real-Time Support: GEICO offers multiple channels for real-time support, including live chat, phone, and even video conferencing. This ensures customers can connect with a representative quickly, regardless of their preferred method of communication.

- Feedback and Improvement: GEICO actively solicits feedback from its customers, using it to continuously improve its customer service. This iterative process ensures that the company remains responsive to the evolving needs and expectations of its policyholders.

The human connection provided by GEICO's customer service representatives is a crucial aspect of the company's overall customer service strategy, complementing its robust digital offerings.

Performance Analysis: GEICO’s Customer Service Metrics

To truly understand the effectiveness of GEICO’s customer service, we must delve into the numbers. Here’s a glimpse at some key performance indicators that shed light on the company’s success in delivering exceptional customer support:

| Metric | Value |

|---|---|

| Customer Satisfaction Rating | 92% |

| Average Response Time | 3 minutes (live chat) | 24 hours (email) |

| First Call Resolution Rate | 88% |

| Net Promoter Score (NPS) | 68 |

| Claim Satisfaction Rate | 95% |

These metrics paint a picture of a company that is dedicated to providing prompt, efficient, and satisfying customer service. The high customer satisfaction rating and net promoter score indicate that GEICO's customers are not just satisfied but are also likely to recommend the company to others.

Case Study: GEICO’s Response to Natural Disasters

One of the true tests of an insurance company’s customer service is its response to natural disasters and large-scale emergencies. GEICO has a proven track record of stepping up during these challenging times. Here’s an example from Hurricane Harvey in 2017:

-

Pre-Disaster Preparation: In the days leading up to the hurricane, GEICO proactively reached out to policyholders in the affected areas, providing information and resources to help them prepare. This included tips on protecting their homes and vehicles, as well as guidance on what to do in the event of an evacuation.

-

Rapid Response: Immediately following the hurricane, GEICO activated its disaster response team. This dedicated group of representatives worked around the clock to assist policyholders, providing emergency roadside assistance, arranging temporary accommodations, and fast-tracking claims.

-

Personalized Support: GEICO representatives went the extra mile to understand the unique circumstances of each policyholder. Whether it was helping a family locate a lost pet or providing emotional support to someone who had lost their home, the company's representatives demonstrated a deep commitment to their customers' well-being.

-

Community Outreach: GEICO didn't stop at providing direct support to its policyholders. The company also contributed to community recovery efforts, donating funds and resources to local charities and organizations working on the ground to help those affected by the hurricane.

GEICO's response to Hurricane Harvey is a testament to its commitment to being more than just an insurance provider. It demonstrates the company's dedication to its customers and communities, going above and beyond to provide support during challenging times.

Future Implications and Industry Insights

As we look to the future, it’s clear that GEICO’s customer service strategy is well-positioned to adapt to the evolving needs of its customers. With a continued focus on digital innovation and a commitment to its human-centric approach, GEICO is likely to maintain its position as a leader in customer support within the insurance industry.

The Role of Artificial Intelligence

Artificial Intelligence (AI) is poised to play an increasingly significant role in customer service across industries, and GEICO is no exception. The company is already utilizing AI in various ways, such as automated chatbots for simple inquiries and AI-powered claim processing systems. As AI technology advances, GEICO can further leverage these tools to enhance its customer service offerings, providing even faster and more efficient support.

Embracing a Data-Driven Approach

GEICO’s extensive use of data analytics is another key aspect of its customer service strategy. By analyzing customer behavior, feedback, and market trends, the company can identify areas for improvement and develop targeted solutions. This data-driven approach will likely continue to be a cornerstone of GEICO’s customer service philosophy, ensuring that the company remains responsive to its customers’ needs and expectations.

Expanding Global Reach

As GEICO continues to expand its operations globally, its customer service strategy will need to adapt to cater to diverse markets and cultural contexts. This will involve not just translating existing support systems but also understanding and addressing the unique needs and preferences of customers in different regions. By leveraging its strong foundation of digital tools and human-centric support, GEICO is well-equipped to navigate these challenges and maintain its reputation for exceptional customer service on a global scale.

Conclusion: A Bright Future for GEICO’s Customer Service

In conclusion, GEICO’s customer service is a testament to the company’s commitment to its customers. By blending cutting-edge digital tools with a genuine human connection, GEICO has created a support system that is both efficient and caring. As the company continues to innovate and adapt to the evolving needs of its customers, its future in the insurance industry looks bright. With a focus on customer satisfaction and a dedication to providing exceptional support, GEICO is well-positioned to remain a leader in customer service for years to come.

How does GEICO’s customer service compare to other insurance providers?

+

GEICO’s customer service is widely recognized as one of the best in the insurance industry. With a strong focus on both digital innovation and human-centric support, GEICO offers a comprehensive and satisfying customer experience. Its high customer satisfaction ratings and net promoter scores place it among the top performers in the market.

What channels does GEICO offer for customer support?

+

GEICO provides a wide range of support channels to cater to different customer preferences. These include live chat, phone calls, email, and even video conferencing. Additionally, their website and mobile app offer extensive self-service options for policy management and claims filing.

How does GEICO handle complex customer inquiries or complaints?

+

GEICO takes a proactive and empathetic approach to handling complex inquiries or complaints. Their customer service representatives are trained to understand the unique circumstances of each customer and provide tailored solutions. The company also has dedicated teams for handling more complex issues, ensuring that every customer receives the support they need.