Best Price For Car Insurance

Finding the best price for car insurance can be a challenging task, especially with the vast number of insurance providers and policies available. Each insurer offers unique coverage options, discounts, and pricing structures, making it crucial to conduct a thorough comparison to secure the most competitive rates. In this comprehensive guide, we will delve into the factors that influence car insurance rates, explore effective strategies to obtain the best prices, and provide valuable insights to ensure you make an informed decision.

Understanding the Factors that Impact Car Insurance Rates

Car insurance rates are influenced by a multitude of factors, each playing a significant role in determining the overall cost of your policy. By understanding these factors, you can better navigate the insurance landscape and identify potential areas for savings.

Demographics and Personal Information

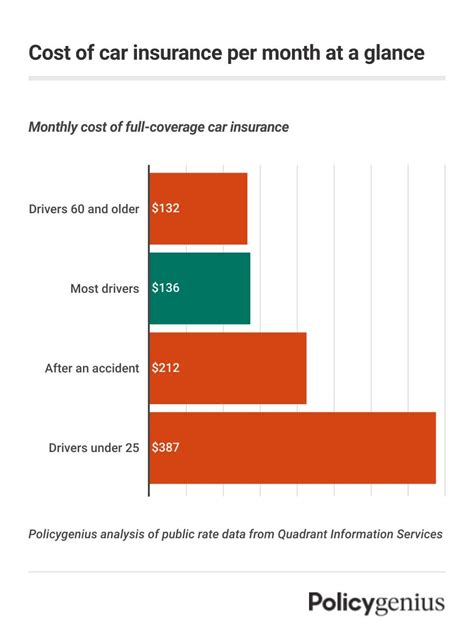

Insurance providers consider various demographic factors when calculating insurance rates. Age, gender, marital status, and even credit score can impact the price you pay for car insurance. For instance, younger drivers, especially those under 25, often face higher premiums due to their perceived higher risk profile. Similarly, single individuals may pay more compared to married couples, as insurers associate marriage with more stable and responsible behavior.

| Demographic Factor | Impact on Rates |

|---|---|

| Age | Younger drivers pay more; rates decrease with age. |

| Gender | Gender may influence rates, with some insurers charging different premiums for males and females. |

| Marital Status | Married individuals often receive discounts, as insurers view them as more responsible. |

| Credit Score | A higher credit score can lead to lower insurance rates, as insurers associate financial responsibility with lower risk. |

Vehicle Factors

The type of vehicle you drive and its features can significantly impact your insurance rates. High-performance cars, luxury vehicles, and sports cars often attract higher premiums due to their increased likelihood of accidents and higher repair costs. Additionally, the age and safety features of your vehicle play a role in determining insurance costs.

Driving History and Claims

Your driving record is a crucial factor in insurance pricing. A clean driving history, free from accidents and traffic violations, can lead to lower insurance rates. Conversely, a history of accidents or traffic citations may result in higher premiums. Insurers view individuals with a history of claims as higher risk, leading to increased costs.

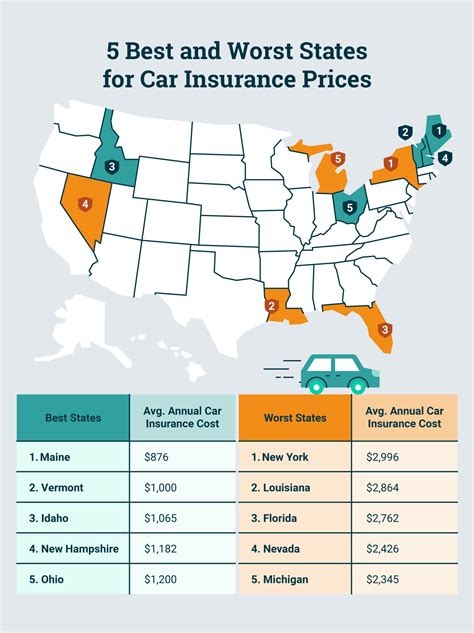

Location and Usage

The area where you live and use your vehicle can influence insurance rates. Urban areas often have higher insurance costs due to increased traffic and the higher likelihood of accidents. Additionally, the purpose of your vehicle usage, whether for commuting, pleasure, or business, can impact your insurance rates. Business usage, for instance, may lead to higher premiums due to the increased mileage and potential for accidents.

Coverage and Deductibles

The level of coverage you choose and the deductibles you select can significantly impact your insurance premiums. Comprehensive and collision coverage, which provide protection for damage to your vehicle, can increase your insurance costs. However, higher deductibles, which are the amount you pay out of pocket before insurance coverage kicks in, can lower your premiums.

Strategies to Find the Best Car Insurance Prices

Now that we have explored the factors influencing car insurance rates, let’s dive into effective strategies to help you secure the best prices.

Shop Around and Compare

One of the most effective ways to find the best car insurance prices is to shop around and compare quotes from multiple insurers. Each insurance provider has its own pricing structure and discounts, so obtaining quotes from various companies allows you to identify the most competitive rates.

- Use online comparison tools: Online insurance marketplaces and comparison websites can provide you with multiple quotes from different insurers in one place. These tools often have partnerships with various insurance providers, ensuring a wide range of options.

- Contact insurance providers directly: Reach out to insurance companies directly to request quotes. This allows you to have a more personalized discussion about your coverage needs and potential discounts.

- Consider local and regional insurers: Don't overlook local and regional insurance providers, as they may offer competitive rates tailored to your specific area.

Bundle Policies and Explore Discounts

Bundling your insurance policies, such as combining your car insurance with home or renters insurance, can often lead to significant savings. Many insurance providers offer multi-policy discounts, rewarding customers who choose to bundle their coverage.

Additionally, explore other discounts that may apply to your situation. These can include safe driver discounts, good student discounts, loyalty discounts, and discounts for safety features in your vehicle. Every insurer offers different discounts, so be sure to inquire about all potential savings opportunities.

Review Coverage and Adjust Deductibles

Review your current insurance coverage to ensure you are not overpaying for unnecessary features. Assess whether you truly need comprehensive and collision coverage, especially if you drive an older vehicle. If your vehicle has low resale value, dropping these coverages may result in significant savings.

Consider increasing your deductibles. While higher deductibles mean you pay more out of pocket in the event of a claim, they can lead to lower premiums. Assess your financial situation and comfort level with risk to determine the appropriate deductible amount.

Improve Your Driving Record

A clean driving record is not only essential for your safety but also for keeping your insurance premiums low. Avoid traffic violations and strive to maintain a safe driving behavior. If you have a history of accidents or traffic citations, consider taking a defensive driving course. Many insurers offer discounts for completing such courses, and it can also help improve your driving skills and reduce the likelihood of future accidents.

Explore Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach that allows insurers to track your driving behavior and reward safe driving habits with lower premiums. This type of insurance uses a small device installed in your vehicle or a smartphone app to monitor your driving habits, such as acceleration, braking, and mileage.

By signing up for usage-based insurance, you may be able to save money if you exhibit safe driving behaviors. However, keep in mind that this approach may not be suitable for everyone, as it requires constant monitoring of your driving habits.

Maintain a Good Credit Score

Your credit score is an important factor in determining your insurance rates. Maintaining a good credit score can lead to lower insurance premiums, as insurers view individuals with strong credit as more financially responsible and less likely to file claims.

If you have a low credit score, focus on improving it. Pay your bills on time, reduce your debt, and monitor your credit report for any errors. By improving your credit score, you may be able to qualify for lower insurance rates in the future.

Negotiating Car Insurance Rates

Negotiating car insurance rates is a common practice, and many insurance providers are open to discussions about pricing. Here are some tips to help you negotiate effectively:

- Gather multiple quotes: Before contacting your insurance provider, ensure you have quotes from several competitors. This allows you to negotiate with confidence, as you can leverage the competitive rates you've found.

- Understand your coverage: Be knowledgeable about your current coverage and the specific features you require. This ensures you are not paying for unnecessary add-ons.

- Discuss discounts: Inquire about all potential discounts that may apply to your situation. Many insurers offer loyalty discounts, safe driver discounts, and other incentives to retain customers.

- Negotiate deductibles: Discuss the possibility of adjusting your deductibles to lower your premiums. However, ensure you can afford the higher out-of-pocket expenses in the event of a claim.

- Consider long-term savings: While negotiating, keep in mind that long-term savings are often more valuable than short-term discounts. Opt for a stable insurance provider with competitive rates and excellent customer service.

The Future of Car Insurance Pricing

The car insurance industry is constantly evolving, and new technologies and trends are shaping the way premiums are calculated. Here are some future implications and trends to consider:

Telematics and Data-Driven Insurance

Usage-based insurance, or telematics, is expected to become more prevalent in the future. As technology advances, insurers will have access to even more data about your driving habits, allowing them to offer more personalized and accurate insurance rates.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning algorithms are being utilized by insurance providers to analyze vast amounts of data and predict potential risks. These technologies can help insurers identify patterns and trends, leading to more accurate pricing models and better risk assessment.

Autonomous Vehicles and Safety Innovations

The rise of autonomous vehicles and advanced safety features is expected to have a significant impact on car insurance rates. As these technologies become more widespread, the likelihood of accidents may decrease, potentially leading to lower insurance premiums in the future.

Data Privacy and Regulation

With the increasing use of data-driven insurance, data privacy and regulation become crucial considerations. Insurers must adhere to strict guidelines to protect customer data and ensure fair pricing practices. As regulations evolve, insurers will need to adapt their data collection and usage methods to comply with legal requirements.

Conclusion

Finding the best price for car insurance requires a comprehensive understanding of the factors that influence rates and a strategic approach to shopping around and negotiating. By exploring multiple options, bundling policies, and maintaining a good driving record, you can significantly reduce your insurance costs. Additionally, staying informed about the latest trends and technologies in the insurance industry can help you anticipate future changes and make informed decisions.

How often should I review my car insurance policy and shop around for better rates?

+It’s recommended to review your car insurance policy and shop around for better rates at least once a year. Insurance providers regularly update their pricing structures and introduce new discounts, so staying informed and comparing quotes annually can help you identify potential savings.

Can I negotiate my car insurance rates if I’ve had an accident or traffic violation?

+Yes, you can still negotiate your car insurance rates even if you’ve had an accident or traffic violation. While these incidents may impact your premiums, it’s worth discussing your situation with your insurance provider. They may offer discounts for safe driving behavior or provide options to mitigate the impact of the incident on your rates.

Are there any downsides to usage-based insurance?

+Usage-based insurance can be a great option for safe drivers, but it may not suit everyone. If you drive frequently or have a history of accidents, your premiums may increase under this type of insurance. Additionally, privacy concerns are a valid consideration, as your driving behavior is constantly monitored. It’s essential to carefully weigh the benefits and drawbacks before opting for usage-based insurance.