Homeowners Insurance Calculated

Homeowners insurance is a crucial aspect of financial planning and asset protection for homeowners. It provides coverage for various risks and liabilities associated with owning a home, offering peace of mind and financial security. However, understanding how homeowners insurance is calculated can be complex. In this comprehensive guide, we will delve into the factors that influence insurance premiums and provide insights into the calculation process, helping homeowners make informed decisions about their coverage.

The Basics of Homeowners Insurance

Homeowners insurance is a type of property insurance designed to protect homeowners from financial losses arising from unexpected events such as natural disasters, theft, and liability claims. It covers the structure of the home, its contents, and provides liability protection for the homeowner. The coverage extends to various aspects, including dwelling coverage, personal property coverage, liability protection, and additional living expenses.

Dwelling Coverage

Dwelling coverage is the foundation of homeowners insurance. It provides protection for the physical structure of the home, including the walls, roof, and permanent fixtures. This coverage ensures that in the event of a covered loss, the homeowner can rebuild or repair their home. The amount of dwelling coverage required is typically based on the replacement cost of the home, which takes into account the cost of rebuilding the home with similar materials and construction techniques.

| Dwelling Coverage Type | Description |

|---|---|

| Replacement Cost | Pays to rebuild the home at current market prices, regardless of the original cost. |

| Actual Cash Value | Provides coverage based on the current value of the home, considering depreciation. |

Personal Property Coverage

Personal property coverage protects the contents of the home, including furniture, appliances, electronics, and personal belongings. This coverage ensures that homeowners can replace or repair damaged items due to covered perils. The amount of personal property coverage is typically a percentage of the dwelling coverage, and it’s important to assess the value of your belongings accurately to ensure adequate coverage.

Liability Protection

Liability protection is a critical component of homeowners insurance. It provides coverage for bodily injury or property damage claims made against the homeowner. This coverage safeguards homeowners from financial losses arising from accidents or injuries that occur on their property. Liability limits vary, and it’s essential to choose an appropriate limit based on your specific needs and potential risks.

Additional Living Expenses

In the event of a covered loss that renders the home uninhabitable, additional living expenses coverage kicks in. It covers the costs of temporary housing, meals, and other necessary expenses until the home is repaired or rebuilt. This coverage ensures that homeowners can maintain their standard of living during the recovery process.

Factors Influencing Homeowners Insurance Premiums

Homeowners insurance premiums are determined by a combination of factors, each playing a role in assessing the risk associated with insuring a particular home. Insurance companies use these factors to calculate the likelihood of a claim and determine the appropriate premium. Here are some key factors that influence homeowners insurance premiums:

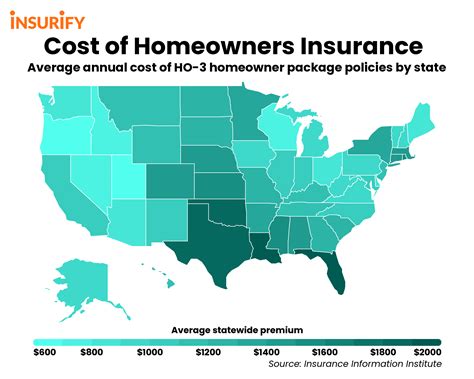

Location

The location of the home is a significant factor in determining insurance premiums. Insurance companies consider the geographical location and assess the risk of natural disasters, such as hurricanes, earthquakes, or floods. Areas prone to these events may have higher premiums to account for the increased likelihood of claims.

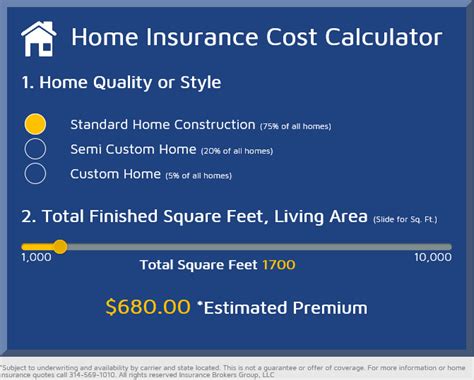

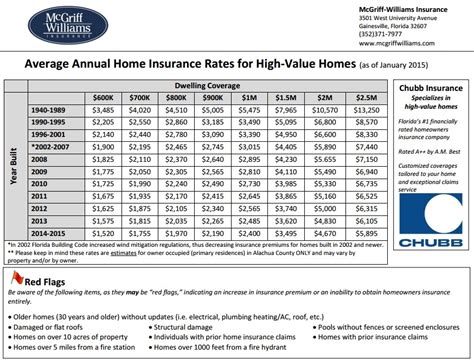

Home Value and Construction

The value and construction of the home are crucial factors. Insurance companies assess the replacement cost of the home, considering factors such as the size, age, and construction materials. Homes with higher replacement costs generally require higher premiums to ensure adequate coverage.

Coverage Limits and Deductibles

The coverage limits and deductibles chosen by the homeowner impact the premium. Higher coverage limits provide more extensive protection but may result in higher premiums. Conversely, opting for a higher deductible can lower premiums, as it reduces the insurer’s financial exposure.

Claim History

The claim history of the homeowner and the neighborhood can influence premiums. Insurance companies analyze past claims to assess the risk of future claims. Homes with a history of frequent claims may face higher premiums, as they pose a greater financial risk to the insurer.

Credit Score

Surprisingly, the homeowner’s credit score can also impact insurance premiums. Insurance companies use credit-based insurance scores to assess the risk associated with insuring a particular individual. A higher credit score may result in lower premiums, as it indicates a lower likelihood of filing claims.

Security and Safety Features

The presence of security and safety features in the home can lead to premium discounts. Insurance companies often offer incentives for homes equipped with features such as burglar alarms, fire sprinklers, and deadbolt locks, as these measures reduce the risk of theft and fire-related claims.

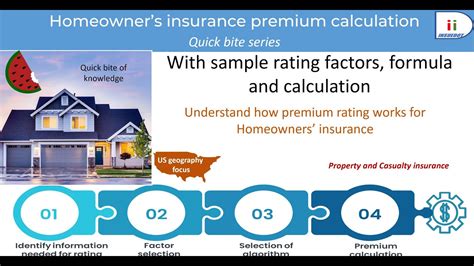

Calculating Homeowners Insurance Premiums

The calculation of homeowners insurance premiums involves a complex process that considers the various factors mentioned above. Insurance companies use actuarial science and statistical analysis to determine the likelihood of claims and set appropriate premiums. Here’s a simplified breakdown of the calculation process:

Step 1: Assessing Risk Factors

Insurance companies gather information about the home, including its location, construction, and claim history. They also consider the chosen coverage limits, deductibles, and any applicable discounts.

Step 2: Calculating Base Premium

Based on the assessed risk factors, insurance companies determine a base premium. This base premium represents the initial cost of insuring the home, considering the likelihood of claims and the chosen coverage limits.

Step 3: Applying Discounts and Surcharges

Insurance companies may apply discounts or surcharges to the base premium based on specific factors. For example, homes with security features or a good claim history may receive discounts, while homes in high-risk areas may incur surcharges.

Step 4: Adjusting for Individual Factors

The final premium is adjusted based on individual factors, such as the homeowner’s credit score and any additional coverage options chosen. This step ensures that the premium reflects the specific risk profile of the homeowner.

Understanding Your Homeowners Insurance Policy

When obtaining homeowners insurance, it’s crucial to thoroughly understand your policy and its coverage. Here are some key considerations:

Policy Types

There are different types of homeowners insurance policies, including HO-1, HO-2, HO-3, and HO-5. Each policy type offers varying levels of coverage, so it’s essential to choose the one that aligns with your needs and the risks associated with your home.

Exclusions and Limitations

Homeowners insurance policies typically have exclusions and limitations. It’s important to review these carefully to understand what is not covered. Common exclusions include flood damage, earthquake damage, and damage caused by pests or vermin.

Policy Endorsements and Riders

Policy endorsements and riders are additional coverage options that can be added to your policy. These allow you to customize your coverage to meet specific needs, such as covering high-value items or providing additional liability protection.

Tips for Lowering Homeowners Insurance Premiums

While homeowners insurance is essential, there are ways to potentially lower your premiums. Here are some tips to consider:

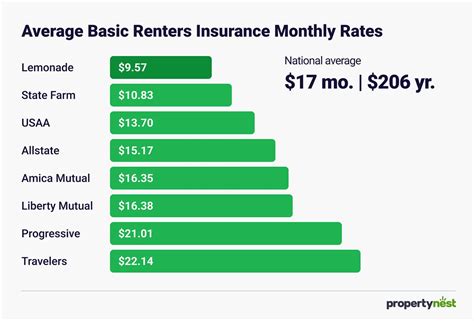

Shop Around

Compare quotes from multiple insurance companies. Rates can vary significantly, so shopping around can help you find the most competitive premiums.

Bundle Policies

Consider bundling your homeowners insurance with other policies, such as auto insurance. Many insurance companies offer discounts for bundling multiple policies, resulting in lower overall premiums.

Improve Home Security

Investing in home security measures, such as burglar alarms and fire safety equipment, can lead to premium discounts. These measures not only protect your home but also reduce the risk of claims, making you a more attractive insurance candidate.

Increase Deductibles

Opting for a higher deductible can lower your premiums. However, it’s essential to choose a deductible amount that you can comfortably afford in the event of a claim.

Maintain a Good Credit Score

Maintaining a good credit score can positively impact your insurance premiums. A higher credit score indicates financial stability and may result in lower rates.

Future Trends and Considerations

The homeowners insurance industry is evolving, and several trends and considerations are worth noting:

Technology Integration

Insurance companies are increasingly leveraging technology to enhance the insurance experience. This includes the use of digital tools for policy management, claims processing, and risk assessment. Homeowners can expect more efficient and personalized insurance services as technology advances.

Climate Change and Natural Disasters

Climate change is expected to impact homeowners insurance in the coming years. With an increase in extreme weather events, insurance companies may adjust their rates and coverage options to account for the heightened risk. Homeowners in areas vulnerable to natural disasters should stay informed about potential changes to their insurance policies.

Telematics and Usage-Based Insurance

Usage-based insurance, also known as telematics, is a developing trend in the insurance industry. This approach uses data from sensors or devices installed in the home to assess risk and set premiums. While still in its early stages, telematics has the potential to revolutionize homeowners insurance, offering more accurate pricing based on actual usage and risk factors.

How often should I review my homeowners insurance policy?

+It is recommended to review your homeowners insurance policy annually or whenever significant changes occur, such as home renovations or purchasing high-value items. Regular reviews ensure your coverage remains up-to-date and adequate.

What happens if I file a claim with my homeowners insurance?

+When you file a claim, your insurance company will assess the damage and determine if it is covered by your policy. If the claim is approved, they will provide financial assistance or compensation based on your coverage limits and deductibles. It’s important to document the damage and cooperate with the insurer during the claims process.

Can I negotiate my homeowners insurance premiums?

+While insurance premiums are largely determined by risk assessment, you can negotiate with your insurance provider to explore potential discounts or alternative coverage options. Being a loyal customer or having a clean claim history may give you leverage in negotiating lower premiums.