Cheapest Florida Homeowners Insurance

Securing the best value for homeowners insurance in Florida is crucial for residents, given the state's unique climate and susceptibility to natural disasters. With a competitive insurance market, understanding the factors that influence rates and knowing how to navigate the process can lead to significant savings.

Understanding the Landscape: Cheapest Homeowners Insurance in Florida

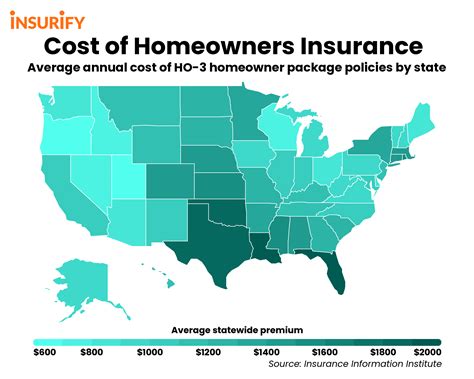

Florida stands out among US states for its distinct insurance landscape, largely influenced by its geographical location and climate. The state’s residents face a unique set of challenges, primarily due to the high risk of hurricanes and other natural calamities. This elevated risk profile often translates to higher insurance premiums compared to other regions.

However, despite these challenges, Florida offers a robust insurance market with numerous providers competing for customers. This competition can work in favor of homeowners, providing an opportunity to secure affordable coverage. It's essential to understand the specific factors that influence rates in Florida to make informed decisions and find the best value.

Key Factors Affecting Homeowners Insurance Rates in Florida

Several factors contribute to the variability in homeowners insurance rates across Florida. Understanding these factors is crucial for homeowners seeking the most affordable coverage. Here’s a breakdown of the key considerations:

- Location: The specific area where your home is located plays a significant role in determining insurance rates. Regions more susceptible to natural disasters, like hurricanes or floods, will generally have higher premiums. For instance, coastal areas prone to hurricanes often face steeper insurance costs.

- Home Value and Age: The value and age of your home are significant factors. Older homes might require more repairs and maintenance, which can lead to higher insurance costs. Similarly, homes with higher replacement values will likely attract higher premiums.

- Coverage Limits: The extent of coverage you opt for directly impacts your premium. Higher coverage limits for your home's structure, personal belongings, and liability will naturally increase your insurance costs.

- Deductibles: Choosing a higher deductible can lead to lower premiums. However, it's essential to ensure you can afford the deductible in the event of a claim.

- Discounts: Many insurance providers offer discounts that can significantly reduce your premium. These may include discounts for bundling home and auto insurance, loyalty discounts for long-term customers, or safety discounts for homes with security systems or storm shutters.

By understanding these factors and their influence on insurance rates, homeowners can make more informed decisions when shopping for coverage. It's essential to compare quotes from multiple providers and consider the specific needs and characteristics of your home to find the best value.

Navigating the Process: Finding Affordable Homeowners Insurance in Florida

Finding the cheapest homeowners insurance in Florida requires a strategic approach. Here’s a step-by-step guide to help you navigate the process and secure the best value:

- Research and Compare Quotes: Start by obtaining quotes from multiple insurance providers. Online comparison tools can be a convenient way to quickly gather a range of quotes. Ensure you're comparing policies with similar coverage limits and deductibles to make an accurate assessment.

- Assess Your Coverage Needs: Before selecting a policy, thoroughly evaluate your coverage needs. Consider the replacement cost of your home, the value of your personal belongings, and the level of liability coverage you require. Ensure the policy aligns with your specific needs to avoid underinsurance or unnecessary costs.

- Utilize Discounts: As mentioned earlier, discounts can significantly reduce your insurance premium. Explore the various discounts offered by insurance providers and determine which ones you're eligible for. This could include discounts for safety features, loyalty, or bundling multiple policies.

- Consider Bundle Options: Many insurance companies offer discounted rates when you bundle multiple policies, such as home and auto insurance. This can be a cost-effective way to secure comprehensive coverage.

- Review Your Policy Regularly: Insurance needs and rates can change over time. Regularly review your policy to ensure it still meets your requirements and to take advantage of any new discounts or promotions. Consider re-shopping your insurance every few years to ensure you're still getting the best value.

By following these steps and staying informed about the Florida insurance landscape, homeowners can make informed decisions and find the cheapest homeowners insurance that meets their specific needs.

The Impact of Natural Disasters on Insurance Rates

Florida’s susceptibility to natural disasters, particularly hurricanes, significantly influences insurance rates. Insurance providers assess the risk of these events when setting premiums. Regions with a higher historical incidence of hurricanes or other natural calamities will typically have higher insurance rates.

However, it's important to note that insurance companies also take into account mitigation measures when assessing risk. Homes equipped with storm shutters, reinforced roofs, or other hurricane-resistant features may be eligible for insurance discounts. These features not only reduce the risk of damage but also demonstrate a proactive approach to disaster preparedness, which is often rewarded by insurance providers.

Real-Life Examples: Success Stories of Affordable Insurance in Florida

Let’s look at some real-life examples of Florida homeowners who successfully navigated the insurance market to secure affordable coverage. These stories highlight the strategies and approaches that led to significant savings:

- Mr. Johnson's Savings: Mr. Johnson, a resident of Miami, Florida, recently saved a substantial amount on his homeowners insurance by bundling his home and auto insurance policies. By doing so, he qualified for a loyalty discount and reduced his overall premium by 20%. He also installed hurricane-resistant windows and doors, which further decreased his premium by an additional 10%.

- Ms. Smith's Experience: Ms. Smith, a homeowner in Tampa, Florida, took advantage of a comprehensive insurance review. By assessing her coverage needs and comparing quotes from multiple providers, she was able to find a policy that offered similar coverage at a significantly lower rate. She also implemented energy-efficient upgrades in her home, which qualified her for an additional discount, reducing her premium by 15%.

- The Jones Family's Strategy: The Jones family, residents of Fort Lauderdale, Florida, focused on safety and mitigation measures. They installed a state-of-the-art security system and fire prevention equipment, which not only increased their home's safety but also qualified them for substantial insurance discounts. By combining these safety measures with regular policy reviews and comparison shopping, they were able to maintain affordable insurance rates year after year.

These success stories demonstrate the effectiveness of a strategic approach to homeowners insurance. By understanding the factors that influence rates, utilizing discounts, and regularly reviewing policies, Florida homeowners can secure the cheapest insurance that meets their needs.

The Future of Homeowners Insurance in Florida: What to Expect

The landscape of homeowners insurance in Florida is constantly evolving, influenced by various factors such as changing climate patterns, technological advancements, and shifts in the insurance market. Here’s a glimpse into the future of homeowners insurance in Florida and what residents can expect:

Impact of Climate Change

Climate change is expected to bring about more frequent and severe weather events, including hurricanes and storms. This increased risk will likely lead to higher insurance premiums as insurance providers adjust their rates to account for the heightened likelihood of claims. However, it’s worth noting that insurance companies are also investing in innovative risk assessment tools and technologies to better predict and manage these risks.

Advancements in Technology

Technological advancements are transforming the insurance industry. The use of big data and analytics is becoming increasingly common, allowing insurance providers to make more accurate risk assessments and offer personalized insurance solutions. This can lead to more efficient pricing models and potentially lower premiums for homeowners who adopt risk-reducing technologies.

Market Competition and Consumer Empowerment

With the rise of digital insurance platforms and online comparison tools, homeowners in Florida have more options and resources at their disposal to compare insurance policies and find the best value. This increased transparency and competition among insurance providers can drive down premiums and improve the overall consumer experience.

Furthermore, the increasing focus on consumer education and empowerment means that homeowners are becoming more knowledgeable about their insurance options and rights. This shift is likely to lead to more informed decision-making and better protection for homeowners.

Regulatory Changes

Regulatory bodies play a crucial role in shaping the insurance landscape. Changes in regulations, such as updates to building codes or insurance laws, can have a significant impact on insurance rates and coverage options. It’s essential for homeowners to stay informed about these changes and understand how they might affect their insurance policies.

In conclusion, while the future of homeowners insurance in Florida presents both challenges and opportunities, proactive homeowners who stay informed, utilize technological advancements, and actively manage their insurance needs are likely to find the best value and protection for their homes.

Frequently Asked Questions (FAQ)

How often should I review my homeowners insurance policy in Florida?

+

It’s recommended to review your homeowners insurance policy annually, or whenever you experience significant changes in your home or personal circumstances. This ensures your coverage remains adequate and up-to-date.

What are some common discounts available for homeowners insurance in Florida?

+

Common discounts include multi-policy discounts (bundling home and auto insurance), loyalty discounts for long-term customers, safety discounts for homes with security systems or storm shutters, and discounts for energy-efficient upgrades or green homes.

How can I reduce my insurance premiums if I live in a high-risk area for natural disasters in Florida?

+

If you live in a high-risk area, consider investing in mitigation measures such as hurricane-resistant windows and doors, reinforced roofs, or storm shutters. These improvements can make your home more resilient to natural disasters and may qualify you for insurance discounts.

Are there any specific insurance companies that offer the cheapest rates in Florida?

+

The insurance company that offers the cheapest rates can vary based on individual circumstances and the specific characteristics of your home. It’s essential to compare quotes from multiple providers to find the best value for your needs. Factors like the location, age, and value of your home, as well as your coverage limits and deductibles, can significantly impact the premiums offered by different insurers.

What steps can I take to ensure I’m getting the best value for my homeowners insurance in Florida?

+

To ensure you’re getting the best value for your homeowners insurance in Florida, it’s crucial to compare quotes from multiple providers, assess your specific coverage needs, and utilize available discounts. Regularly reviewing your policy and staying informed about changes in the insurance landscape can also help you make informed decisions and potentially save money.