Insurance Quote For Car

Obtaining an insurance quote for your car is a crucial step in ensuring you have adequate coverage for your vehicle. The process involves providing detailed information about your car and driving history to insurance providers, who will then assess various factors to determine your premium. With the right approach and understanding of the factors involved, you can secure a competitive insurance quote tailored to your needs.

Understanding Car Insurance Quotes

Car insurance quotes are personalized estimates of the cost of insuring your vehicle. Insurance companies use a comprehensive set of criteria to assess the risk associated with insuring your car, which directly influences the quote they provide. The quote represents the premium you’ll pay for a specific level of coverage, typically over a 12-month period.

It's essential to note that car insurance quotes are not a one-size-fits-all proposition. Each insurance company uses its own proprietary formula, known as an actuarial model, to calculate quotes. These models consider a wide range of factors, ensuring that quotes are as accurate as possible.

Key Factors Influencing Car Insurance Quotes

- Vehicle Type and Usage: The make, model, and year of your car play a significant role in determining your insurance quote. Additionally, how you use your vehicle (commuting, pleasure driving, business use, etc.) can also impact the quote.

- Driving History: Your past driving record is a critical factor. Insurance companies will review your history to assess the level of risk you present. Factors such as accidents, traffic violations, and claims made against your previous insurance policies can influence your quote.

- Personal Information: Your age, gender, marital status, and even your occupation can affect your insurance quote. Insurance providers may also consider your credit score as an indicator of financial responsibility.

- Coverage Level and Deductibles: The level of coverage you choose (liability, comprehensive, collision, etc.) and the deductibles you opt for can significantly impact your premium. Higher deductibles typically result in lower premiums, but you’ll need to pay more out of pocket in the event of a claim.

- Location and Address: Where you live and where you typically park your car can influence your insurance quote. Areas with a higher incidence of accidents, theft, or natural disasters may result in higher premiums.

The Process of Obtaining an Insurance Quote

Getting a car insurance quote typically involves the following steps:

Gathering Information

Before you begin the quote process, ensure you have the following details readily available:

- Personal information: Your name, date of birth, driver’s license number, and contact details.

- Vehicle information: Make, model, year, vehicle identification number (VIN), and details of any modifications.

- Driving history: Details of any accidents, traffic violations, or claims made in the past.

- Current or previous insurance: Details of your current or most recent insurance policy, including coverage levels and any discounts applied.

Choosing Your Coverage

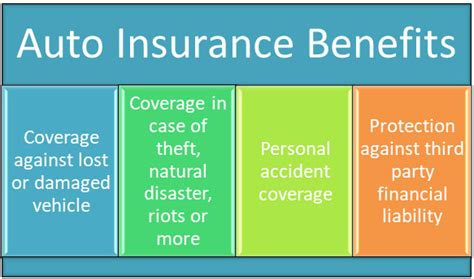

Determine the level of coverage you require. This will depend on factors such as the value of your vehicle, your personal financial situation, and your state’s minimum insurance requirements. Consider the following coverage types:

- Liability Coverage: This covers damages you cause to others in an accident. It’s typically required by law and is the most basic form of car insurance.

- Collision Coverage: This covers damage to your vehicle in the event of an accident, regardless of fault.

- Comprehensive Coverage: This covers damages to your vehicle resulting from events other than collisions, such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): This covers medical expenses for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who has no or insufficient insurance.

Selecting Deductibles

Decide on the deductibles you’re comfortable with. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Higher deductibles mean lower premiums, but you’ll need to pay more if you make a claim. It’s essential to choose a deductible that you can afford.

Comparing Quotes

Once you’ve gathered your information and determined your coverage needs, it’s time to start comparing quotes from different insurance providers. You can obtain quotes online, over the phone, or by visiting insurance brokers. Ensure you’re comparing apples to apples by requesting quotes for the same coverage levels and deductibles.

| Insurance Provider | Quote (Annual Premium) |

|---|---|

| Provider A | $1,200 |

| Provider B | $1,350 |

| Provider C | $1,150 |

Finalizing Your Insurance Policy

Once you’ve selected an insurance provider and received your official quote, review the policy documents carefully. Ensure that the coverage levels, deductibles, and other details match your expectations. If everything is in order, you can proceed to purchase the policy and begin your coverage.

Tips for Securing the Best Car Insurance Quote

- Shop Around: Don’t settle for the first quote you receive. Compare quotes from multiple insurance providers to ensure you’re getting the best deal.

- Bundling Policies: Consider bundling your car insurance with other insurance policies, such as home or renters insurance. Many providers offer discounts for customers who bundle multiple policies.

- Utilize Online Tools: Many insurance providers offer online quote tools that allow you to quickly and easily compare quotes. These tools can save you time and provide a convenient way to shop for insurance.

- Review Your Coverage Regularly: Your insurance needs may change over time. Review your coverage annually to ensure it still meets your needs. You may be able to adjust your coverage or deductibles to save money without sacrificing protection.

- Maintain a Good Driving Record: A clean driving record can lead to significant savings on your insurance premium. Avoid traffic violations and accidents to keep your record clear and your insurance costs down.

Future Implications and Considerations

As the automotive industry continues to evolve, so too will the factors influencing car insurance quotes. The rise of electric vehicles, autonomous driving technologies, and shared mobility services may all impact insurance premiums in the future. Additionally, changes in state regulations and insurance laws could also affect the quote process and the cost of coverage.

It's important to stay informed about these developments and how they may impact your insurance needs. Regularly reviewing your insurance coverage and staying up-to-date with industry trends can help you make informed decisions and ensure you have the right protection at a competitive price.

How often should I review my car insurance policy and quotes?

+It’s recommended to review your car insurance policy and quotes annually or whenever your circumstances change significantly. This ensures that your coverage remains adequate and that you’re not overpaying for unnecessary coverage.

Can I negotiate my insurance quote with providers?

+While insurance quotes are typically based on standardized formulas, there may be room for negotiation, especially if you’re a loyal customer or have a particularly good driving record. Don’t hesitate to ask for a better rate or explore potential discounts.

What factors can I control to reduce my insurance quote?

+You can influence your insurance quote by maintaining a clean driving record, choosing a vehicle with good safety ratings, and selecting higher deductibles. Additionally, taking defensive driving courses or installing safety features in your vehicle may also lead to discounts and reduced quotes.