Auto Insurance Increase

Navigating the world of auto insurance can be a complex and often confusing task. One of the most pressing concerns for many policyholders is the potential for an increase in their insurance premiums. Whether it's due to a change in personal circumstances, an accident, or fluctuations in the market, an auto insurance increase can significantly impact one's finances and peace of mind.

In this comprehensive guide, we will delve into the various factors that can contribute to an auto insurance increase. By understanding these elements, you can make more informed decisions, take proactive measures to mitigate risks, and potentially save on your insurance costs. So, let's explore the ins and outs of auto insurance increases and empower you with the knowledge to navigate this critical aspect of financial planning.

Understanding the Factors Behind Auto Insurance Increases

The auto insurance landscape is intricate, with numerous variables influencing premium rates. By understanding these factors, you can anticipate potential increases and take proactive steps to minimize their impact.

Accidents and Claims

One of the most significant contributors to auto insurance increases is the occurrence of accidents and subsequent claims. When you file a claim with your insurance provider, it impacts your risk profile. Even if the accident was not your fault, the mere involvement can lead to higher premiums. Insurance companies use statistical data to assess the likelihood of future claims and adjust rates accordingly. The more accidents you’ve been in, the higher the perceived risk, which often translates to increased premiums.

Additionally, the type of accident and the resulting damages play a role. For instance, a minor fender bender may result in a smaller increase compared to a severe collision with extensive vehicle damage and medical injuries. It's essential to maintain a clean driving record and take precautions to avoid accidents to keep your insurance costs in check.

Traffic Violations and Driving Record

Your driving behavior is a critical factor in determining your insurance premiums. Traffic violations, such as speeding tickets, running red lights, or driving under the influence, can significantly impact your insurance rates. These violations indicate a higher risk of future accidents, prompting insurance companies to increase your premiums. A single violation may not result in a substantial hike, but multiple offenses over a short period can lead to a significant surge in your insurance costs.

Moreover, your overall driving record, including any at-fault accidents or moving violations, is carefully scrutinized by insurance providers. A history of safe driving can lead to lower premiums, while a record marred by violations and accidents can result in substantial increases. Maintaining a clean driving record is, therefore, essential to keeping your insurance costs manageable.

Changes in Personal Circumstances

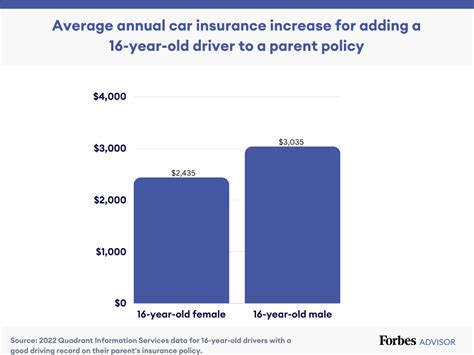

Life is full of changes, and some of these changes can impact your auto insurance premiums. For instance, a move to a new area with a higher crime rate or a higher incidence of accidents can result in an insurance increase. Insurance companies use geographical data to assess the risk associated with different locations and adjust premiums accordingly. Similarly, adding a young driver to your policy, especially if they are a teenager, can lead to a significant hike in your insurance costs due to the higher risk associated with inexperienced drivers.

Other personal circumstances that can influence insurance rates include changes in marital status, the addition of a vehicle to your policy, or even a change in occupation. Insurance companies use statistical data to assess the risk associated with different demographics and adjust premiums based on these factors. Staying informed about these potential changes and their impact on your insurance can help you plan and budget accordingly.

Market Fluctuations and Insurance Provider Decisions

The auto insurance market is subject to fluctuations, and these can impact your premiums. Insurance providers regularly review their rates to ensure they remain competitive while covering their costs and maintaining profitability. Market conditions, such as increased claims frequency or changes in regulatory requirements, can lead to across-the-board rate increases.

Additionally, insurance companies may adjust rates based on their own internal assessments of risk. They continuously analyze their customer base, claim patterns, and market trends to make informed decisions about premium adjustments. While you may not have control over these market-wide or provider-specific factors, staying informed about industry trends and keeping a good relationship with your insurance provider can help you navigate these changes effectively.

Strategies to Mitigate Auto Insurance Increases

While some factors that contribute to auto insurance increases are beyond your control, there are proactive steps you can take to mitigate their impact and potentially save on your insurance costs.

Maintaining a Clean Driving Record

One of the most effective ways to keep your insurance premiums in check is to maintain a clean driving record. This means avoiding accidents and traffic violations. While accidents can happen, being vigilant and practicing defensive driving can help reduce the likelihood of being involved in a collision. Similarly, adhering to traffic laws and avoiding risky behaviors, such as speeding or driving under the influence, can keep your record clean and your insurance rates stable.

Comparing Insurance Providers and Shopping Around

Insurance providers offer a range of rates and coverage options, and shopping around can help you find the best deal. Compare quotes from multiple providers to ensure you’re getting a competitive rate. Additionally, don’t be afraid to negotiate with your current provider. Insurance companies often offer loyalty discounts or special rates to retain customers. By discussing your options and highlighting your clean driving record or other mitigating factors, you may be able to negotiate a lower premium.

Utilizing Discounts and Bundle Offers

Insurance providers offer a variety of discounts to incentivize customers and reward safe driving. These discounts can significantly reduce your insurance premiums. Some common discounts include:

- Safe Driver Discount: This is often the most significant discount available and is awarded to drivers with a clean record.

- Multi-Policy Discount: Combining your auto insurance with other policies, such as home or life insurance, can result in substantial savings.

- Good Student Discount: If you have a young driver on your policy who maintains good grades, you may be eligible for this discount.

- Low Mileage Discount: If you drive fewer miles than the average driver, you may qualify for this discount.

- Safety Features Discount: Vehicles equipped with advanced safety features, such as anti-lock brakes or lane departure warning systems, may be eligible for this discount.

Additionally, many insurance providers offer bundle deals, where you can combine multiple policies (e.g., auto and home insurance) to save money. By taking advantage of these discounts and bundle offers, you can significantly reduce your insurance costs.

Improving Your Credit Score

Your credit score is often a factor in determining your insurance premiums. Insurance companies use credit-based insurance scores to assess your financial responsibility and predict the likelihood of future claims. Improving your credit score can lead to lower insurance rates. This involves paying your bills on time, reducing debt, and maintaining a positive payment history.

Raising Your Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. By raising your deductible, you can lower your insurance premiums. However, it’s important to ensure that you can afford the higher deductible in the event of a claim. This strategy works best for those who have a good financial cushion and are unlikely to make frequent claims.

The Impact of Auto Insurance Increases: Financial Planning and Budgeting

An auto insurance increase can have a significant impact on your financial planning and budgeting. It’s essential to anticipate these increases and plan accordingly to avoid unexpected financial strains.

Understanding Your Policy and Premium Structure

Familiarize yourself with your auto insurance policy and the factors that influence your premiums. This includes understanding your coverage limits, deductibles, and any optional add-ons you may have. By comprehending your policy inside and out, you can better anticipate potential increases and make informed decisions about your coverage.

Budgeting for Insurance Costs

Incorporate your auto insurance premiums into your monthly or annual budget. Consider setting aside a specific amount each month to cover your insurance costs. This can help you prepare for any potential increases and ensure you have the funds available when it’s time to renew your policy.

Assessing Your Coverage Needs and Adjusting Accordingly

Regularly review your auto insurance coverage to ensure it aligns with your current needs and circumstances. If your financial situation has changed, you may be able to reduce your coverage to save on premiums. Alternatively, if you’ve acquired a new vehicle or added a driver to your policy, you may need to increase your coverage to ensure adequate protection.

Seeking Professional Advice

If you’re unsure about the impact of an auto insurance increase on your financial situation or how to optimize your coverage, consider seeking advice from a financial advisor or insurance broker. They can provide personalized guidance based on your specific circumstances and help you navigate the complex world of auto insurance to find the best coverage at the most competitive rates.

The Future of Auto Insurance: Technological Advances and Industry Trends

The auto insurance industry is undergoing significant changes due to technological advancements and evolving market trends. These developments have the potential to impact insurance premiums and the overall landscape of auto insurance.

Telematics and Usage-Based Insurance

Telematics devices and usage-based insurance programs are gaining traction in the auto insurance industry. These technologies allow insurance providers to track driving behavior and assess risk more accurately. By installing a telematics device in your vehicle or enrolling in a usage-based insurance program, you can provide real-time data on your driving habits, such as speed, braking, and mileage. This data is then used to calculate your insurance premiums, offering the potential for lower rates for safe drivers.

Autonomous Vehicles and Safety Innovations

The advent of autonomous vehicles and advanced safety features is poised to revolutionize the auto insurance industry. As these technologies become more prevalent, insurance providers will need to adapt their risk assessment models. Vehicles equipped with advanced driver-assistance systems (ADAS) and autonomous features are expected to reduce the likelihood of accidents, leading to lower insurance premiums. However, the transition period as these technologies are adopted may result in some fluctuations in insurance rates.

Data Analytics and Predictive Modeling

Insurance providers are increasingly leveraging data analytics and predictive modeling to enhance their risk assessment capabilities. By analyzing vast amounts of data, including driving behavior, accident trends, and geographic risk factors, insurance companies can more accurately predict future claims and adjust premiums accordingly. This advanced data-driven approach has the potential to reward safe drivers with lower premiums while ensuring insurance providers remain financially stable.

Collaborative Industry Efforts

The auto insurance industry is recognizing the importance of collaboration to address shared challenges and drive innovation. Industry associations and regulatory bodies are working together to establish standardized data sharing protocols and best practices. This collaborative approach aims to improve data accuracy, enhance risk assessment, and promote fair and transparent insurance practices, ultimately benefiting consumers and insurance providers alike.

Conclusion

Auto insurance increases are a complex and multifaceted aspect of financial planning. By understanding the factors that contribute to these increases, you can take proactive measures to mitigate risks and potentially save on your insurance costs. From maintaining a clean driving record to leveraging discounts and bundle offers, there are numerous strategies to keep your premiums in check.

Additionally, staying informed about the latest industry trends and technological advancements can help you anticipate potential changes in the auto insurance landscape. As the industry continues to evolve, it's essential to stay vigilant, review your coverage regularly, and seek professional advice when needed. With the right knowledge and approach, you can navigate the complexities of auto insurance and ensure you have the coverage you need at a price you can afford.

How often can my insurance provider increase my premiums?

+Insurance providers typically have a set schedule for reviewing and adjusting premiums, which can vary by state and provider. However, certain events, such as an accident or a violation, can trigger an immediate increase. It’s important to review your policy terms and understand the factors that can lead to premium adjustments.

Can I negotiate my insurance premiums if they increase significantly?

+Absolutely! While insurance providers have their own methodologies for setting premiums, they are often open to negotiations. Contact your provider and discuss your concerns. Highlight any mitigating factors, such as a clean driving record or the absence of recent claims, to potentially negotiate a lower rate.

What can I do to reduce my insurance costs if I’ve had an accident or violation?

+If you’ve had an accident or violation, it’s important to understand that your insurance premiums will likely increase. However, there are steps you can take to mitigate the impact. Consider raising your deductible, which can lower your premiums. Additionally, explore any available discounts, such as a safe driver discount or a good student discount, to offset the increase.

Are there any alternatives to traditional auto insurance providers?

+Yes, there are alternative insurance models emerging, such as usage-based insurance and peer-to-peer insurance. Usage-based insurance programs, often referred to as pay-as-you-drive or pay-how-you-drive, offer rates based on your actual driving behavior. Peer-to-peer insurance, on the other hand, allows drivers to pool their resources and share risks collectively. These alternatives can provide more flexibility and potentially lower rates for certain drivers.