Nj Auto Insurance Quotes

Welcome to the comprehensive guide on New Jersey Auto Insurance! In this expert-written article, we will delve into the intricacies of auto insurance in the Garden State, providing you with all the information you need to make informed decisions about your vehicle coverage. New Jersey is known for its unique insurance landscape, and understanding the specific requirements and options available is crucial for every driver.

Understanding the Basics of NJ Auto Insurance

Auto insurance in New Jersey is a necessity, ensuring drivers are protected against financial risks associated with owning and operating a vehicle. The state has implemented a No-Fault Insurance system, which means that regardless of who is at fault in an accident, your insurance provider covers your medical expenses up to a certain limit. This system aims to streamline the claims process and provide faster compensation.

However, New Jersey's insurance requirements go beyond the basic liability coverage. The state mandates that drivers carry Personal Injury Protection (PIP) coverage, which provides broader medical and income protection for both the policyholder and their passengers. Additionally, Uninsured/Underinsured Motorist Coverage is also required, ensuring protection against accidents involving drivers without adequate insurance.

Key Coverage Options in NJ Auto Insurance

While the aforementioned coverages are mandatory, New Jersey drivers have the flexibility to choose additional optional coverages to tailor their insurance policies to their specific needs. Here's a breakdown of some essential coverages:

- Liability Coverage: This covers damages you cause to others' property or injuries you cause to others. It's divided into Bodily Injury Liability and Property Damage Liability coverage.

- Collision Coverage: Pays for repairs to your vehicle after an accident, regardless of fault. It's especially beneficial for newer or leased vehicles.

- Comprehensive Coverage: Covers damages to your vehicle due to non-accident events like theft, vandalism, weather-related incidents, or collisions with animals.

- Medical Payments Coverage: Provides additional medical expense coverage for you and your passengers, often with a higher limit than PIP.

- Rental Car Reimbursement: Covers the cost of renting a vehicle while yours is being repaired after an insured accident.

- Gap Insurance: Bridges the gap between what your insurance pays and what you owe on a leased or financed vehicle if it's totaled.

Each of these coverages comes with its own set of benefits and potential drawbacks, and the decision to include them in your policy should be based on your individual circumstances and financial situation.

Factors Influencing NJ Auto Insurance Quotes

When requesting auto insurance quotes in New Jersey, it's essential to understand the various factors that insurance companies consider to determine your premium. These factors can significantly impact the cost of your coverage, and being aware of them can help you make more informed choices.

Vehicle Type and Usage

The make, model, and year of your vehicle play a crucial role in determining your insurance rates. Generally, newer, more expensive vehicles with advanced safety features tend to have higher insurance premiums. Additionally, the primary use of your vehicle, whether for commuting, business, or pleasure, can also influence your rates.

Driver Profile and History

Your driving record is a significant factor in insurance pricing. A clean driving record with no accidents or violations can lead to lower premiums. Conversely, a history of accidents, traffic violations, or even certain types of convictions can result in higher rates. Insurance companies also consider your age, gender, and marital status, as these factors can indicate a level of driving experience and responsibility.

Location and Usage Patterns

The area where you live and work can significantly impact your insurance rates. Urban areas with higher populations often have more accidents and thefts, leading to increased premiums. Additionally, the number of miles you drive annually can influence your rates, as higher mileage typically indicates a higher risk of accidents.

Credit History and Insurance Score

Insurance companies in New Jersey are allowed to consider your credit history when determining your insurance rates. A good credit score can lead to lower premiums, as it is often correlated with lower claims frequency and severity. Additionally, insurance companies may use an insurance score, which is a rating based on your credit history and other factors, to assess your risk level.

Insurance Company and Policy Details

Different insurance companies have varying policies and rates. It's essential to compare quotes from multiple providers to find the best fit for your needs. Additionally, the specific coverage limits and deductibles you choose will impact your premium. Higher coverage limits and lower deductibles typically result in higher premiums.

| Coverage Type | Real Impact on Premium |

|---|---|

| Liability Coverage | Higher limits lead to increased premiums |

| Collision and Comprehensive Coverage | Optional, but can significantly increase protection and cost |

| Uninsured/Underinsured Motorist Coverage | Required, but additional coverage can provide extra protection |

Shopping for the Best NJ Auto Insurance Quote

Now that you understand the factors influencing insurance quotes, it's time to dive into the process of finding the best coverage for your needs. Here's a step-by-step guide to help you navigate the quote comparison process in New Jersey.

Assess Your Coverage Needs

Before requesting quotes, take the time to assess your specific coverage needs. Consider factors such as the value of your vehicle, your daily commute, and any unique circumstances that might impact your risk profile. Determine the coverages you require and the limits that provide adequate protection without being excessive.

Research Top Insurance Providers

New Jersey is home to numerous insurance companies, each with its own strengths and weaknesses. Research the top providers in the state, considering factors like financial stability, customer satisfaction ratings, and the range of coverages offered. Online resources, consumer reviews, and industry rankings can provide valuable insights into the best insurance companies for your needs.

Compare Quotes and Policies

Utilize online quote comparison tools or work with an independent insurance agent to gather quotes from multiple providers. Compare not only the premiums but also the specific coverages, deductibles, and policy terms. Look for companies that offer flexible payment options and additional perks, such as discounts for safe driving or loyalty programs.

Evaluate Additional Benefits

Beyond the basic coverages, insurance companies often provide additional benefits and services that can enhance your overall experience. These may include roadside assistance, rental car coverage, or even discounts for taking defensive driving courses. Evaluate these benefits and consider how they might impact your decision-making process.

Review Policy Exclusions and Conditions

While comparing policies, pay close attention to the exclusions and conditions outlined in each contract. These can vary significantly between providers and may impact your coverage in unforeseen ways. Understanding these exclusions is crucial to ensuring you have the protection you need when it matters most.

Expert Tips for Lowering Your NJ Auto Insurance Costs

Obtaining affordable auto insurance in New Jersey is possible with the right strategies. Here are some expert tips to help you lower your insurance costs without compromising on coverage.

Improve Your Driving Record

A clean driving record is one of the most effective ways to lower your insurance premiums. Avoid traffic violations and accidents, as these can remain on your record for several years and impact your rates. Additionally, consider taking a defensive driving course, as some insurance companies offer discounts for completing such courses.

Raise Your Deductibles

Increasing your deductible, the amount you pay out of pocket before your insurance coverage kicks in, can significantly reduce your insurance premiums. However, it's essential to choose a deductible amount that you can afford to pay in the event of a claim. Striking the right balance between deductible and premium is crucial.

Explore Discounts and Savings

Insurance companies offer a variety of discounts to policyholders. These may include multi-policy discounts (if you bundle your auto insurance with other types of insurance, such as homeowners or renters insurance), safe driver discounts, good student discounts, and loyalty discounts. Take the time to understand the discounts available and ensure you're taking advantage of all applicable savings.

Maintain a Good Credit Score

As mentioned earlier, insurance companies in New Jersey consider your credit history when determining your rates. Maintaining a good credit score can lead to significant savings on your insurance premiums. Focus on paying your bills on time, reducing credit card balances, and regularly monitoring your credit report for any errors or discrepancies.

Review Your Policy Annually

Insurance needs and rates can change over time. It's essential to review your policy annually to ensure it still meets your needs and to look for opportunities to save. This might involve updating your coverage limits, adjusting your deductibles, or taking advantage of new discounts that become available.

Frequently Asked Questions about NJ Auto Insurance

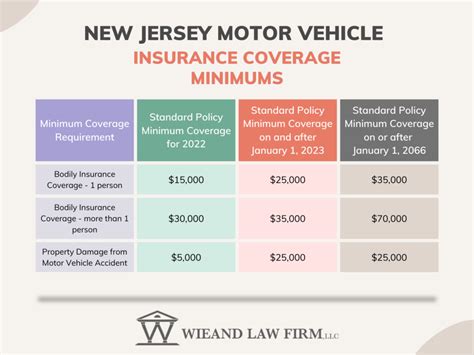

What is the minimum required coverage for auto insurance in New Jersey?

+New Jersey requires drivers to carry liability insurance with a minimum limit of 15,000 for bodily injury to one person, 30,000 for bodily injury to two or more people, and $5,000 for property damage. Additionally, Personal Injury Protection (PIP) and Uninsured/Underinsured Motorist Coverage are also mandatory.

How can I lower my insurance premiums in New Jersey?

+There are several ways to reduce your insurance premiums, including maintaining a clean driving record, increasing your deductible, exploring discounts, improving your credit score, and regularly reviewing your policy for potential savings.

Are there any discounts available for New Jersey auto insurance policies?

+Yes, New Jersey auto insurance companies offer various discounts, such as multi-policy discounts, safe driver discounts, good student discounts, and loyalty discounts. It’s worth exploring these options to see if you qualify for any savings.

What happens if I don’t have auto insurance in New Jersey?

+Driving without insurance in New Jersey is illegal and can result in significant penalties, including fines, suspension of your driver’s license and vehicle registration, and even jail time. It’s crucial to maintain adequate insurance coverage to avoid these consequences.

Can I choose my own repair shop after an accident in New Jersey?

+Yes, New Jersey is a “choice” state, which means you have the right to choose your own repair shop for collision repairs. Your insurance company may have preferred shops, but you are not obligated to use them. It’s important to choose a reputable shop that offers quality repairs and works with your insurance provider.