Benefits Of Insurance

Insurance is a vital aspect of modern life, providing individuals and businesses with a crucial safety net to protect against unforeseen events and financial losses. The benefits of insurance are far-reaching and encompass various aspects of personal and professional life, offering peace of mind, financial security, and a means to mitigate risks effectively. This comprehensive guide explores the myriad advantages that insurance brings, from its fundamental role in safeguarding assets to its ability to empower individuals and businesses to pursue opportunities with confidence.

A Pillar of Financial Stability

At its core, insurance serves as a cornerstone of financial stability. It provides a robust mechanism to manage risks and uncertainties that can arise in daily life, be it a sudden health issue, an accident, a natural disaster, or a business interruption. By transferring the financial burden of these events to an insurance company, policyholders gain a vital layer of protection that safeguards their assets and livelihood.

Consider health insurance, for instance. It ensures individuals have access to necessary medical care without incurring catastrophic expenses. Similarly, auto insurance provides a safety net in case of accidents, covering vehicle repairs or replacements and protecting policyholders from liability claims. In the business realm, insurance is an indispensable tool for managing risks, from property damage to liability suits, ensuring operations can continue uninterrupted.

Real-World Protection: A Case Study

Take the example of Sarah, a small business owner who recently experienced a devastating fire at her boutique. Thanks to her business insurance policy, she was able to swiftly recover from the incident. The insurance provider covered the cost of repairing the damaged premises, replacing lost inventory, and even provided temporary space for her to continue operations while the repairs were underway. This real-world scenario illustrates the critical role insurance plays in helping businesses bounce back from crises.

Empowering Opportunities

Beyond its protective function, insurance empowers individuals and businesses to take calculated risks and pursue opportunities. With insurance as a safety net, entrepreneurs can launch new ventures, knowing they have a backup plan in case things don’t go as expected. Similarly, individuals can make bold career moves, travel the world, or pursue ambitious projects without the fear of financial ruin.

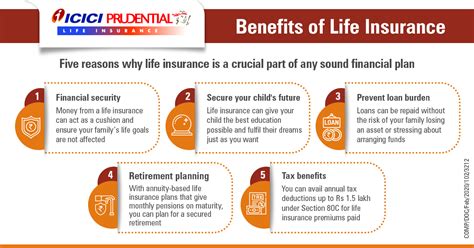

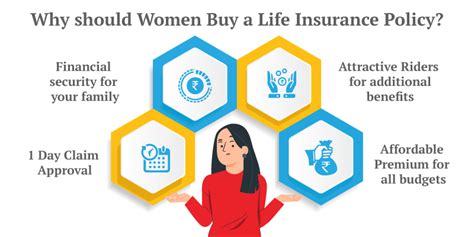

Life insurance, for example, provides a financial safety net for families. It ensures that loved ones are provided for in the event of an untimely death, covering living expenses, mortgage payments, and even funding education costs for children. This security allows individuals to focus on their goals and aspirations, knowing their loved ones' futures are secure.

The Power of Insurance: A Testimonial

“Insurance has given me the courage to follow my dreams. Knowing that I have a financial safety net in place, I was able to take the leap and start my own business. The peace of mind it provides is invaluable, and it’s a critical part of my long-term financial plan.”

— John, Entrepreneur

Risk Management and Mitigation

Insurance is not just about financial protection; it’s also an effective tool for managing and mitigating risks. Insurance companies, with their vast data and expertise, can identify and assess risks more accurately than individuals or businesses operating alone. This enables policyholders to make informed decisions and take proactive measures to minimize potential losses.

For instance, homeowners' insurance often comes with risk assessment services. These services help identify potential hazards in a home, such as faulty wiring or outdated plumbing, and recommend improvements. By addressing these risks, homeowners can prevent accidents and reduce the likelihood of insurance claims, ultimately lowering their premiums.

Risk Assessment in Action

A homeowner’s insurance company might offer a service that identifies and prioritizes risks in a property. This could involve inspecting the home for fire hazards, water damage risks, or structural issues. By addressing these risks proactively, homeowners can enhance their safety and potentially qualify for lower insurance rates.

| Risk Category | Mitigation Strategies |

|---|---|

| Fire Hazards | Install smoke detectors, upgrade electrical systems, and maintain a clear evacuation plan. |

| Water Damage | Regularly inspect and maintain plumbing, ensure proper drainage, and consider flood protection measures. |

| Structural Issues | Conduct periodic inspections, address foundation problems promptly, and ensure roof maintenance. |

A Platform for Financial Planning

Insurance, particularly certain types like life insurance and annuities, can be powerful tools for financial planning. These products offer a means to save and invest for the future, providing a steady stream of income during retirement or in case of unexpected events. They also often come with tax benefits, further enhancing their value as financial planning instruments.

Annuities, for instance, offer a guaranteed income stream for a specified period or for life. This makes them an attractive option for individuals seeking a reliable source of income during retirement. Life insurance policies, on the other hand, can accumulate cash value over time, providing a financial buffer for emergencies or a legacy for loved ones.

Financial Planning with Insurance: A Strategy

A comprehensive financial plan might involve a combination of life insurance and annuities. Life insurance provides a safety net for loved ones, while annuities offer a predictable income stream during retirement. By strategically utilizing these products, individuals can ensure their financial security and peace of mind throughout their lives.

| Financial Product | Key Benefits |

|---|---|

| Life Insurance | Provides financial protection for loved ones, offers cash value accumulation, and may have tax advantages. |

| Annuities | Guarantees a steady income stream during retirement, can be tailored to individual needs, and often has tax-deferred growth. |

How does insurance help with financial planning?

+Insurance products like life insurance and annuities offer a way to save and invest for the future. They provide financial security and can be a key part of a comprehensive financial plan, often with tax benefits.

What are the main types of insurance and their benefits?

+Health insurance ensures access to medical care; auto insurance covers vehicle-related risks; homeowners’ insurance protects property; and life insurance provides financial security for loved ones. Each type offers unique benefits tailored to specific needs.

How does insurance empower individuals and businesses?

+Insurance provides a safety net, allowing individuals and businesses to take calculated risks and pursue opportunities with confidence. It offers financial protection and peace of mind, enabling people to focus on their goals and aspirations.