Cheapest Insurances

In today's world, insurance is an essential aspect of financial planning, providing individuals and businesses with a safety net against unexpected events and risks. However, the cost of insurance policies can vary significantly, and finding the cheapest options can be a challenging task. This comprehensive guide aims to shed light on the world of affordable insurance, offering insights and strategies to help you secure the best coverage at the lowest possible price.

Understanding the Factors that Influence Insurance Costs

Before delving into the strategies for finding the cheapest insurance, it’s crucial to understand the key factors that influence the cost of insurance policies. These factors can vary depending on the type of insurance and the provider, but there are some common considerations that affect pricing across the board.

Risk Assessment

Insurance companies calculate premiums based on the level of risk they associate with insuring you or your assets. This risk assessment takes into account various factors, including your age, health status, occupation, and lifestyle choices. For instance, younger individuals may pay lower premiums for life insurance as they are generally considered less risky than older individuals.

| Risk Factor | Impact on Premium |

|---|---|

| Age | Younger individuals often pay less. |

| Health | Good health can lead to lower premiums. |

| Occupation | Risky occupations may incur higher costs. |

| Lifestyle | Healthy habits can reduce insurance costs. |

Coverage and Deductibles

The type and extent of coverage you choose also play a significant role in determining the cost of your insurance. Generally, more comprehensive coverage comes with higher premiums. Additionally, the choice of deductibles can impact the cost; higher deductibles often result in lower premiums, as you’re assuming more of the initial risk.

Location and Personal Circumstances

Your location and personal circumstances can also affect insurance costs. For example, car insurance rates can vary significantly based on your state or even your neighborhood, as insurance companies consider factors like traffic density and crime rates. Personal circumstances like marital status and number of dependents can also influence the cost of life insurance.

Strategies for Finding the Cheapest Insurance

Now that we’ve explored the key factors influencing insurance costs, let’s delve into the strategies you can employ to find the cheapest insurance options available.

Compare Quotes from Multiple Providers

One of the most effective ways to find cheap insurance is to compare quotes from multiple providers. Insurance companies use different methods to calculate premiums, and the rates they offer can vary significantly. By obtaining quotes from several insurers, you can identify the companies that offer the most competitive rates for your specific circumstances.

Online insurance marketplaces and comparison websites can be valuable tools for this purpose. These platforms allow you to input your details once and receive multiple quotes, saving you time and effort. Additionally, some insurers offer discounts for purchasing multiple policies (e.g., car and home insurance) from them, so consider bundling your insurance needs.

Utilize Online Resources and Tools

The internet offers a wealth of resources and tools to help you find cheap insurance. Apart from comparison websites, there are numerous insurance blogs, forums, and review sites that can provide valuable insights and recommendations. These platforms often feature real-life experiences and tips from individuals who have successfully navigated the insurance market, offering a wealth of knowledge and guidance.

Additionally, many insurance companies now offer online tools and calculators that can help you estimate the cost of coverage based on your specific needs. These tools can be particularly useful for understanding the impact of different coverage levels and deductibles on your premiums.

Negotiate with Your Current Provider

If you’re already insured, don’t underestimate the power of negotiation. Insurance companies often offer loyalty discounts to retain customers, so it’s worth discussing your options with your current provider. You can leverage quotes from other companies to negotiate a better rate, especially if you’ve been a loyal customer for an extended period.

Additionally, consider reviewing your coverage needs annually. Your circumstances and requirements may change over time, and you might be paying for coverage you no longer need. By regularly assessing your insurance needs and negotiating with your provider, you can ensure you're getting the best value for your money.

Consider Alternative Insurance Options

Sometimes, the cheapest insurance option might not be a traditional insurance policy. There are alternative forms of insurance, such as mutual insurance companies and captive agents, that can offer more affordable coverage. Mutual insurance companies are owned by policyholders, which can result in more competitive rates and better customer service.

Captive agents, on the other hand, work exclusively for one insurance company, which can sometimes lead to more personalized service and better rates. While these alternatives might not always be the cheapest, they are worth considering, especially if you value customer service and personalized attention.

Take Advantage of Discounts and Rewards

Insurance companies often offer discounts and rewards to attract and retain customers. These discounts can significantly reduce your premiums, so it’s worth exploring all the options available to you.

Some common discounts include:

- Safe driver discounts for car insurance.

- Bundling discounts when you purchase multiple policies from the same insurer.

- Loyalty discounts for long-term customers.

- Good student discounts for young drivers with good academic records.

- Health-related discounts for maintaining a healthy lifestyle (e.g., non-smoker discounts for life insurance).

Additionally, some insurance companies offer rewards programs that can provide additional savings or perks. These programs might reward you for maintaining a good driving record, taking defensive driving courses, or even using fitness tracking apps. By taking advantage of these discounts and rewards, you can further reduce your insurance costs.

Cheapest Insurance Options by Category

Now, let’s explore some of the cheapest insurance options available for various categories, based on market research and expert insights.

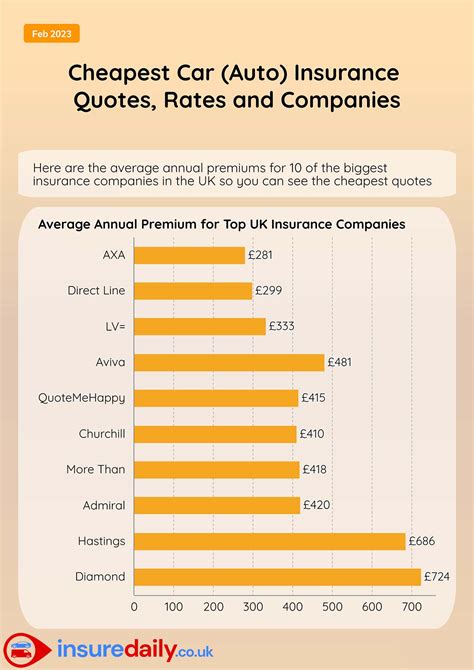

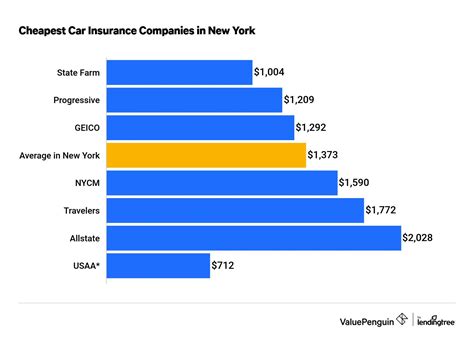

Cheapest Car Insurance

Finding cheap car insurance can be a challenge, as rates can vary significantly based on your location, driving record, and the type of car you drive. However, there are several strategies you can employ to secure the most affordable coverage.

Firstly, consider increasing your deductible. While this means you'll have to pay more out-of-pocket in the event of a claim, it can significantly reduce your premiums. Additionally, maintaining a clean driving record and shopping around for the best rates can lead to substantial savings.

Some of the most affordable car insurance providers include:

- Geico: Known for its competitive rates and excellent customer service.

- State Farm: Offers a wide range of discounts and personalized service.

- Progressive: Provides flexible payment options and a user-friendly online platform.

- USAA: Offers affordable rates exclusively to military members and their families.

- Esurance: Provides digital-first insurance solutions with convenient online tools.

Cheapest Home Insurance

Home insurance is essential for protecting your property and belongings, but it doesn't have to break the bank. By understanding the factors that influence home insurance rates and shopping around for the best deals, you can find affordable coverage.

Factors that can impact your home insurance rates include the location and age of your home, as well as any additional safety features you have installed. Maintaining a good credit score and bundling your home and car insurance policies can also lead to significant savings.

Some of the most affordable home insurance providers include:

- State Farm: Offers a range of discounts and comprehensive coverage options.

- Allstate: Provides customizable policies and a user-friendly online experience.

- Liberty Mutual: Known for its excellent customer service and competitive rates.

- Farmers Insurance: Offers specialized coverage for unique homes and valuable possessions.

- Amica Mutual: Provides personalized service and a strong focus on customer satisfaction.

Cheapest Life Insurance

Life insurance is an important investment for your loved ones' financial security. While the cost of life insurance can vary based on your age, health, and the type of policy you choose, there are affordable options available.

Term life insurance is generally the most affordable option, as it provides coverage for a set period of time (e.g., 10, 20, or 30 years). If you're in good health, you may also be eligible for no-medical-exam policies, which can offer substantial savings. Additionally, some insurers offer discounts for purchasing life insurance online or for maintaining a healthy lifestyle.

Some of the most affordable life insurance providers include:

- TermLife2Go: Specializes in providing term life insurance at competitive rates.

- Bestow: Offers convenient online applications and affordable coverage.

- PolicyGenius: Provides a user-friendly platform for comparing life insurance policies.

- Haven Life: Known for its simple application process and competitive rates.

- AIG Direct: Offers a range of life insurance products with flexible payment options.

Cheapest Health Insurance

Health insurance is a critical component of financial planning, providing coverage for medical expenses. The cost of health insurance can vary based on your age, location, and the level of coverage you choose. However, there are ways to find affordable health insurance plans.

If you're eligible, consider enrolling in government-sponsored health insurance programs like Medicaid or Medicare. These programs provide comprehensive coverage at little to no cost. For those who don't qualify for government programs, comparing plans on the healthcare marketplace can help you find the most affordable option that meets your needs.

Some of the most affordable health insurance providers include:

- UnitedHealthcare: Offers a wide range of health insurance plans with a focus on quality care.

- Aetna: Provides comprehensive coverage and a network of high-quality healthcare providers.

- Blue Cross Blue Shield: Offers a variety of plans and is accepted by many healthcare providers.

- Humana: Known for its customer-centric approach and personalized health plans.

- Kaiser Permanente: Provides integrated healthcare services and a focus on preventive care.

The Future of Affordable Insurance

The insurance industry is evolving, and the future holds exciting possibilities for affordable insurance. Technological advancements are driving innovation, with insurance companies adopting digital tools and data analytics to offer more personalized and cost-effective solutions.

One of the most significant trends is the rise of usage-based insurance (UBI) models, particularly in the auto insurance sector. With UBI, insurance premiums are based on how, when, and where you drive, rather than solely on demographic factors. This approach can lead to more affordable coverage for safe drivers and those who drive infrequently.

Additionally, the increasing adoption of telematics technology allows insurance companies to gather real-time data on driving behavior, which can further refine risk assessment and pricing. This technology, coupled with the growing popularity of electric vehicles and autonomous driving, is expected to revolutionize the auto insurance market, making insurance more accessible and affordable.

In the realm of health insurance, the focus is shifting towards preventive care and personalized medicine. With advancements in genomics and precision medicine, insurance companies are exploring ways to offer tailored coverage and incentives for healthy lifestyle choices. This shift towards a more proactive approach to healthcare could lead to more affordable insurance options in the future.

Frequently Asked Questions

How can I reduce my car insurance costs?

+

There are several strategies to reduce car insurance costs. These include shopping around for quotes, increasing your deductible, maintaining a clean driving record, and considering usage-based insurance (UBI) models if available.

What factors influence the cost of home insurance?

+

Home insurance costs can be influenced by factors such as the location and age of your home, the level of coverage you choose, and any additional safety features you have installed. Maintaining a good credit score and bundling policies can also lead to savings.

How can I find affordable life insurance coverage?

+

Term life insurance is generally the most affordable option. Additionally, consider no-medical-exam policies if you’re in good health, and look for discounts for purchasing online or maintaining a healthy lifestyle.

What are some tips for finding cheap health insurance?

+

If eligible, enroll in government-sponsored programs like Medicaid or Medicare. Otherwise, compare plans on the healthcare marketplace and consider high-deductible health plans (HDHPs) paired with a health savings account (HSA) for potential tax benefits.

How can I stay updated on the latest trends in affordable insurance?

+

Stay informed by following insurance industry news and trends, reading blogs and forums, and engaging with insurance professionals. Online resources and communities can provide valuable insights into the latest developments in affordable insurance.