Mortgage Calculator With Insurance And Tax

The Mortgage Calculator with Insurance and Tax is an invaluable tool for anyone looking to navigate the complex world of homeownership. This sophisticated calculator goes beyond the traditional by factoring in two essential components: insurance and property taxes. These elements are often overlooked in basic mortgage calculations, leading to potential financial surprises down the line. By incorporating these factors, individuals can gain a more accurate understanding of their true monthly mortgage obligations, helping them make informed decisions about their home purchase journey.

Understanding the Comprehensive Mortgage Calculator

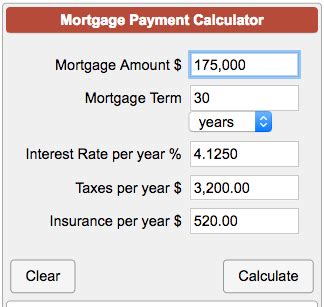

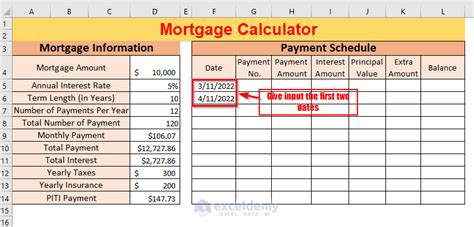

This advanced mortgage calculator is designed to provide a comprehensive view of the financial commitment associated with homeownership. By inputting key details such as the property value, down payment, interest rate, and loan term, the calculator generates a detailed breakdown of monthly mortgage payments. But what sets this calculator apart is its ability to include the costs of homeowner’s insurance and property taxes in its calculations.

Homeowner’s Insurance: A Vital Protection

Homeowner’s insurance is a critical aspect of homeownership, providing financial protection against a range of potential issues, including damage to the property, theft, and liability for accidents on the premises. The cost of this insurance varies based on factors such as the location, size, and age of the home, as well as the coverage limits chosen by the homeowner.

Incorporating homeowner’s insurance into the mortgage calculator allows individuals to see the full financial picture. It highlights the total monthly cost, including the principal and interest on the loan, as well as the insurance premium. This transparency helps potential homeowners understand the true cost of homeownership and plan their finances accordingly.

| Insurance Type | Average Annual Premium |

|---|---|

| Standard Homeowner's Insurance | $1,200 |

| Flood Insurance (Additional) | $400 |

Property Taxes: A Key Component of Ownership

Property taxes are another significant expense associated with homeownership. These taxes are typically calculated as a percentage of the property’s assessed value and are used to fund local services and infrastructure. The amount of property tax owed can vary greatly depending on the location and the specific tax rates in that area.

By including property taxes in the mortgage calculator, individuals can see the full financial commitment required each month. This transparency ensures that potential homeowners are aware of all the costs associated with their mortgage, helping them make more informed decisions about their housing choices.

| Property Tax Rate | Annual Tax Amount |

|---|---|

| 1.5% | $3,000 |

The Benefits of Using a Comprehensive Mortgage Calculator

The Mortgage Calculator with Insurance and Tax offers several key advantages to individuals considering homeownership:

- Accurate Financial Planning: By including insurance and tax costs, the calculator provides a realistic view of the total monthly mortgage obligation. This accuracy helps individuals budget effectively and ensure they can afford their chosen home.

- Avoiding Financial Surprises: Traditional mortgage calculators often overlook insurance and tax expenses. This comprehensive calculator prevents potential homeowners from being caught off guard by unexpected costs, helping them maintain financial stability.

- Comparative Analysis: When considering multiple properties, this calculator allows for an apples-to-apples comparison. Users can input different property values, insurance estimates, and tax rates to determine the most financially feasible option.

- Long-Term Financial Strategy: Understanding the full financial commitment of homeownership enables individuals to plan for the future. This calculator helps users assess their financial goals and ensure their home purchase aligns with their long-term financial vision.

Practical Application of the Mortgage Calculator

Let’s explore a real-world example to understand how this calculator can benefit potential homeowners. Imagine a couple, Sarah and David, who are considering purchasing their first home. They’ve found a property they love and want to ensure they can afford the monthly payments.

Using the Mortgage Calculator with Insurance and Tax, Sarah and David input the following details:

- Property Value: $500,000

- Down Payment: 20% ($100,000)

- Interest Rate: 4%

- Loan Term: 30 years

- Estimated Homeowner's Insurance: $1,200 annually

- Property Tax Rate: 1.5%

The calculator provides the following results:

- Monthly Mortgage Payment: $2,120 (including principal, interest, insurance, and taxes)

- Annual Insurance Premium: $1,200

- Annual Property Tax: $7,500

- Total Annual Cost of Ownership: $25,800

With this detailed breakdown, Sarah and David can assess whether this home fits within their budget and financial goals. They can also adjust variables, such as the down payment or loan term, to see how these changes impact their monthly and annual costs.

Conclusion: Empowering Homeownership Decisions

The Mortgage Calculator with Insurance and Tax is a powerful tool that empowers individuals to make informed decisions about homeownership. By providing a comprehensive view of the financial commitment, this calculator ensures that potential homeowners are aware of all the costs associated with their mortgage. This transparency helps individuals avoid financial pitfalls, plan effectively, and make confident choices about their housing journey.

How often should I update my mortgage calculations to include insurance and tax costs?

+It’s recommended to update your calculations annually or whenever there are significant changes in insurance rates or property tax assessments. Regular updates ensure that your financial planning remains accurate and up-to-date.

Can I adjust my insurance coverage to lower my monthly payments?

+Yes, you can adjust your insurance coverage to potentially lower your monthly payments. However, it’s important to strike a balance between affordability and adequate protection. Reducing coverage too much could leave you vulnerable to significant financial losses in the event of a claim.

What if my property taxes increase unexpectedly?

+Unexpected increases in property taxes can impact your monthly mortgage payments. It’s essential to stay informed about local tax assessments and consider setting aside funds in an emergency fund to cover such unexpected increases.