Rv Insurance Cost Calculator

The cost of insuring your recreational vehicle (RV) is an important consideration for any RV owner or enthusiast. With the rising popularity of RV travel and the diverse range of RV types available, understanding the factors that influence insurance costs is crucial. In this comprehensive guide, we delve into the world of RV insurance, exploring the variables that impact coverage expenses and offering valuable insights to help you navigate the process effectively.

Understanding RV Insurance Costs: A Comprehensive Overview

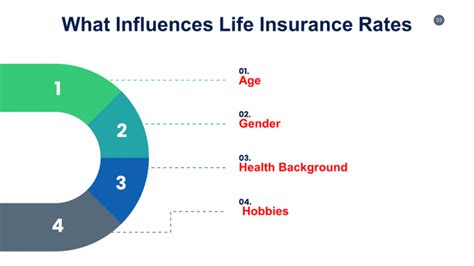

RV insurance costs can vary significantly depending on a multitude of factors. From the type of RV you own to your driving history and the coverage options you choose, each element plays a role in determining the final insurance premium. Let’s explore these factors in detail to provide a clearer picture of what affects RV insurance expenses.

RV Type and Value

One of the primary factors influencing RV insurance costs is the type and value of your recreational vehicle. RVs come in various forms, including motorhomes, travel trailers, campervans, and more. Each type has unique characteristics and value, which insurance providers consider when calculating premiums. For instance, a luxury motorhome with high-end features and a substantial price tag will generally attract higher insurance costs compared to a basic travel trailer.

| RV Type | Average Cost |

|---|---|

| Motorhome | $1,200 - $2,500 annually |

| Travel Trailer | $500 - $1,200 annually |

| Campervan | $800 - $1,800 annually |

| Pop-up Trailer | $300 - $800 annually |

Coverage Options and Deductibles

The level of coverage you choose for your RV also significantly impacts the insurance cost. Comprehensive coverage options, such as collision, liability, and comprehensive coverage, can protect you from a wide range of potential risks and damages. However, opting for more extensive coverage will typically result in higher premiums. On the other hand, selecting higher deductibles can reduce your insurance costs, as you agree to pay a larger portion of the claim expenses.

| Coverage Type | Average Cost |

|---|---|

| Collision Coverage | +$200 - +$400 annually |

| Liability Coverage | +$150 - +$300 annually |

| Comprehensive Coverage | +$100 - +$250 annually |

Driving History and Location

Your driving history and the location where you primarily use your RV are additional factors that insurance providers consider. A clean driving record with no accidents or violations can lead to lower insurance costs, as it indicates a lower risk of claims. Conversely, a history of accidents or traffic violations may result in higher premiums. Additionally, the location where you store and use your RV can impact insurance rates. RVs used in areas with a higher risk of theft, natural disasters, or heavy traffic may attract higher insurance costs.

Discounts and Savings

Insurance providers often offer discounts and savings opportunities to attract and retain customers. These discounts can significantly reduce your RV insurance costs. Common discounts include:

- Multi-Policy Discounts: Insuring multiple vehicles or assets, such as your RV and personal vehicle, with the same provider can result in substantial savings.

- Membership Discounts: Affiliation with certain organizations or associations, such as RV clubs or associations, may qualify you for exclusive insurance discounts.

- Safe Driver Discounts: Maintaining a clean driving record for a specified period can earn you discounts on your RV insurance premiums.

- Loyalty Discounts: Staying with the same insurance provider for an extended period may lead to loyalty-based discounts.

Performance Analysis: Real-World RV Insurance Costs

To provide a more tangible understanding of RV insurance costs, let’s analyze real-world examples. These case studies illustrate how different RV owners with varying circumstances might experience different insurance costs.

Case Study 1: John’s Motorhome Adventure

RV Type: 35-foot Class A Motorhome

Value: 120,000</p> <p><strong>Coverage Options:</strong> Comprehensive, Collision, Liability</p> <p><strong>Annual Premium:</strong> 2,200

John, a seasoned RV enthusiast, owns a luxurious Class A motorhome. With its high value and comprehensive coverage options, John’s insurance premium reflects the cost of insuring a premium RV. His clean driving record and affiliation with an RV club helped him secure a competitive rate from his insurance provider.

Case Study 2: Sarah’s Travel Trailer Getaway

RV Type: 24-foot Travel Trailer

Value: 30,000</p> <p><strong>Coverage Options:</strong> Liability Only</p> <p><strong>Annual Premium:</strong> 650

Sarah, a budget-conscious traveler, opted for a more affordable travel trailer. Choosing liability-only coverage and selecting a higher deductible, she was able to keep her insurance costs low. Her excellent credit score and safe driving history also contributed to the favorable insurance rate.

Case Study 3: Mike’s Campervan Exploration

RV Type: 20-foot Campervan

Value: 45,000</p> <p><strong>Coverage Options:</strong> Comprehensive, Collision, Liability, Emergency Roadside Assistance</p> <p><strong>Annual Premium:</strong> 1,400

Mike, an adventurous spirit, chose a versatile campervan for his travels. His insurance coverage includes comprehensive protection and emergency roadside assistance, reflecting his desire for added peace of mind. Despite a minor traffic violation in the past, his overall clean driving record and multi-policy discount helped keep his insurance costs manageable.

Future Implications: Navigating RV Insurance in a Changing Landscape

As the RV industry continues to evolve, insurance providers are adapting to meet the unique needs of RV owners. Here are some key trends and considerations for the future of RV insurance:

Growing Popularity of RVs

The RV market is experiencing significant growth, with more individuals embracing the RV lifestyle. This surge in popularity has led to increased demand for RV insurance. Insurance providers are responding by offering specialized coverage options and competitive rates to cater to this expanding market.

Technological Advances

Advancements in technology are shaping the RV industry, and insurance providers are taking note. From advanced safety features in modern RVs to digital tools for policy management, technology is playing a pivotal role. Insurers are leveraging these advancements to enhance their services, improve risk assessment, and offer more personalized coverage options.

Environmental Considerations

With a growing emphasis on sustainability and environmental consciousness, the RV industry is also adapting. Insurance providers are recognizing the importance of eco-friendly practices and may offer incentives or discounts for RV owners who adopt sustainable measures. This trend aligns with the overall shift towards greener travel options.

RV Community Engagement

The RV community is a tight-knit group, and insurance providers are recognizing the value of engaging with this community. By partnering with RV associations, clubs, and events, insurers can better understand the unique needs and preferences of RV owners. This engagement can lead to more tailored coverage options and enhanced services for the RV community.

How often should I review my RV insurance policy?

+It’s recommended to review your RV insurance policy annually or whenever significant changes occur in your circumstances. This includes changes in RV ownership, usage patterns, or personal life events. Regular policy reviews ensure that your coverage remains up-to-date and aligned with your needs.

Can I insure multiple RVs under one policy?

+Yes, many insurance providers offer the option to insure multiple RVs under a single policy. This can be advantageous, as it may result in multi-policy discounts and streamlined management. However, it’s essential to ensure that each RV’s unique characteristics and values are accurately reflected in the policy.

What factors should I consider when choosing RV insurance coverage?

+When selecting RV insurance coverage, consider factors such as your RV’s value, the risks you face during travel, and your personal financial situation. Opting for comprehensive coverage provides broader protection, but it may not be necessary if your RV has a lower value or if you primarily use it for short-distance travel. Evaluate your needs and risks to choose the coverage that suits you best.