Which Insurance Is Better Term Or Whole Life

In the realm of financial planning and investment, one of the most fundamental decisions an individual can make is choosing the right life insurance policy. With a myriad of options available, understanding the nuances between term and whole life insurance is crucial. This comprehensive guide aims to provide an in-depth analysis of these two popular insurance types, helping readers make an informed choice tailored to their specific needs and financial goals.

Term Life Insurance: A Comprehensive Overview

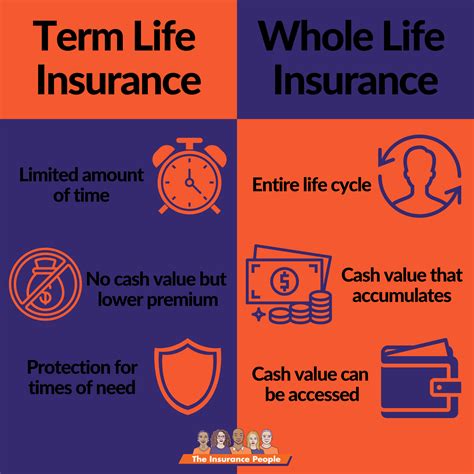

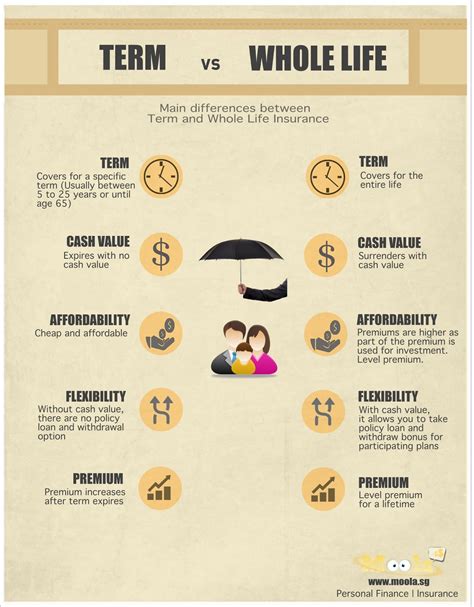

Term life insurance is a straightforward and affordable type of coverage that offers financial protection for a specified period, often ranging from 10 to 30 years. This type of policy is designed to provide a death benefit to beneficiaries if the policyholder passes away during the term of the policy. One of the key advantages of term life insurance is its cost-effectiveness, making it an accessible option for many individuals and families.

Key Features and Benefits of Term Life Insurance

Term life insurance offers a range of benefits that make it an attractive choice for many consumers. Firstly, its simplicity is a key selling point. Policyholders can easily understand the terms and conditions, ensuring they know exactly what they’re paying for and what their beneficiaries will receive in the event of their demise.

Secondly, the flexibility of term life insurance is notable. Policyholders can choose the coverage amount and the duration of the policy, allowing them to tailor the policy to their specific needs. This flexibility is especially beneficial for those with changing life circumstances, such as starting a family or purchasing a new home.

Another advantage of term life insurance is its affordability. Compared to whole life insurance, term policies often have significantly lower premiums, making them an excellent option for those on a budget or those who require coverage for a specific period.

| Pros of Term Life Insurance | Cons of Term Life Insurance |

|---|---|

| Affordable premiums | Coverage ends at the end of the term |

| Flexibility in coverage amounts and durations | No cash value accumulation |

| Easy to understand and manage | May require medical exams and health screenings |

Real-World Examples of Term Life Insurance

Consider John, a 35-year-old father of two. He decides to purchase a 20-year term life insurance policy with a coverage amount of $500,000 to ensure his family’s financial security in the event of his untimely death. The policy’s affordability allows John to allocate his resources efficiently, focusing on his family’s present and future needs.

On the other hand, Sarah, a 28-year-old professional, opts for a 10-year term life insurance policy with a coverage amount of $250,000. She chooses this option to cover her outstanding student loans and provide a financial cushion for her partner if something were to happen to her during this period.

Whole Life Insurance: A Permanent Solution

Whole life insurance, also known as permanent life insurance, is a type of coverage that offers lifetime protection and builds cash value over time. Unlike term life insurance, whole life policies remain in effect until the policyholder passes away or cancels the policy. This type of insurance is designed to provide a death benefit to beneficiaries and also serves as a savings or investment vehicle.

Understanding the Components of Whole Life Insurance

Whole life insurance policies consist of two main components: the death benefit and the cash value. The death benefit is the amount paid to the beneficiaries upon the policyholder’s death, providing financial security and covering expenses such as funeral costs, outstanding debts, and long-term financial needs.

The cash value component of whole life insurance acts as a savings account. Policyholders can accumulate cash value over time, which can be accessed through loans or withdrawals. This cash value can be used for various purposes, such as supplementing retirement income, paying for a child's education, or covering unexpected expenses.

Key Advantages of Whole Life Insurance

One of the primary advantages of whole life insurance is its longevity. Unlike term life insurance, which has a defined end date, whole life policies provide coverage for the policyholder’s entire life, offering peace of mind and a lifetime of financial protection.

Another benefit of whole life insurance is its guaranteed death benefit. The death benefit amount remains fixed throughout the policy's duration, providing certainty and stability for beneficiaries. This is particularly valuable for individuals who want to ensure their loved ones' financial security regardless of market fluctuations or changing economic conditions.

Furthermore, the cash value accumulation aspect of whole life insurance provides an opportunity for policyholders to build wealth over time. The cash value grows tax-deferred, and policyholders can access it through loans or withdrawals, offering flexibility and potential tax advantages.

| Pros of Whole Life Insurance | Cons of Whole Life Insurance |

|---|---|

| Lifetime coverage | Higher premiums compared to term life insurance |

| Guaranteed death benefit | Limited flexibility in coverage amounts |

| Cash value accumulation | Longer commitment required |

A Real-Life Scenario: The Benefits of Whole Life Insurance

Imagine Robert, a 45-year-old business owner. He chooses to invest in a whole life insurance policy to provide financial security for his family and business. The policy’s death benefit ensures his family’s financial stability, while the cash value component allows him to accumulate wealth tax-efficiently. Robert can use this cash value to supplement his retirement income or pass on a substantial inheritance to his children.

Comparative Analysis: Term vs. Whole Life Insurance

When deciding between term and whole life insurance, it’s essential to consider various factors, including your financial goals, budget, and personal circumstances. Term life insurance is ideal for those seeking temporary coverage at an affordable price, while whole life insurance is a better fit for those seeking permanent coverage and the potential for wealth accumulation.

Key Differences Between Term and Whole Life Insurance

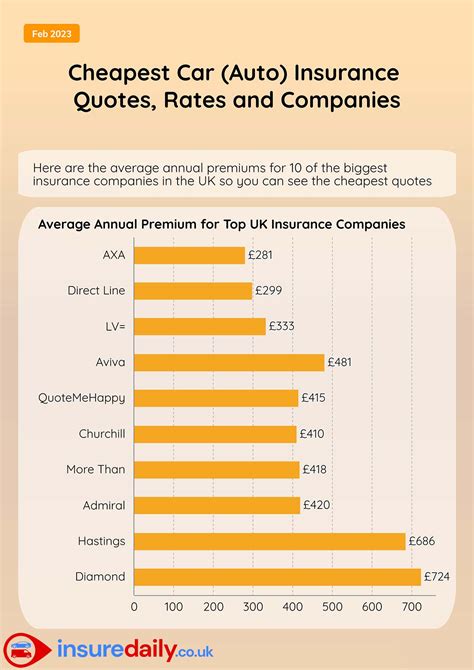

One of the most significant differences between term and whole life insurance is the cost. Term life insurance policies generally have lower premiums, making them more accessible to a broader range of individuals. On the other hand, whole life insurance policies have higher premiums due to the added benefits of lifetime coverage and cash value accumulation.

Another key distinction is the flexibility offered by each type of insurance. Term life insurance provides flexibility in coverage amounts and durations, allowing policyholders to adjust their coverage as their life circumstances change. In contrast, whole life insurance offers less flexibility in coverage amounts but provides the stability of permanent coverage.

Finding the Right Fit: Term or Whole Life Insurance

The decision between term and whole life insurance ultimately depends on individual needs and preferences. Term life insurance is an excellent choice for those with short-term financial goals or those who require coverage for a specific period, such as covering mortgage payments or providing for dependent children.

On the other hand, whole life insurance is a better fit for individuals seeking long-term financial protection and wealth accumulation. It is particularly beneficial for those who want to ensure their financial legacy and provide for their loved ones well into the future. Whole life insurance can also be a valuable tool for business owners, offering a way to protect their business interests and provide for key employees or family members involved in the business.

The Future of Life Insurance: Trends and Innovations

The life insurance industry is constantly evolving, with new trends and innovations shaping the landscape. As technology advances, insurers are leveraging data analytics and artificial intelligence to offer more personalized and efficient services. This includes the development of digital platforms that streamline the application process and provide real-time policy management.

Additionally, the rise of hybrid life insurance policies, which combine elements of term and whole life insurance, is gaining popularity. These policies offer the flexibility of term insurance with the long-term benefits of whole life insurance, providing a middle ground for individuals seeking a balanced approach to their financial protection and wealth accumulation.

Expert Insights: Navigating the Life Insurance Landscape

Frequently Asked Questions

What is the primary difference between term and whole life insurance?

+The primary difference lies in the duration and nature of coverage. Term life insurance offers temporary coverage for a specified period, often 10 to 30 years, while whole life insurance provides permanent coverage for the policyholder’s entire life.

How do the costs of term and whole life insurance compare?

+Term life insurance generally has lower premiums, making it more affordable for many individuals. Whole life insurance, on the other hand, has higher premiums due to the added benefits of permanent coverage and cash value accumulation.

Can I convert a term life insurance policy to a whole life policy?

+Yes, many term life insurance policies offer a conversion option, allowing policyholders to convert their term policy to a whole life policy without undergoing a new medical exam. This provides flexibility and the ability to adapt to changing financial needs.

What are some key factors to consider when choosing between term and whole life insurance?

+Consider your financial goals, budget, and personal circumstances. Term life insurance is ideal for temporary coverage needs, while whole life insurance is suitable for long-term financial protection and wealth accumulation.

Are there any tax advantages associated with whole life insurance?

+Yes, the cash value accumulation within whole life insurance policies grows tax-deferred, offering potential tax benefits. Policyholders can access this cash value through loans or withdrawals, providing flexibility and the opportunity to optimize their tax situation.