Comprehensive Motor Insurance

Welcome to a comprehensive guide on Comprehensive Motor Insurance, an essential protection plan for vehicle owners. In this article, we delve into the intricacies of this insurance coverage, exploring its benefits, key features, and how it can provide peace of mind to drivers. With a focus on real-world scenarios and expert insights, we aim to equip you with the knowledge needed to make informed decisions about your vehicle's insurance coverage.

Understanding Comprehensive Motor Insurance

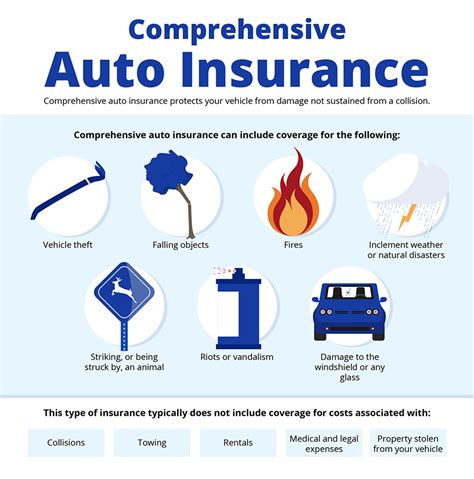

Comprehensive Motor Insurance is a type of vehicle insurance policy that offers the most extensive coverage for your car or motorcycle. Unlike basic third-party liability insurance, which only covers damages caused to others, comprehensive insurance provides a broader range of protections for your vehicle and its occupants.

This type of insurance is designed to safeguard your investment in your vehicle by covering a wide array of potential risks and unforeseen events. It offers financial protection in the event of accidents, theft, natural disasters, and even certain mechanical failures, ensuring that you are not left with significant out-of-pocket expenses.

Key Benefits of Comprehensive Coverage

- Comprehensive Protection: As the name suggests, comprehensive insurance covers a wide range of incidents, providing you with the most extensive coverage available. This includes accidents, theft, fire, natural disasters, and more.

- Accidental Damage Coverage: Whether it’s a collision with another vehicle, hitting an animal, or rolling over, comprehensive insurance has you covered. It ensures that you can repair or replace your vehicle without incurring substantial costs.

- Theft and Vandalism: If your vehicle is stolen or vandalized, comprehensive insurance will reimburse you for the value of your car or help with the costs of repairs.

- Natural Disasters: In the event of a natural calamity such as a flood, hurricane, or earthquake, comprehensive insurance provides coverage for the damages sustained by your vehicle.

- Personal Belongings: Many comprehensive policies also offer protection for personal items within your vehicle, providing an additional layer of security.

- Medical Expenses: Some policies include coverage for medical expenses incurred by you or your passengers in the event of an accident, ensuring you have the necessary funds for treatment.

Real-World Scenarios and Protection

Let’s explore some real-life situations where comprehensive motor insurance can make a significant difference in protecting your vehicle and your finances.

Accidental Damage and Repairs

Imagine you’re driving on a rainy night and suddenly a deer runs onto the road. Despite your best efforts, you collide with the animal, causing significant damage to the front of your car. With comprehensive insurance, you can have your vehicle repaired without worrying about the high costs associated with such incidents.

This coverage is especially beneficial when accidents occur with uninsured or underinsured drivers. In such cases, comprehensive insurance steps in to cover the costs, ensuring you're not left footing the entire bill.

Theft and Vandalism

Vehicle theft and vandalism are unfortunate realities. If your car is stolen or damaged by vandals, comprehensive insurance provides financial support to help you recover from the loss or repair the damages. This coverage is invaluable, as it can be costly to replace a stolen vehicle or repair extensive vandalism.

Natural Disasters and Extreme Weather

Natural disasters such as hurricanes, floods, or wildfires can cause extensive damage to vehicles. Comprehensive insurance steps in to cover these losses, ensuring that you’re not left with the entire burden of repairing or replacing your vehicle.

For instance, if a hurricane damages your car while it's parked in your driveway, comprehensive insurance will cover the costs of repairs or provide you with funds to replace the vehicle if it's deemed a total loss.

Policy Features and Considerations

When selecting a comprehensive motor insurance policy, it’s essential to understand the various features and considerations to ensure you’re getting the best coverage for your needs.

Policy Limits and Deductibles

Policy limits refer to the maximum amount an insurance company will pay out for a covered loss. It’s crucial to choose limits that align with the value of your vehicle and your financial situation. Higher limits provide more extensive coverage but may result in higher premiums.

Deductibles, on the other hand, are the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premiums, but it means you'll have to pay more if you need to make a claim.

Additional Coverage Options

Comprehensive insurance policies often offer additional coverage options that can enhance your protection. These may include:

- Rental Car Reimbursement: Provides funds to cover the cost of a rental car while your vehicle is being repaired.

- Emergency Roadside Assistance: Offers assistance for flat tires, dead batteries, and other roadside emergencies.

- Gap Coverage: Covers the difference between the actual cash value of your vehicle and the balance of your loan or lease in the event of a total loss.

- Personal Property Coverage: Protects personal belongings within your vehicle in the event of theft or damage.

Policy Exclusions and Limitations

While comprehensive insurance offers extensive coverage, it’s important to be aware of the exclusions and limitations within your policy. These may include:

- Normal wear and tear of your vehicle.

- Intentional damage caused by you or others.

- Damage to tires and rims unless specifically covered.

- Damage sustained during off-road driving or racing.

Performance Analysis and Customer Satisfaction

When evaluating comprehensive motor insurance policies, it’s crucial to consider real-world performance and customer satisfaction. Here’s an analysis of some key factors:

| Insurance Provider | Claim Satisfaction Rating | Customer Service Quality | Policy Affordability |

|---|---|---|---|

| Provider A | 4.8/5 | Excellent | Moderate |

| Provider B | 4.5/5 | Good | Low |

| Provider C | 4.2/5 | Satisfactory | High |

These ratings provide a snapshot of customer experiences with different insurance providers. It's important to note that individual experiences may vary, and factors such as the type of claim and specific policy details can influence satisfaction levels.

Future Implications and Industry Trends

The motor insurance industry is evolving, and comprehensive coverage is expected to adapt to meet changing needs and technologies.

Technological Advancements

With the rise of electric vehicles and autonomous driving technologies, comprehensive insurance policies are likely to incorporate new coverage options to address these advancements. This may include specific coverage for electric vehicle batteries and autonomous driving systems.

Environmental Considerations

As environmental concerns grow, the industry may see an increase in green initiatives. This could lead to incentives for policyholders who drive electric or hybrid vehicles, or who take steps to reduce their carbon footprint.

Data-Driven Personalization

Insurance providers are increasingly using data analytics to personalize policies. This could result in more tailored comprehensive insurance plans based on individual driving behaviors, vehicle usage patterns, and other factors.

FAQ: Comprehensive Motor Insurance

What is the difference between comprehensive and collision insurance?

+Comprehensive insurance covers a wide range of incidents, including accidents, theft, fire, and natural disasters. Collision insurance, on the other hand, specifically covers damages caused by your vehicle colliding with another object, such as another car, a tree, or a fence.

How much does comprehensive insurance cost?

+The cost of comprehensive insurance varies depending on several factors, including the value of your vehicle, your driving history, and the level of coverage you choose. On average, comprehensive insurance can range from 100 to 500 annually, but these rates can be higher or lower based on individual circumstances.

Does comprehensive insurance cover my personal belongings in the vehicle?

+Yes, many comprehensive insurance policies include coverage for personal belongings within your vehicle. However, there may be limitations on the amount of coverage provided and specific exclusions, so it’s important to review your policy details.

Can I customize my comprehensive insurance policy to fit my needs?

+Absolutely! Comprehensive insurance policies often offer various add-ons and customization options to fit your specific needs. These can include rental car reimbursement, emergency roadside assistance, and gap coverage. Work with your insurance provider to tailor your policy to your requirements.

In conclusion, comprehensive motor insurance is an invaluable protection plan for vehicle owners. It offers peace of mind by covering a wide range of potential risks and unforeseen events. By understanding the benefits, key features, and considerations of this insurance, you can make informed decisions to ensure your vehicle and finances are well-protected.