Wa State Health Insurance

In the ever-evolving landscape of healthcare, understanding the intricacies of health insurance coverage is paramount, especially when considering the unique landscape of Washington State. This article delves into the specifics of Wa State Health Insurance, providing an in-depth analysis of the options, benefits, and considerations for residents.

Understanding Wa State Health Insurance

Washington State, often referred to as Wa State, offers a comprehensive and diverse range of health insurance options tailored to meet the needs of its residents. The state’s healthcare system is governed by a set of regulations and policies that aim to ensure accessibility, affordability, and quality of healthcare services.

One of the key aspects of Wa State's approach to health insurance is its focus on individual and family coverage. The state recognizes the importance of providing comprehensive healthcare options to its residents, regardless of their age, income, or employment status. This inclusive approach has led to the development of various insurance plans and programs, each with its unique features and benefits.

Key Players in Wa State Health Insurance

The Wa State health insurance market is characterized by a mix of private insurers, government-funded programs, and employer-based coverage. Here’s a breakdown of the key players:

- Private Health Insurers: Companies like Premera Blue Cross, Regence BlueShield, and Kaiser Permanente are prominent players in the Wa State insurance market. These insurers offer a range of plans, including PPOs, HMOs, and EPOs, providing flexibility and choice to consumers.

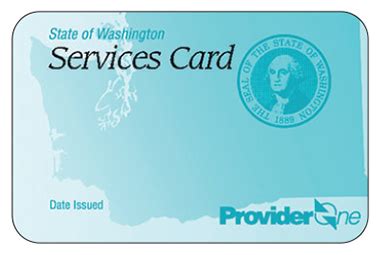

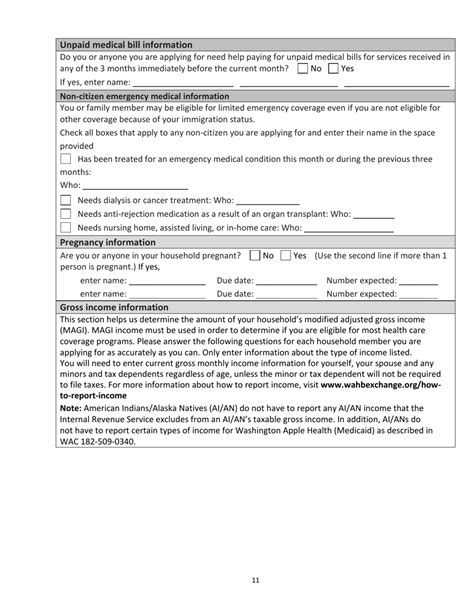

- Washington Apple Health (Medicaid): This government-funded program provides healthcare coverage to eligible low-income individuals and families. Apple Health covers a wide range of services, including medical, dental, and behavioral health, ensuring comprehensive care for those who need it most.

- Washington Basic Health: Basic Health is a state-funded program designed to offer affordable coverage to residents who don't qualify for Medicaid but cannot afford private insurance. It provides access to essential health benefits at a lower cost.

- Employer-Sponsored Plans: Many employers in Wa State offer health insurance as part of their benefits package. These plans often provide comprehensive coverage and may include additional perks like wellness programs and discounted rates.

The Benefits of Wa State Health Insurance

Wa State’s commitment to healthcare accessibility and quality is evident in the benefits offered by its insurance programs. Here are some key advantages:

- Comprehensive Coverage: Whether it's through private insurers or government programs, Wa State residents have access to a wide range of healthcare services, including primary care, specialty care, prescription drugs, and preventive services.

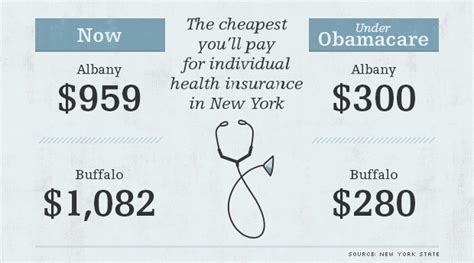

- Affordable Options: The state's efforts to make healthcare more affordable are reflected in programs like Washington Apple Health and Basic Health. These initiatives ensure that low-income individuals and families can access essential healthcare without facing financial barriers.

- Prevention and Wellness: Many insurance plans in Wa State emphasize preventive care and wellness. This includes annual check-ups, immunizations, and health education programs, helping residents maintain their health and well-being.

- Mental Health Support: Wa State recognizes the importance of mental health, and many insurance plans cover behavioral health services, including therapy, counseling, and medication management.

| Insurance Category | Key Benefits |

|---|---|

| Private Insurers | Flexibility, Choice of Providers, Additional Perks |

| Washington Apple Health | Comprehensive Coverage, Low-Income Eligibility, Dental and Behavioral Health Services |

| Washington Basic Health | Affordable Premiums, Essential Health Benefits, Access for Middle-Income Residents |

| Employer-Sponsored Plans | Comprehensive Coverage, Often with Additional Wellness Benefits |

Navigating Wa State Health Insurance Options

With a plethora of health insurance options available in Wa State, it’s essential for residents to understand their needs and preferences before making a choice. Here’s a guide to help navigate the process:

Assessing Your Needs

Before selecting a health insurance plan, take the time to evaluate your healthcare needs. Consider factors such as your age, health status, prescription medication requirements, and preferred providers. If you have a family, their healthcare needs should also be taken into account.

Additionally, think about the type of coverage you desire. Do you prefer the flexibility of a PPO or the cost-effectiveness of an HMO? Understanding your preferences will help narrow down your options.

Comparing Plans and Costs

Once you have a clear idea of your needs, it’s time to compare different health insurance plans. Consider factors like:

- Premiums: The amount you pay monthly for your insurance coverage. Compare premiums across different plans to find the most affordable option for your budget.

- Deductibles and Copays: Deductibles are the amount you pay out of pocket before your insurance coverage kicks in. Copays are the fixed amounts you pay for specific services, like doctor visits or prescriptions. Lower deductibles and copays can make coverage more accessible.

- Network of Providers: Check if your preferred doctors, hospitals, and specialists are in-network for the plan you're considering. Out-of-network care can result in higher costs.

- Covered Services: Review the list of covered services and benefits to ensure the plan aligns with your healthcare needs. Look for plans that cover essential services like preventive care, maternity care, and mental health support.

Enrolling in Wa State Health Insurance

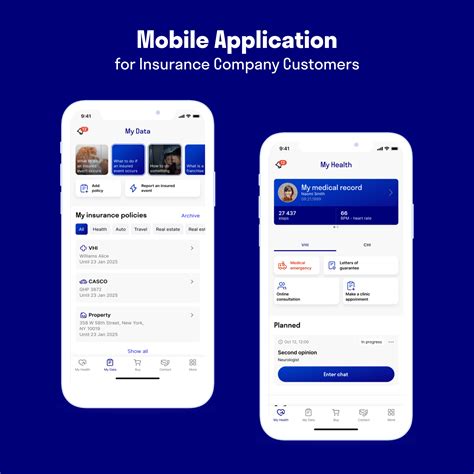

Enrolling in a health insurance plan is a straightforward process in Wa State. Residents can choose to enroll through the state’s health insurance marketplace, known as Washington Healthplanfinder. This online platform provides a one-stop shop for comparing and enrolling in various health insurance plans.

During the enrollment period, typically from November to January, residents can browse and select plans that suit their needs. It's important to note that some plans may have specific enrollment requirements, so it's advisable to check the eligibility criteria before applying.

Special Enrollment Periods

In addition to the annual open enrollment period, Wa State residents may also qualify for special enrollment periods. These periods allow individuals to enroll outside of the regular timeframe due to specific life events, such as marriage, birth or adoption of a child, loss of job-based coverage, or moving to a new state.

To take advantage of a special enrollment period, residents must act promptly and provide the necessary documentation to support their eligibility. This ensures that they can access healthcare coverage without waiting for the next open enrollment period.

Wa State Health Insurance: A Comprehensive Overview

In conclusion, Wa State’s approach to health insurance is characterized by its commitment to providing accessible and comprehensive healthcare options. From private insurers to government-funded programs, residents have a wide array of choices to meet their unique needs.

By understanding the key players, benefits, and enrollment processes, Wa State residents can make informed decisions about their health insurance coverage. Whether it's through the state's marketplace or employer-sponsored plans, the goal remains the same: ensuring that every resident has access to quality healthcare services.

What is the difference between Washington Apple Health and Washington Basic Health?

+Washington Apple Health (Medicaid) is a government-funded program that provides comprehensive healthcare coverage to eligible low-income individuals and families. It covers a wide range of services, including medical, dental, and behavioral health. Washington Basic Health, on the other hand, is a state-funded program designed for residents who don’t qualify for Medicaid but cannot afford private insurance. It offers affordable premiums and covers essential health benefits.

Are there any tax benefits associated with Wa State health insurance plans?

+Yes, certain health insurance plans in Wa State may offer tax benefits. For example, individuals who purchase health insurance through the state’s marketplace may be eligible for premium tax credits, which can reduce the cost of their monthly premiums. Additionally, some plans may offer flexible spending accounts (FSAs) or health savings accounts (HSAs), which allow individuals to set aside pre-tax dollars for qualified medical expenses.

How do I know if I qualify for Washington Apple Health (Medicaid)?

+Eligibility for Washington Apple Health (Medicaid) is based on income and certain other factors. Generally, individuals and families with incomes up to 138% of the federal poverty level may qualify. However, eligibility criteria can vary depending on factors like age, disability status, and pregnancy. It’s recommended to use the state’s online eligibility tool or consult with a local enrollment specialist to determine your eligibility.