At&T Phone Insurance Claims

In today's fast-paced world, our smartphones have become an integral part of our daily lives, serving as our primary means of communication, entertainment, and even work. With the constant evolution of technology, we often find ourselves upgrading to the latest models, and as a result, phone insurance has become a popular choice for many to protect their investments. Among the various phone insurance providers, AT&T offers a comprehensive insurance program with a unique claim process. This article will delve into the intricacies of AT&T's phone insurance claims, exploring the process, coverage, and benefits to help you make informed decisions about your phone protection.

Understanding AT&T Phone Insurance

AT&T’s phone insurance program, known as AT&T Protect, is designed to offer customers peace of mind by providing coverage for a range of unexpected phone mishaps. This program aims to protect your device against damages, defects, and even loss or theft. By enrolling in AT&T Protect, you gain access to a comprehensive insurance plan that covers a wide array of potential issues.

Eligibility and Enrollment

AT&T Protect is available to both new and existing AT&T customers. When you purchase a new device from AT&T, you can opt to enroll in the insurance program at the same time. For existing customers, you can add the insurance plan to your account by contacting AT&T’s customer service or visiting an AT&T store. The eligibility criteria include having an active AT&T service plan and a compatible device. It’s worth noting that not all devices are eligible for insurance, so it’s essential to check the list of eligible devices before enrolling.

| Eligible Devices | Example Models |

|---|---|

| Smartphones | iPhone 13, Samsung Galaxy S22 |

| Tablets | iPad Pro, Samsung Galaxy Tab S7 |

| Wearables | Apple Watch Series 7, Samsung Galaxy Watch 4 |

AT&T Protect offers two types of plans: AT&T Protect Advantage and AT&T Protect Premier. The Advantage plan provides coverage for accidental damage, mechanical or electrical failure, and out-of-warranty defects. The Premier plan, on the other hand, includes all the coverage of the Advantage plan, plus protection against loss and theft. The choice between these plans depends on your personal needs and the value of your device.

The AT&T Phone Insurance Claims Process

When an unexpected event occurs, such as a cracked screen or a malfunctioning device, the AT&T phone insurance claims process is straightforward and designed to provide quick assistance. Here’s a step-by-step guide to help you navigate through the claims process:

Step 1: Assess the Damage

Before initiating a claim, it’s essential to thoroughly assess the damage to your device. Take note of any visible cracks, water damage, or other signs of malfunction. Document the issue with clear photographs, as these will be crucial when filing your claim. This step ensures that you have a clear understanding of the extent of the damage and can provide accurate information to AT&T’s claims team.

Step 2: Contact AT&T Customer Service

The next step is to contact AT&T’s customer service. You can reach them via phone, live chat, or email. Provide them with your account details and a brief description of the issue. AT&T’s representative will guide you through the initial claim process, verifying your insurance coverage and eligibility. They may ask for additional information or documentation to support your claim.

Step 3: File Your Claim

Once your claim is verified, you’ll be guided through the official claim filing process. AT&T provides an online platform where you can log in to your account and submit your claim. This platform allows you to upload the necessary documentation, including photographs and any relevant receipts or reports. Ensure that all the information you provide is accurate and up-to-date.

Step 4: Review and Approval

After submitting your claim, AT&T’s claims team will review the details and assess the damage. This process typically takes a few business days. During the review, the team may reach out to you for additional information or clarification. It’s important to respond promptly to any requests to avoid delays in the approval process.

Step 5: Receive Your Replacement Device

If your claim is approved, AT&T will provide you with a replacement device. The replacement process varies depending on the type of plan you have and the extent of the damage. For minor damages, such as a cracked screen, AT&T may offer a repair service or provide a refurbished device. In more severe cases, you’ll receive a new device to replace your damaged one. The replacement device will be delivered to your preferred location, ensuring you stay connected without interruption.

Step 6: Deductible and Claim Limits

AT&T Protect plans come with a deductible, which is the amount you must pay out of pocket for each approved claim. The deductible amount varies based on the plan and the type of claim. It’s important to understand the deductible structure to manage your expectations and budget accordingly. Additionally, AT&T Protect plans have claim limits, which specify the maximum number of claims you can make within a certain period. Exceeding these limits may result in additional fees or termination of your insurance coverage.

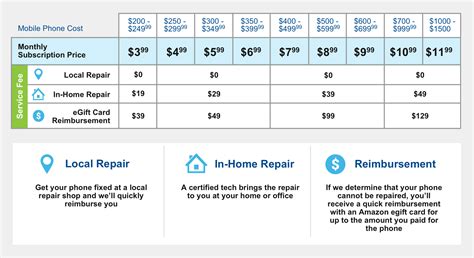

| Plan | Deductible | Claim Limit |

|---|---|---|

| AT&T Protect Advantage | $49 for accidental damage | 2 claims per 12 months |

| AT&T Protect Premier | $99 for accidental damage | 2 claims per 12 months |

| AT&T Protect Premier | $175 for loss or theft | 2 claims per 12 months |

Benefits of AT&T Phone Insurance Claims

AT&T’s phone insurance claims process offers several advantages to customers. Firstly, it provides a quick and efficient way to resolve unexpected phone issues. With a streamlined claims process, you can get your device repaired or replaced in a timely manner, minimizing downtime. Additionally, AT&T’s insurance plans offer comprehensive coverage, ensuring that a wide range of phone-related problems are addressed.

Comprehensive Coverage

AT&T Protect plans cover a variety of scenarios, including accidental damage, mechanical failure, out-of-warranty defects, and even loss or theft (for the Premier plan). This comprehensive coverage ensures that you’re protected against a broad spectrum of potential issues. Whether it’s a cracked screen, water damage, or a stolen device, AT&T’s insurance plans have you covered.

Convenient Repair or Replacement Options

When your claim is approved, AT&T offers convenient repair or replacement options. Depending on the nature of the damage, you may have the choice between repairing your device or receiving a replacement. This flexibility allows you to choose the option that best suits your needs and preferences. For minor damages, repairing your device can be a cost-effective solution, while for more severe issues, a replacement ensures you have a fully functional device without delay.

Access to Quality Devices

AT&T provides its customers with access to high-quality replacement devices. Whether you opt for a refurbished or brand-new device, you can trust that it will meet your expectations. AT&T’s commitment to quality ensures that you receive a device that performs optimally, allowing you to continue your daily activities without compromise.

Quick Turnaround Times

One of the key benefits of AT&T’s phone insurance claims process is the quick turnaround time. From the initial claim submission to receiving your replacement device, the entire process is designed to be efficient. This means you won’t have to wait long to get your device repaired or replaced, ensuring minimal disruption to your daily life and work.

Expert Support

AT&T’s customer service team is trained to provide expert support throughout the claims process. They are knowledgeable about the insurance plans and can guide you through the steps, answering any questions or concerns you may have. Their expertise ensures that you receive accurate information and assistance, making the claims process smoother and less stressful.

Real-Life Success Stories

To illustrate the effectiveness of AT&T’s phone insurance claims process, let’s explore a couple of real-life success stories:

Case Study 1: Accidental Damage

Sarah, an AT&T customer, accidentally dropped her iPhone in a pool during a family gathering. The phone was completely submerged and suffered severe water damage. In a panic, she contacted AT&T’s customer service, explaining the situation. The representative promptly guided her through the claims process, assuring her that her AT&T Protect Advantage plan covered water damage. Within a few days, Sarah received a replacement iPhone, allowing her to stay connected and avoid the hassle of a lengthy repair process.

Case Study 2: Theft Recovery

Michael, a busy professional, had his phone stolen while traveling abroad. He immediately contacted AT&T’s customer service, reporting the theft and filing a claim under his AT&T Protect Premier plan. The claims team worked diligently to process his claim, and within a week, Michael received a brand-new replacement phone. This swift action not only provided him with a new device but also helped him stay connected and continue his work without missing a beat.

FAQs

What happens if I exceed the claim limit on my AT&T Protect plan?

+

If you exceed the claim limit on your AT&T Protect plan, you may be subject to additional fees or your insurance coverage may be terminated. It’s important to review the terms and conditions of your plan to understand the specific consequences of exceeding the claim limit.

Can I cancel my AT&T Protect plan at any time?

+

Yes, you have the flexibility to cancel your AT&T Protect plan at any time. However, it’s important to note that canceling your plan may result in the termination of your insurance coverage, leaving you unprotected in the event of a phone-related issue.

Are there any exclusions or limitations to AT&T’s phone insurance coverage?

+

Yes, AT&T’s phone insurance coverage does have certain exclusions and limitations. These may include intentional damage, negligence, or damage caused by natural disasters. It’s crucial to review the policy details to understand the specific exclusions and limitations applicable to your plan.

How long does it typically take to receive a replacement device after an approved claim?

+

The time it takes to receive a replacement device after an approved claim can vary depending on several factors, including the type of damage, the availability of replacement devices, and your location. AT&T aims to provide replacement devices as quickly as possible, typically within a few business days.

In conclusion, AT&T's phone insurance claims process is designed to provide customers with a seamless and efficient experience when dealing with unexpected phone issues. With comprehensive coverage, convenient repair or replacement options, and expert support, AT&T Protect plans offer peace of mind to smartphone users. By understanding the eligibility, enrollment process, and the steps involved in filing a claim, you can make the most of your AT&T phone insurance coverage.

Remember, your smartphone is an essential tool in today’s world, and protecting it with a reliable insurance plan is a wise investment. Stay connected, and let AT&T’s phone insurance claims process take care of the rest!