Best Insurance Cars

Choosing the right car can have a significant impact on your insurance costs. While various factors influence insurance premiums, such as your driving history, location, and personal circumstances, the type of car you drive plays a crucial role. In this comprehensive guide, we will explore the best insurance cars, delving into their features, safety ratings, and how they can potentially lower your insurance expenses. By understanding the key considerations and making an informed choice, you can find the perfect vehicle that aligns with your needs and budget.

Understanding Insurance Costs for Cars

Before we dive into the specific models, it’s essential to grasp the primary factors that influence insurance premiums for cars. These factors include:

- Vehicle Type and Make: Different car models have varying insurance costs. Sports cars, luxury vehicles, and certain makes known for high repair expenses tend to have higher insurance premiums.

- Safety Features: Cars equipped with advanced safety technologies often result in lower insurance rates. Features like anti-lock brakes, electronic stability control, and collision avoidance systems can significantly impact insurance costs.

- Repair Costs: Vehicles with costly parts and specialized repair needs generally attract higher insurance premiums. It’s crucial to consider the availability and cost of replacement parts when choosing a car.

- Theft and Vandalism Risks: Cars prone to theft or vandalism are typically more expensive to insure. Insurance companies consider the risk profile of different models when setting premiums.

- Age and Condition: Older cars may have lower insurance costs due to their reduced value, but they can also be more prone to mechanical issues, which can affect insurance rates.

Top Insurance-Friendly Car Models

Now, let’s explore some of the best insurance cars available in the market, considering their safety features, repair costs, and overall insurance-friendliness.

Toyota Prius

The Toyota Prius is a hybrid vehicle renowned for its fuel efficiency and low maintenance costs. It boasts an impressive safety record, with advanced driver-assistance systems and a solid build quality. The Prius is known for its reliability, reducing the risk of unexpected repairs and associated insurance claims.

Key Features:

- Hybrid Engine: The Prius offers excellent fuel efficiency, reducing the cost of ownership.

- Advanced Safety Suite: Includes lane departure warning, automatic high beams, and a pre-collision system.

- Excellent Reliability: Consistently ranks high in reliability surveys, minimizing repair expenses.

Honda Civic

The Honda Civic is a popular choice for its affordability, reliability, and impressive safety ratings. It comes equipped with a range of safety features, making it an excellent option for those seeking insurance-friendly vehicles.

Key Features:

- Efficient Engine Options: Offers a balance between performance and fuel efficiency.

- Honda Sensing: Includes lane keeping assist, adaptive cruise control, and collision mitigation braking.

- Reputable Reliability: Honda is known for its durable and long-lasting vehicles.

Subaru Outback

The Subaru Outback is a versatile crossover SUV known for its all-wheel drive and exceptional safety ratings. It’s an excellent choice for families and outdoor enthusiasts seeking a reliable and insurance-friendly vehicle.

Key Features:

- Symmetrical All-Wheel Drive: Provides superior traction and handling in various road conditions.

- Advanced Driver-Assistance Systems: Includes lane keep assist, adaptive cruise control, and pre-collision braking.

- Subaru’s EyeSight Technology: Offers a suite of safety features, enhancing driver awareness and reducing accident risks.

Mazda CX-5

The Mazda CX-5 is a compact SUV that combines style, performance, and efficiency. It offers a range of safety features and reliable performance, making it an attractive option for those seeking an insurance-friendly vehicle.

Key Features:

- Skyactiv Technology: Provides efficient engines and responsive handling.

- i-Activsense Safety Suite: Includes lane departure warning, blind spot monitoring, and a rear cross-traffic alert system.

- Excellent Fuel Economy: Offers impressive mileage, reducing running costs.

Hyundai Elantra

The Hyundai Elantra is a compact sedan known for its affordability and impressive safety ratings. It offers a range of features, making it an excellent choice for those seeking a budget-friendly and insurance-conscious vehicle.

Key Features:

- Efficient Engine Options: Provides a balance between performance and fuel efficiency.

- Hyundai SmartSense: Includes lane keeping assist, forward collision avoidance, and a driver attention warning system.

- Affordable Pricing: Offers excellent value for money without compromising on safety.

Safety Ratings and Insurance Costs

Safety ratings play a crucial role in determining insurance costs. Vehicles with higher safety ratings are often associated with lower insurance premiums. Here’s a brief overview of some of the renowned safety rating organizations:

- National Highway Traffic Safety Administration (NHTSA): Provides star ratings for crashworthiness, assessing a vehicle’s performance in frontal, side, and rollover crashes.

- Insurance Institute for Highway Safety (IIHS): Conducts rigorous crash tests and evaluates vehicles for various safety aspects, including front crash prevention, headlights, and child seat anchors.

- Euro NCAP: A European organization that assesses vehicle safety, focusing on adult and child occupant protection, pedestrian safety, and driver assistance systems.

Insurance-Friendly Car Features

When selecting a car with insurance costs in mind, certain features can significantly impact your premiums. Here are some key aspects to consider:

- Advanced Driver-Assistance Systems (ADAS): Vehicles equipped with ADAS, such as lane departure warning, adaptive cruise control, and collision avoidance systems, often result in lower insurance premiums. These features enhance safety and reduce the risk of accidents.

- Anti-Theft Devices: Installing approved anti-theft devices can lower your insurance costs. These devices include immobilizers, tracking systems, and alarm systems, which deter theft and reduce the risk of vandalism.

- Safe Construction and Materials: Vehicles built with high-strength steel and advanced safety cages offer better protection in crashes. These construction materials can result in lower insurance premiums.

- Reliability and Durability: Choosing a car known for its reliability and durability reduces the likelihood of frequent repairs and unexpected expenses. Reliable vehicles often have lower insurance costs due to reduced risk of breakdowns and accidents.

The Impact of Car Modifications on Insurance

Modifying your car can have a significant impact on insurance costs. While some modifications may enhance safety and performance, others can lead to higher premiums or even insurance denial. Here are some key considerations:

- Performance Modifications: Upgrading your car’s engine, suspension, or exhaust system can increase its performance but may also raise insurance premiums. Insurance companies consider these modifications as potential risks and may charge higher rates.

- Appearance Modifications: Customizing your car’s exterior, such as adding spoilers, body kits, or distinctive paint jobs, can affect insurance costs. While these modifications may not directly impact safety, they can increase the risk of vandalism or theft, leading to higher premiums.

- Security and Safety Modifications: Adding approved security devices, such as immobilizers or tracking systems, can reduce insurance costs. These modifications deter theft and enhance safety, making your car a lower-risk proposition for insurance companies.

- Insurance Company Approval: Always consult your insurance provider before making significant modifications. Some companies may have specific guidelines or requirements for certain modifications, and failure to comply can result in higher premiums or coverage denial.

Tips for Lowering Insurance Costs

Apart from choosing an insurance-friendly car, there are several strategies you can employ to lower your insurance premiums. Here are some effective tips:

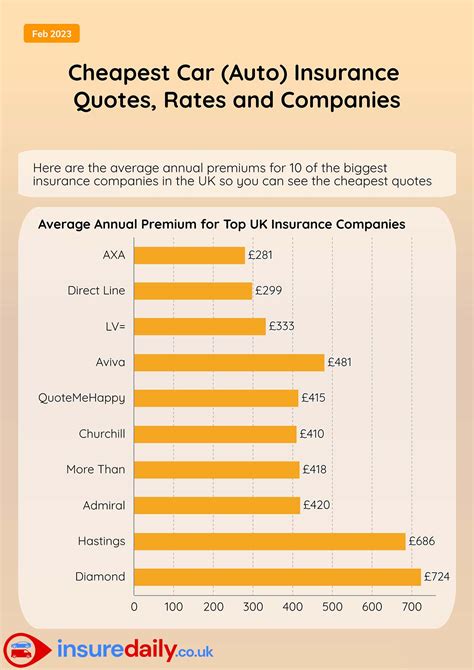

- Shop Around for Insurance Quotes: Compare rates from different insurance providers. Prices can vary significantly, so obtaining multiple quotes ensures you get the best deal.

- Consider Higher Deductibles: Opting for a higher deductible can reduce your insurance premiums. However, ensure you can afford the deductible in case of an accident.

- Bundle Your Insurance Policies: Combining your auto insurance with other policies, such as home or life insurance, can lead to substantial savings.

- Maintain a Clean Driving Record: A clean driving history is crucial for obtaining lower insurance rates. Avoid traffic violations and accidents to keep your premiums down.

- Take Advantage of Discounts: Many insurance companies offer discounts for various reasons, such as good student discounts, safe driver discounts, or loyalty rewards. Ask your insurer about available discounts and ensure you meet the eligibility criteria.

Conclusion

Choosing the right car can have a significant impact on your insurance costs. By considering factors like safety ratings, reliability, and insurance-friendly features, you can make an informed decision that aligns with your budget and needs. Remember, while the car you drive is important, maintaining a safe driving record and exploring insurance options can also contribute to lower premiums. By following the tips and insights provided in this guide, you’ll be well-equipped to find the best insurance car and save on your auto insurance expenses.

Can I lower my insurance costs by driving an older car?

+While older cars may have lower insurance costs due to their reduced value, they can also be more prone to mechanical issues, which can affect insurance rates. It’s essential to consider the age and condition of the car and its potential repair expenses.

Do electric cars have lower insurance premiums compared to traditional vehicles?

+Electric cars often have lower insurance premiums due to their advanced safety features and reduced risk of accidents. However, repair costs for specialized components can be higher, which may impact insurance rates. It’s crucial to compare insurance quotes for electric vehicles to traditional cars to make an informed decision.

How do insurance companies determine the risk profile of different car models?

+Insurance companies analyze various factors, including safety ratings, theft statistics, repair costs, and historical data on insurance claims for different car models. They use this information to assess the risk associated with insuring a particular vehicle and set premiums accordingly.