Health Insurance Rates

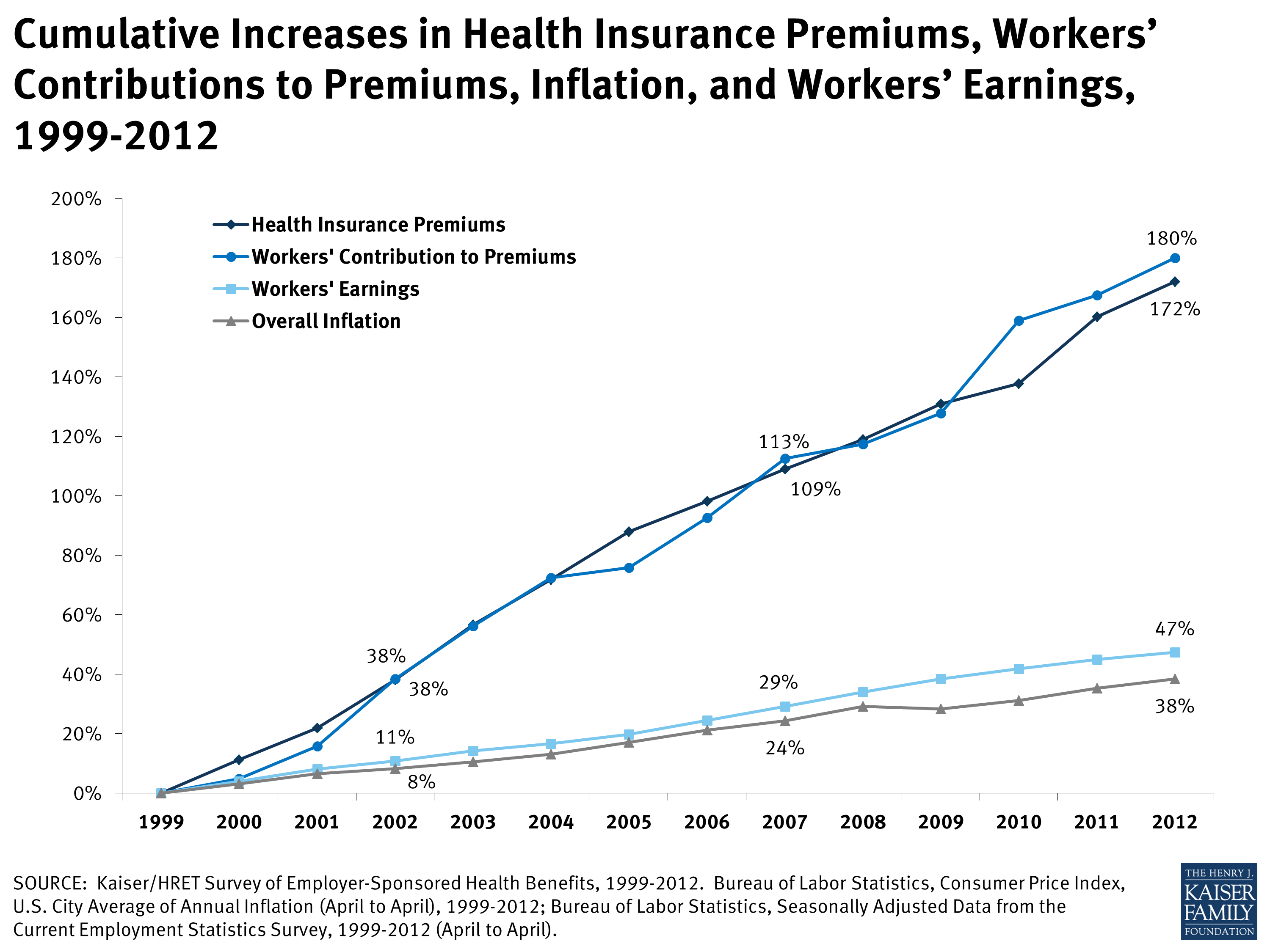

Health insurance is a vital aspect of healthcare, offering financial protection and access to essential medical services. With rising healthcare costs and varying insurance plans, understanding the factors influencing health insurance rates is crucial for individuals and families. This comprehensive guide delves into the intricacies of health insurance rates, exploring the key drivers, trends, and strategies to navigate this complex landscape.

The Complex Web of Health Insurance Rates

Health insurance rates are influenced by a multitude of factors, creating a dynamic and often perplexing landscape for consumers. From individual demographics to regional healthcare costs, the pricing of health insurance plans is a finely tuned mechanism. Let’s unravel this complexity layer by layer, shedding light on the key elements that shape the cost of health insurance.

Demographic Factors: Age, Gender, and Lifestyle

One of the primary determinants of health insurance rates is an individual’s demographic profile. Age, for instance, plays a significant role. Young adults, typically in their 20s and 30s, often enjoy lower premiums due to their relatively lower risk of developing serious health conditions. On the other hand, as individuals age, the risk of chronic illnesses increases, leading to higher insurance costs. Gender is another demographic factor; in some regions, insurance providers may charge different rates for men and women based on historical health trends and statistical data.

Lifestyle choices also impact insurance rates. Smokers, for example, may face higher premiums due to the increased risk of respiratory and cardiovascular diseases associated with tobacco use. Similarly, individuals with hazardous occupations or those participating in high-risk sports may be charged more, as their activities increase the likelihood of accidents and injuries.

Health Status and Pre-Existing Conditions

An individual’s health status is a critical factor in determining insurance rates. Those with pre-existing medical conditions, such as diabetes, heart disease, or certain genetic disorders, often face higher premiums. Insurance providers consider these conditions as potential risk factors that may lead to more frequent and costly medical treatments. In some cases, individuals with severe pre-existing conditions may struggle to find affordable coverage, highlighting the importance of comprehensive health insurance reform.

Regional Variations: Cost of Living and Healthcare Services

Health insurance rates can vary significantly from one region to another. The cost of living and the availability and cost of healthcare services play a pivotal role in determining insurance premiums. In urban areas with advanced medical facilities and a high cost of living, insurance rates tend to be higher. Conversely, rural areas may have lower insurance costs due to reduced healthcare utilization and a lower cost of living.

Additionally, the prevalence of certain health conditions in a region can influence insurance rates. Areas with high rates of infectious diseases or specific health issues may see insurance premiums increase to account for the higher likelihood of claims.

Plan Type and Coverage Options

The type of health insurance plan and the level of coverage chosen also impact the overall cost. Basic health insurance plans with higher deductibles and out-of-pocket expenses generally have lower premiums. Conversely, comprehensive plans with lower deductibles and extensive coverage for a wide range of services will likely carry higher premiums.

Furthermore, the inclusion of specific services in a health insurance plan can affect its cost. For instance, plans that cover mental health services, prescription medications, or alternative therapies may be more expensive due to the additional coverage provided.

Insurance Provider and Market Competition

The insurance provider and the level of competition in the market are additional factors influencing health insurance rates. Established insurance companies with a strong market presence may offer competitive rates due to their ability to negotiate with healthcare providers and manage costs effectively. In contrast, smaller providers or those entering a new market may have higher rates initially as they establish their presence.

Market competition can also drive insurance rates down. When multiple insurance companies compete for customers in a region, they may offer more affordable plans to attract consumers. This dynamic is particularly evident in areas with a high concentration of insurance providers.

Strategies for Navigating Health Insurance Rates

Understanding the factors that influence health insurance rates is the first step towards making informed decisions. Here are some strategies to navigate the complex world of health insurance and potentially reduce costs:

Shop Around and Compare Plans

The health insurance market is diverse, offering a range of plans with varying premiums and coverage. It’s essential to compare multiple plans from different providers to find the best fit for your needs. Online platforms and insurance brokers can be valuable resources for comparing plans and getting quotes.

Consider High-Deductible Health Plans (HDHPs)

HDHPs are a cost-effective option for individuals who are generally healthy and don’t anticipate frequent medical expenses. These plans have lower premiums but higher deductibles, making them suitable for those who want to save on insurance costs while still having coverage for major medical events.

Utilize Tax-Advantaged Accounts

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) are tax-advantaged accounts that can be used to pay for qualified medical expenses. Contributions to these accounts are tax-deductible, and withdrawals for eligible medical costs are tax-free. HSAs, in particular, can be used in conjunction with HDHPs to further reduce healthcare costs.

Negotiate with Insurance Providers

Insurance providers often have some flexibility in setting premiums, especially for individuals or small groups. If you have a good relationship with your insurance provider and a clean claims history, you may be able to negotiate lower rates, especially if you’ve been a loyal customer for several years.

Stay Informed and Advocate for Reform

The healthcare and insurance industries are constantly evolving, and staying informed about changes in policies and regulations can help you make better decisions. Additionally, advocating for healthcare reform and supporting initiatives that aim to reduce costs and improve access to healthcare can have long-term benefits for everyone.

Future Implications and Industry Trends

The landscape of health insurance is ever-changing, and several trends are shaping the future of this industry. Here’s a glimpse into the potential developments that could impact health insurance rates and coverage options:

Telemedicine and Digital Health Solutions

The rise of telemedicine and digital health solutions has the potential to revolutionize healthcare delivery and reduce costs. With increased access to virtual consultations and remote monitoring, patients can receive care more conveniently and efficiently, potentially lowering the overall demand for in-person medical services and reducing insurance costs.

Value-Based Care Models

Value-based care models, which focus on the quality and outcomes of healthcare rather than the quantity of services provided, are gaining traction. These models aim to improve patient health while reducing unnecessary costs. By incentivizing healthcare providers to deliver efficient and effective care, insurance companies may be able to offer more competitive rates and improve overall coverage.

Expanding Access to Affordable Coverage

Efforts to expand access to affordable health insurance are ongoing, with initiatives like the Affordable Care Act (ACA) and various state-level reforms. As these initiatives evolve and new policies are implemented, they have the potential to reduce the number of uninsured individuals and drive down insurance costs by spreading the risk across a larger population.

Focus on Preventive Care and Wellness

A growing emphasis on preventive care and wellness initiatives is likely to shape the future of health insurance. By encouraging healthy lifestyles and early detection of health issues, insurance providers can reduce the need for costly treatments and improve overall population health. This shift towards prevention could lead to more affordable insurance plans and better health outcomes.

Conclusion

Health insurance rates are a complex interplay of demographic, health, and market factors. While the cost of insurance can be a significant concern, understanding the drivers of these rates empowers individuals to make informed choices and potentially reduce their healthcare costs. As the industry continues to evolve, staying informed and proactive in managing your health insurance is essential.

How do health insurance rates affect the overall healthcare system?

+Health insurance rates play a critical role in determining access to healthcare services. Higher insurance rates can lead to individuals avoiding necessary medical care due to cost concerns, potentially resulting in poorer health outcomes. On the other hand, lower rates can encourage more people to seek preventive care and early treatment, improving overall population health.

Are there any government initiatives to regulate health insurance rates?

+Yes, many governments have implemented regulations and initiatives to control health insurance rates and improve access to affordable coverage. For example, the Affordable Care Act (ACA) in the United States introduced reforms aimed at making health insurance more accessible and cost-effective for individuals and families.

What can individuals do to reduce their health insurance costs?

+Individuals can explore various strategies to reduce health insurance costs, such as shopping around for plans, considering High-Deductible Health Plans (HDHPs), utilizing tax-advantaged accounts like HSAs and FSAs, and negotiating with insurance providers. Additionally, maintaining a healthy lifestyle and utilizing preventive care services can help keep costs down.