National General Auto Insurance Company

In the vast landscape of the insurance industry, National General Auto Insurance Company stands out as a prominent player, offering comprehensive coverage and innovative solutions to its policyholders. With a rich history spanning several decades, the company has evolved to meet the dynamic needs of modern motorists, earning a reputation for reliability and customer satisfaction.

A Legacy of Service and Innovation

National General Auto Insurance, headquartered in New York, has been a trusted name in the insurance sector since its inception in the 1920s. Originally known as National Indemnity Company, the organization pioneered insurance solutions, particularly in the auto insurance niche. Over the years, the company has undergone strategic transformations, acquiring and merging with other prominent entities, which has not only expanded its reach but also fortified its position as a leader in the industry.

One of the key milestones in the company's history was its acquisition by OneBeacon Insurance Group in 1998. This merger not only expanded the company's market share but also introduced innovative products and services, solidifying its position as a major player in the insurance arena. The subsequent rebranding as National General in 2015 marked a new era, emphasizing the company's commitment to providing personalized, technology-driven insurance solutions.

A Comprehensive Auto Insurance Portfolio

National General Auto Insurance offers a diverse range of auto insurance products tailored to meet the specific needs of its customers. From standard liability coverage to comprehensive plans that include collision and comprehensive coverage, the company ensures that motorists have the protection they need, regardless of their driving history or vehicle type.

One of the standout features of National General's auto insurance policies is their personalization. The company understands that every driver is unique, and their insurance needs are equally distinct. Hence, they offer customizable policies that can be tailored to include specific coverages like personal injury protection, uninsured/underinsured motorist coverage, and medical payments coverage. This flexibility allows policyholders to create a coverage plan that aligns perfectly with their requirements and budget.

Furthermore, National General Auto Insurance provides specialized coverage for unique vehicles. Whether you own a classic car, an electric vehicle, or a high-performance sports car, the company offers tailored policies to ensure your vehicle is adequately protected. This commitment to catering to diverse vehicle types and driving needs sets National General apart from its competitors.

Coverage Options and Benefits

- Liability Coverage: This includes bodily injury liability and property damage liability, which are essential for protecting you financially if you’re at fault in an accident.

- Collision Coverage: Pays for damages to your vehicle after a collision, regardless of fault.

- Comprehensive Coverage: Covers non-collision incidents like theft, vandalism, fire, and natural disasters.

- Personal Injury Protection (PIP): Provides medical coverage for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who doesn’t have enough insurance.

- Medical Payments Coverage: Covers medical expenses for you and your passengers, regardless of fault.

Technology-Driven Solutions for a Seamless Experience

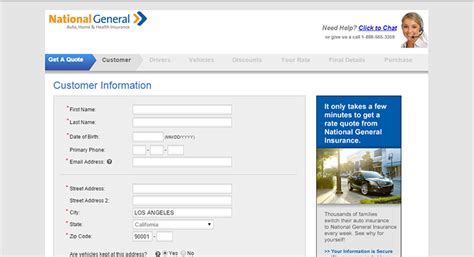

National General Auto Insurance understands the importance of technology in today’s fast-paced world. The company has embraced digital transformation, leveraging technology to enhance the overall customer experience. From online policy management and claims reporting to innovative payment options, National General has streamlined the insurance process, making it more accessible and convenient for policyholders.

One of the key advantages of National General's technological integration is its mobile app. The app allows policyholders to manage their policies, make payments, and even file claims from the convenience of their smartphones. This level of accessibility ensures that policyholders can address their insurance needs promptly, without the hassle of traditional paper-based processes.

Furthermore, National General's website is designed with user experience in mind. The intuitive interface allows visitors to easily navigate through different sections, obtain quotes, and learn about various insurance products. This digital presence not only caters to tech-savvy individuals but also simplifies the insurance journey for those who may not be as familiar with online platforms.

Key Technological Features

- Online Policy Management: Policyholders can view and manage their policies, make changes, and access important documents.

- Mobile App: The National General app offers a range of services, including policy management, claims reporting, and payment options.

- Paperless Options: Customers can choose to receive and manage their documents digitally, reducing paper waste.

- Digital Claims Reporting: The company’s online platform allows for efficient and convenient claims reporting, with real-time updates.

- Text Message Updates: Policyholders can opt to receive text message updates on their claims, providing a quick and convenient way to stay informed.

A Commitment to Customer Satisfaction and Claims Handling

National General Auto Insurance prides itself on its customer-centric approach. The company understands that purchasing insurance is not just a transaction but a commitment to protect what matters most. This philosophy is evident in their approach to claims handling, where efficiency and empathy are the key tenets.

When a policyholder files a claim, National General's dedicated claims team springs into action. The team is trained to provide prompt and efficient service, ensuring that the claims process is as smooth and stress-free as possible. Whether it's a minor fender bender or a more significant incident, National General is committed to providing timely and fair resolutions.

Furthermore, National General understands that every claim is unique and may present its own set of challenges. The company's claims adjusters are equipped with the knowledge and resources to handle a wide range of situations, from assessing property damage to coordinating repairs. This comprehensive approach ensures that policyholders receive the support they need during what can be a stressful time.

Claims Handling Process

- Reporting a Claim: Policyholders can report claims online, via the mobile app, or over the phone. The process is designed to be quick and straightforward.

- Claim Assessment: National General’s claims team thoroughly assesses the claim, gathering all necessary information and documentation.

- Claims Investigation: Depending on the nature of the claim, the company may conduct a detailed investigation to determine liability and the extent of damages.

- Resolution and Payment: Once the claim is approved, National General works swiftly to provide a resolution, which often includes a financial settlement or the arrangement of repairs.

- Customer Support: Throughout the claims process, policyholders are kept informed and can reach out to their dedicated claims adjuster for updates and assistance.

Financial Stability and Industry Recognition

National General Auto Insurance’s financial stability is a testament to its success and longevity in the insurance industry. The company has consistently maintained a strong financial position, which is a critical factor for policyholders seeking long-term reliability and peace of mind. This stability is underscored by the company’s A.M. Best rating, which reflects its financial strength and ability to meet its obligations.

In addition to its financial prowess, National General has garnered recognition for its innovation and customer service. The company has been the recipient of numerous awards and accolades, including recognition for its digital initiatives and commitment to customer satisfaction. This industry validation further solidifies National General's position as a leading auto insurance provider.

Financial Ratings and Awards

- A.M. Best Rating: National General Auto Insurance holds an A (Excellent) rating from A.M. Best, a leading insurance rating agency. This rating signifies the company’s strong financial position and ability to meet its obligations.

- J.D. Power Awards: National General has received accolades from J.D. Power for its outstanding customer service and claims handling, highlighting its commitment to providing a positive customer experience.

- Digital Innovation Awards: The company has been recognized for its innovative use of technology, particularly in its mobile app and online platforms, which have enhanced the customer journey.

A Bright Future: National General’s Continuous Evolution

As the insurance landscape continues to evolve, National General Auto Insurance remains at the forefront, continuously innovating and adapting to meet the changing needs of its customers. The company’s focus on technological advancements and customer-centric solutions positions it well for the future, ensuring that policyholders can rely on National General for comprehensive protection and an exceptional customer experience.

With a rich history, a robust financial foundation, and a commitment to innovation, National General Auto Insurance is poised to remain a leading provider in the auto insurance market. The company's dedication to its customers and its ability to anticipate and meet their needs sets it apart, making it a trusted choice for motorists seeking reliable and personalized insurance coverage.

Future Prospects and Innovations

- Telematics and Usage-Based Insurance: National General is exploring the use of telematics to offer personalized insurance rates based on individual driving behavior, promoting safer driving practices.

- Enhanced Digital Services: The company is committed to further enhancing its digital platforms, offering more sophisticated tools for policy management and claims reporting.

- Expanded Coverage Options: National General is continuously evaluating and introducing new coverage options to meet the diverse needs of its customers, including those with unique vehicles or specific requirements.

Frequently Asked Questions

What types of discounts does National General Auto Insurance offer?

+

National General Auto Insurance offers a range of discounts to its policyholders, including multi-policy discounts, safe driver discounts, and discounts for vehicles with certain safety features. They also provide loyalty discounts for long-term customers.

How does National General handle claims for accidents with uninsured or underinsured drivers?

+

National General provides Uninsured/Underinsured Motorist coverage, which covers policyholders when they’re involved in an accident with a driver who doesn’t have enough insurance. The company’s claims team will assess the situation and work to provide a fair resolution, ensuring that policyholders are not left financially vulnerable.

Can I bundle my auto insurance with other types of insurance through National General?

+

Yes, National General offers the option to bundle auto insurance with other types of insurance, such as homeowners or renters insurance. Bundling can often result in significant savings and simplified policy management.

Does National General provide roadside assistance as part of their auto insurance policies?

+

Yes, National General offers roadside assistance as an optional add-on to their auto insurance policies. This service provides 24⁄7 support for a range of roadside emergencies, including towing, flat tire changes, and battery jump starts.

How does National General’s claims process compare to other insurance companies?

+

National General’s claims process is designed to be efficient and customer-centric. The company’s dedicated claims team provides prompt and personalized service, ensuring a smooth and stress-free experience. They also offer digital tools for claims reporting and management, making the process even more convenient.