At&T Phone Insurance Company

Understanding AT&T Phone Insurance: A Comprehensive Guide

In today's digital age, our smartphones have become an integral part of our lives, housing important data, serving as communication tools, and providing access to various services. As such, protecting these devices has become a priority for many. AT&T, a leading telecommunications company, offers a range of phone insurance plans to its customers, ensuring that your valuable devices are covered in case of accidents or unforeseen circumstances.

This guide aims to delve into the world of AT&T phone insurance, exploring its various aspects, benefits, and considerations. By understanding the nuances of this service, you can make informed decisions to safeguard your devices and data.

The Importance of Phone Insurance

Phone insurance serves as a crucial safety net for individuals and businesses, offering financial protection against the unexpected. Smartphones are susceptible to a myriad of issues, from accidental damage and theft to hardware malfunctions and software glitches. While some of these issues may be covered under manufacturer warranties, they often have limited coverage and timeframes, leaving users vulnerable.

AT&T's phone insurance plans bridge this gap, providing comprehensive coverage for a range of scenarios. By enrolling in these plans, customers can ensure that their devices are protected, giving them peace of mind and the ability to focus on their daily lives and businesses without the worry of costly repairs or replacements.

AT&T Phone Insurance Plans: An Overview

AT&T offers a range of insurance plans tailored to different needs and budgets. These plans typically cover accidental damage, including cracked screens, water damage, and internal malfunctions. Additionally, many plans include protection against theft and loss, ensuring that customers are not left stranded without a device or faced with the financial burden of replacing a stolen phone.

The specific features and benefits of AT&T's insurance plans can vary depending on the device, the plan chosen, and the customer's location. Some key aspects to consider include:

- Coverage Limits: Each plan will have a maximum coverage limit, which represents the maximum amount AT&T will pay out for a claim. This limit can vary based on the device and the plan, so it's essential to review the fine print to ensure your device is adequately covered.

- Deductibles: Like most insurance policies, AT&T's plans often come with a deductible, which is the amount the customer must pay out of pocket when making a claim. This deductible can vary based on the type of claim and the plan chosen.

- Exclusions: While AT&T's insurance plans are comprehensive, there may be certain scenarios or types of damage that are not covered. It's crucial to understand these exclusions to ensure you're aware of any situations where your device may not be protected.

Enrolling in AT&T Phone Insurance

Enrolling in AT&T's phone insurance is a straightforward process. Customers can typically add insurance to their plan when purchasing a new device or anytime thereafter, provided the device is still in good working condition. The cost of insurance varies based on the plan and the device, and it's usually billed monthly alongside the customer's regular AT&T service fees.

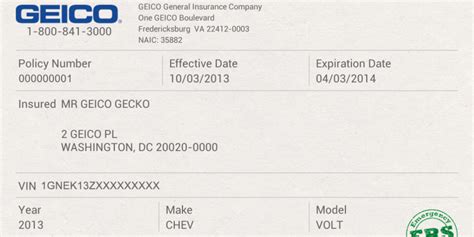

During the enrollment process, customers will be asked to provide basic information about their device, such as the make, model, and IMEI number. They may also be required to complete a short questionnaire to assess their risk profile and determine the appropriate plan and pricing.

Once enrolled, customers will receive a confirmation and details about their coverage, including any exclusions or limitations. It's important to review this information carefully and contact AT&T if any clarifications are needed.

Filing a Claim with AT&T Phone Insurance

Should the need arise, filing a claim with AT&T's phone insurance is a relatively simple process. Customers can typically initiate a claim by contacting AT&T's customer support team, either via phone, email, or online chat. The support team will guide the customer through the process, which may involve providing proof of purchase, submitting a police report in the case of theft, or sending the damaged device for inspection.

Once the claim is approved, AT&T will typically provide a replacement device or reimburse the customer for repairs, up to the plan's coverage limit. The time it takes to process a claim can vary, so it's essential to plan accordingly if you rely heavily on your device for work or personal use.

Benefits and Considerations of AT&T Phone Insurance

AT&T's phone insurance plans offer several key benefits, including:

- Peace of Mind: By enrolling in an insurance plan, customers can rest easy knowing that their devices are protected against a range of scenarios, from accidental damage to theft.

- Cost Savings: Insurance plans can save customers money in the long run by covering the cost of repairs or replacements, which can be significantly more expensive if paid out of pocket.

- Convenience: AT&T's insurance plans are designed to be easy to understand and manage, with straightforward enrollment and claim processes.

- Device Flexibility: AT&T's insurance plans cover a wide range of devices, from smartphones to tablets, ensuring that customers can protect all their essential devices.

However, there are also a few considerations to keep in mind when evaluating AT&T's phone insurance plans, including:

- Cost: While insurance plans offer valuable protection, they come at a cost. It's essential to weigh the cost of insurance against the potential risks and the value of your device to determine if the coverage is worth the investment.

- Exclusions: As mentioned earlier, it's crucial to understand the exclusions and limitations of your plan. Some scenarios, such as intentional damage or loss due to negligence, may not be covered, so it's important to review the fine print.

- Claim Process: While AT&T's claim process is generally straightforward, it can be time-consuming, especially if repairs or replacements are needed. Customers should consider how long they can go without their device and plan accordingly.

Comparing AT&T Phone Insurance to Other Providers

When it comes to phone insurance, AT&T is not the only player in the market. Many other telecommunications companies and third-party providers offer similar services, each with its own set of features, benefits, and limitations.

When comparing AT&T's phone insurance to other providers, it's essential to consider factors such as coverage limits, deductibles, exclusions, and the overall cost. While AT&T's plans are generally comprehensive and easy to manage, other providers may offer more specialized coverage or additional benefits, such as extended warranties or device trade-in programs.

It's also worth noting that some device manufacturers, such as Apple and Samsung, offer their own insurance plans or extended warranties. These plans can sometimes provide more tailored coverage for specific devices, but they may also come with limitations or be more expensive than third-party options.

Real-World Examples of AT&T Phone Insurance in Action

To illustrate the value of AT&T's phone insurance plans, let's explore a few real-world scenarios where these plans have proven to be invaluable:

Scenario 1: Accidental Damage

Imagine a customer, let's call them Sarah, who accidentally drops her brand-new smartphone, causing the screen to crack. Without insurance, Sarah would be faced with a costly repair bill or the need to purchase a new device. However, with AT&T's insurance plan, she can simply file a claim, pay the deductible, and receive a replacement device or have her screen repaired, all within a few days.

Scenario 2: Theft

John, a busy professional, has his smartphone stolen while traveling. Without insurance, he would not only lose his device but also all the important data and contacts it contained. However, with AT&T's insurance plan, John can file a theft claim, providing a police report and proof of purchase. AT&T will then replace his device, ensuring he can get back to work quickly and without incurring a significant financial loss.

Scenario 3: Hardware Malfunction

Emily, a student, notices that her smartphone's battery is not holding a charge as it should. After taking it to a repair shop, she learns that the battery needs to be replaced, a costly repair. With AT&T's insurance plan, Emily can have the battery replaced at a significantly reduced cost, ensuring she can continue using her device without interruption.

Conclusion

AT&T's phone insurance plans offer a valuable layer of protection for customers, safeguarding their devices and data against a range of scenarios. While these plans come at a cost, the peace of mind and potential cost savings they provide can be well worth the investment. By understanding the nuances of AT&T's insurance offerings and comparing them to other providers, customers can make informed decisions to protect their valuable devices and ensure they're covered for the unexpected.

Frequently Asked Questions

Can I add insurance to my AT&T phone after purchasing it?

+Yes, you can typically add insurance to your AT&T phone after purchase, provided the device is still in good working condition. This allows you to protect your device even if you didn’t initially enroll in an insurance plan.

What happens if my claim is denied by AT&T phone insurance?

+If your claim is denied, AT&T will provide a reason for the denial. This could be due to an exclusion in your plan, such as damage caused by intentional misuse or negligence. You can review the terms of your insurance plan to better understand the reasons for denial and take steps to avoid future denials.

How long does it typically take to process a claim with AT&T phone insurance?

+The time it takes to process a claim can vary depending on the nature of the claim and the need for repairs or replacements. Generally, AT&T aims to process claims within a few days to a week. However, complex claims or those requiring extensive repairs may take longer.

Are there any alternative insurance providers I can consider for my AT&T phone?

+Yes, there are several third-party insurance providers that offer coverage for AT&T phones. These providers may offer different coverage options, prices, and benefits, so it’s worth exploring their offerings to find the best fit for your needs.

Can I transfer my AT&T phone insurance to a new device?

+In some cases, yes. If you’re upgrading to a new device, you may be able to transfer your existing insurance plan to the new device. This typically involves updating your plan details with AT&T to reflect the new device’s make and model.