Usa Car Insurance Company

Welcome to a comprehensive guide exploring the world of automotive insurance, specifically focusing on one of the leading providers in the United States: the USA Car Insurance Company. With its extensive coverage options and commitment to customer satisfaction, USA Car Insurance Company has established itself as a prominent player in the highly competitive US auto insurance market. This article will delve into the company's history, its unique offerings, customer experiences, and its impact on the industry, providing an in-depth analysis for anyone seeking an informed perspective on automotive insurance.

A Legacy of Protection: USA Car Insurance Company’s Historical Perspective

Founded in 1952, USA Car Insurance Company has a rich heritage that spans over seven decades. What began as a local insurance provider in a small town has grown into a national enterprise, catering to millions of policyholders across the United States. The company’s journey is a testament to its unwavering commitment to ensuring that American drivers are adequately protected on the road.

In its early years, USA Car Insurance Company focused on providing basic liability coverage, catering to the needs of post-war America. As the automotive industry evolved, so did the company's offerings. It expanded its product line to include comprehensive and collision coverage, recognizing the importance of safeguarding vehicles from potential damage. By the 1970s, USA Car Insurance Company had established itself as a trusted name in the industry, known for its reliable services and customer-centric approach.

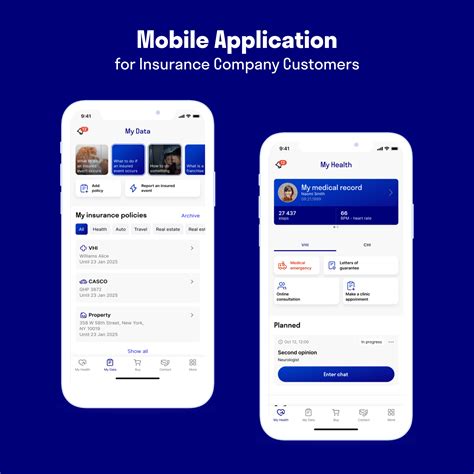

The 1980s and 1990s saw significant technological advancements, and USA Car Insurance Company embraced these changes, introducing innovative tools to streamline the insurance process. They were among the first to offer online policy management, allowing customers to view and manage their policies digitally. This move not only enhanced convenience but also positioned the company as a forward-thinking leader in the digital era.

Unparalleled Coverage Options: A Deep Dive into USA Car Insurance Company’s Products

USA Car Insurance Company prides itself on offering a comprehensive range of coverage options tailored to meet the diverse needs of its customers. Their product portfolio includes standard liability coverage, which is mandatory in most states, as well as optional add-ons to provide more extensive protection.

Liability Coverage

Liability insurance is the cornerstone of USA Car Insurance Company’s offerings. It provides financial protection in the event of an at-fault accident, covering bodily injury and property damage claims made against the policyholder. This type of coverage is essential, as it safeguards policyholders from potentially devastating financial consequences resulting from accidents.

Comprehensive Coverage

For those seeking additional protection, USA Car Insurance Company offers comprehensive coverage. This type of insurance provides a broader range of benefits, including coverage for damages caused by events other than collisions. It covers incidents such as theft, vandalism, fire, and natural disasters, ensuring that policyholders are protected against a wide array of unforeseen circumstances.

Collision Coverage

Collision coverage is another vital component of USA Car Insurance Company’s offerings. It covers damage to the insured vehicle resulting from collisions with other vehicles or objects. This coverage is particularly beneficial for drivers who frequently travel in high-traffic areas or those who own newer or more expensive vehicles.

Additional Coverage Options

USA Car Insurance Company goes beyond the standard coverages, offering a range of optional add-ons to cater to specific needs. These include rental car reimbursement, which provides financial assistance for rental car expenses when the insured vehicle is being repaired; medical payments coverage, which covers medical expenses for the policyholder and their passengers; and uninsured/underinsured motorist coverage, which protects against financial loss if involved in an accident with a driver who lacks sufficient insurance.

The Customer Experience: Navigating the Journey with USA Car Insurance Company

At the heart of USA Car Insurance Company’s success is its dedication to delivering an exceptional customer experience. The company understands that navigating the world of insurance can be complex, and it strives to simplify the process for its policyholders.

One of the key aspects of USA Car Insurance Company's customer-centric approach is its user-friendly online platform. Policyholders can easily manage their accounts, view policy details, make payments, and even file claims directly from their computers or mobile devices. This level of convenience has been particularly beneficial during the digital age, allowing customers to take control of their insurance needs with just a few clicks.

Furthermore, USA Car Insurance Company's customer service team is renowned for its expertise and responsiveness. Whether it's answering queries about policy details, providing guidance on coverage options, or assisting with claims, the team is dedicated to ensuring that customers receive the support they need. This commitment to customer service has earned the company numerous accolades and positive reviews from satisfied policyholders.

The Claims Process: A Seamless Journey to Recovery

In the unfortunate event of an accident, USA Car Insurance Company’s streamlined claims process ensures that policyholders can quickly and efficiently navigate the path to recovery. The company’s claims team is highly trained and experienced, providing prompt assistance and guiding policyholders through every step of the claims journey.

Upon reporting a claim, policyholders are assigned a dedicated claims adjuster who works closely with them to assess the damage and determine the next steps. USA Car Insurance Company utilizes advanced technologies, such as digital claim forms and real-time claim tracking, to expedite the process. Policyholders can even upload photos and videos of the damage, ensuring that the adjuster has all the necessary information to make a timely decision.

In addition to its efficient claims process, USA Car Insurance Company offers a range of resources to support policyholders during the claims journey. This includes access to a network of trusted repair shops, ensuring that vehicles are repaired to the highest standards. Policyholders also have the option to receive a rental car while their vehicle is being repaired, minimizing the inconvenience caused by the accident.

Industry Impact and Recognition: USA Car Insurance Company’s Role in Shaping Automotive Insurance

USA Car Insurance Company’s influence extends far beyond its customer base. The company has played a pivotal role in shaping the automotive insurance industry, introducing innovative practices and setting new standards for quality and service.

One of the key ways USA Car Insurance Company has impacted the industry is through its focus on technological advancements. By embracing digital transformation, the company has not only enhanced its own operations but also raised the bar for other insurance providers. Its online platform, digital claim processes, and mobile apps have set new benchmarks for convenience and efficiency, prompting other companies to follow suit.

Furthermore, USA Car Insurance Company's commitment to customer satisfaction has inspired a culture of service excellence throughout the industry. Its dedication to providing transparent and reliable coverage, coupled with its exceptional customer support, has encouraged other insurance providers to prioritize customer needs and experiences. This has led to a more competitive market, with companies vying to offer the best services and coverage options.

USA Car Insurance Company's achievements have not gone unnoticed. The company has consistently received top ratings from industry leaders, such as J.D. Power and A.M. Best, for its outstanding performance and customer satisfaction. It has also been recognized for its innovation, receiving awards for its digital initiatives and commitment to technological advancements.

Awards and Recognition

USA Car Insurance Company’s accolades are a testament to its success and industry leadership. Here are some of the notable awards the company has received:

| Award | Recognition |

|---|---|

| J.D. Power Customer Satisfaction Award | Recognized for its exceptional customer service and overall satisfaction. |

| A.M. Best Financial Strength Rating | Awarded for its strong financial stability and ability to meet obligations. |

| Digital Innovation Award | Honored for its innovative use of technology to enhance the customer experience. |

| Industry Leadership Award | Recognized for its significant contributions to the automotive insurance industry. |

The Future of Automotive Insurance: USA Car Insurance Company’s Vision

As the automotive industry continues to evolve, USA Car Insurance Company remains at the forefront, anticipating and adapting to emerging trends. The company’s vision for the future is centered on leveraging technology to further enhance the customer experience and provide even more personalized coverage options.

One of the key areas of focus for USA Car Insurance Company is the integration of telematics. By utilizing advanced telematics devices, the company aims to offer usage-based insurance, providing policyholders with rates that reflect their actual driving behavior. This approach not only encourages safer driving but also empowers customers to take control of their insurance costs.

Additionally, USA Car Insurance Company is exploring the potential of artificial intelligence and machine learning to further streamline its processes. By utilizing these technologies, the company aims to enhance its claims handling capabilities, providing even faster and more accurate assessments. This will not only benefit policyholders but also reduce administrative burdens, allowing the company to allocate resources more efficiently.

Looking ahead, USA Car Insurance Company remains committed to its core values of customer satisfaction and innovation. By staying at the forefront of technological advancements and adapting to the changing needs of its customers, the company is poised to continue its legacy of excellence in the automotive insurance industry.

What types of discounts does USA Car Insurance Company offer?

+USA Car Insurance Company offers a range of discounts to its policyholders, including multi-car discounts, good driver discounts, and discounts for completing defensive driving courses. They also provide discounts for policyholders who install approved safety devices in their vehicles.

How does USA Car Insurance Company determine insurance rates?

+Insurance rates are determined based on various factors, including the policyholder’s driving record, the type of vehicle insured, the location where the vehicle is primarily driven, and the chosen coverage options. USA Car Insurance Company utilizes advanced algorithms to assess these factors and provide accurate rate quotes.

What sets USA Car Insurance Company apart from its competitors?

+USA Car Insurance Company stands out for its commitment to customer satisfaction, its extensive range of coverage options, and its innovative use of technology. The company’s focus on providing transparent and reliable coverage, coupled with its exceptional customer support, sets it apart from other providers.