Insurance Company Employee

The insurance industry is a vast and multifaceted sector that plays a crucial role in modern society. It provides financial protection and peace of mind to individuals, businesses, and communities, helping them navigate life's uncertainties. At the heart of this industry are the dedicated professionals who work tirelessly to ensure its smooth operation and effectiveness. One such role is that of an Insurance Company Employee, a position that offers a unique perspective on the inner workings of the insurance world.

The Role of an Insurance Company Employee: An In-Depth Exploration

An insurance company employee is a professional who is responsible for a wide range of tasks that contribute to the overall functioning of an insurance provider. This role is diverse and can vary significantly depending on the employee’s specialization, the type of insurance, and the company’s structure. However, regardless of their specific duties, insurance company employees play a vital role in safeguarding the interests of policyholders and maintaining the integrity of the insurance system.

Understanding the Insurance Landscape

The insurance industry is a complex ecosystem with numerous stakeholders and a wide array of products and services. Insurance company employees are the experts who navigate this landscape, ensuring that clients receive the coverage they need and that the company operates efficiently and ethically. From the moment a potential client expresses interest in an insurance policy, the employee’s expertise comes into play.

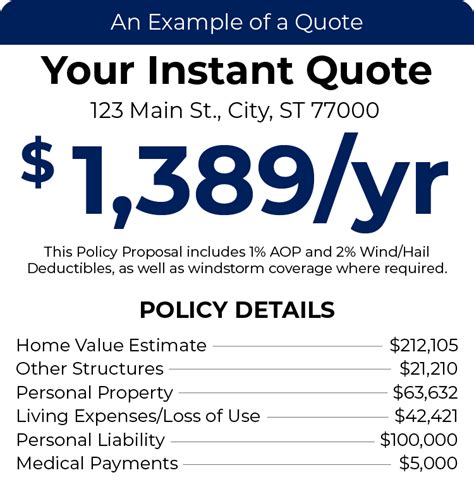

For instance, consider a typical scenario where a homeowner seeks insurance coverage. An insurance company employee would assess the client’s needs, provide tailored recommendations, and guide them through the application process. This process involves evaluating the client’s risk profile, understanding their unique circumstances, and matching them with the most suitable insurance policy.

Furthermore, insurance company employees are often the first point of contact for policyholders in the event of a claim. They play a crucial role in facilitating the claims process, ensuring that policyholders receive the benefits they are entitled to in a timely and efficient manner. This aspect of the role requires a deep understanding of insurance policies, contractual obligations, and the ability to effectively communicate with clients during stressful situations.

Specializations and Expertise

The role of an insurance company employee is not limited to a single specialization. In fact, the industry offers a myriad of career paths, each with its own unique challenges and rewards. Here are some of the key specializations within the insurance sector:

- Underwriting: Underwriters are responsible for evaluating the risk associated with insuring a person or entity. They assess the potential for loss and determine the appropriate premium to charge, ensuring the financial stability of the insurance company.

- Claims Handling: Claims adjusters or handlers are at the forefront of the insurance process when a claim is made. They investigate claims, assess the extent of the loss, and work to resolve claims in a fair and timely manner.

- Sales and Customer Service: Insurance company employees in sales and customer service roles are the public face of the company. They engage with potential and existing clients, providing information, guidance, and support throughout the insurance journey.

- Risk Management: Risk managers identify, assess, and mitigate potential risks that could impact the insurance company’s operations and financial stability. This role involves a deep understanding of risk analysis and management strategies.

- Actuarial Science: Actuaries use mathematical and statistical models to analyze and manage the financial risks associated with insurance policies. They play a critical role in determining insurance rates and reserves.

Each specialization requires a unique skill set and expertise, contributing to the overall effectiveness and success of the insurance company. Insurance company employees undergo rigorous training and education to develop the necessary knowledge and skills to excel in their respective roles.

The Impact of Technology on Insurance Company Employees

The insurance industry, like many others, has undergone significant transformation with the advent of technology. Digitalization has brought about new challenges and opportunities for insurance company employees, reshaping the way they work and interact with clients.

One notable impact is the increased use of artificial intelligence (AI) and machine learning in various aspects of insurance operations. AI-powered systems can now handle tasks such as policy underwriting, claims processing, and customer service, enhancing efficiency and accuracy. However, this technological advancement also requires insurance company employees to adapt and develop new skills to work alongside these innovative tools.

For instance, AI-based chatbots and virtual assistants are now common features on insurance company websites, providing instant support to customers. While these technologies handle basic inquiries and routine tasks, insurance company employees are still needed to oversee these systems, ensure their accuracy, and step in for more complex or sensitive issues.

Furthermore, the rise of insurtech (insurance technology) startups has brought about innovative solutions and disrupted traditional insurance models. Insurance company employees must stay abreast of these developments to ensure their companies remain competitive and relevant in the digital age.

The Human Element: Building Trust and Relationships

Despite the advancements in technology, the human element remains crucial in the insurance industry. Insurance company employees are often the link between the company and its clients, building trust, and fostering long-lasting relationships.

For example, in the aftermath of a natural disaster or a significant loss, insurance company employees provide vital support and guidance to policyholders. They navigate the complex claims process, ensuring that clients receive the compensation they deserve. This role requires empathy, excellent communication skills, and a deep understanding of the emotional impact of such events.

Additionally, insurance company employees play a critical role in educating clients about insurance products and their benefits. They provide personalized advice, helping clients make informed decisions about their coverage needs. This aspect of the role involves building trust and establishing a relationship of confidence with clients.

The Future of Insurance Company Employees

As the insurance industry continues to evolve, the role of insurance company employees will also adapt and transform. The increasing focus on digital transformation and sustainability will shape the skills and competencies required in the future.

For instance, with the growing awareness of environmental issues, insurance companies are developing new products and services to address sustainability challenges. Insurance company employees will need to understand these emerging trends and educate clients on the importance of sustainable insurance practices.

Furthermore, the rise of remote work and digital communication has brought about new opportunities and challenges for insurance company employees. The ability to work remotely has opened up talent pools, allowing companies to hire the best talent regardless of geographic location. However, it also requires employees to adapt to virtual collaboration and maintain high levels of engagement and productivity.

The future of insurance company employees will likely involve a blend of technological proficiency and human connection. As AI and automation continue to handle routine tasks, insurance professionals will focus on complex problem-solving, strategic decision-making, and building meaningful relationships with clients.

The Bottom Line

The role of an insurance company employee is multifaceted and dynamic, offering a unique perspective on the insurance industry. These professionals play a crucial role in safeguarding the interests of policyholders, maintaining the financial stability of insurance companies, and contributing to the overall resilience of the insurance sector.

As the insurance landscape continues to evolve, insurance company employees will remain at the forefront, adapting to new technologies, trends, and challenges. Their expertise, dedication, and commitment to serving clients will continue to be the cornerstone of the insurance industry’s success.

| Industry Sector | Insurance |

|---|---|

| Key Role | Insurance Company Employee |

| Specializations | Underwriting, Claims Handling, Sales, Risk Management, Actuarial Science |

| Challenges | Navigating Complex Insurance Landscape, Adapting to Technological Advancements, Building Trust with Clients |

| Future Trends | Digital Transformation, Sustainability Focus, Remote Work Opportunities |

What are the key skills required for an insurance company employee?

+

Insurance company employees require a diverse skill set, including strong analytical abilities, excellent communication skills, attention to detail, and a deep understanding of insurance products and regulations. Additionally, adaptability and the ability to work in a fast-paced environment are crucial.

How does technology impact the daily tasks of insurance company employees?

+

Technology, particularly AI and automation, has transformed the insurance industry. It has streamlined many processes, allowing employees to focus on more complex tasks. However, employees must also adapt to new digital tools and ensure their accurate use.

What is the role of insurance company employees in building client relationships?

+

Insurance company employees are often the primary point of contact for clients. They build trust, provide personalized advice, and guide clients through the insurance journey. Their expertise and empathy are vital in fostering long-lasting relationships.