Cat Insurance Near Me

Welcome to a comprehensive guide on understanding the ins and outs of cat insurance and how to navigate the process of finding the right coverage for your feline friend. As a responsible pet owner, you want to ensure your cat receives the best medical care, and insurance can be a crucial tool in achieving that. In this article, we will delve into the world of cat insurance, exploring its benefits, different types of policies, and how to locate providers in your area. By the end, you'll have the knowledge and tools to make an informed decision about protecting your beloved pet's health.

The Importance of Cat Insurance

In the realm of pet ownership, cat insurance serves as a vital safeguard against unexpected veterinary expenses. Just like human health insurance, cat insurance provides coverage for a range of medical treatments, from routine check-ups to emergency surgeries. This financial protection can prove invaluable, especially when faced with costly medical procedures or chronic conditions that require ongoing care.

The benefits of cat insurance extend beyond the immediate relief of financial strain. It promotes proactive healthcare for your pet, encouraging regular veterinary visits that can detect health issues early on. Early detection often leads to more effective and less invasive treatments, improving your cat's quality of life and potentially extending their lifespan.

Common Misconceptions About Cat Insurance

Before we delve into the specifics of cat insurance, it's essential to address some common misconceptions that might deter pet owners from considering this option.

- Misconception 1: Cat insurance is only for expensive breeds. While certain breeds may be predisposed to specific health conditions, all cats, regardless of breed or mix, can benefit from insurance coverage. Routine care, accidents, and illnesses can affect any feline, making insurance a wise investment for all cat owners.

- Misconception 2: Cat insurance is too expensive. The cost of cat insurance varies depending on factors such as your cat's age, breed, and the level of coverage you choose. While it's true that some policies can be pricier, there are often more affordable options available, especially if you start coverage when your cat is young and healthy.

- Misconception 3: My cat is healthy, so insurance is unnecessary. While it's wonderful that your cat is currently in good health, accidents and illnesses can strike at any time. Insurance provides peace of mind and ensures that you're prepared for unexpected veterinary bills, which can range from hundreds to thousands of dollars.

Understanding Different Types of Cat Insurance Policies

Cat insurance policies can vary significantly in terms of coverage and cost. It's crucial to understand the different types available to choose the one that best suits your cat's needs and your budget.

Accident-Only Coverage

As the name suggests, this type of policy covers injuries resulting from accidents, such as being hit by a car, falling from a height, or ingesting a foreign object. Accident-only policies typically have lower premiums than more comprehensive plans, making them an attractive option for budget-conscious pet owners.

Accident and Illness Coverage

These policies provide a more extensive range of coverage, including not only accidents but also illnesses and conditions such as diabetes, kidney disease, and cancer. While they may have higher premiums, they offer comprehensive protection for your cat's health.

Wellness Plans

Wellness plans are designed to cover routine care and preventive treatments, such as vaccinations, annual check-ups, spaying or neutering, and flea and tick treatments. These plans can be a cost-effective way to manage your cat's ongoing healthcare needs.

Lifetime Policies

Lifetime policies are the most comprehensive option, offering continuous coverage for the duration of your cat's life. They typically include accident and illness coverage, as well as routine care benefits. While they may have higher initial costs, they provide long-term peace of mind and consistent protection.

How to Find Cat Insurance Providers Near You

Locating cat insurance providers in your area is a straightforward process, thanks to the wealth of online resources available. Here are some steps to guide you:

Online Research

Start by conducting an online search for "cat insurance providers near me." This will yield a list of companies that offer cat insurance in your region. You can also visit reputable pet insurance comparison websites, which often have search tools that allow you to filter results by location, coverage type, and other factors.

Vet Recommendations

Your veterinarian can be a valuable source of information. They often work closely with various insurance providers and can recommend those with whom they've had positive experiences. Additionally, they may offer insight into which providers offer the best coverage for the specific needs of your cat.

Social Media and Online Communities

Social media platforms and online pet communities can be excellent resources for finding recommendations and reviews of cat insurance providers. Join pet-related groups and forums, where you can ask for suggestions and share experiences with other pet owners.

Review Websites

Consumer review websites can provide insights into the experiences of other pet owners with different insurance providers. Look for platforms that allow users to rate and review companies based on factors like customer service, claim processing, and coverage.

Local Pet Stores and Shelters

Don't underestimate the value of local resources. Many pet stores and shelters have partnerships with insurance providers and can offer recommendations or discounts on policies. Stop by your local pet store or shelter and inquire about their preferred insurance partners.

Comparing Cat Insurance Policies: What to Look For

Once you've identified potential cat insurance providers in your area, it's time to compare policies and choose the one that best aligns with your needs and budget. Here are some key factors to consider during your comparison process:

Coverage Limits and Deductibles

Examine the policy's coverage limits, which dictate the maximum amount the insurance company will pay out for a specific condition or treatment. Also, consider the deductibles, which are the amounts you'll need to pay out of pocket before the insurance coverage kicks in. Lower deductibles generally result in higher premiums, so find a balance that suits your financial situation.

Reimbursement Options

Determine how the insurance provider handles reimbursement. Some companies offer direct payment to the veterinarian, while others require you to pay upfront and then submit a claim for reimbursement. Direct payment can be more convenient, but it may limit your choice of veterinary clinics.

Waiting Periods

Waiting periods refer to the time you must wait after purchasing a policy before certain conditions or treatments are covered. These periods can vary, so be sure to inquire about them when comparing policies.

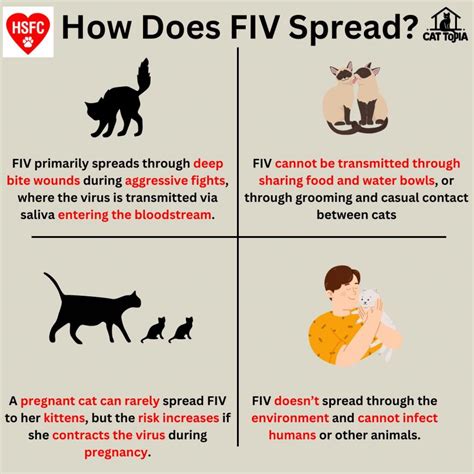

Pre-Existing Condition Clauses

Pre-existing conditions are illnesses or injuries that your cat had before you purchased the insurance policy. Many policies exclude coverage for pre-existing conditions, so it's crucial to understand how each provider defines and handles these situations.

Coverage for Routine Care

If you're considering a wellness plan or a policy with routine care benefits, ensure that the coverage aligns with your cat's needs. Look for policies that cover vaccinations, spaying or neutering, dental care, and other preventive treatments.

Additional Considerations: Customizing Your Cat's Insurance Policy

When selecting a cat insurance policy, keep in mind that you can often customize the coverage to better suit your cat's unique needs and your budget. Here are some additional considerations to explore:

Add-Ons and Riders

Many insurance providers offer add-ons or riders that allow you to enhance your policy's coverage. For example, you might be able to add coverage for alternative therapies like acupuncture or chiropractic care, or opt for higher limits for specific conditions.

Discounts and Promotions

Keep an eye out for discounts and promotions that can help reduce the cost of your cat's insurance. Some providers offer discounts for multiple pets, while others may have seasonal promotions or partnerships with specific organizations that result in reduced rates.

Flexible Payment Plans

Inquire about the payment options available. Some providers offer flexible payment plans, allowing you to pay premiums monthly, quarterly, or annually. This can help you manage the cost of insurance more effectively.

Frequently Asked Questions

How much does cat insurance typically cost?

+The cost of cat insurance varies widely depending on factors such as your cat's age, breed, location, and the type of coverage you choose. On average, you can expect to pay between $20 and $50 per month for a basic policy, but prices can go much higher for more comprehensive coverage.

Can I insure an older cat, or are there age restrictions?

+While some insurance providers have age restrictions, many offer coverage for older cats. However, premiums may be higher for older pets, as they are more prone to health issues. It's best to inquire directly with providers about their age-related policies.

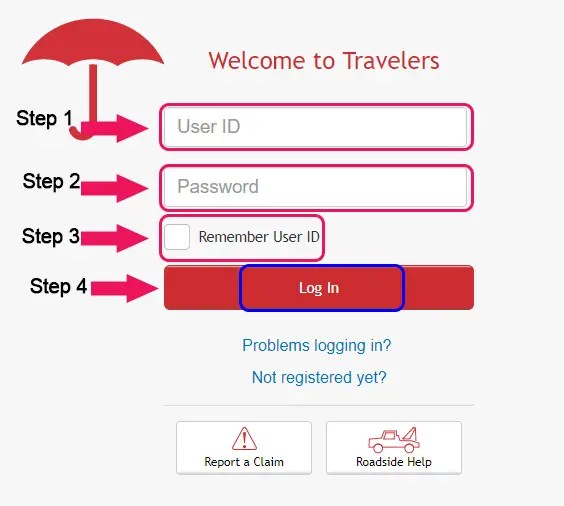

What happens if I need to make a claim for my cat's insurance?

+The claim process can vary slightly between insurance providers, but generally, you'll need to pay for the veterinary treatment upfront and then submit a claim form, along with any required documentation, to the insurance company. The company will then review the claim and reimburse you according to the terms of your policy.

Are there any exclusions or limitations I should be aware of?

+Yes, most cat insurance policies have exclusions and limitations. These can include pre-existing conditions, certain breeds known for genetic disorders, and elective procedures. It's crucial to carefully review the policy's terms and conditions to understand what is and isn't covered.

In conclusion, cat insurance is a valuable tool for pet owners looking to protect their feline companions and ensure they receive the best possible healthcare. By understanding the different types of policies, researching providers in your area, and comparing coverage options, you can make an informed decision that provides peace of mind and financial security for you and your cat.