Is United Healthcare Ppo Good Insurance

UnitedHealthcare is one of the leading healthcare insurance providers in the United States, offering a range of plans and options to cater to different needs and preferences. When considering UnitedHealthcare's PPO (Preferred Provider Organization) plans, it's essential to delve into the specifics to understand if they align with your healthcare requirements and financial situation.

Understanding UnitedHealthcare PPO Plans

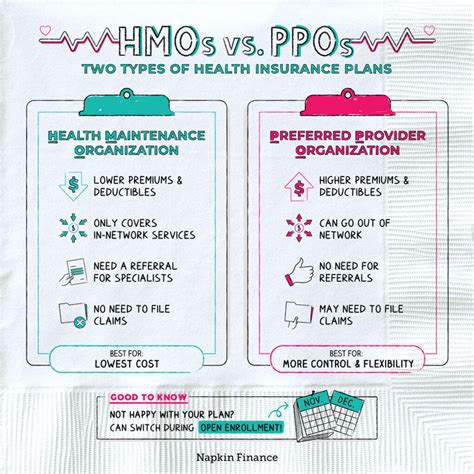

UnitedHealthcare’s PPO plans provide members with a network of healthcare providers, including doctors, specialists, hospitals, and other medical facilities. Members have the flexibility to choose their healthcare providers from within this network without needing a referral for specialist care. This freedom of choice is a significant advantage, especially for those who have established relationships with specific healthcare professionals.

PPO plans typically offer more extensive coverage options compared to other plan types, such as HMO (Health Maintenance Organization) plans. Members have the freedom to visit healthcare providers outside the network, although they may incur higher out-of-pocket costs. The cost-sharing between the member and the insurance company can vary based on the specific plan and the member's healthcare utilization.

Key Features of UnitedHealthcare PPO Plans

- Provider Network: UnitedHealthcare’s PPO plans provide access to a broad network of healthcare providers, ensuring members have a wide range of options for their medical care.

- Flexibility: Members can choose their healthcare providers, including specialists, without the need for referrals, allowing for greater control over their healthcare journey.

- Out-of-Network Coverage: While PPO plans encourage the use of in-network providers, they also offer coverage for out-of-network care, although at a higher cost-sharing rate.

- Preventive Care: Many PPO plans include coverage for preventive services, such as annual check-ups, screenings, and immunizations, which are often fully covered or have minimal out-of-pocket costs.

- Specialist Care: Access to specialists is a key benefit of PPO plans, as members can directly schedule appointments without going through a primary care physician.

| Plan Feature | Description |

|---|---|

| Provider Network Size | Varies by plan, but typically includes a substantial number of healthcare providers across different specialties. |

| Out-of-Pocket Costs | Depends on the specific plan; may include deductibles, copayments, and coinsurance. |

| Prescription Drug Coverage | Prescription drug benefits are often included, with varying levels of coverage and cost-sharing. |

| Wellness Programs | Some PPO plans offer wellness incentives and programs to encourage healthy lifestyles. |

Factors to Consider When Choosing a UnitedHealthcare PPO Plan

Selecting the right insurance plan is a crucial decision, and several factors should be taken into account when considering UnitedHealthcare’s PPO offerings.

Your Healthcare Needs

Assess your current and potential future healthcare needs. If you have chronic conditions or require regular specialist care, a PPO plan’s flexibility in choosing providers can be beneficial. Consider the network of providers available in your area and whether they align with your healthcare preferences.

Cost and Budget

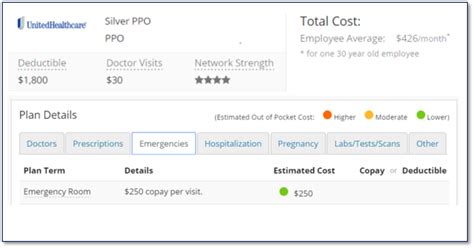

UnitedHealthcare PPO plans can vary significantly in cost. Evaluate the premiums, deductibles, copayments, and coinsurance to understand the financial commitment. Consider your budget and how the plan’s cost-sharing structure aligns with your healthcare utilization expectations.

Prescription Drug Coverage

If you rely on prescription medications, ensure that the PPO plan you choose provides adequate coverage for your specific medications. Some plans may have different tiers of coverage or cost-sharing for brand-name and generic drugs.

Wellness Programs and Incentives

UnitedHealthcare offers various wellness programs and incentives to encourage healthy behaviors. Explore these options and determine if they can help you maintain a healthy lifestyle and potentially reduce your healthcare costs.

Customer Service and Claims Process

Research UnitedHealthcare’s reputation for customer service and the ease of their claims process. Efficient and responsive customer support can make a significant difference, especially when you need assistance with billing, coverage questions, or claim submissions.

Comparing UnitedHealthcare PPO Plans

UnitedHealthcare offers a range of PPO plans, each with its own set of features and benefits. When comparing plans, pay attention to the following key aspects:

- Network Size and Provider Availability: Ensure that the plan's network includes your preferred healthcare providers and facilities.

- Out-of-Pocket Costs: Compare the deductibles, copayments, and coinsurance across different plans to understand the financial impact.

- Prescription Drug Coverage: Evaluate the plan's coverage for prescription medications, including any potential restrictions or tiers.

- Wellness Benefits: Assess the availability and value of wellness programs and incentives offered by each plan.

- Customer Satisfaction and Reviews: Research customer reviews and ratings to gauge the overall satisfaction with UnitedHealthcare's PPO plans.

Real-World Insights and Examples

Let’s explore a few real-world scenarios to illustrate the benefits and considerations of UnitedHealthcare’s PPO plans.

Scenario 1: Flexible Healthcare for an Active Family

The Johnson family, with two active children, values the flexibility and choice offered by UnitedHealthcare’s PPO plans. They frequently need access to specialists for sports-related injuries and have established relationships with specific healthcare providers. With a PPO plan, they can continue visiting their preferred providers without the hassle of referrals, ensuring timely and convenient care.

Scenario 2: Cost-Effective Coverage for a Healthy Individual

Sarah, a young professional, leads a healthy lifestyle and rarely requires medical care. She chooses a UnitedHealthcare PPO plan with a higher deductible and lower monthly premiums to save costs. While she may incur higher out-of-pocket expenses if she requires medical attention, the plan’s preventive care coverage ensures she can access annual check-ups and screenings at minimal cost.

Scenario 3: Comprehensive Coverage for Chronic Conditions

John, who has been managing a chronic condition, opts for a UnitedHealthcare PPO plan with a larger network and comprehensive coverage. This plan provides him with access to a wide range of specialists and ensures that his condition is well-managed without financial strain. The plan’s cost-sharing structure is designed to support individuals with ongoing healthcare needs.

Conclusion: Is UnitedHealthcare PPO a Good Choice for You?

UnitedHealthcare’s PPO plans offer a flexible and comprehensive healthcare solution, catering to a wide range of individuals and families. The ability to choose healthcare providers and access specialists without referrals is a significant advantage, especially for those with specific healthcare needs or established relationships.

However, the decision to choose a UnitedHealthcare PPO plan should be made based on a thorough evaluation of your healthcare needs, budget, and preferences. Consider the factors discussed above, compare different plan options, and seek advice from healthcare professionals or insurance brokers to ensure you make an informed choice. Remember, the "goodness" of an insurance plan is highly subjective and depends on your unique circumstances.

Frequently Asked Questions

What is the average monthly premium for a UnitedHealthcare PPO plan?

+Monthly premiums can vary significantly based on factors such as age, location, and the specific plan chosen. On average, UnitedHealthcare PPO plans range from 300 to 800 per month for an individual, with family plans typically costing more.

Are there any age restrictions for UnitedHealthcare PPO plans?

+No, UnitedHealthcare PPO plans are available to individuals of all ages, including children and seniors. The cost and coverage may vary based on age, with younger individuals typically paying lower premiums.

Can I keep my current doctor with a UnitedHealthcare PPO plan?

+Yes, one of the key advantages of UnitedHealthcare PPO plans is the flexibility to choose your healthcare providers. If your current doctor is part of the PPO network, you can continue seeing them without any disruptions to your care.