Low Mileage Car Insurance For Seniors

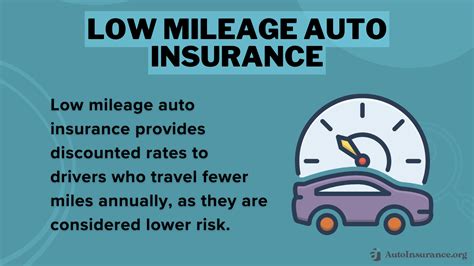

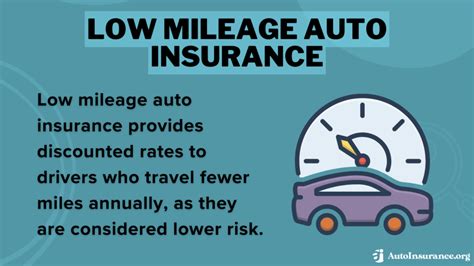

When it comes to car insurance for seniors, there are often unique considerations and factors that come into play. One particular aspect that can impact insurance rates is the mileage a vehicle accumulates. Many seniors drive fewer miles annually compared to younger drivers, and this low mileage can lead to potential savings on insurance premiums. In this article, we will delve into the world of low-mileage car insurance for seniors, exploring the benefits, factors influencing rates, and strategies to secure the best coverage.

The Advantages of Low Mileage Car Insurance for Seniors

Seniors who drive fewer miles each year can reap several benefits from low-mileage car insurance policies. These policies are designed to cater to the specific needs and circumstances of low-mileage drivers, offering tailored coverage and potential cost savings.

Reduced Premiums

One of the most significant advantages of low-mileage car insurance is the potential for lower premiums. Insurance companies often offer discounts or special rates for seniors who drive less, recognizing that reduced mileage correlates with a lower risk of accidents and claims. This means that seniors can save a substantial amount on their insurance costs without compromising on essential coverage.

For instance, let's consider the case of Mr. Johnson, a 65-year-old retiree who drives his car only for occasional trips to the grocery store and social engagements. With an annual mileage of less than 5,000 miles, Mr. Johnson qualifies for a low-mileage discount. As a result, his insurance premium is significantly lower compared to his peers who drive more frequently.

Customized Coverage Options

Low-mileage car insurance policies provide seniors with the flexibility to customize their coverage based on their specific needs. Insurance providers understand that seniors’ driving habits and requirements may differ, and thus, they offer a range of options to tailor the policy accordingly.

Some insurers provide usage-based insurance programs, where the premium is calculated based on the actual miles driven. This means that seniors who drive even fewer miles than the average low-mileage driver can further reduce their insurance costs. Additionally, these programs often utilize telematics devices or smartphone apps to track mileage accurately.

Additional Perks and Discounts

Beyond reduced premiums, low-mileage car insurance policies often come with added perks and discounts. Many insurers offer multi-policy discounts, meaning seniors can bundle their auto insurance with other policies, such as homeowners or life insurance, to save even more.

Furthermore, some insurance companies provide loyalty discounts for long-term customers or seniors who have maintained a clean driving record for an extended period. These incentives reward seniors for their safe driving habits and loyalty to the insurance provider.

Factors Influencing Low Mileage Car Insurance Rates for Seniors

While low mileage is a significant factor in determining insurance rates for seniors, it is not the sole consideration. Insurance companies assess a range of variables to calculate premiums, ensuring a fair and accurate assessment of risk.

Age and Driving Experience

Age plays a crucial role in determining insurance rates. As seniors age, their driving experience and skills often improve, leading to a lower risk of accidents. Insurance companies take this into account and may offer more favorable rates to seniors with a long history of safe driving.

Additionally, seniors who have maintained a clean driving record, free from accidents or traffic violations, are likely to receive discounts on their insurance premiums. Insurance providers view this as a positive indicator of responsible driving behavior.

Vehicle Type and Safety Features

The type of vehicle a senior drives can also impact insurance rates. Insurance companies consider factors such as the make, model, and safety features of the vehicle. Vehicles with advanced safety technologies, such as collision avoidance systems and lane departure warnings, may be eligible for discounts as they reduce the risk of accidents.

Furthermore, the overall safety record of the vehicle, as determined by industry ratings, can influence insurance rates. Seniors who drive vehicles with excellent safety ratings may benefit from lower premiums.

Location and Usage

The location where a senior resides and the primary usage of their vehicle are additional factors that insurance companies consider. Urban areas with higher traffic volumes and accident rates may result in slightly higher insurance premiums compared to rural areas.

Additionally, insurance providers assess the primary purpose of the vehicle. Seniors who primarily use their cars for leisure activities or short-distance travel may be eligible for lower rates compared to those who commute to work or drive frequently for business purposes.

Strategies for Securing the Best Low Mileage Car Insurance

To maximize savings and obtain the best low-mileage car insurance coverage, seniors can employ several strategies. These strategies involve careful research, comparison, and negotiation to ensure they receive the most favorable rates and comprehensive coverage.

Research and Compare Insurance Providers

Before settling on a particular insurance provider, seniors should conduct thorough research and compare multiple options. Different insurers may have varying approaches to low-mileage car insurance, offering unique discounts and coverage options. By exploring multiple providers, seniors can identify the one that best suits their needs and provides the most significant savings.

Online comparison tools and insurance aggregator websites can be valuable resources for seniors to quickly assess and compare insurance rates from multiple providers. These platforms often provide detailed information about coverage options, discounts, and customer reviews, enabling seniors to make informed decisions.

Negotiate and Bundle Policies

Negotiation is a powerful tool when it comes to securing the best insurance rates. Seniors should feel empowered to discuss their specific circumstances and negotiate with insurance providers to obtain the most favorable terms. Explaining their low-mileage driving habits and highlighting their safe driving record can help persuade insurers to offer competitive rates.

Additionally, seniors can leverage the power of bundling multiple insurance policies. By combining their auto insurance with other policies, such as homeowners or life insurance, they can often negotiate significant discounts. Insurance companies often provide multi-policy discounts to reward customers for their loyalty and comprehensive coverage.

Utilize Telematics Devices or Mileage Tracking Apps

Telematics devices or mileage tracking apps can be valuable tools for seniors to accurately monitor and demonstrate their low mileage. These technologies provide real-time data on miles driven, allowing insurance companies to assess the actual usage of the vehicle. By using these devices or apps, seniors can provide concrete evidence of their low mileage and potentially qualify for even more significant discounts.

Some insurance providers offer incentives or discounts specifically for customers who utilize telematics devices or mileage tracking apps. These programs often reward drivers for maintaining low mileage and encourage safe driving behaviors.

Review and Adjust Coverage Regularly

Insurance needs and circumstances can change over time, and it is essential for seniors to regularly review and adjust their car insurance coverage accordingly. As their driving habits evolve or as they acquire new vehicles, seniors should reassess their insurance needs to ensure they have adequate coverage without paying for unnecessary features.

Insurance providers often offer periodic policy reviews to help seniors stay informed about any changes in their coverage or premiums. By staying engaged with their insurance provider and keeping them updated on any significant life changes, seniors can ensure they receive the most suitable and cost-effective coverage.

| Low Mileage Discount | Annual Savings |

|---|---|

| Usage-based Insurance | $300 - $500 |

| Multi-Policy Discount | $150 - $250 |

| Loyalty Discount | $100 - $200 |

How do insurance companies determine low mileage for car insurance discounts?

+Insurance companies typically define low mileage as an annual mileage of 7,500 miles or less. However, the exact threshold may vary between insurers. Some providers offer discounts for mileage as low as 5,000 miles per year, while others may require more precise mileage tracking through telematics devices or apps.

Can seniors combine low-mileage car insurance with other discounts to save more on premiums?

+Absolutely! Seniors can often maximize their savings by combining low-mileage car insurance with other applicable discounts. These may include multi-policy discounts, safe driver discounts, loyalty discounts, or even discounts for completing defensive driving courses. By exploring and utilizing multiple discounts, seniors can significantly reduce their insurance premiums.

Are there any disadvantages to low-mileage car insurance policies for seniors?

+While low-mileage car insurance policies offer significant advantages, there are a few potential drawbacks to consider. One potential disadvantage is that these policies may have limitations on the number of miles driven annually. Exceeding the allowed mileage limit could result in additional fees or even policy cancellation. Additionally, some low-mileage policies may have higher deductibles, which means seniors would need to pay more out-of-pocket in the event of a claim.