American Life Insurance Co

In the vast landscape of the insurance industry, American Life Insurance Co., often referred to as ALICO, stands as a venerable institution with a rich history and a profound impact on the financial well-being of countless individuals and families. With a legacy spanning decades, ALICO has not only weathered the storms of economic fluctuations but has also emerged as a trusted guardian of financial security, offering a comprehensive range of life insurance solutions. This article delves into the story of ALICO, exploring its evolution, the pivotal role it plays in the industry, and the enduring relevance of its services in today’s world.

A Century of Evolution: From Inception to Innovation

The journey of American Life Insurance Co. began in the early 20th century, a time when the concept of life insurance was still taking root in American society. ALICO’s founders, visionary leaders with a keen understanding of the financial needs of the burgeoning middle class, recognized the importance of providing a safety net for families in the event of unforeseen tragedies.

The Early Years: Building Trust

In its formative years, ALICO focused on establishing itself as a reliable provider of life insurance policies. The company’s initial offerings were simple yet effective, catering to the basic needs of policyholders. ALICO’s agents, often the face of the company, worked tirelessly to educate the public about the importance of financial planning and the role of life insurance in securing one’s future.

Expansion and Diversification

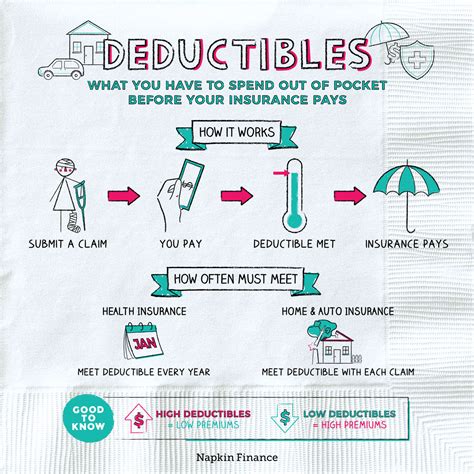

As the company gained traction and established itself as a trusted brand, it began to expand its horizons. The mid-20th century saw ALICO branching out into various insurance sectors, offering not just life insurance but also annuities, health insurance, and even property and casualty insurance. This diversification strategy not only broadened the company’s customer base but also positioned it as a comprehensive financial services provider.

The Modern Era: Adapting to a Changing World

The turn of the millennium brought with it a new set of challenges and opportunities for ALICO. The company, now a stalwart in the industry, had to adapt to the rapidly evolving financial landscape and the changing needs of its customers.

Digital Transformation

One of the most significant shifts in the industry was the advent of digital technology. ALICO embraced this change, investing heavily in digital infrastructure to streamline its processes and enhance the customer experience. The company’s online platforms now offer a seamless and user-friendly interface, allowing policyholders to manage their accounts, access information, and even purchase new policies with just a few clicks.

Tailored Solutions

Understanding that every individual’s financial situation is unique, ALICO has honed its focus on providing tailored insurance solutions. Whether it’s custom-built life insurance policies, flexible payment plans, or specialized coverage for specific needs, the company aims to cater to the diverse requirements of its customers.

Impact and Relevance Today

Despite the ever-changing nature of the insurance industry, ALICO’s core values and commitment to its customers remain unwavering. The company’s impact is felt not just in the financial security it provides but also in the community initiatives it undertakes.

Community Engagement

ALICO has long recognized its role as a corporate citizen and has actively participated in various community development programs. From sponsoring local events to supporting charitable causes, the company demonstrates its commitment to giving back to the communities it serves.

Education and Awareness

ALICO’s educational initiatives play a crucial role in raising awareness about the importance of financial planning and insurance. The company regularly conducts workshops, seminars, and online webinars to educate the public about various insurance products, helping individuals make informed decisions about their financial future.

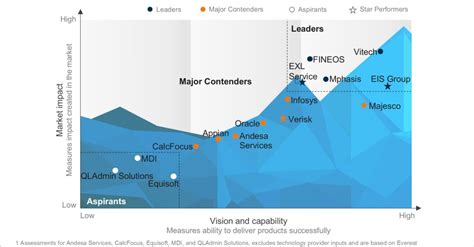

Performance Analysis and Market Standing

American Life Insurance Co.’s performance over the years has been a testament to its resilience and adaptability. The company has consistently maintained a strong financial position, with robust growth and a stable customer base.

Financial Strength

ALICO’s financial strength is reflected in its consistent A-ratings from leading credit rating agencies. This rating signifies the company’s ability to meet its financial obligations and its stability in the face of economic fluctuations.

Market Share and Growth

The company’s market share has grown steadily over the years, particularly in the life insurance sector. ALICO’s innovative products, coupled with its focus on customer satisfaction, have attracted a loyal customer base. The company’s growth is a testament to its ability to adapt to changing market dynamics and cater to the evolving needs of its customers.

The Future of American Life Insurance Co.

As ALICO looks to the future, the company remains committed to its core values while embracing the challenges and opportunities presented by the digital age.

Technological Integration

ALICO is poised to further integrate technology into its operations, leveraging artificial intelligence and machine learning to enhance its services. From personalized policy recommendations to efficient claims processing, technology will play a pivotal role in the company’s future strategies.

Expansion and Global Reach

With a solid foundation in the American market, ALICO is now turning its gaze towards global expansion. The company’s plans to enter new international markets demonstrate its ambition and confidence in its ability to provide world-class insurance solutions on a global scale.

Frequently Asked Questions

What sets ALICO apart from other insurance companies?

ALICO's commitment to customer satisfaction and its ability to adapt to changing market needs have been key differentiators. The company's focus on providing tailored solutions and its strong financial standing have made it a trusted choice for many.

How does ALICO ensure the financial security of its policyholders?

ALICO maintains a robust financial strategy, regularly investing in stable assets and maintaining a diverse portfolio. This ensures that the company has the resources to meet its financial obligations, providing peace of mind to its policyholders.

What are some of ALICO’s most popular insurance products?

ALICO offers a range of products, including term life insurance, whole life insurance, and various annuity plans. The company's customized coverage options and flexible payment plans have made these products particularly popular.

How does ALICO contribute to community development?

ALICO actively participates in community initiatives through sponsorship programs, volunteer efforts, and charitable donations. The company believes in giving back to the communities it serves, fostering a sense of social responsibility.

What are ALICO’s plans for the future in terms of product innovation?

ALICO is continuously innovating its product offerings, with a focus on digital integration and personalized solutions. The company aims to stay ahead of the curve by anticipating customer needs and leveraging technology to provide cutting-edge insurance products.