Private Auto Insurance Companies

In the realm of personal finance and security, private auto insurance companies play a pivotal role, offering essential coverage and protection to vehicle owners. These companies are a vital component of the insurance industry, providing financial safeguards against a range of potential risks and liabilities associated with automobile ownership and usage.

This comprehensive guide delves into the world of private auto insurance companies, exploring their operations, products, and the critical role they play in safeguarding individuals and their vehicles. By the end of this article, readers will have a deeper understanding of the intricacies of this industry and the value it brings to society.

Understanding the Auto Insurance Industry

The auto insurance industry is a multifaceted sector, characterized by a diverse range of companies, each offering unique policies and coverage options. These companies are typically classified into two main categories: private and government-run.

Private auto insurance companies, as the name suggests, are privately owned and operated entities that provide insurance coverage to individuals and businesses. They operate independently of government regulations and are primarily driven by market forces and consumer demand. These companies offer a wide array of insurance products, catering to the diverse needs of their clientele.

Key Players in the Private Auto Insurance Market

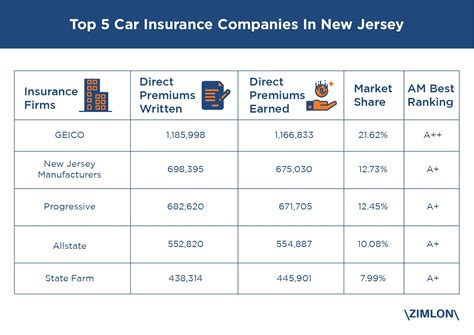

The private auto insurance market is highly competitive, with numerous companies vying for market share. Some of the most prominent players include:

- State Farm: One of the largest and most recognizable auto insurance providers in the United States, State Farm offers a comprehensive range of insurance products, including auto, home, life, and health insurance.

- Geico: Known for its innovative marketing strategies and competitive pricing, Geico has become a household name in the insurance industry. They provide auto, motorcycle, and RV insurance, among other coverage options.

- Progressive: Progressive is renowned for its customer-centric approach and digital-first strategy. They offer a wide array of insurance products, including auto, home, and commercial insurance.

- Allstate: Allstate is another major player in the auto insurance market, providing a comprehensive suite of insurance products and services to individuals and businesses.

- Liberty Mutual: Liberty Mutual is a leading global insurer, offering a diverse range of insurance products, including auto, home, life, and business insurance.

These companies, along with numerous others, compete to provide the best value and coverage to their customers, often leveraging innovative technologies and data analytics to enhance their offerings.

The Role of Private Auto Insurance Companies

Private auto insurance companies serve as a vital pillar of the financial safety net for vehicle owners. They provide coverage for a wide range of risks and liabilities, ensuring that policyholders are protected in the event of accidents, theft, natural disasters, and other unforeseen events.

Key Functions and Responsibilities

- Risk Assessment and Underwriting: Private insurance companies employ sophisticated risk assessment methodologies to evaluate the potential risks associated with insuring a particular individual or vehicle. This process, known as underwriting, involves analyzing various factors such as driving history, vehicle type, location, and demographic data to determine the level of risk and the corresponding premium.

- Policy Creation and Customization: Based on the assessed risk, insurance companies create tailored policies that provide coverage for specific risks and liabilities. These policies can be customized to meet the unique needs of the policyholder, offering a range of coverage options and add-ons.

- Claims Processing and Settlement: When an insured event occurs, private auto insurance companies are responsible for processing and settling claims. This involves assessing the extent of damage, determining liability, and providing financial compensation to the policyholder or other parties involved in the incident.

- Customer Service and Support: Private insurance companies prioritize customer satisfaction and provide comprehensive support throughout the policy lifecycle. This includes assisting with policy selection, providing guidance on coverage options, and offering prompt assistance during the claims process.

The Benefits of Private Auto Insurance

Private auto insurance offers several advantages to policyholders, including:

- Customized Coverage: Private insurance companies offer a wide range of coverage options, allowing policyholders to tailor their policies to their specific needs and circumstances.

- Competitive Pricing: With a highly competitive market, private insurance companies often offer competitive premiums, providing value for money to policyholders.

- Innovative Technologies: Many private insurance companies leverage cutting-edge technologies, such as telematics and digital platforms, to enhance the customer experience and improve risk assessment.

- Specialized Products: Private insurers often offer specialized products tailored to specific industries or niche markets, providing tailored coverage solutions for unique needs.

The Evolution of Auto Insurance

The auto insurance industry has undergone significant transformations over the years, driven by technological advancements, changing consumer preferences, and evolving regulatory landscapes.

Impact of Technology

The advent of technology has had a profound impact on the auto insurance industry. Insurers now leverage advanced analytics, artificial intelligence, and machine learning to enhance their risk assessment capabilities and offer more accurate and personalized coverage. Additionally, the rise of telematics and usage-based insurance has revolutionized the way policies are priced and tailored to individual driving behaviors.

Regulatory Landscape

The regulatory environment plays a critical role in shaping the auto insurance industry. Governments and regulatory bodies implement laws and guidelines to ensure fair practices, protect consumers, and maintain market stability. Private insurance companies must navigate these regulations, ensuring compliance while also adapting to changing market dynamics.

Consumer Behavior and Preferences

Consumer preferences and behaviors have also influenced the evolution of auto insurance. With the rise of digital technologies, consumers now expect seamless, digital experiences when interacting with insurance providers. As a result, private insurance companies have embraced digital transformation, offering online policy management, mobile apps, and self-service portals to enhance customer convenience and satisfaction.

Future Trends and Innovations

The auto insurance industry is poised for further evolution, driven by ongoing technological advancements and changing market dynamics. Here are some key trends and innovations that are shaping the future of private auto insurance:

Connected Car Technologies

The integration of connected car technologies, such as advanced driver assistance systems (ADAS) and vehicle-to-everything (V2X) communication, is transforming the auto insurance landscape. These technologies enable real-time data collection and analysis, providing insurers with valuable insights into driving behaviors and vehicle performance. This data can be leveraged to offer more accurate and personalized coverage, as well as enhance claims management and fraud detection.

Data Analytics and AI

The continued advancement of data analytics and artificial intelligence (AI) is revolutionizing the way private insurance companies operate. Insurers are leveraging AI-powered platforms to automate risk assessment, claims processing, and customer service interactions. These technologies enable more efficient and accurate decision-making, improve operational efficiency, and enhance the overall customer experience.

Telematics and Usage-Based Insurance

Telematics and usage-based insurance models are gaining traction, offering policyholders the opportunity to pay premiums based on their actual driving behavior and usage. This data-driven approach provides insurers with valuable insights into individual driving patterns, allowing for more precise risk assessment and pricing. As a result, policyholders can benefit from more affordable and tailored coverage options.

Sustainable and Green Insurance

The growing focus on sustainability and environmental consciousness is driving the development of green insurance products. Private insurance companies are introducing policies that incentivize eco-friendly driving behaviors and the adoption of electric vehicles. These initiatives not only contribute to environmental sustainability but also provide policyholders with additional benefits and discounts.

Digital Transformation and Customer Experience

Private insurance companies are prioritizing digital transformation to enhance the customer experience and improve operational efficiency. This includes investing in robust digital platforms, mobile apps, and self-service portals to streamline policy management, claims processing, and customer interactions. By leveraging technology, insurers can offer convenient and seamless experiences, meeting the evolving expectations of modern consumers.

Conclusion

Private auto insurance companies are a cornerstone of the financial security ecosystem, providing essential protection and peace of mind to vehicle owners. Through their innovative products, risk assessment methodologies, and customer-centric approaches, these companies have become integral to the lives of millions of individuals and businesses. As the industry continues to evolve, driven by technological advancements and changing market dynamics, private auto insurance companies will play a pivotal role in shaping the future of financial protection and risk management.

How do private auto insurance companies determine premiums?

+Premiums are determined through a comprehensive risk assessment process known as underwriting. This process considers various factors, including driving history, vehicle type, location, and demographic data. Based on these factors, insurance companies calculate the level of risk associated with insuring a particular individual or vehicle, and set premiums accordingly.

What types of coverage do private auto insurance companies offer?

+Private auto insurance companies offer a wide range of coverage options, including liability coverage, collision coverage, comprehensive coverage, personal injury protection (PIP), medical payments coverage, and uninsured/underinsured motorist coverage. Additionally, they may offer add-ons and endorsements to customize policies based on individual needs.

How can I choose the right private auto insurance company for my needs?

+When selecting a private auto insurance company, it’s important to consider factors such as the range of coverage options, competitive pricing, customer service reputation, financial stability, and any specialized products or services that align with your specific needs. Researching and comparing multiple providers can help you find the best fit for your insurance requirements.