Insurance Deductible Explained

Understanding the concept of an insurance deductible is crucial for anyone seeking to protect their assets and financial well-being through insurance policies. A deductible is a fundamental component of most insurance plans, impacting the overall cost and coverage of the policy. This article will delve into the intricacies of insurance deductibles, providing a comprehensive guide to help you make informed decisions when choosing and utilizing insurance coverage.

The Role and Function of an Insurance Deductible

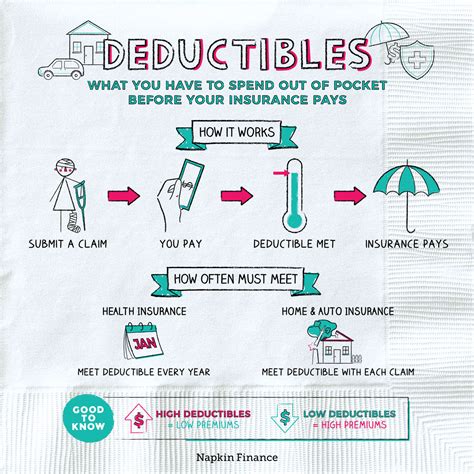

An insurance deductible is essentially a predetermined amount that the policyholder agrees to pay out of pocket before the insurance coverage kicks in. This deductible serves as a financial barrier, ensuring that policyholders have a stake in the potential losses and encouraging them to be more cautious and responsible in their activities. By implementing a deductible, insurance companies aim to reduce the frequency and cost of claims, which ultimately helps to keep insurance premiums affordable for everyone.

For instance, imagine you have a car insurance policy with a $500 deductible. In the event of an accident, you would be responsible for paying the first $500 of the repair costs, and your insurance company would cover the remaining amount, up to the limits of your policy. This deductible structure encourages policyholders to be more mindful drivers, as they are financially accountable for a portion of any losses.

Types of Insurance Deductibles

Insurance deductibles come in various forms, and the type of deductible can significantly impact the cost and coverage of your insurance policy. Here are some common types of insurance deductibles:

Standard Deductible

A standard deductible is the most common type, where the policyholder pays a set amount for each covered loss. This type of deductible is straightforward and often chosen for its simplicity. For example, if you have a 1,000 standard deductible</strong> on your homeowners insurance, you would pay <strong>1,000 for every claim you make, regardless of the total cost of the claim.

Percentage Deductible

A percentage deductible is calculated as a certain percentage of the total claim amount. This type of deductible can vary based on the severity of the loss. For instance, you might have a 2% percentage deductible on your flood insurance policy. In the event of a flood, you would be responsible for paying 2% of the total damage costs, with your insurance covering the remaining 98%.

Aggregate Deductible

An aggregate deductible, also known as a per-occurrence deductible, applies to multiple claims within a specific period, typically a year. This type of deductible can provide significant cost savings for policyholders who experience multiple small claims in a single policy term. For example, if you have an aggregate deductible of 2,000</strong> on your business insurance, you would only pay the first <strong>2,000 of claims across all covered losses during the policy year, with your insurance covering any additional amounts.

Waivable Deductible

A waivable deductible is an optional feature that allows policyholders to choose whether to pay the deductible or not. This type of deductible is often offered as an add-on to the policy, and it can be particularly beneficial for high-value items or situations where the policyholder wants to minimize their financial risk. For instance, you might opt for a waivable deductible on your luxury car insurance, ensuring that you don’t have to pay a deductible in the event of a claim.

Factors Influencing Deductible Amounts

The amount of an insurance deductible can vary significantly based on several factors. Understanding these factors can help you negotiate better deals and make more informed choices when selecting insurance policies.

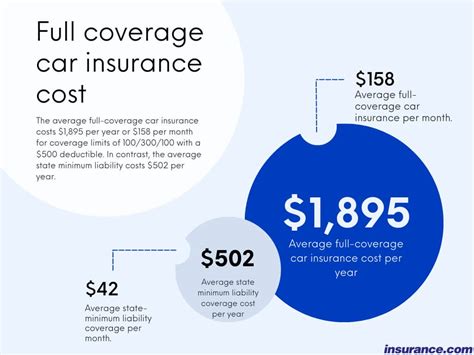

Policy Type and Coverage

Different types of insurance policies often have varying deductible structures. For instance, health insurance policies typically have separate deductibles for individual and family coverage, while auto insurance deductibles can differ based on the level of coverage (e.g., comprehensive vs. collision). It’s essential to review the specific terms of each policy to understand the deductible requirements.

Risk Assessment

Insurance companies assess the risk associated with insuring a particular individual or property. Higher-risk policyholders may be offered policies with higher deductibles to mitigate the insurer’s potential losses. For example, if you live in an area prone to natural disasters, your homeowners insurance deductible might be higher than that of someone in a low-risk area.

Policy Limits and Coverage Amounts

The deductible amount can also be influenced by the policy limits and coverage amounts. Policies with higher limits and broader coverage often come with higher deductibles. This balance ensures that policyholders have a reasonable stake in the potential losses while still providing adequate protection.

Historical Claims Data

Insurance companies analyze historical claims data to set deductible amounts. If a particular policyholder or area has a history of frequent or costly claims, the deductible might be adjusted accordingly. This data-driven approach helps insurance companies manage their risk effectively.

Strategies for Managing Insurance Deductibles

Understanding how to effectively manage insurance deductibles can help you save money and make the most of your insurance coverage. Here are some strategies to consider:

Choose the Right Deductible Amount

When selecting an insurance policy, carefully consider the deductible amount. A higher deductible can lead to lower premiums, but it also means you’ll pay more out of pocket if you need to make a claim. Conversely, a lower deductible provides more financial protection but can result in higher premiums. Assess your financial situation and the likelihood of claims to make an informed decision.

Utilize Waivable Deductibles

If available, consider adding a waivable deductible to your policy, especially for high-value assets or situations where you want to minimize your financial risk. While this option may increase your premiums, it provides peace of mind and ensures that you don’t have to pay a deductible in the event of a claim.

Bundle Your Policies

Bundling multiple insurance policies, such as auto and homeowners insurance, can often lead to discounts and more favorable deductible terms. Insurance companies often reward loyal customers with lower deductibles and other perks. Contact your insurer to explore bundle options and potential savings.

Negotiate Deductible Amounts

In some cases, you may be able to negotiate the deductible amount with your insurance provider. If you have a good claims history or other mitigating factors, your insurer might be willing to adjust the deductible to meet your needs. Don’t be afraid to discuss your options and advocate for a deductible that aligns with your financial situation and risk tolerance.

The Impact of Deductibles on Claims

Understanding how deductibles affect your claims process is crucial for effective insurance management. Here’s how deductibles influence the claims process:

Filing a Claim

When you file a claim, the first step is to determine whether the cost of the loss exceeds the deductible amount. If the loss amount is less than the deductible, it’s generally not worth filing a claim, as you would be responsible for the entire cost. However, if the loss exceeds the deductible, you would pay the deductible amount, and your insurance company would cover the remaining costs up to your policy limits.

Claim Settlement

During the claim settlement process, your insurance company will assess the extent of the loss and calculate the payout. The deductible amount will be subtracted from the total claim amount to determine the insurance company’s liability. For example, if your claim is valued at 8,000</strong> and you have a <strong>1,000 deductible, the insurance company would pay $7,000 towards the claim.

Understanding Deductible Waivers

In certain situations, insurance companies may waive the deductible, either partially or fully. This decision is typically made on a case-by-case basis and is influenced by factors such as the severity of the loss, the policyholder’s claims history, and the insurer’s overall risk assessment. Understanding when and how deductibles can be waived can help you navigate the claims process more effectively.

Future Trends and Developments in Insurance Deductibles

The insurance industry is constantly evolving, and the concept of deductibles is no exception. Here are some potential future trends and developments to watch for:

Dynamic Deductibles

Dynamic deductibles are an innovative concept that adjusts the deductible amount based on real-time data and risk assessment. This approach allows for more flexible and tailored insurance coverage. For example, a dynamic deductible might increase during periods of higher risk, such as severe weather events, and decrease during more stable periods.

Usage-Based Insurance

Usage-based insurance (UBI) is gaining traction, especially in the auto insurance sector. UBI policies use telematics devices to track driving behavior and reward safe drivers with lower premiums and potentially reduced deductibles. This data-driven approach can lead to more personalized insurance coverage and incentivize safer driving habits.

Artificial Intelligence and Predictive Analytics

The integration of artificial intelligence (AI) and predictive analytics into insurance processes can lead to more accurate risk assessment and dynamic deductible structures. AI-powered systems can analyze vast amounts of data to identify patterns and predict potential losses, helping insurance companies set more appropriate deductibles for individual policyholders.

Blockchain Technology

Blockchain technology has the potential to revolutionize the insurance industry, including the management of deductibles. Blockchain’s secure and transparent nature can streamline the claims process, reduce fraud, and enhance data integrity. This technology can also facilitate more efficient and accurate deductible calculations, ensuring a fair and reliable claims settlement process.

Conclusion

Insurance deductibles are a vital component of insurance policies, impacting both the cost and coverage of your protection. By understanding the different types of deductibles, the factors that influence their amounts, and the strategies for managing them, you can make more informed decisions about your insurance coverage. As the insurance industry continues to evolve, keep an eye on emerging trends and technologies that may shape the future of insurance deductibles and overall policy structures.

How do insurance deductibles impact my overall insurance costs?

+The choice of deductible can significantly impact your insurance premiums. A higher deductible often leads to lower premiums, as it reduces the insurer’s potential liability. Conversely, a lower deductible results in higher premiums, as the insurer assumes more financial responsibility. It’s essential to find a balance that aligns with your financial situation and risk tolerance.

Can I negotiate my insurance deductible amount with my insurer?

+Yes, you can negotiate your deductible amount with your insurer, especially if you have a good claims history or other mitigating factors. Insurers often consider the overall risk profile and may be willing to adjust the deductible to meet your needs. Don’t hesitate to discuss your options and advocate for a deductible that suits your financial situation.

What happens if I can’t afford to pay my insurance deductible?

+If you’re unable to pay your insurance deductible, it’s essential to communicate with your insurer as soon as possible. They may offer payment plans or other solutions to help you manage the cost. However, keep in mind that failing to pay your deductible could result in your claim being denied or delayed, so it’s crucial to address this issue promptly.