Cheap Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides lifelong coverage and accumulates cash value over time. It is an attractive option for many individuals seeking long-term financial protection and peace of mind. However, the cost of whole life insurance can be a significant concern, especially for those on a budget. In this article, we delve into the world of cheap whole life insurance, exploring the factors that influence its affordability and offering valuable insights to help you secure adequate coverage without breaking the bank.

Understanding Whole Life Insurance

Whole life insurance is a comprehensive financial tool that offers both death benefit protection and cash value accumulation. Unlike term life insurance, which provides coverage for a specified period, whole life insurance remains in force throughout your lifetime, as long as premiums are paid. This feature makes it an appealing choice for individuals seeking long-term financial security and estate planning.

The cash value component of whole life insurance is a key differentiator. This value grows on a tax-deferred basis and can be accessed through policy loans or withdrawals. It serves as a financial resource that policyholders can tap into during their lifetime, offering flexibility and potential benefits beyond traditional life insurance coverage.

Factors Influencing the Cost of Whole Life Insurance

The cost of whole life insurance can vary significantly based on several factors. Understanding these factors is crucial in determining how to obtain affordable coverage. Here are some key considerations:

Age and Health

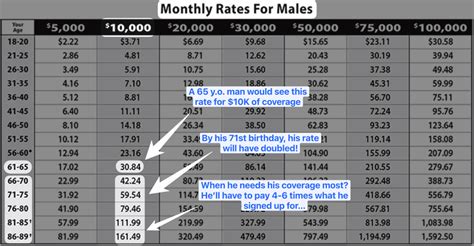

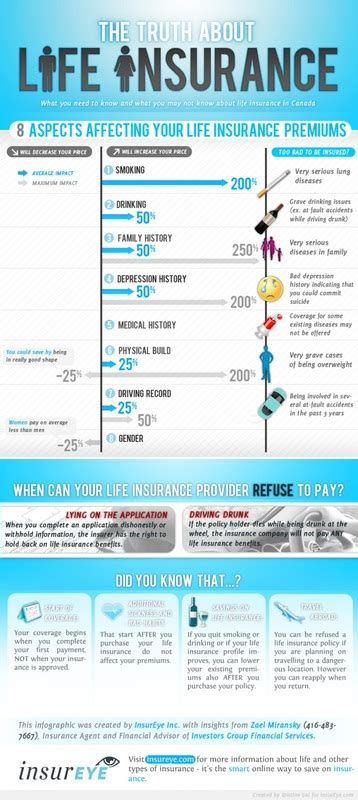

One of the primary determinants of whole life insurance premiums is the age and health of the policyholder. In general, younger individuals enjoy lower premiums due to their longer life expectancy and lower risk of health issues. As you age, the cost of coverage tends to increase, reflecting the higher likelihood of health-related claims.

Additionally, your overall health plays a significant role. Those with pre-existing medical conditions or a history of health issues may face higher premiums or even denial of coverage. It's essential to disclose any health concerns accurately during the application process to ensure the policy aligns with your needs and budget.

Policy Design and Face Value

The design and face value of your whole life insurance policy are critical factors in determining its cost. Face value refers to the death benefit amount the policy pays out upon the insured’s death. Higher face values naturally result in higher premiums, as the insurer assumes a greater financial risk.

Policy design also influences cost. Whole life insurance policies can have various features and riders, such as accelerated death benefits, waiver of premium, or long-term care coverage. These additional benefits can increase the overall cost of the policy. When selecting a policy, carefully consider the features you need to ensure you're not paying for unnecessary add-ons.

Premium Payment Options

Whole life insurance policies offer flexibility in premium payment options. You can choose to pay premiums annually, semi-annually, quarterly, or monthly. While monthly payments may seem more affordable in the short term, they often come with higher overall costs due to administrative fees and interest charges. Consider your financial situation and budget to determine the most suitable payment option.

Additionally, some policies allow for premium payment through policy loans or dividends. Understanding these options and their potential impact on your overall costs is essential for making informed decisions.

Company and Policy Rating

The financial stability and rating of the insurance company issuing your whole life policy are critical factors. Highly rated companies with a strong financial foundation can offer more competitive rates and provide greater assurance of policy continuity. Researching and selecting a reputable insurer is crucial to ensure your policy remains affordable and reliable over the long term.

Strategies for Affordable Whole Life Insurance

Obtaining cheap whole life insurance is not solely dependent on external factors; it also involves making informed choices and taking proactive steps. Here are some strategies to consider:

Shop Around and Compare

Don’t settle for the first whole life insurance quote you receive. Shopping around and comparing policies from multiple insurers is essential to finding the best value. Each insurer has its own underwriting guidelines and rating systems, so rates can vary significantly. Use online tools and insurance brokers to gather quotes and assess the market thoroughly.

Consider Term Life Insurance

Term life insurance is often more affordable than whole life insurance, especially for younger individuals. It provides coverage for a specified period, typically 10, 20, or 30 years. If you have specific financial goals or needs that can be met within a defined term, term life insurance may be a more cost-effective option. You can always convert term life insurance to whole life insurance later if your circumstances change.

Optimize Your Health

Maintaining a healthy lifestyle can have a significant impact on the cost of your whole life insurance policy. Regular exercise, a balanced diet, and avoiding risky behaviors such as smoking or excessive alcohol consumption can improve your overall health and reduce the likelihood of health-related claims. By demonstrating a commitment to your well-being, you may qualify for lower premiums and better rates.

Choose a Suitable Face Value

The face value of your whole life insurance policy should align with your financial needs and goals. Overinsuring yourself can lead to unnecessary expenses. Assess your financial obligations, such as mortgage payments, outstanding debts, and dependents’ future needs, to determine an appropriate death benefit amount. Working with a financial advisor can help ensure you choose a face value that provides adequate coverage without incurring excessive costs.

Explore Group Policies

If you’re employed, consider group life insurance policies offered through your employer. These policies often come with reduced premiums due to the large pool of participants. While group policies may have lower face values and fewer customization options, they can be a cost-effective solution for basic financial protection.

Negotiate and Bundle

Don’t be afraid to negotiate with insurance providers. Discuss your budget and financial goals openly, and inquire about potential discounts or promotions. Many insurers offer bundle discounts when you combine multiple insurance policies, such as auto and home insurance with life insurance. Negotiating and bundling can lead to significant savings on your whole life insurance premiums.

Case Study: Affordable Whole Life Insurance for John

Let’s consider a hypothetical case study to illustrate how these strategies can be applied in practice. Meet John, a 35-year-old professional with a young family. John is seeking affordable whole life insurance to provide financial protection for his loved ones.

John starts by shopping around and comparing quotes from several reputable insurers. He discovers that his age and good health qualify him for competitive rates. He then explores term life insurance options and realizes that a 20-year term policy with a face value of $500,000 would meet his immediate financial needs at a significantly lower cost.

Recognizing the long-term benefits of whole life insurance, John decides to combine his term life policy with a whole life policy. He negotiates with his insurer to bundle the policies, resulting in a 10% discount on his whole life insurance premiums. Additionally, John optimizes his health by adopting a healthier lifestyle, which further reduces his premiums over time.

By following these strategies, John is able to secure affordable whole life insurance coverage that aligns with his financial goals and provides peace of mind for his family's future.

Conclusion: Affordable Protection for Your Loved Ones

Cheap whole life insurance is within reach for those who understand the factors influencing its cost and employ strategic approaches to obtaining coverage. By considering your age, health, policy design, premium payment options, and insurer rating, you can make informed decisions that align with your budget and financial goals.

Remember, whole life insurance is a long-term commitment, and finding the right balance between coverage and affordability is crucial. Don't hesitate to seek professional advice from financial advisors or insurance brokers to ensure you make the best choices for your unique circumstances.

With careful planning and the right strategies, you can secure affordable whole life insurance, providing the financial protection and peace of mind your loved ones deserve.

Can I get whole life insurance if I have pre-existing health conditions?

+Yes, it is possible to obtain whole life insurance with pre-existing health conditions. However, your premiums may be higher, and you may face more stringent underwriting requirements. It’s essential to be transparent about your health conditions during the application process to ensure you receive an accurate quote and suitable coverage.

How does the cash value of whole life insurance work?

+The cash value of whole life insurance is a tax-deferred savings component that accumulates over time. You can access this value through policy loans or withdrawals, providing a financial resource during your lifetime. The cash value grows based on the policy’s guaranteed interest rate and any dividends declared by the insurer.

What are the benefits of whole life insurance compared to term life insurance?

+Whole life insurance offers lifelong coverage and accumulates cash value, providing long-term financial protection and flexibility. Term life insurance, on the other hand, offers coverage for a specified period and typically has lower premiums. Whole life insurance is ideal for those seeking permanent coverage and cash value accumulation, while term life insurance may be more suitable for short-term financial needs.