Fl Auto Insurance

Navigating the complex world of automotive insurance can be a daunting task, especially when considering the unique requirements and regulations of each state. In this comprehensive guide, we will delve into the specifics of Florida auto insurance, offering expert insights and practical advice to help you make informed decisions.

Understanding Florida’s Auto Insurance Landscape

Florida, known for its vibrant culture and diverse landscapes, also presents a unique set of challenges when it comes to automotive insurance. With a high volume of traffic and a range of weather conditions, Florida residents and visitors require comprehensive coverage to protect themselves and their vehicles.

Florida operates under a no-fault insurance system, which means that regardless of who is at fault in an accident, each party's insurance provider is responsible for covering the costs of their respective policyholders' injuries and vehicle damages. This system aims to expedite the claims process and reduce litigation.

Mandatory Coverage Requirements

In Florida, all registered vehicles must carry a minimum level of insurance coverage to comply with state law. These requirements are designed to protect both the policyholder and other parties involved in an accident. The specific coverages and limits are as follows:

- Personal Injury Protection (PIP): This coverage is mandatory in Florida and pays for the medical expenses of the policyholder and their passengers, regardless of fault. The minimum required limit is $10,000 per person, but drivers can opt for higher limits.

- Property Damage Liability (PDL): PDL coverage is also mandatory and protects the policyholder against claims for damage caused to another person's property in an accident. The minimum required limit is $10,000 per accident.

While these are the basic requirements, it's important to note that Florida's no-fault system does not cover all damages. For instance, it does not provide compensation for pain and suffering, or for property damage above the PDL limit. To address these gaps, drivers can opt for additional coverage options, such as:

- Bodily Injury Liability (BI): BI coverage protects the policyholder if they are found at fault in an accident and the other party sustains injuries. It covers medical expenses, lost wages, and pain and suffering.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage is highly recommended in Florida, as it provides protection in the event of an accident with a driver who either lacks insurance or has insufficient coverage to compensate for the damages caused.

- Collision and Comprehensive Coverage: These coverages are optional but highly beneficial, as they protect the policyholder's vehicle in various scenarios, including accidents, theft, vandalism, and natural disasters.

Factors Influencing Insurance Rates

Like in any state, insurance rates in Florida are influenced by a variety of factors, including:

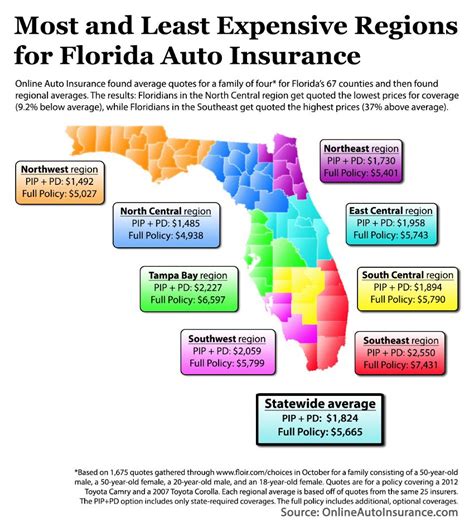

- Location: Insurance rates can vary significantly based on the specific city or region within Florida. Areas with higher populations and traffic congestion often have higher rates due to increased accident risks.

- Vehicle Type: The make, model, and year of the vehicle can impact insurance rates. Sports cars and luxury vehicles, for example, may have higher premiums due to their performance capabilities and repair costs.

- Driving Record: A clean driving record is crucial for obtaining lower insurance rates. Traffic violations, DUIs, and accidents can all lead to increased premiums, as they indicate a higher risk of future incidents.

- Age and Gender: Younger drivers, particularly those under 25, often face higher insurance rates due to their lack of driving experience. Gender can also play a role, with some insurers charging different rates based on statistical risk profiles.

- Credit Score: In Florida, insurers are allowed to use credit-based insurance scores when determining rates. A higher credit score may result in lower premiums, as it is seen as an indicator of financial responsibility.

It's important to note that Florida has a unique rating system known as the Insurance Services Office (ISO) rating, which assigns a risk classification to each zip code within the state. This classification takes into account factors such as traffic density, crime rates, and accident statistics. As a result, insurance rates can vary significantly even within the same city.

Comparing Insurance Providers in Florida

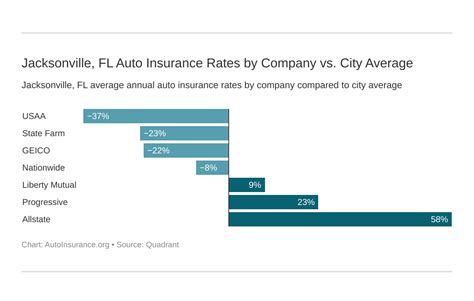

With numerous insurance providers operating in Florida, it can be challenging to choose the right one for your needs. Here’s a breakdown of some of the leading insurers in the state, along with their unique offerings and considerations:

State Farm

State Farm is one of the largest insurance providers in Florida, offering a comprehensive range of products, including auto, home, and life insurance. The company is known for its competitive rates and excellent customer service. State Farm provides a variety of discounts, such as those for safe driving, multiple policies, and accident-free records.

Geico

Geico, short for Government Employees Insurance Company, is another prominent insurer in Florida. It caters to a wide range of customers, including military personnel and government employees. Geico offers a user-friendly online platform for policy management and claims submission. The company provides discounts for safe driving, military affiliation, and vehicle safety features.

Progressive

Progressive is a well-known insurer that provides a wide array of insurance products, including auto, motorcycle, and RV insurance. The company is renowned for its innovative approaches, such as its Name Your Price tool, which allows customers to set their own coverage limits and premiums. Progressive also offers discounts for safe driving, multiple policies, and vehicle safety features.

Allstate

Allstate is a trusted insurer with a strong presence in Florida. The company offers a range of auto insurance products, including standard coverage and specialized plans for classic cars and motorcycles. Allstate provides a variety of discounts, such as those for safe driving, loyalty, and bundling with other Allstate policies.

USAA

USAA is a highly regarded insurer that caters exclusively to military personnel, veterans, and their families. The company offers comprehensive auto insurance coverage with a focus on military-friendly features, such as flexible payment options and discounts for deployment. USAA is known for its exceptional customer service and competitive rates.

When comparing insurance providers, it's essential to consider not only the rates and discounts offered but also the quality of service and the specific coverage options provided. Reading customer reviews and seeking recommendations from trusted sources can also be beneficial in making an informed decision.

Navigating the Claims Process

In the event of an accident or vehicle-related incident, understanding the claims process is crucial. Here’s a step-by-step guide to help you navigate this process effectively:

- Report the Accident: Immediately after an accident, ensure the safety of all involved parties. If necessary, call emergency services. Then, report the accident to the police and obtain a copy of the accident report.

- Notify Your Insurance Provider: Contact your insurance company as soon as possible to report the accident. Provide them with all relevant details, including the date, time, location, and any available evidence, such as photos or witness statements.

- File a Claim: Your insurance provider will guide you through the claims process. They may ask for additional information or documentation to support your claim. Be sure to cooperate fully and provide accurate details.

- Assess the Damage: An insurance adjuster will inspect the damage to your vehicle and determine the extent of the repairs needed. They will provide an estimate for the repairs and guide you through the repair process.

- Choose a Repair Shop: You have the right to choose the repair shop for your vehicle. Consider factors such as the shop's reputation, location, and the quality of their work when making your decision.

- Monitor the Repair Process: Stay in touch with the repair shop and your insurance provider during the repair process. Ensure that all repairs are completed to your satisfaction and that any additional issues are addressed promptly.

- Settlement and Payment: Once the repairs are completed and the insurance provider has approved the claim, you will receive a settlement for the damages. This settlement may include reimbursement for rental car expenses, if applicable.

It's important to note that the claims process can vary depending on the nature of the accident and the insurance provider. Always refer to your specific policy documents and reach out to your insurer with any questions or concerns.

Future Outlook and Industry Trends

The automotive insurance industry in Florida is constantly evolving, influenced by technological advancements, changing regulations, and shifting consumer preferences. Here are some key trends to watch for in the coming years:

- Telematics and Usage-Based Insurance (UBI): Telematics devices and UBI programs are gaining popularity in Florida. These technologies allow insurers to track driving behavior and offer personalized insurance rates based on factors like mileage, driving habits, and accident risk.

- Increased Focus on Customer Experience: Insurance providers are investing in digital platforms and customer service initiatives to enhance the overall customer experience. This includes streamlined claims processes, mobile apps for policy management, and personalized communication.

- Adoption of Artificial Intelligence (AI): AI is being utilized in various aspects of the insurance industry, from claims processing to risk assessment. Insurers are leveraging AI to improve efficiency, accuracy, and customer satisfaction.

- Emphasis on Risk Mitigation: With the increasing frequency and severity of natural disasters in Florida, insurers are placing a greater emphasis on risk mitigation strategies. This includes offering incentives for homeowners to implement hurricane-resistant features and providing resources for disaster preparedness.

- Collaborative Partnerships: Insurance providers are partnering with technology companies and startups to develop innovative solutions. These partnerships aim to enhance risk assessment, improve customer engagement, and provide more personalized insurance products.

Conclusion

Florida’s unique insurance landscape requires careful consideration and informed decision-making. By understanding the state’s specific requirements, comparing insurance providers, and staying up-to-date with industry trends, you can navigate the complex world of auto insurance with confidence. Remember, your choice of insurance provider and coverage options can have a significant impact on your financial security and peace of mind.

How often should I review my auto insurance policy in Florida?

+It is recommended to review your auto insurance policy annually or whenever you experience significant life changes, such as purchasing a new vehicle, moving to a different city, or getting married. Regular reviews ensure that your coverage remains adequate and aligned with your current needs.

What are some common discounts available for auto insurance in Florida?

+Florida insurers offer a variety of discounts, including safe driver discounts, multi-policy discounts (bundling auto insurance with home or life insurance), good student discounts, and discounts for completing defensive driving courses. Be sure to inquire about these discounts when shopping for insurance.

Can I switch insurance providers if I’m unhappy with my current coverage or rates?

+Absolutely! Florida has a competitive insurance market, and switching providers is a common practice. If you’re dissatisfied with your current coverage, rates, or customer service, you can shop around for a new insurer. Be sure to compare policies and rates carefully to ensure you’re getting the best value for your money.