Low Cost Business Insurance Quotes

Starting a business requires careful planning and consideration of various aspects, one of which is securing adequate insurance coverage. Insurance plays a vital role in protecting your business against potential risks and liabilities. However, finding affordable business insurance quotes can be a challenging task, especially for small and medium-sized enterprises with limited budgets. In this comprehensive guide, we will explore the world of low-cost business insurance, providing you with expert insights, strategies, and real-world examples to help you navigate the process and make informed decisions.

Understanding Business Insurance Needs

Every business is unique, and so are its insurance requirements. Before diving into the world of insurance quotes, it’s essential to understand the specific needs of your enterprise. Consider the following factors to determine the right coverage for your business:

Industry-Specific Risks

Different industries come with their own set of risks and liabilities. For instance, a construction business may face hazards related to heavy machinery and worker safety, while a tech startup might be more concerned about data breaches and cyberattacks. Identify the potential risks associated with your industry and tailor your insurance coverage accordingly.

Liability Protection

General liability insurance is a fundamental coverage for most businesses. It protects against third-party claims arising from accidents, property damage, or bodily injury. Whether it’s a customer slipping on a wet floor or a product defect causing harm, general liability insurance can provide a safety net for your business.

Property and Equipment Coverage

If your business owns physical assets such as offices, warehouses, or specialized equipment, property insurance is crucial. This coverage ensures that you can recover financially in case of fire, theft, or natural disasters. Additionally, consider business interruption insurance to cover lost income during periods when your operations are disrupted.

Professional Indemnity and Errors & Omissions

Professional services businesses, such as consultants, accountants, or legal firms, should consider professional indemnity insurance. This coverage protects against claims of negligence, errors, or omissions in the services provided. It’s an essential safeguard for businesses that rely on their expertise and advice.

Employee-Related Insurance

If you have employees, you may be required by law to provide workers’ compensation insurance. This coverage ensures that injured employees receive medical care and compensation for lost wages. Additionally, consider health insurance options for your workforce to promote a healthy and motivated team.

Strategies for Securing Low-Cost Business Insurance Quotes

Now that you have a clearer understanding of your insurance needs, let’s explore some expert strategies to obtain low-cost business insurance quotes:

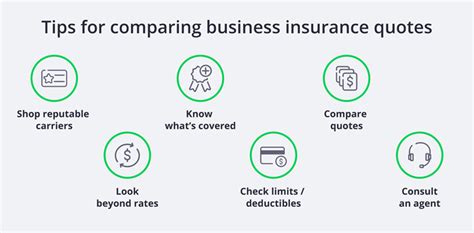

Shop Around and Compare

The insurance market is highly competitive, and prices can vary significantly between providers. Take the time to shop around and compare quotes from multiple insurers. Online platforms and insurance brokers can be valuable resources for obtaining multiple quotes quickly. Compare not only the premiums but also the coverage limits and exclusions to ensure you’re getting the best value.

Bundle Your Policies

Many insurance providers offer discounts when you bundle multiple policies with them. For instance, you might consider combining your business property insurance with general liability insurance. By doing so, you can often save money on your overall insurance costs. However, ensure that the bundled policies meet your specific needs and provide adequate coverage.

Increase Your Deductibles

Increasing your deductibles (the amount you pay out of pocket before insurance coverage kicks in) can significantly reduce your insurance premiums. While this strategy requires you to have a larger financial buffer in case of a claim, it can lead to substantial savings. Assess your business’s financial capabilities and determine the appropriate deductible amount that balances cost-effectiveness and risk.

Review Your Coverage Regularly

Business insurance needs can evolve over time as your enterprise grows and changes. Regularly review your coverage to ensure it remains relevant and adequate. As your business expands, you may need to adjust your insurance policies to reflect new assets, increased revenue, or changes in your operational processes.

Implement Risk Management Measures

Insurance providers often offer lower rates to businesses that demonstrate a commitment to risk management. Implement safety protocols, employee training programs, and other measures to mitigate potential risks. By proving your proactive approach to risk management, you may qualify for preferred rates and discounts.

Consider Small Business Insurance Programs

Many countries and regions have programs specifically designed to support small businesses in obtaining affordable insurance coverage. These programs may offer reduced premiums, simplified application processes, or access to specialized insurance products tailored to small enterprises. Research the options available in your jurisdiction and explore the benefits they provide.

Leverage Technology for Comparison and Convenience

In today’s digital age, numerous online platforms and apps have emerged to simplify the process of comparing insurance quotes. These tools allow you to input your business details and receive multiple quotes from various insurers in a matter of minutes. Additionally, many insurance providers now offer online applications and policy management, making the entire process more efficient and convenient.

Case Study: Low-Cost Business Insurance for a Small Retail Store

Let’s explore a real-world example to illustrate how a small business owner can navigate the process of obtaining low-cost business insurance quotes. Imagine Sarah, who recently opened a boutique clothing store in a bustling city center.

Sarah’s Insurance Journey

Sarah understands the importance of insurance for her business. She begins by identifying her key insurance needs, which include general liability to protect against customer accidents, property insurance for her retail space and inventory, and product liability insurance to cover potential issues with the clothing items she sells.

Sarah starts her quest for low-cost insurance quotes by utilizing online comparison platforms. She inputs her business details, including the nature of her store, its location, and the coverage she seeks. Within minutes, she receives multiple quotes from different insurers, allowing her to compare prices and coverage options.

Noticing that certain insurers offer bundled policies at discounted rates, Sarah decides to explore this option further. She contacts an insurance broker who specializes in small business insurance. The broker helps her understand the benefits of bundling general liability and property insurance, as well as the potential savings. With the broker's guidance, Sarah selects a comprehensive package that meets her needs while keeping costs affordable.

Additionally, Sarah takes the initiative to implement risk management measures in her store. She invests in security cameras, ensures proper lighting throughout the store, and trains her staff on safety protocols. By demonstrating her commitment to risk mitigation, Sarah qualifies for a preferred rate with her chosen insurer, further reducing her insurance costs.

Future Trends and Implications for Business Insurance

The world of business insurance is constantly evolving, driven by technological advancements, changing regulations, and emerging risks. Staying informed about these trends can help businesses make strategic decisions regarding their insurance coverage.

The Rise of Insurtech

Insurtech, a portmanteau of insurance and technology, refers to the use of innovative technologies to transform the insurance industry. Insurtech startups and established insurers are leveraging digital tools, artificial intelligence, and data analytics to streamline processes, enhance risk assessment, and offer personalized insurance solutions. As a result, businesses can expect more efficient quote comparisons, faster claim processing, and potentially lower premiums in the future.

Increased Focus on Cyber Insurance

With the rise of digital transformations and remote work, cyber threats have become a significant concern for businesses of all sizes. Cyber insurance, which provides coverage for data breaches, hacking incidents, and other cyber-related risks, is expected to gain prominence. As businesses increasingly rely on digital systems and data, having adequate cyber insurance coverage will become crucial to mitigate potential financial losses.

Environmental and Sustainability Considerations

Sustainability and environmental consciousness are growing trends across various industries, including insurance. Insurers are increasingly offering specialized coverage for businesses committed to sustainability initiatives. These policies may provide benefits such as reduced premiums for eco-friendly practices or coverage for potential liabilities arising from environmental impacts. As businesses embrace sustainability, insurance providers are likely to adapt their offerings accordingly.

Impact of Remote Work and Hybrid Models

The COVID-19 pandemic has accelerated the adoption of remote work and hybrid workplace models. As a result, businesses need to reconsider their insurance coverage to account for potential risks associated with remote operations. Insurers are developing new policies and endorsements to address these emerging risks, such as cyber insurance for remote employees and coverage for home offices. Businesses should stay updated on these developments to ensure their insurance remains relevant in a changing work environment.

Global Insurance Market Dynamics

The global insurance market is dynamic, with insurers entering and exiting markets, mergers and acquisitions, and changing regulatory landscapes. These dynamics can impact the availability and cost of insurance for businesses. Staying informed about global insurance trends and regional variations can help businesses make strategic decisions when it comes to their insurance needs.

Conclusion

Securing low-cost business insurance quotes requires a combination of careful planning, market research, and strategic decision-making. By understanding your unique insurance needs, implementing cost-saving strategies, and staying abreast of industry trends, you can navigate the insurance landscape effectively. Remember, insurance is an essential component of risk management for any business, and finding the right coverage at an affordable price is a crucial step toward long-term success and peace of mind.

How can I determine the right amount of insurance coverage for my business?

+Assessing your insurance needs accurately involves considering factors such as the value of your assets, potential liabilities, and the specific risks associated with your industry. It’s recommended to consult with an insurance professional who can guide you in determining the appropriate coverage limits for your business.

Are there any government programs or subsidies available for small businesses to access affordable insurance?

+Yes, many countries and regions offer programs and subsidies to support small businesses in obtaining insurance coverage. These initiatives often provide reduced premiums, simplified application processes, and access to specialized insurance products. Research the options available in your jurisdiction to take advantage of these benefits.

What are some common exclusions or limitations in business insurance policies that I should be aware of?

+Insurance policies typically come with exclusions and limitations. Common exclusions may include acts of war, nuclear incidents, intentional misconduct, and certain types of professional negligence. It’s essential to carefully review the policy documents to understand the exclusions and limitations applicable to your coverage.

How often should I review and update my business insurance policies?

+It’s recommended to review your business insurance policies annually or whenever significant changes occur in your business. These changes may include expansion into new markets, adding new products or services, hiring additional employees, or experiencing notable growth. Regular reviews ensure that your insurance coverage remains aligned with your evolving business needs.

Can I negotiate with insurance providers to obtain better rates or coverage terms?

+Absolutely! Negotiating with insurance providers is a common practice, especially for businesses with complex insurance needs or those seeking specialized coverage. By presenting a comprehensive understanding of your business and its risks, you can engage in constructive discussions with insurers to obtain favorable rates and coverage terms.