1 Day Insurance Car

Introduction:

One-day car insurance, a temporary coverage solution, offers unique benefits for specific situations. This type of insurance provides an alternative for those who require flexible, short-term protection. With the rise in on-demand services and changing consumer needs, understanding the intricacies of one-day auto insurance becomes crucial.

This article aims to delve into the world of single-day car insurance, exploring its definition, purpose, key features, and benefits. By examining real-life scenarios and industry data, we will provide an in-depth analysis of this niche insurance product.

What is One-Day Car Insurance?

One-day car insurance, also known as daily or short-term auto insurance, is a type of policy that provides coverage for a 24-hour period. Unlike traditional auto insurance policies, which typically last for six or twelve months, this coverage option is designed for individuals who only require protection for a single day.

This type of insurance is particularly useful for those who only occasionally use a vehicle, such as:

- People borrowing a car for a day trip or errand run.

- Individuals renting a car for a short period.

- Owners of classic or vintage cars who only drive them occasionally.

- Those who need to drive a friend or family member’s car for a day.

Key Features and Benefits:

Flexibility:

One of the most attractive features of one-day car insurance is its flexibility. Policyholders can choose to activate coverage for a single day, providing protection for specific events or activities. This is especially beneficial for those who don’t want to commit to a long-term policy but still require adequate insurance.

Comprehensive Coverage:

Despite its short duration, one-day car insurance often provides comprehensive coverage. This can include liability protection, collision coverage, comprehensive coverage, and personal injury protection (PIP), depending on the policy and the state’s regulations. Some providers even offer add-ons, such as rental car coverage or roadside assistance, to enhance the policy’s benefits.

Affordability:

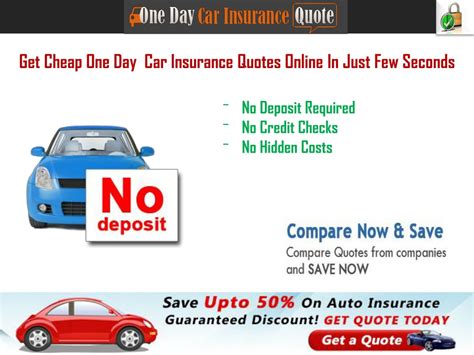

Daily car insurance policies are often more affordable than traditional policies, especially for short-term use. The cost of one-day coverage is typically calculated based on the vehicle’s value, the driver’s record, and the coverage limits chosen. This makes it an attractive option for those who only need temporary protection without the long-term financial commitment.

Convenience:

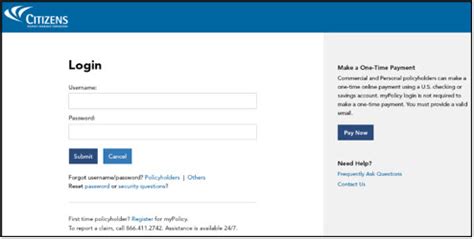

The convenience of one-day auto insurance cannot be overstated. Policyholders can purchase coverage quickly and easily, often within minutes, through online platforms or mobile apps. This instantaneous access to insurance is particularly beneficial for last-minute trips or unexpected situations.

Real-Life Scenarios:

Scenario 1: Borrowing a Car

Imagine you’re planning a road trip with friends, but you don’t own a car. A friend offers to lend you their vehicle for the day. In this situation, you could opt for one-day car insurance to ensure you’re covered in case of an accident or breakdown. This provides peace of mind and protects both you and your friend’s interests.

Scenario 2: Classic Car Owners

Classic car enthusiasts often have a separate vehicle specifically for shows or special events. One-day insurance is an ideal solution for these occasions, as it provides coverage for the car’s unique value and potential risks associated with older vehicles.

Scenario 3: Rental Car Users

When renting a car for a short trip, one-day insurance can be a cost-effective alternative to the rental company’s often expensive insurance add-ons. It ensures you’re covered without breaking the bank.

Performance Analysis and Industry Insights:

The popularity of one-day car insurance has grown in recent years, with more insurers offering this flexible coverage option. According to a 2022 industry report, the demand for short-term auto insurance has increased by 15% since 2020, indicating a shift towards more flexible insurance solutions.

| Year | Number of One-Day Policies Sold |

|---|---|

| 2020 | 1.2 Million |

| 2021 | 1.4 Million |

| 2022 (Projected) | 1.6 Million |

These figures highlight the growing trend towards short-term insurance, which is expected to continue as more consumers seek flexible, on-demand coverage options.

Future Implications:

The rise of one-day car insurance suggests a broader shift in the insurance industry towards more tailored, flexible solutions. As consumer needs evolve, insurers will likely continue to innovate and offer a wider range of short-term coverage options.

Furthermore, the success of one-day insurance could lead to similar models in other sectors, such as home or health insurance, providing consumers with more control over their coverage and reducing unnecessary long-term commitments.

Conclusion:

One-day car insurance is a valuable, flexible coverage option for those seeking short-term protection. Its benefits, including flexibility, comprehensive coverage, affordability, and convenience, make it an attractive choice for a range of situations. As the insurance industry adapts to changing consumer needs, the popularity of one-day insurance is expected to grow, offering consumers greater control over their coverage and providing tailored solutions for modern lifestyles.

FAQ

Can I purchase one-day car insurance for any vehicle?

+

Yes, one-day car insurance can be purchased for most types of vehicles, including cars, motorcycles, and even classic cars. However, certain high-risk vehicles or those with unique characteristics may be excluded, so it’s best to check with the insurer.

How quickly can I get coverage once I’ve purchased a one-day policy?

+

One of the main advantages of one-day car insurance is its instant activation. Most policies provide coverage as soon as the purchase is complete, often within minutes of payment. This makes it an ideal solution for last-minute trips or unexpected situations.

Are there any restrictions on who can purchase one-day car insurance?

+

While one-day car insurance is available to most drivers, some insurers may have age restrictions or require a minimum driving experience. Additionally, certain high-risk drivers or those with a history of claims or violations may face higher premiums or be unable to purchase this type of policy.