Progressive Home Owner Insurance

In the realm of home insurance, the concept of progressiveness has taken on new meaning with the emergence of innovative coverage options that go beyond traditional policies. This evolution in the insurance industry is reshaping the way homeowners protect their most valuable assets, offering a more tailored and comprehensive approach to risk management. Progressive Home Owner Insurance is at the forefront of this transformation, providing an array of benefits and features that set a new standard in the market.

Understanding Progressive Home Owner Insurance

Progressive Home Owner Insurance is a comprehensive insurance solution designed to protect homeowners from a wide range of potential risks. It is an innovative product that offers more than just basic coverage, providing a personalized approach to ensure your home and its contents are adequately safeguarded. The policy encompasses various elements, including:

- Dwelling Coverage: This aspect of the policy covers the physical structure of your home, including the walls, roof, and other permanent fixtures. It ensures that in the event of a covered loss, such as fire, storm damage, or vandalism, the costs to repair or rebuild your home are covered.

- Personal Property Coverage: Progressive's policy extends to the contents of your home, from furniture and electronics to clothing and personal belongings. In the unfortunate event of a loss, this coverage helps replace or repair these items.

- Liability Protection: A critical component of any home insurance policy, liability protection safeguards homeowners from financial losses arising from accidents or injuries that occur on their property. This coverage can protect you from costly legal battles and medical expenses.

- Additional Living Expenses: In the event that your home becomes uninhabitable due to a covered loss, this coverage helps cover the additional costs of temporary housing and other living expenses until your home is repaired or rebuilt.

- Optional Coverages: Progressive offers a range of optional coverages to tailor the policy to your specific needs. These can include coverage for high-value items, identity theft protection, and even pet injury coverage.

Key Features and Benefits

Progressive Home Owner Insurance stands out for its innovative features and benefits that set it apart from traditional home insurance policies. Here are some of the key advantages:

Flexible Coverage Options

One of the most notable features of Progressive’s home insurance is its flexibility. Homeowners can choose from a range of coverage options to create a policy that suits their unique needs and budget. Whether you require extensive coverage for a high-value home or a more basic policy for a starter home, Progressive offers customizable solutions.

Discounts and Savings

Progressive is known for its commitment to helping customers save. They offer a variety of discounts, including multi-policy discounts (for customers who bundle their home and auto insurance), loyalty discounts for long-term customers, and safety discounts for homes equipped with certain safety features like fire alarms and burglar alarms.

| Discount Category | Discount Description |

|---|---|

| Multi-Policy | Save by bundling your home and auto insurance policies with Progressive. |

| Loyalty | Enjoy discounts for being a long-term, loyal customer. |

| Safety | Homes with certain safety features qualify for reduced rates. |

Claim Satisfaction Guarantee

Progressive understands that dealing with a claim can be a stressful experience. To ensure customer satisfaction, they offer a unique claim satisfaction guarantee. If a customer is not satisfied with the claim settlement, Progressive will work with them to resolve the issue. This guarantee demonstrates the company’s commitment to customer service and ensures homeowners have peace of mind when it comes to their claims.

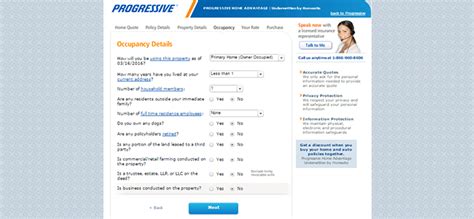

Digital Tools and Resources

Progressive leverages technology to enhance the customer experience. Their website and mobile app provide easy access to policy information, billing, and claims management. Additionally, they offer a range of digital tools, such as the HomeQuote Explorer, which allows customers to get an instant home insurance quote and compare coverages and prices.

Performance and Customer Satisfaction

Progressive Home Owner Insurance has consistently demonstrated strong performance in the market, earning high marks for customer satisfaction and financial stability. Independent rating agencies, such as J.D. Power and AM Best, regularly assess Progressive’s home insurance offerings, highlighting the company’s commitment to excellence.

J.D. Power Ratings

J.D. Power, a leading consumer insights and analytics company, has awarded Progressive with top ratings for overall customer satisfaction in home insurance. Their studies take into account various factors, including policy offerings, billing process, policy information, and claims handling.

| Rating Category | J.D. Power Rating |

|---|---|

| Overall Customer Satisfaction | 4.5/5 |

| Policy Offerings | 4.7/5 |

| Billing Process | 4.4/5 |

| Policy Information | 4.6/5 |

| Claims Handling | 4.3/5 |

AM Best Financial Strength Rating

AM Best, a global credit rating agency, assesses the financial strength and creditworthiness of insurance companies. Progressive has consistently earned an A (Excellent) rating from AM Best, indicating its strong financial position and ability to meet its ongoing insurance obligations.

Future Outlook and Innovations

As the insurance landscape continues to evolve, Progressive remains committed to innovation. The company is constantly exploring new technologies and strategies to enhance the customer experience and improve risk management. Here are some insights into Progressive’s future outlook and potential innovations:

Artificial Intelligence and Data Analytics

Progressive is leveraging artificial intelligence (AI) and data analytics to improve risk assessment and pricing. By analyzing vast amounts of data, they can more accurately predict potential risks and offer personalized coverage options. This technology also enhances the efficiency of the claims process, allowing for faster and more accurate settlements.

Smart Home Integration

The integration of smart home technology is another area of focus for Progressive. By partnering with smart home device manufacturers, they aim to offer discounts and incentives for homeowners who utilize these technologies. Smart home devices, such as security systems and fire detection systems, can help prevent losses and provide real-time data to insurers, leading to more accurate risk assessments.

Sustainable and Green Initiatives

Progressive is also exploring ways to support sustainable and green initiatives. This includes offering incentives for homeowners who take steps to make their homes more energy-efficient and environmentally friendly. By encouraging these practices, Progressive aims to reduce the environmental impact of homes and promote a more sustainable future.

Conclusion

Progressive Home Owner Insurance offers a modern, comprehensive, and flexible approach to home insurance. With a range of coverage options, competitive pricing, and a commitment to customer satisfaction, it is an attractive choice for homeowners. As the insurance industry continues to evolve, Progressive is well-positioned to lead with its innovative strategies and dedication to meeting the evolving needs of its customers.

What types of homes does Progressive Home Owner Insurance cover?

+Progressive’s home insurance policy covers a wide range of residential properties, including single-family homes, condominiums, townhouses, and even mobile homes. The policy can be tailored to suit the specific needs of each property type.

Does Progressive offer flood insurance as part of its home insurance policy?

+No, Progressive does not include flood insurance in its standard home insurance policy. However, they can refer customers to the National Flood Insurance Program (NFIP) or private flood insurance providers to ensure comprehensive coverage.

How can I get a quote for Progressive Home Owner Insurance?

+You can easily get a quote for Progressive’s home insurance by visiting their website and using their online quote tool. Alternatively, you can call their customer service team or reach out to a local Progressive agent for a personalized quote.