State Farm Insurance Companies

In the realm of insurance, few names carry as much weight as State Farm. With a rich history spanning decades, State Farm Insurance Companies have established themselves as a prominent force in the industry, offering a comprehensive range of insurance services to individuals and businesses alike. This article aims to delve deep into the world of State Farm, exploring its origins, growth, and the diverse array of services it provides, while also shedding light on its impact and future prospects.

A Legacy of Trust: The Evolution of State Farm

State Farm’s journey began in 1922 when founder George J. Mecherle, a former farmer and insurance salesman, recognized the need for affordable auto insurance for farmers and rural motorists. His innovative idea to sell auto insurance directly to policyholders, bypassing the traditional agency system, laid the foundation for State Farm’s success. Mecherle’s vision was simple yet powerful: to provide quality insurance protection at competitive rates.

Over the years, State Farm expanded its offerings to include a wide range of insurance products, catering to the evolving needs of its customers. From auto insurance, its flagship service, to home, life, health, and business insurance, State Farm became a one-stop solution for all insurance-related needs. The company's commitment to customer satisfaction and its focus on building long-lasting relationships have been instrumental in its growth and success.

Diverse Insurance Solutions for Every Need

State Farm’s product portfolio is incredibly diverse, reflecting its comprehensive approach to insurance. Let’s explore some of its key offerings:

Auto Insurance

State Farm’s auto insurance is tailored to meet the unique needs of its customers. With a range of coverage options, including liability, collision, comprehensive, and personal injury protection, policyholders can customize their plans to fit their specific requirements. The company also offers discounts for safe driving, multiple vehicles, and accident-free records, making its auto insurance plans even more attractive.

| Coverage Type | Description |

|---|---|

| Liability | Covers bodily injury and property damage caused by the policyholder. |

| Collision | Pays for damages to the insured vehicle in the event of an accident, regardless of fault. |

| Comprehensive | Covers damages caused by non-collision incidents like theft, vandalism, or natural disasters. |

| Personal Injury Protection (PIP) | Provides coverage for medical expenses, lost wages, and other related costs incurred due to an accident. |

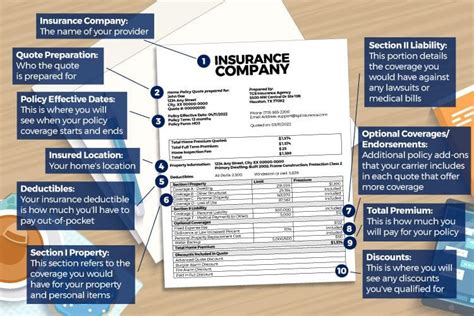

Home Insurance

State Farm’s home insurance policies offer protection for homeowners and renters alike. These policies cover a wide range of risks, including fire, theft, vandalism, and natural disasters. Policyholders can choose from various coverage options, such as replacement cost coverage, which ensures that they receive enough money to rebuild their home in the event of a total loss.

Life Insurance

State Farm provides life insurance solutions to help families and individuals protect their loved ones’ financial future. Its life insurance policies offer flexible terms, allowing policyholders to choose the coverage amount and term length that best suits their needs. Whether it’s term life insurance for temporary coverage or permanent life insurance for lifelong protection, State Farm has options to meet diverse requirements.

Health Insurance

In today’s healthcare landscape, having reliable health insurance is crucial. State Farm offers a variety of health insurance plans, including individual and family policies, as well as group health insurance for businesses. These plans cover essential health services, prescription medications, and often include additional benefits like vision and dental coverage.

Business Insurance

State Farm understands the unique risks faced by businesses, which is why it provides a comprehensive range of business insurance solutions. From general liability insurance to protect against third-party claims to property insurance for physical assets, State Farm ensures that businesses are adequately protected. Additionally, the company offers business interruption insurance to help cover losses during unexpected downtimes.

Industry Leadership and Impact

State Farm’s influence extends far beyond its insurance offerings. The company has been a pioneer in several areas, driving industry-wide changes and setting new standards.

Innovation and Technology

State Farm has embraced technology to enhance its services and improve the customer experience. Its digital platforms, including the State Farm Mobile app, allow policyholders to manage their policies, file claims, and access important documents with ease. The company has also invested in artificial intelligence and machine learning to streamline processes and provide more accurate risk assessments.

Community Engagement

State Farm is deeply committed to giving back to the communities it serves. Through various initiatives and partnerships, the company supports education, safety, and disaster relief efforts. Its Neighborhood of Good® program, for instance, empowers employees and agents to make a positive impact in their local communities.

Financial Strength and Stability

State Farm’s financial strength is a testament to its success and reliability. With a strong capital base and a track record of prudent financial management, the company has consistently maintained an excellent credit rating. This financial stability ensures that policyholders can rely on State Farm to deliver on its promises, even in challenging economic times.

The Future of State Farm

As the insurance landscape continues to evolve, State Farm remains focused on adapting and innovating. The company is investing in data analytics and predictive modeling to enhance its risk assessment capabilities and develop more tailored insurance products. Additionally, State Farm is exploring partnerships and collaborations to expand its reach and offer even more comprehensive solutions to its customers.

In conclusion, State Farm Insurance Companies have established themselves as a trusted partner for individuals and businesses seeking comprehensive insurance solutions. With a rich history, a diverse range of products, and a commitment to innovation and community engagement, State Farm is well-positioned to continue its legacy of providing quality protection and service for years to come.

What sets State Farm apart from other insurance companies?

+State Farm’s direct-to-consumer business model, focus on customer relationships, and commitment to innovation and community engagement set it apart. Its diverse range of insurance products and financial stability also contribute to its reputation as a trusted insurance provider.

How does State Farm ensure customer satisfaction?

+State Farm prioritizes customer satisfaction through its personalized approach, offering customized insurance solutions and excellent customer service. Its digital platforms and mobile app also enhance the customer experience by providing easy access to policy management and claims filing.

What is State Farm’s approach to risk assessment and management?

+State Farm utilizes advanced technology, including AI and machine learning, to assess and manage risks accurately. This allows the company to offer tailored insurance solutions and ensure that its policyholders receive the coverage they need at competitive rates.