How Much To Insure A Car

Car insurance is a crucial aspect of vehicle ownership, offering financial protection and peace of mind to drivers. The cost of insuring a car can vary significantly based on numerous factors, making it essential to understand the key elements that influence insurance premiums. In this comprehensive guide, we will delve into the world of car insurance, exploring the factors that impact rates, providing real-world examples, and offering insights to help you navigate the process of obtaining affordable coverage.

Understanding the Cost of Car Insurance

The expense of insuring a car is influenced by a myriad of factors, each playing a role in determining the overall premium. From the type of vehicle you drive to your personal driving history, every detail matters when it comes to car insurance costs. Let’s explore these factors and their impact on insurance rates.

Vehicle Factors

The type of car you drive is a significant determinant of your insurance premium. High-performance vehicles and luxury cars often come with higher insurance costs due to their value and the potential for increased repair expenses. Conversely, economical cars and standard sedans tend to be more affordable to insure.

| Vehicle Type | Average Annual Insurance Premium |

|---|---|

| Sports Car | $2,500 - $3,000 |

| SUV | $1,800 - $2,200 |

| Sedan | $1,500 - $1,800 |

| Hatchback | $1,400 - $1,600 |

Furthermore, the age and condition of your vehicle can also impact insurance costs. Older cars may be more affordable to insure, as they typically have lower replacement and repair costs. However, if your vehicle has unique features or modifications, insurance rates could increase.

Driver Factors

Your personal driving history and demographics are crucial factors in determining insurance rates. Insurance providers carefully assess your risk profile, considering elements such as age, gender, driving experience, and claim history.

Young drivers, particularly those under the age of 25, often face higher insurance premiums due to their limited driving experience and increased risk of accidents. Similarly, drivers with a history of accidents or traffic violations may also encounter higher insurance costs. Maintaining a clean driving record is essential for keeping insurance rates affordable.

| Driver Profile | Average Annual Insurance Premium |

|---|---|

| Male, Age 22, 2 Years Experience | $2,200 - $2,500 |

| Female, Age 35, 10 Years Experience | $1,600 - $1,800 |

| Male, Age 50, 25 Years Experience | $1,400 - $1,600 |

Additionally, the location where you primarily drive and store your vehicle can affect insurance rates. Areas with higher crime rates or a history of frequent accidents may result in increased insurance premiums. It's essential to consider these factors when assessing the overall cost of insuring your car.

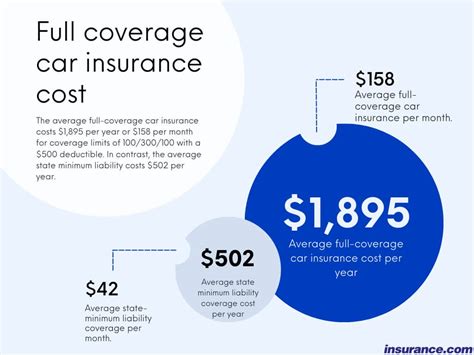

Coverage and Deductible

The level of coverage you choose for your car insurance policy plays a significant role in determining your premium. Comprehensive coverage, which includes protection against theft, vandalism, and natural disasters, typically costs more than basic liability coverage. However, the added peace of mind and financial protection may be worth the additional expense for some drivers.

Furthermore, the deductible you select can also impact your insurance costs. A higher deductible means you'll pay more out of pocket in the event of a claim, but it can result in lower monthly premiums. It's essential to find a balance between affordability and adequate coverage when choosing your deductible.

| Coverage Type | Average Annual Premium |

|---|---|

| Comprehensive | $1,800 - $2,200 |

| Liability Only | $1,200 - $1,500 |

| Collision | $1,500 - $1,800 |

Additional Factors

Beyond the primary factors mentioned above, several other elements can influence car insurance costs. These include:

- Credit Score: Insurance providers often consider your credit score when determining rates, as it can indicate your financial responsibility.

- Marital Status: Some insurers offer discounts to married couples, believing they are less likely to be involved in accidents.

- Occupational Discounts: Certain professions may qualify for insurance discounts, such as teachers or military personnel.

- Bundling Policies: Combining your car insurance with other policies, like home insurance, can sometimes result in lower overall costs.

Strategies for Affordable Car Insurance

While the cost of insuring a car can vary widely, there are strategies you can employ to keep your insurance premiums as low as possible. Here are some tips to help you find affordable car insurance coverage:

Shop Around and Compare

One of the most effective ways to save on car insurance is to compare quotes from multiple providers. Insurance rates can vary significantly between companies, so taking the time to shop around can pay off. Use online quote comparison tools or reach out to different insurers to get a sense of the market and find the best deal for your specific situation.

Review Your Coverage

Regularly reviewing your car insurance coverage is essential to ensure you’re not overpaying. Assess your current policy and make sure the coverage aligns with your needs. If your circumstances have changed, such as acquiring a new vehicle or moving to a different location, update your policy accordingly. Additionally, evaluate your deductible to find a balance between affordability and adequate protection.

Improve Your Driving Record

Your driving record is a significant factor in determining insurance rates. Maintaining a clean driving record can lead to lower premiums. Avoid traffic violations and work on improving your driving skills to reduce the risk of accidents. Remember, a safe driver is often rewarded with more affordable insurance.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative approach to car insurance that considers your actual driving behavior. Providers offer discounts to drivers who exhibit safe driving habits, such as avoiding hard braking or excessive speeding. By embracing this type of insurance, you can potentially lower your premiums if you’re a cautious and mindful driver.

Explore Discounts and Savings

Insurance companies often provide a range of discounts to policyholders. Take advantage of any applicable discounts, such as those for good students, safe drivers, or vehicle safety features. Additionally, inquire about loyalty discounts if you’ve been with the same insurer for an extended period. Every discount can contribute to significant savings on your insurance premiums.

Maintain a Good Credit Score

Your credit score is an important factor in determining insurance rates. A strong credit score can lead to lower premiums, as it indicates financial responsibility. If you have a low credit score, consider taking steps to improve it, such as paying bills on time and reducing debt. A better credit score can result in more affordable car insurance.

Conclusion

Insuring your car is a necessary expense, but understanding the factors that influence insurance rates can help you make informed decisions and potentially save money. By considering the vehicle you drive, your personal driving history, coverage choices, and additional factors, you can tailor your insurance policy to fit your needs and budget. Remember to shop around, review your coverage regularly, and explore strategies to lower your premiums.

With the right approach and a careful consideration of your options, you can find affordable car insurance that provides the protection you need without breaking the bank. Stay informed, stay safe on the roads, and enjoy the peace of mind that comes with adequate insurance coverage.

How often should I review my car insurance policy?

+It’s a good practice to review your car insurance policy annually or whenever your circumstances change significantly. This ensures that your coverage remains adequate and that you’re not overpaying for unnecessary features.

Can I get car insurance if I have a poor driving record?

+Yes, you can still obtain car insurance with a poor driving record, but it may come at a higher cost. Insurance providers may offer specialized policies for high-risk drivers, so it’s worth exploring your options with different insurers.

Are there any ways to lower my insurance premiums without sacrificing coverage?

+Absolutely! Exploring usage-based insurance, taking advantage of applicable discounts, and maintaining a good credit score are all strategies to lower your premiums without compromising on essential coverage.

What factors influence the cost of car insurance the most?

+The cost of car insurance is primarily influenced by your driving history, the type of vehicle you drive, and the level of coverage you choose. These factors can significantly impact your insurance premiums.