Low Price Auto Insurance

Securing affordable auto insurance is a crucial financial decision for any vehicle owner. In today's market, numerous factors influence the cost of insurance, from the make and model of your car to your driving history and location. This comprehensive guide will delve into the strategies and insights that can help you navigate the complex world of auto insurance, ultimately enabling you to find the best coverage at the most competitive rates.

Understanding the Factors that Affect Auto Insurance Rates

The price of auto insurance is determined by a myriad of factors, each playing a significant role in assessing the risk associated with insuring a particular driver. These factors can be broadly categorized into three main groups: personal, vehicle-related, and environmental.

Personal Factors

Your personal details, such as age, gender, marital status, and driving history, are key considerations for insurance providers. Young drivers, especially males under the age of 25, are often seen as higher-risk due to their propensity for more frequent and severe accidents. Similarly, a history of at-fault accidents or traffic violations can significantly increase your insurance premiums.

On the other hand, certain personal attributes can work in your favor. Being married often results in lower insurance rates, as married couples are statistically involved in fewer accidents. Additionally, completing a defensive driving course or having a clean driving record for an extended period can lead to substantial discounts.

| Personal Factor | Impact on Rates |

|---|---|

| Age | Younger drivers often pay more due to higher risk. |

| Gender | Males tend to have higher premiums, especially at younger ages. |

| Marital Status | Married individuals may enjoy lower rates. |

| Driving History | Clean records lead to discounts; at-fault accidents increase costs. |

Vehicle-Related Factors

The type of vehicle you drive and its usage significantly impact your insurance rates. Sports cars and luxury vehicles generally attract higher premiums due to their higher repair costs and tendency for speed-related accidents. Conversely, family sedans and compact cars are often associated with lower insurance costs.

The frequency and purpose of your driving also matter. If you drive long distances or commute to work daily, your insurance premiums are likely to be higher than those who use their vehicles less frequently or for shorter trips. This is because the more you drive, the higher the chances of being involved in an accident.

| Vehicle Factor | Impact on Rates |

|---|---|

| Vehicle Type | Sports and luxury cars often cost more to insure. |

| Usage | Frequent or long-distance driving can increase premiums. |

| Safety Features | Cars with advanced safety systems may qualify for discounts. |

Environmental Factors

The location where you reside and drive plays a pivotal role in determining your insurance rates. Urban areas often have higher insurance costs due to the increased likelihood of accidents and car theft. Conversely, rural areas may offer more affordable rates due to lower traffic density and reduced crime rates.

The climate and weather conditions of your region can also influence insurance rates. Areas prone to extreme weather events, such as hurricanes or heavy snowfall, may see higher insurance costs due to the increased risk of weather-related accidents.

Strategies to Lower Your Auto Insurance Costs

While the factors mentioned above are largely out of your control, there are several strategies you can employ to lower your auto insurance costs and secure the best possible rates.

Shop Around and Compare Quotes

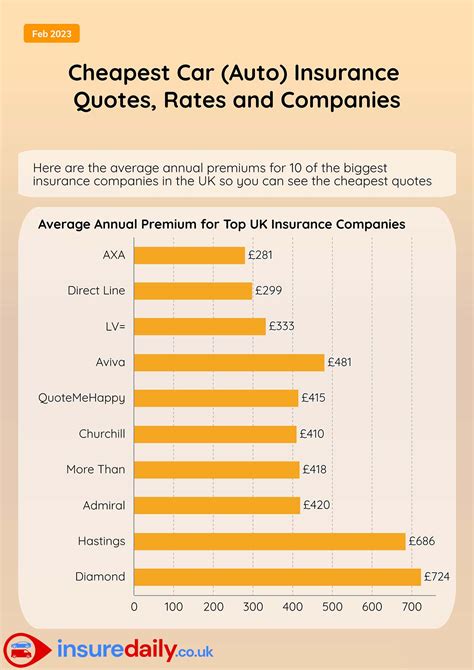

The auto insurance market is highly competitive, with numerous providers offering a wide range of policies and rates. By shopping around and comparing quotes from different insurers, you can identify the best value for your specific circumstances. Online comparison tools can be particularly useful for quickly gathering multiple quotes.

Remember, insurance companies often specialize in certain types of coverage or cater to specific demographics. By understanding your unique needs and shopping with that in mind, you can find providers that offer the best rates for your situation.

Increase Your Deductible

The deductible is the amount you pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you can significantly reduce your insurance premiums. This strategy works best for those with sufficient savings to cover the higher deductible in the event of an accident. It’s a trade-off between immediate savings on your insurance premiums and the potential for a larger out-of-pocket expense in the event of a claim.

Bundle Your Policies

If you have multiple insurance needs, such as auto, home, or renters insurance, consider bundling these policies with the same provider. Insurance companies often offer significant discounts to customers who purchase multiple policies, as it simplifies their administrative processes and reduces the risk of policy cancellations. This strategy can lead to substantial savings on your overall insurance costs.

Maintain a Good Driving Record

Your driving history is a critical factor in determining your insurance rates. By maintaining a clean driving record, you can qualify for substantial discounts on your auto insurance. This means avoiding at-fault accidents and traffic violations, as well as completing defensive driving courses, which can often lead to reduced premiums.

Take Advantage of Discounts

Insurance providers offer a variety of discounts to attract and retain customers. These discounts can be based on factors such as your occupation, educational background, or even your membership in certain organizations. It’s worth exploring these discounts to see if you qualify for any, as they can lead to significant savings on your insurance premiums. Some common discounts include:

- Good Student Discount: Offered to students with a certain GPA or higher.

- Senior Discount: Targeted at older drivers, often over the age of 55.

- Loyalty Discount: Rewarding long-term customers for their continued patronage.

- Occupational Discount: Given to individuals in certain professions, like teachers or military personnel.

The Impact of Coverage Options on Insurance Costs

The level of coverage you choose directly influences the cost of your auto insurance. While comprehensive coverage provides the most protection, it also comes with the highest premiums. On the other hand, basic liability coverage is typically the most affordable option but offers limited protection.

Comprehensive vs. Liability Coverage

Comprehensive coverage, also known as full coverage, is the most extensive type of auto insurance. It includes liability coverage, which protects you if you cause an accident, as well as coverage for damage to your own vehicle, regardless of fault. This can include damage from accidents, theft, vandalism, or natural disasters.

While comprehensive coverage offers the highest level of protection, it also comes with the highest premiums. If you have an older vehicle or one with a low resale value, comprehensive coverage may not be cost-effective. In such cases, liability-only coverage, which is the minimum required by law in most states, may be a more suitable and affordable option.

| Coverage Type | Description | Premium Cost |

|---|---|---|

| Comprehensive | Covers a wide range of incidents, including accidents, theft, and natural disasters. | Highest |

| Liability-Only | Provides coverage if you cause an accident but does not cover damage to your own vehicle. | Lowest |

| Collision | Covers damage to your vehicle caused by an accident, regardless of fault. | Mid-range |

Additional Coverage Options

Beyond comprehensive and liability coverage, there are several additional coverage options you can choose to enhance your protection. These include:

- Collision Coverage: Covers damage to your vehicle caused by an accident, regardless of fault. While it doesn't cover incidents like theft or natural disasters, it's a valuable addition for drivers who want peace of mind.

- Uninsured/Underinsured Motorist Coverage: Protects you if you're involved in an accident with a driver who doesn't have insurance or doesn't have enough insurance to cover the damages. This coverage is particularly important, as it ensures you're not left paying for damages caused by another driver's negligence.

- Personal Injury Protection (PIP) or Medical Payments Coverage: Provides coverage for medical expenses, lost wages, and other related costs if you or your passengers are injured in an accident, regardless of fault. This coverage is vital for ensuring you receive the necessary medical care without incurring significant out-of-pocket expenses.

Future Implications and Industry Trends

The auto insurance industry is undergoing significant transformations due to advancements in technology and changing consumer preferences. These trends are expected to shape the future of auto insurance, potentially impacting the cost and availability of coverage.

Telematics and Usage-Based Insurance

Telematics refers to the use of technology to track and analyze driving behavior. With the advent of connected cars and smartphones, insurance companies can now offer usage-based insurance policies that tailor premiums based on individual driving habits. These policies often use telematics devices or smartphone apps to monitor factors such as miles driven, driving speed, and braking patterns.

Usage-based insurance can benefit safe drivers by offering lower premiums, as their data demonstrates a reduced risk of accidents. However, it may also lead to higher costs for those with riskier driving habits. This trend is expected to continue growing, as more insurers adopt telematics technology to offer personalized insurance plans.

Autonomous Vehicles and Safety Innovations

The rise of autonomous vehicles and advanced driver-assistance systems (ADAS) is expected to significantly impact the auto insurance industry. As these technologies become more prevalent, they are likely to reduce the number of accidents caused by human error, leading to lower insurance claims and potentially lower premiums.

However, the transition to autonomous vehicles may also present new challenges for insurers. The responsibility for accidents could shift from drivers to vehicle manufacturers or software developers, leading to complex liability issues. Insurers will need to adapt their policies and pricing models to accommodate these changes and ensure they remain competitive in the market.

Climate Change and Extreme Weather Events

Climate change is expected to lead to an increase in extreme weather events, such as hurricanes, floods, and wildfires. These events can cause significant damage to vehicles and infrastructure, leading to higher insurance claims and potentially driving up insurance premiums. Insurers will need to carefully assess and manage their exposure to these risks to maintain affordability and sustainability.

What is the average cost of auto insurance in the US?

+The average cost of auto insurance in the US varies greatly depending on factors like location, driving history, and the type of vehicle insured. As of 2022, the national average cost for a full coverage policy is around 1,674 per year, or about 140 per month. However, prices can range from as low as 500 to over 3,000 per year, depending on individual circumstances.

How can I get cheap auto insurance with a bad driving record?

+Getting cheap auto insurance with a bad driving record can be challenging, but it’s not impossible. Some strategies include shopping around for quotes from multiple insurers, considering usage-based insurance policies that reward safe driving, and opting for higher deductibles to reduce premiums. You can also try to improve your driving record by taking defensive driving courses, which may lead to discounts.

Are there any ways to get auto insurance without a car?

+Yes, it is possible to get auto insurance without owning a car. Non-owner car insurance policies provide liability coverage for individuals who occasionally borrow or rent vehicles. These policies can be useful for people who primarily use public transportation but occasionally need to drive, or for those who are in the process of purchasing a car and want coverage during the transition period.