Car Insurance Low

In the ever-evolving landscape of personal finance and insurance, finding ways to reduce expenses is a priority for many individuals. Among the various costs that individuals face, car insurance often stands out as a significant expense. The quest for more affordable coverage has led to a growing interest in strategies to lower car insurance premiums. This article aims to delve into the world of car insurance, exploring effective strategies, real-world examples, and expert insights to help you navigate the path to lower insurance costs.

Understanding Car Insurance Costs

Car insurance costs are influenced by a multitude of factors, including individual risk profiles, the type of vehicle insured, and the specific coverage options chosen. These factors collectively determine the premium an insurer charges. Understanding these elements is crucial to developing an effective strategy to reduce insurance costs.

Risk Assessment and Premiums

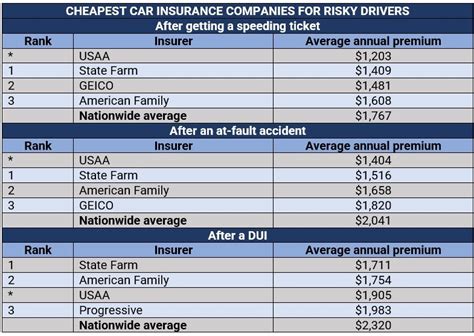

Insurance companies assess risk to determine the likelihood of an insured individual filing a claim. Factors such as age, driving record, and location play a significant role in this assessment. For instance, younger drivers, especially those under 25, are often considered high-risk due to their limited driving experience and are charged higher premiums. Similarly, living in an area with a high crime rate or a history of frequent accidents can also lead to increased insurance costs.

| Risk Factor | Impact on Premium |

|---|---|

| Age | Younger drivers pay higher premiums due to increased risk. |

| Driving Record | A clean driving record with no accidents or violations can lead to lower premiums. |

| Location | High-crime or accident-prone areas may result in higher insurance costs. |

It's important to note that while these factors are beyond an individual's control, understanding them can help in anticipating insurance costs and potentially taking steps to mitigate the impact.

Vehicle Choice and Insurance Costs

The type of vehicle you insure can also significantly influence your insurance premiums. Insurers consider various aspects of a vehicle, including its make, model, and age. For instance, sports cars and luxury vehicles are often more expensive to insure due to their higher repair costs and increased risk of theft. Similarly, older vehicles may have lower premiums as they generally have lower repair costs and are less desirable to thieves.

| Vehicle Type | Insurance Premium Impact |

|---|---|

| Sports Cars | Higher premiums due to increased repair costs and theft risk. |

| Luxury Vehicles | Similar to sports cars, luxury vehicles are costly to insure. |

| Older Vehicles | Lower premiums as repair costs are generally lower. |

Choosing a vehicle that is more affordable to insure can be a strategic move to reduce insurance costs. However, it's important to balance this decision with other factors, such as personal preferences and safety features.

Coverage Options and Their Impact

The coverage options you choose for your car insurance policy also play a significant role in determining your premium. Different levels of coverage offer varying levels of protection and corresponding costs. For example, comprehensive and collision coverage, which protect against damage to your vehicle from various causes, typically result in higher premiums. On the other hand, liability-only coverage, which provides protection for damage you cause to others, is generally more affordable.

| Coverage Type | Premium Impact |

|---|---|

| Comprehensive and Collision Coverage | Higher premiums due to increased protection. |

| Liability-Only Coverage | Lower premiums as it provides basic protection. |

Understanding the trade-offs between different coverage options is crucial to making informed decisions about your car insurance policy. While comprehensive coverage offers more protection, it may not be necessary for older vehicles that have been paid off.

Strategies to Lower Car Insurance Costs

Now that we have a solid understanding of the factors influencing car insurance costs, let's explore some effective strategies to reduce your premiums. These strategies are based on real-world examples and expert insights, providing a comprehensive guide to lowering your car insurance expenses.

Shop Around and Compare Quotes

One of the simplest yet most effective ways to lower your car insurance costs is to shop around and compare quotes from different insurers. Insurance rates can vary significantly between companies, and getting multiple quotes can help you identify the most competitive rates for your specific situation. Online comparison tools can be a great starting point, but it's also beneficial to reach out to individual insurers to discuss your options and potential discounts.

For instance, a recent study by Consumer Reports found that drivers could save an average of $436 per year by comparing quotes from at least three insurers. This highlights the potential savings that can be achieved through this simple strategy.

Utilize Discounts and Rewards

Insurance companies offer a wide range of discounts and rewards to attract and retain customers. These discounts can significantly reduce your insurance premiums. Some common discounts include:

- Safe Driver Discount: Insurers often reward drivers with a clean driving record, free of accidents and violations, with lower premiums.

- Multi-Policy Discount: Combining your car insurance with other policies, such as home or renters insurance, can lead to substantial savings.

- Good Student Discount: Students with a certain GPA or higher may be eligible for a discount on their car insurance.

- Loyalty Discount: Staying with the same insurer for an extended period can result in loyalty discounts.

- Safe Vehicle Discount: Vehicles equipped with safety features like anti-lock brakes or airbags may qualify for a discount.

By taking advantage of these discounts, you can significantly reduce your insurance costs. It's worth exploring the specific discounts offered by your insurer and ensuring you meet the criteria to qualify.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is a relatively new concept that allows insurers to track your driving habits and adjust your premiums accordingly. This type of insurance uses a small device installed in your vehicle or an app on your smartphone to monitor your driving behavior, including distance traveled, time of day, and driving style.

For example, a driver who primarily uses their vehicle for short, local trips and avoids peak traffic hours may be eligible for lower premiums under a usage-based insurance policy. This is because their driving behavior is considered less risky compared to someone who regularly drives long distances or during high-risk hours.

While usage-based insurance may not be suitable for everyone, it can be a great option for those who drive infrequently or have a consistently safe driving record. It provides an opportunity to tailor your insurance costs to your specific driving habits, potentially leading to significant savings.

Increase Your Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can lead to lower premiums, as you are assuming a larger portion of the financial risk. However, it's important to choose a deductible amount that you can comfortably afford in the event of an accident or claim.

For instance, if you currently have a $500 deductible and increase it to $1,000, you may be able to reduce your insurance premiums by a significant amount. This strategy works best for individuals who have a strong financial foundation and are confident they can cover a higher deductible in the event of an accident.

Maintain a Good Driving Record

A clean driving record is one of the most effective ways to keep your insurance costs low. Insurance companies heavily weigh driving history when determining premiums, as it is a strong indicator of future risk. A single traffic violation or accident can lead to increased premiums, while a clean record can result in substantial savings.

For example, a driver with a clean record for the past five years may be eligible for a significant discount on their insurance premium. This discount can continue to increase over time as long as the driver maintains their safe driving habits.

It's important to note that driving records are public information, and insurance companies can access them to assess your risk. Therefore, it's crucial to drive safely and responsibly to maintain a clean record and keep your insurance costs down.

Explore Group or Employee Discounts

Many insurance companies offer group or employee discounts, which can lead to significant savings on your car insurance premiums. These discounts are often available through organizations like alumni associations, professional groups, or even your employer.

For instance, some insurance companies partner with specific organizations to offer exclusive group rates to their members. By joining such an organization, you may be eligible for a discount on your car insurance. Similarly, many employers offer employee benefits packages that include discounted insurance rates as a perk.

It's worth exploring these options to see if you qualify for any group or employee discounts. Often, these discounts can be combined with other savings strategies to further reduce your insurance costs.

Expert Insights and Future Trends

As the insurance industry continues to evolve, it's essential to stay informed about emerging trends and expert insights. These can provide valuable guidance on future strategies to lower car insurance costs.

The Rise of Telematics and Data Analytics

The increasing use of telematics and data analytics in the insurance industry is a significant trend that is expected to continue in the coming years. These technologies allow insurers to gather and analyze vast amounts of data, providing a more accurate picture of individual risk profiles.

For example, telematics devices installed in vehicles can track driving behavior, including acceleration, braking, and cornering, providing insurers with detailed insights into individual driving habits. This data can be used to offer more personalized insurance rates, potentially leading to savings for safe drivers.

Additionally, data analytics can help insurers identify trends and patterns that were previously difficult to detect. This can lead to more efficient risk assessment and pricing, which could benefit consumers in the form of lower premiums.

The Role of Artificial Intelligence

Artificial Intelligence (AI) is another technology that is revolutionizing the insurance industry. AI algorithms can process vast amounts of data quickly and accurately, enabling insurers to make more informed decisions about risk assessment and pricing.

For instance, AI can analyze historical data to identify patterns and predict future claims, helping insurers set more accurate premiums. Additionally, AI-powered chatbots and virtual assistants are becoming increasingly common, providing customers with efficient and personalized support, which can lead to improved customer satisfaction and potentially lower costs for insurers.

As AI continues to advance, it is expected to play an even greater role in the insurance industry, potentially leading to more efficient processes and lower costs for consumers.

The Impact of Autonomous Vehicles

The emergence of autonomous vehicles (AVs) is another significant trend that is expected to have a profound impact on the insurance industry. As AV technology continues to advance and become more widespread, it could lead to a significant reduction in accidents, which is a primary driver of insurance costs.

For example, AVs equipped with advanced sensors and artificial intelligence can detect and respond to potential hazards more quickly and accurately than human drivers, potentially reducing the number of accidents. This could lead to a decrease in insurance claims and, subsequently, lower insurance premiums.

However, the widespread adoption of AVs is still in its early stages, and there are many regulatory and technological challenges to be addressed. Nonetheless, the potential impact on insurance costs is a topic of great interest and ongoing research in the industry.

The Future of Car Insurance

Looking ahead, the car insurance industry is poised for significant changes. The increasing adoption of data-driven technologies, AI, and autonomous vehicles is expected to revolutionize the way insurance is priced and delivered.

For consumers, this could mean more personalized insurance options, with premiums tailored to individual driving habits and risk profiles. It could also lead to a more efficient claims process, potentially reducing the time and cost associated with resolving insurance claims.

While these changes are still in their early stages, staying informed about these emerging trends and technologies can help you navigate the evolving landscape of car insurance and potentially save on your insurance costs in the future.

FAQ

How often should I review my car insurance policy to ensure I’m getting the best rates?

+It’s a good practice to review your car insurance policy annually, or whenever you experience a significant life change (e.g., moving to a new location, getting married, or purchasing a new vehicle). Regular reviews can help you stay updated on potential discounts and ensure you’re getting the most competitive rates.

Can I switch car insurance companies to save money without affecting my coverage or record?

+Absolutely! Switching car insurance companies is a common practice and can often lead to significant savings. When switching, ensure that your new policy provides comparable coverage to your previous one. Also, make sure to maintain continuous insurance coverage to avoid any gaps that could impact your driving record or future insurance costs.

What are some common mistakes to avoid when trying to lower car insurance costs?

+Some common mistakes to avoid include: neglecting to shop around for the best rates, not taking advantage of available discounts, failing to maintain a clean driving record, and opting for bare-bones coverage without considering your specific needs. It’s important to thoroughly research and understand your options to make informed decisions about your car insurance.