New York State Medical Insurance Exchange

Welcome to the comprehensive guide on the New York State Medical Insurance Exchange, a crucial platform for individuals and businesses seeking affordable and comprehensive healthcare coverage. In the vast landscape of healthcare options, this exchange stands as a vital resource, offering a streamlined process to navigate the complexities of medical insurance. As we delve into the specifics, we'll uncover the exchange's features, its impact on New York residents, and the key considerations for those exploring their healthcare insurance options.

Understanding the New York State Medical Insurance Exchange

The New York State Medical Insurance Exchange, often referred to as the NY Health Exchange, is a centralized online marketplace designed to simplify the process of purchasing health insurance. Established in accordance with the Affordable Care Act (ACA), the exchange serves as a one-stop shop for individuals, families, and small businesses to compare and enroll in health plans offered by various insurance providers.

The NY Health Exchange plays a pivotal role in promoting accessibility and affordability in healthcare. By aggregating a wide range of insurance plans, it empowers users to make informed decisions based on their specific needs and budgets. This platform is particularly beneficial for those who may not have access to employer-sponsored health insurance or who are seeking more tailored coverage options.

Key Features of the Exchange

- Plan Comparison: Users can easily compare different health insurance plans based on factors such as premiums, deductibles, copays, and coverage details. This feature ensures that individuals can find a plan that best aligns with their healthcare requirements.

- Premium Subsidies: For those with limited incomes, the exchange offers financial assistance in the form of premium tax credits. These subsidies can significantly reduce the cost of health insurance, making it more accessible to a broader range of individuals.

- Small Business Health Options Program (SHOP): The exchange provides a dedicated platform for small businesses to offer health insurance to their employees. This program simplifies the process of selecting and managing health plans for businesses, helping them provide essential healthcare benefits to their workforce.

- Open Enrollment Periods: The NY Health Exchange operates within specific enrollment periods, typically allowing individuals to enroll in or switch health plans annually. However, qualifying life events, such as marriage, divorce, or job loss, may enable special enrollment periods outside of the regular open enrollment window.

By leveraging these features, the New York State Medical Insurance Exchange has become a critical tool for ensuring that residents have access to quality healthcare, regardless of their financial situation or employment status.

How the Exchange Benefits New Yorkers

The implementation of the NY Health Exchange has had a significant impact on the healthcare landscape in New York State. Here’s a closer look at how this platform benefits residents:

Affordable Healthcare Options

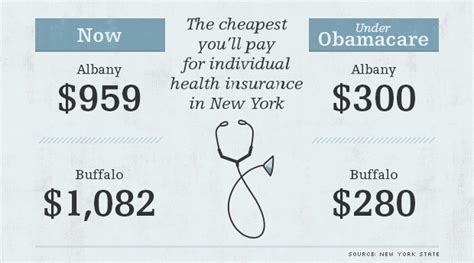

One of the primary advantages of the exchange is its ability to provide affordable healthcare options. The competitive nature of the marketplace, coupled with premium subsidies, makes health insurance more accessible to a broader demographic. This is especially beneficial for low-income individuals and families who may have previously struggled to afford comprehensive coverage.

| Income Level | Premium Subsidy Eligibility |

|---|---|

| 400% of Federal Poverty Level (FPL) | May qualify for reduced premiums |

| 200% - 400% of FPL | Eligible for premium tax credits |

| Below 200% of FPL | May receive additional financial assistance |

With these subsidies, individuals can obtain coverage at a fraction of the standard cost, ensuring that healthcare remains within reach for those who need it most.

Simplified Enrollment Process

The online nature of the NY Health Exchange simplifies the often-complex process of enrolling in health insurance. Users can create an account, input their personal and financial information, and instantly view a range of plan options tailored to their needs. This streamlined approach saves time and effort, making it more convenient for individuals to secure the coverage they require.

Access to a Variety of Plans

The exchange aggregates plans from multiple insurance providers, offering a diverse range of options. This includes plans with varying levels of coverage, from Bronze to Platinum, ensuring that individuals can find a plan that suits their healthcare needs and preferences. Whether it’s a focus on prescription drug coverage or specialized medical services, the exchange provides a comprehensive array of choices.

Navigating the Exchange: A Step-by-Step Guide

For those new to the NY Health Exchange, here’s a detailed guide to help you navigate the platform effectively:

Step 1: Understanding Your Eligibility

Before diving into plan comparisons, it’s essential to understand your eligibility for the exchange. This includes determining whether you qualify for premium subsidies based on your income and family size. The exchange website provides tools to help you assess your eligibility and estimate the potential cost of insurance plans.

Step 2: Exploring Plan Options

Once you’ve established your eligibility, the next step is to explore the available plan options. The exchange’s user-friendly interface allows you to filter plans based on various criteria, including premium cost, deductible amounts, and provider networks. Take the time to review the details of each plan, ensuring that the coverage aligns with your healthcare needs.

Step 3: Comparing Costs and Benefits

With a shortlist of plans, it’s time to delve deeper into the specifics. Compare the costs, including premiums, deductibles, and out-of-pocket maximums. Additionally, review the benefits covered by each plan, such as prescription drugs, mental health services, and specialist care. Consider your healthcare history and future needs to make an informed decision.

Step 4: Enrolling in Your Chosen Plan

Once you’ve selected the plan that best meets your requirements, the final step is to enroll. The exchange provides a straightforward enrollment process, often completed entirely online. Ensure that you have all the necessary documentation, such as proof of income and identity, to expedite the process. After enrollment, you’ll receive confirmation of your coverage and any relevant materials from your chosen insurance provider.

Future Implications and Continuous Improvement

The New York State Medical Insurance Exchange is a dynamic platform that continues to evolve to meet the changing needs of its users. As healthcare policies and regulations shift, the exchange adapts to ensure it remains a valuable resource for New Yorkers.

One of the key future implications is the potential expansion of coverage options. As more insurance providers join the exchange and new healthcare initiatives are introduced, individuals can expect an even broader range of plans to choose from. This increased competition could further drive down costs and improve the overall quality of healthcare coverage available through the exchange.

Additionally, the exchange is committed to enhancing its user experience. Ongoing improvements to the platform's interface and functionality aim to make navigating the exchange more intuitive and efficient. This includes streamlining the enrollment process, providing more comprehensive plan comparisons, and offering personalized recommendations based on user preferences and needs.

The exchange also plays a vital role in promoting healthcare equity. By providing accessible and affordable insurance options, it ensures that individuals and families from all socioeconomic backgrounds have the opportunity to obtain quality healthcare. This aligns with the broader goal of creating a healthier and more resilient community in New York State.

FAQs

Can I enroll in the NY Health Exchange outside of the open enrollment period?

+

Yes, you may be eligible for a special enrollment period if you’ve experienced a qualifying life event, such as marriage, divorce, or loss of job-based coverage. These events allow you to enroll outside of the regular open enrollment window.

How do I know if I qualify for premium subsidies on the exchange?

+

Premium subsidy eligibility is based on your income level relative to the Federal Poverty Level (FPL). You can use the exchange’s online tools to assess your eligibility and estimate the potential cost savings.

What happens if I miss the open enrollment period?

+

If you miss the open enrollment period and don’t qualify for a special enrollment period, you may need to wait until the next open enrollment to enroll in or change your health plan. However, you can still access urgent care and receive treatment for emergencies at any time.

As the New York State Medical Insurance Exchange continues to evolve, it remains a vital resource for individuals and businesses seeking accessible and affordable healthcare coverage. By providing a user-friendly platform and a range of plan options, the exchange ensures that New Yorkers can make informed decisions about their healthcare, ultimately contributing to a healthier and more resilient community.