Travel Insurance From Australia

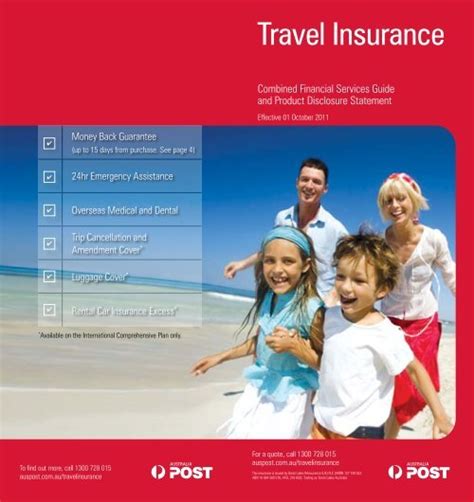

Travel insurance is a crucial aspect to consider when planning any international journey, especially when departing from Australia. With its diverse landscapes, vibrant cities, and unique wildlife, Australia is a popular destination for travelers worldwide. However, when Australians embark on their own adventures abroad, having the right travel insurance becomes essential to ensure a safe and stress-free experience. This article will delve into the world of travel insurance, specifically tailored for Australian travelers, exploring the key aspects, benefits, and considerations to help you make informed decisions before your next trip.

Understanding the Need for Travel Insurance

Travel insurance is a vital safeguard for unexpected events that may occur during your travels. Whether it’s a medical emergency, trip cancellation, lost luggage, or any other unforeseen circumstance, travel insurance provides financial protection and peace of mind. For Australians venturing overseas, where healthcare costs can be significantly higher than at home, travel insurance becomes an even more critical component of trip planning.

Key Coverage Areas for Australian Travelers

When evaluating travel insurance policies, it’s important to understand the coverage options available. Here are some key areas to consider:

- Medical and Hospital Cover: Comprehensive medical coverage is a priority for any traveler. Australian policies typically include cover for overseas medical treatment, emergency dental care, and even repatriation if necessary. It’s crucial to check the limits and exclusions for each policy to ensure adequate coverage.

- Trip Cancellation and Interruption: This coverage provides financial relief if your trip is canceled or interrupted due to unforeseen circumstances. It can reimburse non-refundable expenses such as flights, accommodation, and tour packages. Australian policies often include coverage for a range of events, including illness, injury, and natural disasters.

- Luggage and Personal Belongings: Misplaced or damaged luggage can be a significant inconvenience during travel. Travel insurance policies usually offer cover for lost, stolen, or damaged baggage and personal effects. Some policies may also provide emergency replacement of essential items.

- Emergency Assistance: Access to 24⁄7 emergency assistance is a valuable benefit of travel insurance. This service can provide support for medical emergencies, travel disruptions, and even legal advice if needed. It’s essential to understand the scope and limitations of the emergency assistance provided by your chosen insurer.

Choosing the Right Travel Insurance Provider

With numerous travel insurance providers in the market, selecting the right one can be a daunting task. Here are some factors to consider when choosing a travel insurance provider for your Australian travels:

Reputation and Financial Stability

Look for established insurance companies with a solid reputation in the travel industry. Check their financial stability ratings to ensure they are capable of honoring claims. A financially stable insurer provides peace of mind that your policy is secure and claims will be processed efficiently.

Policy Features and Benefits

Review the policy features and benefits offered by different providers. Compare coverage limits, exclusions, and additional benefits such as travel delays, rental car excess, and sports coverage. Ensure the policy aligns with your specific travel needs and activities.

| Policy Feature | Provider A | Provider B | Provider C |

|---|---|---|---|

| Medical Expenses Cover | $5,000,000 | $10,000,000 | $7,500,000 |

| Trip Cancellation | Yes | Yes | Yes |

| Baggage Cover | $2,000 | $3,000 | $2,500 |

| Adventure Sports Cover | Limited | Extensive | Standard |

Price and Value

While price is an important consideration, it should not be the sole factor in your decision. Evaluate the value each policy offers by considering the coverage limits, benefits, and any additional perks. Some insurers may offer loyalty discounts or flexible payment options, making their policies more attractive.

Claims Process and Customer Service

Research the claims process and customer service reputation of potential providers. A smooth and efficient claims process is essential when you need assistance during your travels. Check online reviews and testimonials to gauge the overall satisfaction of previous customers.

Tips for Australian Travelers

As an Australian traveler, there are a few additional considerations to keep in mind when purchasing travel insurance:

Adventures and Sports Activities

If your travel plans involve adventure sports or activities, ensure your policy covers these specifically. Some insurers offer additional adventure sports coverage, while others may exclude certain high-risk activities. Disclose all planned activities to your insurer to avoid any surprises later.

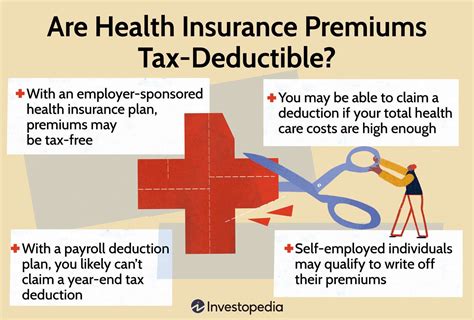

Pre-Existing Medical Conditions

If you have a pre-existing medical condition, it’s crucial to declare this when purchasing travel insurance. Some insurers may provide cover for pre-existing conditions, while others may exclude them or offer limited coverage. Disclose all relevant medical information to ensure you have the necessary protection.

Travel Destinations and Duration

Consider the countries you plan to visit and the duration of your trip. Some travel insurance policies may have restrictions on the number of days or countries covered. Ensure your policy aligns with your travel itinerary to avoid any gaps in coverage.

Compare Multiple Policies

Don’t settle for the first policy you come across. Take the time to compare multiple travel insurance policies to find the one that best suits your needs and budget. Online comparison tools can be helpful in evaluating different options.

Real-Life Scenarios and Case Studies

To illustrate the importance of travel insurance, let’s explore some real-life scenarios experienced by Australian travelers:

Medical Emergency Abroad

Imagine you’re on a hiking trip in the Swiss Alps when you sustain a serious ankle injury. Without travel insurance, the cost of emergency medical treatment and repatriation could be astronomically high. With comprehensive travel insurance, you can receive the necessary medical care and be repatriated back to Australia with minimal financial burden.

Trip Cancellation Due to Natural Disaster

You’ve planned a dream vacation to Bali, but a volcanic eruption disrupts your travel plans. If you’ve purchased travel insurance with trip cancellation coverage, you can receive reimbursement for non-refundable expenses such as flights and accommodation. This coverage provides financial relief during an unexpected event.

Lost Luggage on a European Tour

During a multi-city tour of Europe, your luggage goes missing at the airport. With travel insurance, you can file a claim for the value of your lost items and receive emergency funds to purchase essential items. This coverage ensures you can continue your trip without unnecessary financial strain.

Future of Travel Insurance

The travel insurance industry is constantly evolving to meet the changing needs of travelers. Here are some trends and developments to watch out for:

Digitalization and Instant Coverage

With the rise of digital technologies, travel insurance providers are offering more convenient and instant coverage options. Online platforms and mobile apps allow travelers to purchase policies quickly and easily, often providing coverage within minutes.

Personalized and Flexible Policies

Insurance providers are recognizing the unique needs of individual travelers. Personalized policies allow travelers to tailor their coverage to specific activities, destinations, and durations. This flexibility ensures travelers only pay for the coverage they need.

Enhanced Medical Assistance and Evacuation

As the cost of medical treatment continues to rise, travel insurance providers are investing in enhanced medical assistance and evacuation services. This includes access to specialized medical teams and efficient repatriation processes.

Artificial Intelligence and Claims Processing

Artificial Intelligence (AI) is revolutionizing the claims process. Insurers are utilizing AI technologies to streamline claim assessments, making the process faster and more efficient for travelers.

Conclusion

Travel insurance is an essential aspect of international travel for Australians. By understanding the coverage options, choosing the right provider, and considering your specific travel needs, you can ensure a safe and stress-free journey. Remember, travel insurance provides financial protection and peace of mind, allowing you to focus on creating unforgettable memories during your travels.

How much does travel insurance cost for Australian travelers?

+The cost of travel insurance for Australian travelers varies depending on several factors, including the duration of the trip, destination(s), age of the traveler, and the level of coverage required. On average, travel insurance for a 10-day trip to a popular destination like Europe or the USA can range from AUD 100 to AUD 200. However, it’s essential to compare policies and choose one that suits your specific needs.

What should I do if I need to make a claim while traveling abroad?

+If you find yourself in a situation where you need to make a claim while traveling, it’s important to act promptly. Contact your travel insurance provider as soon as possible to inform them of the incident. Gather all relevant documentation, such as medical reports, police reports, or receipts, and provide them to your insurer. Follow their instructions and complete any necessary claim forms to initiate the claims process.

Are there any exclusions or limitations I should be aware of in travel insurance policies?

+Yes, it’s crucial to carefully review the exclusions and limitations outlined in your travel insurance policy. Common exclusions may include pre-existing medical conditions (unless specifically declared and covered), high-risk activities (e.g., extreme sports), travel to high-risk destinations, and failure to disclose all relevant information when purchasing the policy. It’s essential to understand these exclusions to avoid any surprises later.

Can I extend my travel insurance policy if my trip is longer than expected?

+Yes, most travel insurance providers offer the option to extend your policy if your trip duration exceeds the initial coverage period. It’s important to contact your insurer well in advance of your planned return date to request an extension. Keep in mind that there may be additional costs involved, and the terms and conditions of the extension may differ from the original policy.