Farmers Insurance Agency Near Me

In today's digital age, finding a reliable and trusted insurance agency has become easier than ever. With just a few clicks, you can locate the best insurance providers in your area and compare their services and policies. In this article, we will delve into the world of Farmers Insurance Agency, a well-known and respected name in the insurance industry, and explore how you can connect with their local representatives to secure the coverage you need. We will also discuss the benefits of choosing a local Farmers Insurance Agency and provide you with valuable insights to make an informed decision.

Understanding Farmers Insurance Agency

Farmers Insurance Group, commonly known as Farmers Insurance, is a leading insurance provider in the United States. Founded in 1928, Farmers Insurance has grown to become a trusted name in the industry, offering a wide range of insurance products and services to individuals and businesses alike. The company’s mission is to provide exceptional customer service and tailored insurance solutions to meet the unique needs of its clients.

Farmers Insurance operates through a network of independent insurance agents who are licensed and trained to provide personalized guidance and support. These agents are the face of the company and are dedicated to helping customers navigate the complex world of insurance. With a strong focus on local presence, Farmers Insurance Agency aims to build strong relationships with its customers and offer tailored coverage options.

Locating a Farmers Insurance Agency Near You

Finding a Farmers Insurance Agency near your location is a straightforward process. Farmers Insurance has a vast network of local agencies across the country, ensuring that you can easily access their services regardless of your geographical area. Here are some simple steps to locate a Farmers Insurance Agency close to you:

Online Search

Begin by conducting an online search using the term “Farmers Insurance Agency Near Me.” Most search engines will provide you with a list of local agencies along with their contact details and locations. You can refine your search by adding your city or zip code to get more precise results.

Farmers Insurance also has a dedicated agency locator tool on their official website. By entering your address or zip code, you can instantly find the nearest Farmers Insurance Agency and get their contact information. This tool is user-friendly and provides a quick and convenient way to locate an agency in your area.

Referrals and Recommendations

Word-of-mouth recommendations can be a powerful tool when searching for a reliable insurance agency. Ask your friends, family, or colleagues if they have any personal experiences with Farmers Insurance Agency. Positive referrals can provide valuable insights and help you make an informed decision.

Additionally, local business directories, community forums, and social media groups can be excellent resources for finding trusted insurance agencies. Engage with these platforms and seek recommendations from individuals who have had positive experiences with Farmers Insurance.

Visiting Farmers Insurance Website

The official Farmers Insurance website is a wealth of information and resources. Visit their website and navigate to the “Find an Agent” or “Locate an Agency” section. Here, you can input your location details and browse through a list of local Farmers Insurance Agencies. The website often provides detailed profiles of each agency, including their specialties, contact information, and customer reviews.

Benefits of Choosing a Local Farmers Insurance Agency

While Farmers Insurance is a well-established brand with a national presence, choosing a local Farmers Insurance Agency offers several advantages. Here are some key benefits to consider:

Personalized Service

Local Farmers Insurance Agencies are run by independent agents who have a deep understanding of the unique needs and challenges of their community. These agents can provide personalized guidance and tailor insurance policies to fit your specific requirements. Whether you need auto insurance, home insurance, or business coverage, a local agent will take the time to understand your situation and offer tailored solutions.

Community Expertise

Local Farmers Insurance Agents are deeply rooted in the community they serve. They have a comprehensive understanding of the local risks, regulations, and market trends. This expertise allows them to provide accurate and relevant advice, ensuring that your insurance coverage aligns with the specific needs of your area. From natural disasters to local laws, a local agent will have the knowledge to guide you effectively.

Face-to-Face Interaction

Dealing with a local Farmers Insurance Agency provides the opportunity for face-to-face interactions. You can meet with your agent in person, discuss your insurance needs, and establish a personal connection. This level of interaction fosters trust and allows for open communication, ensuring that you receive the best possible service. In-person meetings also make it easier to clarify any doubts or address concerns promptly.

Quick Response Times

In times of need, such as during an insurance claim, having a local Farmers Insurance Agency can be advantageous. Local agents are readily accessible and can respond quickly to your queries or emergencies. They understand the importance of timely assistance and are dedicated to providing efficient and effective support throughout the claims process.

Community Support

Local Farmers Insurance Agencies often actively participate in community events and initiatives. By choosing a local agency, you contribute to the growth and development of your community. These agencies sponsor local sports teams, support charitable causes, and engage in various community projects. Your decision to work with a local Farmers Insurance Agency not only benefits you but also supports the well-being of your neighborhood.

Performance and Customer Satisfaction

Farmers Insurance Agency has consistently demonstrated strong performance and high customer satisfaction ratings. The company’s commitment to excellence and customer-centric approach has earned it a reputation for reliability and trust. Here are some key aspects that contribute to their success:

Claim Satisfaction

Farmers Insurance has a dedicated claims team that works diligently to ensure a smooth and efficient claims process. Their focus on customer satisfaction is evident in the positive feedback and reviews received from policyholders. The company’s claims department is known for its prompt response, fair settlements, and excellent customer service during times of need.

Financial Strength

Farmers Insurance is a financially stable and secure company. They have maintained a strong financial position over the years, which provides assurance to policyholders. With a solid financial foundation, Farmers Insurance can honor its commitments and provide reliable coverage to its customers.

Customer Service Excellence

The company places a strong emphasis on delivering exceptional customer service. Their network of independent agents is trained to provide personalized attention and guidance. Farmers Insurance consistently strives to meet and exceed customer expectations, ensuring a positive and satisfying experience throughout the insurance journey.

Customer Reviews and Testimonials

Farmers Insurance actively encourages customer feedback and testimonials. Positive reviews from satisfied customers can be found on various online platforms and social media. These reviews highlight the company’s commitment to providing excellent service, prompt claim settlements, and a dedicated approach to customer satisfaction.

Conclusion

Finding a reliable insurance agency is an important step towards securing your assets and future. Farmers Insurance Agency, with its extensive network of local agents, offers a personalized and community-focused approach to insurance. By choosing a local Farmers Insurance Agency, you gain access to expert guidance, tailored coverage, and a strong support system. The company’s strong performance, financial stability, and customer-centric culture make it a trusted choice for individuals and businesses alike.

As you embark on your journey to find the right insurance coverage, consider the benefits of a local Farmers Insurance Agency. With their dedication to excellence and community involvement, you can rest assured that your insurance needs are in capable hands. Take the time to explore the options available near you and make an informed decision that aligns with your unique requirements.

How can I compare insurance quotes from Farmers Insurance Agency with other providers?

+Comparing insurance quotes is a crucial step in finding the best coverage for your needs. To compare quotes from Farmers Insurance Agency with other providers, you can utilize online comparison tools or reach out to multiple insurance agencies directly. These tools allow you to input your information once and receive multiple quotes from different insurers, including Farmers Insurance. By comparing coverage options, premiums, and additional benefits, you can make an informed decision.

What are the different types of insurance coverage offered by Farmers Insurance Agency?

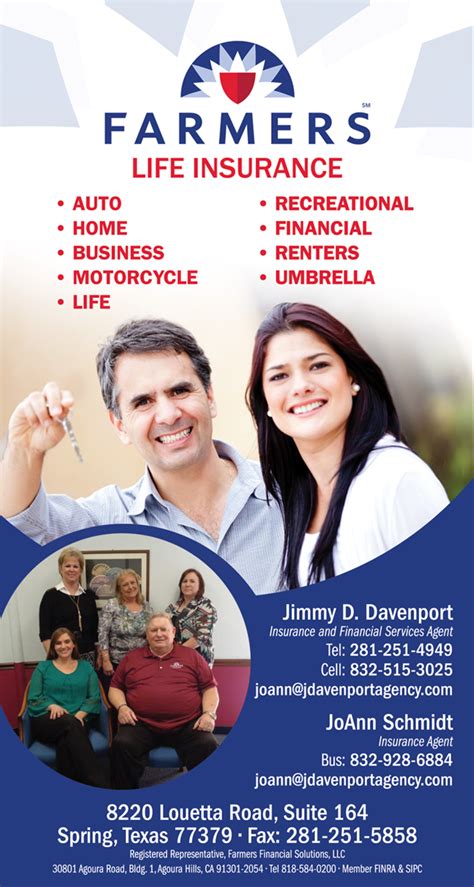

+Farmers Insurance Agency offers a comprehensive range of insurance coverage options to meet the diverse needs of its customers. These include auto insurance, home insurance, renters insurance, life insurance, business insurance, and more. Each policy can be tailored to fit your specific requirements, ensuring you receive the coverage you need at an affordable price.

Can I get a quote for insurance coverage online from Farmers Insurance Agency?

+Yes, Farmers Insurance Agency provides an online quoting tool on their website. By visiting their official website and navigating to the “Get a Quote” section, you can input your details and receive a personalized insurance quote. This online tool is user-friendly and allows you to compare different coverage options and premiums before making a decision.

How can I contact a local Farmers Insurance Agency representative for assistance?

+To contact a local Farmers Insurance Agency representative, you can use the agency locator tool on their website. Simply enter your location details, and the tool will provide you with a list of nearby agencies along with their contact information. You can then reach out to the agency via phone, email, or even schedule an in-person meeting to discuss your insurance needs.

What should I consider when choosing an insurance policy from Farmers Insurance Agency?

+When selecting an insurance policy from Farmers Insurance Agency, it’s important to consider your specific needs and circumstances. Evaluate the coverage limits, deductibles, and additional benefits offered by different policies. Assess your risk tolerance and the potential financial impact of various scenarios. Additionally, consider the reputation, customer service, and claims handling process of Farmers Insurance Agency to ensure a positive and reliable experience.