Farmers Insurance Homeowners

Farmers Insurance: Protecting Homes and Dreams Across the Nation

In the vast landscape of insurance providers, Farmers Insurance stands as a stalwart guardian of homeowners’ peace of mind. With a rich history dating back to the 1920s, Farmers has established itself as a trusted partner, offering comprehensive coverage tailored to the diverse needs of American homeowners. This article delves into the world of Farmers Insurance, exploring its offerings, expertise, and the unique value it brings to policyholders.

A Legacy of Service and Innovation

The story of Farmers Insurance is one of resilience and forward-thinking. Founded in 1928 by Thomas E. Leavey and John C. Tyler, Farmers Insurance Group began as a simple concept: to provide affordable auto insurance to farmers and rural residents in California. Over the decades, the company expanded its reach and offerings, evolving into a leading provider of insurance and financial services across the United States.

Today, Farmers Insurance is a household name, known for its commitment to customer satisfaction and its ability to adapt to the changing needs of homeowners. With a network of over 48,000 exclusive and independent agents, Farmers provides personalized service and tailored coverage to protect the places people call home.

Comprehensive Homeowners Insurance Solutions

Farmers Insurance understands that every home is unique, and so are the risks it faces. That’s why their homeowners insurance policies are designed to be flexible and customizable, offering a range of coverage options to meet the diverse needs of policyholders.

Dwelling Coverage

At the heart of every Farmers homeowners policy is dwelling coverage, which protects the physical structure of the home itself. This coverage extends to the main dwelling, as well as any attached structures like garages and carports. In the event of a covered loss, Farmers will help policyholders rebuild their homes, ensuring peace of mind during difficult times.

Personal Property Protection

Farmers recognizes that a home is more than just a structure—it’s a collection of cherished possessions. That’s why their policies include personal property protection, which covers the cost of replacing or repairing damaged or stolen items within the home. From furniture and electronics to clothing and collectibles, Farmers helps policyholders safeguard their belongings.

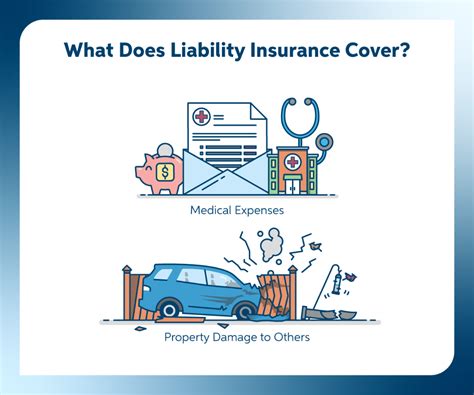

Liability Protection

In today’s litigious society, liability risks are a real concern for homeowners. Farmers offers liability protection as part of its homeowners policies, providing coverage for legal defense and damages in the event of a covered lawsuit. This protection extends to a wide range of situations, from dog bites to slip-and-fall accidents on the property.

Additional Coverages

Beyond the standard coverage options, Farmers Insurance offers a suite of additional coverages to further protect policyholders. These include:

Replacement Cost Coverage: Ensures that, in the event of a covered loss, the policyholder receives enough to rebuild their home to its pre-loss condition, regardless of the home’s depreciated value.

Extended Dwelling Coverage: Provides additional protection for the main dwelling, covering expenses above the policy’s limit in the event of a covered loss.

Personal Injury Coverage: Covers legal expenses and damages resulting from personal injury lawsuits, such as libel, slander, or invasion of privacy claims.

Loss of Use Coverage: Helps policyholders cover additional living expenses if their home becomes uninhabitable due to a covered loss.

Identity Theft Coverage: Assists policyholders in resolving identity theft issues and provides reimbursement for certain expenses incurred during the process.

Risk Management and Loss Prevention

Farmers Insurance believes that prevention is just as important as protection. That’s why they offer a range of resources and tools to help policyholders reduce the risk of losses and mitigate potential damages.

Risk Assessment

Farmers agents conduct thorough risk assessments of each property, identifying potential hazards and providing recommendations for improvements. This proactive approach helps policyholders understand and address vulnerabilities, ultimately reducing the likelihood of losses.

Safety and Prevention Resources

Farmers provides policyholders with access to a wealth of safety and prevention resources, including guides on fire safety, water damage prevention, and home security. These resources empower homeowners to take an active role in safeguarding their properties.

Discounts and Incentives

To encourage risk mitigation, Farmers offers a variety of discounts and incentives. For example, policyholders who install security systems, smoke detectors, or fire sprinklers may be eligible for premium discounts. Additionally, Farmers recognizes the value of energy-efficient homes, offering discounts to policyholders who invest in green renovations.

Claims Process: A Seamless Experience

In the event of a covered loss, Farmers Insurance is committed to providing a seamless claims process. Their dedicated claims specialists work tirelessly to ensure policyholders receive the support and compensation they need to get back on their feet quickly.

Prompt Response

Farmers understands that time is of the essence when dealing with a loss. That’s why they pride themselves on a rapid response time, with agents available 24⁄7 to assist policyholders and begin the claims process.

Expertise and Personalized Service

Farmers’ claims specialists are highly trained and experienced, capable of handling a wide range of claim types. They work closely with policyholders, providing personalized service and guidance throughout the claims process. From initial reporting to final settlement, Farmers aims to make the experience as stress-free as possible.

Advanced Technology

To streamline the claims process, Farmers utilizes advanced technology, including mobile apps and online portals. Policyholders can easily report claims, track their progress, and upload necessary documentation through these digital platforms, ensuring a more efficient and convenient experience.

Community Involvement and Giving Back

Beyond its insurance offerings, Farmers Insurance is committed to making a positive impact in the communities it serves. Through various initiatives and partnerships, Farmers actively supports local causes and gives back to those in need.

Disaster Relief

In times of crisis, Farmers steps up to provide support and relief. The company has a long history of assisting policyholders and communities affected by natural disasters, such as hurricanes, wildfires, and floods. Through financial donations, volunteer efforts, and insurance-related support, Farmers helps communities rebuild and recover.

Educational Initiatives

Farmers recognizes the importance of financial literacy and insurance education. Through partnerships with schools and community organizations, Farmers offers educational programs and resources to help individuals and families understand the value of insurance and make informed decisions about their coverage needs.

Supporting Veterans and Military Families

Farmers is dedicated to supporting the men and women who have served our country. The company actively hires veterans and military spouses, and offers a range of insurance products tailored to the unique needs of military families. Additionally, Farmers partners with organizations like Homes for Our Troops, contributing to the construction of accessible homes for severely injured veterans.

The Future of Farmers Insurance

As the insurance landscape continues to evolve, Farmers Insurance remains committed to staying at the forefront of innovation and customer satisfaction. With a focus on technology, data analytics, and personalized service, Farmers is well-positioned to meet the changing needs of homeowners in the digital age.

Digital Transformation

Farmers is investing heavily in digital transformation, leveraging technology to enhance the customer experience. From streamlined online quoting and policy management to advanced claims processing, Farmers is making it easier and more convenient for policyholders to interact with their insurance provider.

Data-Driven Insights

By harnessing the power of data analytics, Farmers is able to gain deeper insights into risk patterns and customer needs. This allows the company to develop more targeted and effective coverage options, as well as provide policyholders with personalized recommendations to mitigate risks and lower premiums.

Partnerships and Innovation

Farmers is actively exploring partnerships and collaborations to drive innovation in the insurance industry. Through collaborations with startups and established technology companies, Farmers is developing new solutions to enhance the customer experience and improve risk management.

Sustainability and Environmental Initiatives

In line with its commitment to community involvement, Farmers is increasingly focused on sustainability and environmental initiatives. The company is exploring ways to reduce its environmental impact, from adopting green business practices to offering incentives for policyholders who invest in energy-efficient renovations.

Continuing Education and Expertise

Farmers Insurance understands that staying ahead in the insurance industry requires a commitment to ongoing education and expertise. The company invests in training and development programs for its agents and employees, ensuring they remain at the forefront of industry knowledge and best practices.

Conclusion: A Trusted Partner for Homeowners

Farmers Insurance has established itself as a trusted partner for homeowners across the nation. With a rich history, a commitment to innovation, and a focus on customer satisfaction, Farmers provides comprehensive coverage, expert risk management, and seamless claims support.

As the company continues to evolve and adapt to the changing needs of homeowners, it remains dedicated to its founding principles: providing affordable, accessible insurance to protect the places people call home. With Farmers Insurance by their side, homeowners can rest easy, knowing their dreams and investments are safeguarded for years to come.

How do I choose the right homeowners insurance coverage for my needs?

+Choosing the right homeowners insurance coverage involves assessing your specific needs and risks. Consider factors such as the replacement cost of your home, the value of your personal belongings, and potential liability risks. Consult with a Farmers agent who can guide you through the available coverage options and help tailor a policy that provides adequate protection.

What should I do if I need to file a claim with Farmers Insurance?

+If you need to file a claim with Farmers Insurance, the first step is to contact your Farmers agent or the company’s 24⁄7 claims hotline. Provide as much detail as possible about the incident and any damages incurred. Farmers will guide you through the claims process, assign a dedicated claims specialist, and work to resolve your claim as quickly and efficiently as possible.

How can I take advantage of Farmers Insurance’s risk management resources and discounts?

+Farmers Insurance offers a wealth of resources and tools to help policyholders manage risks and qualify for discounts. Access these resources through your online account or by contacting your Farmers agent. Take advantage of risk assessment tools, safety guides, and preventative measures to mitigate potential losses. Additionally, review the available discounts and speak with your agent about how you can qualify for premium reductions.