Coverage Dental Insurance

The Ultimate Guide to Understanding Dental Insurance Coverage

Dental insurance is an essential aspect of healthcare coverage, offering individuals and families financial protection and access to essential dental services. With a wide range of plans and benefits available, it's crucial to have a comprehensive understanding of dental insurance to make informed decisions and maximize your coverage. In this guide, we will delve into the intricacies of dental insurance, providing you with the knowledge and insights to navigate the world of dental care confidently.

Understanding Dental Insurance Basics

Dental insurance operates similarly to other health insurance plans, providing coverage for a variety of dental procedures and services. It is designed to help individuals manage the costs associated with maintaining good oral health, which is closely linked to overall well-being.

At its core, dental insurance works by establishing a contract between the insurer and the policyholder. The insurer agrees to cover a portion of the costs for specified dental treatments, while the policyholder pays a premium and typically contributes through copays or deductibles.

Key Components of Dental Insurance

To comprehend dental insurance, it's essential to grasp its key components:

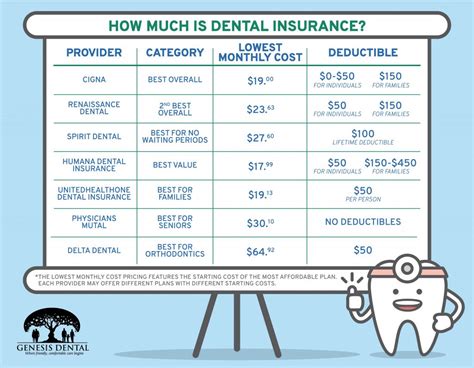

- Premiums: The regular payments made by the policyholder to maintain the insurance coverage.

- Deductibles: The amount the policyholder must pay out of pocket before the insurance coverage kicks in.

- Copayments (Copays): The fixed amount paid by the policyholder for a covered service, usually determined as a percentage of the total cost.

- Coinsurance: The percentage of the cost that the policyholder is responsible for after meeting the deductible.

- Maximum Annual Benefits: The highest amount the insurance company will pay toward covered services within a year.

- Network Providers: Dentists and specialists who have agreed to work with the insurance company, often offering reduced rates.

Types of Dental Insurance Plans

Dental insurance plans come in various forms, each with its own set of features and coverage levels. Understanding the different types of plans is crucial in selecting the right option for your needs.

Indemnity Plans

Indemnity, or fee-for-service plans, offer the most flexibility in choosing dental providers. With this type of plan, you can visit any dentist of your choice without being restricted to a specific network. The insurance company typically reimburses a percentage of the dentist's fees, and you pay the remaining balance.

| Pros | Cons |

|---|---|

| Flexibility in choosing dentists | Potentially higher out-of-pocket costs |

| Wide range of covered services | May require more paperwork for reimbursement |

| Customizable coverage options | Limited coverage for certain procedures |

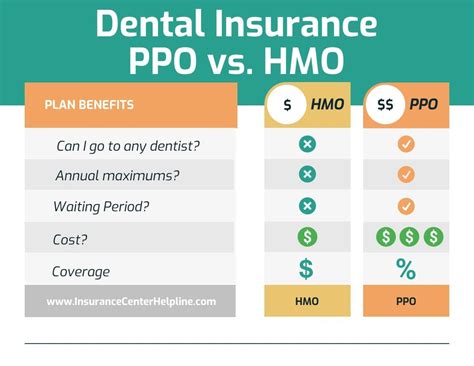

Preferred Provider Organization (PPO) Plans

PPO plans provide a balance between flexibility and cost savings. Policyholders have the freedom to choose from a network of preferred dentists, who agree to offer discounted rates. While you can still visit dentists outside the network, you may incur higher out-of-pocket expenses.

| Pros | Cons |

|---|---|

| Flexibility in choosing dentists within the network | Limited savings when visiting out-of-network providers |

| Potential for lower copays and deductibles | Limited coverage for out-of-network services |

| Comprehensive coverage for preventive care | Annual maximum benefits may be lower |

Health Maintenance Organization (HMO) Plans

HMO plans typically offer the most affordable premiums but come with stricter provider restrictions. Policyholders must choose a primary dentist from within the HMO network and receive referrals for specialized care. While HMOs may have lower out-of-pocket costs, the coverage options can be more limited.

| Pros | Cons |

|---|---|

| Affordable premiums | Limited choice of dentists |

| Lower out-of-pocket expenses | Need for referrals for specialized care |

| Focus on preventive care | Limited coverage for certain procedures |

Dental Insurance Coverage and Benefits

Dental insurance plans offer a range of benefits to policyholders, covering various dental procedures and services. The extent of coverage can vary significantly depending on the plan and the insurance provider.

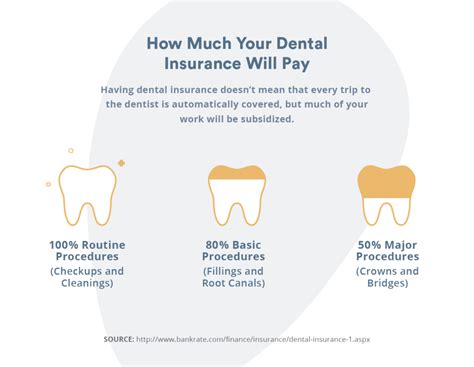

Preventive Care

Preventive care is a cornerstone of dental insurance, with most plans covering routine procedures that help maintain good oral health. This typically includes:

- Dental cleanings (usually twice a year)

- Dental exams and X-rays

- Fluoride treatments

- Sealants for children

Basic Restorative Procedures

Basic restorative procedures focus on repairing damaged teeth. These procedures are often covered at a higher percentage by dental insurance plans and may include:

- Fillings (amalgam or composite)

- Root canal treatments

- Extractions

- Periodontal (gum) treatments

Major Restorative Procedures

Major restorative procedures are more extensive and typically covered at a lower percentage or with specific limitations. These procedures might include:

- Crowns

- Bridges

- Dentures

- Implants

Orthodontic Care

Orthodontic care, such as braces and other forms of teeth straightening, is often covered to a certain extent by dental insurance plans. However, it's important to note that orthodontic coverage usually has separate maximums and waiting periods.

Maximizing Your Dental Insurance Coverage

To get the most out of your dental insurance, it's essential to understand how to navigate the system effectively.

Choosing the Right Dentist

Select a dentist who accepts your insurance plan and is experienced in working with insurance companies. This can streamline the billing process and ensure you receive the maximum coverage.

Understanding Your Benefits

Familiarize yourself with your plan's benefits and limitations. Review the policy documents, and don't hesitate to reach out to your insurance provider for clarification on specific procedures and their coverage.

Utilizing Preventive Care

Make the most of your preventive care coverage by scheduling regular dental check-ups and cleanings. Preventive care is often fully covered, and it's a crucial step in maintaining good oral health and catching potential issues early.

Exploring Alternative Treatments

If a particular procedure is not fully covered by your insurance, discuss alternative treatments with your dentist. Sometimes, a slightly different approach can result in better coverage and reduced out-of-pocket costs.

Filing Claims Promptly

Submit your insurance claims as soon as possible after receiving treatment. This ensures timely processing and minimizes the risk of delays or denials due to missing information.

Common Challenges and Solutions

While dental insurance is designed to provide coverage, there are common challenges that policyholders may encounter.

Dental Insurance Denials

Insurance claims can be denied for various reasons, such as missing information, pre-existing conditions, or non-covered procedures. If your claim is denied, carefully review the denial notice and contact your insurance provider to understand the reason and explore options for appealing the decision.

Limited Coverage for Certain Procedures

Some dental procedures, especially major restorative and cosmetic treatments, may have limited coverage or specific restrictions. In such cases, consider alternative financing options or discuss payment plans with your dentist.

Waiting Periods

Certain dental plans may have waiting periods before certain procedures are covered. Understand the waiting periods for your plan and plan your dental treatments accordingly to avoid unexpected delays or out-of-pocket expenses.

The Future of Dental Insurance

The landscape of dental insurance is evolving, driven by technological advancements and changing consumer needs. Here are some trends and predictions for the future of dental insurance:

Digital Transformation

Dental insurance providers are increasingly adopting digital technologies to enhance the customer experience. This includes online portals for policyholders to manage their benefits, file claims, and track their dental history. The use of digital platforms can streamline processes and improve overall efficiency.

Focus on Preventive Care

With a growing emphasis on preventive care, dental insurance plans are likely to continue expanding their coverage for routine check-ups, cleanings, and preventive treatments. This shift towards preventive care can lead to better overall oral health and potentially reduce the need for more costly procedures in the future.

Personalized Treatment Plans

In the future, dental insurance may move towards more personalized treatment plans. By analyzing individual dental histories and risk factors, insurance providers could offer tailored coverage options and preventive measures to address specific needs.

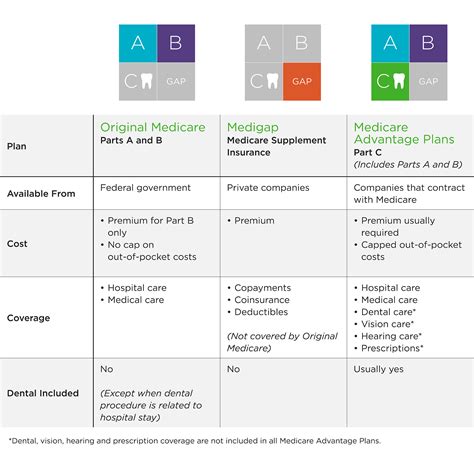

Integration with Overall Healthcare

There is a growing recognition of the link between oral health and overall well-being. As a result, dental insurance may become more integrated with medical insurance, offering coordinated care and coverage for procedures that impact both oral and general health.

Can I choose any dentist with my dental insurance plan?

+It depends on the type of plan you have. Indemnity plans offer the most flexibility, allowing you to choose any dentist. PPO plans also provide flexibility but within a network of preferred providers. HMO plans typically require you to choose a primary dentist from within their network.

What are the most common reasons for dental insurance claims to be denied?

+Claims can be denied for various reasons, including missing information, pre-existing conditions, non-covered procedures, or failure to meet the plan’s requirements. It’s essential to review your plan’s coverage and guidelines carefully to avoid common pitfalls.

How can I maximize my dental insurance coverage for major procedures?

+To maximize coverage for major procedures, consider the following: understand your plan’s limitations and exclusions, explore alternative treatments, discuss payment plans with your dentist, and consider supplemental insurance or dental savings plans to bridge the gap in coverage.

Are there any trends in dental insurance that could impact my coverage in the future?

+Yes, several trends are shaping the future of dental insurance. These include the digital transformation of insurance processes, a stronger focus on preventive care, the development of personalized treatment plans, and increased integration with overall healthcare. Staying informed about these trends can help you make better decisions regarding your dental insurance coverage.