Liability Cover Insurance

In the intricate landscape of modern business and personal affairs, the concept of liability looms large, posing potential threats to financial stability and operational continuity. This is where Liability Cover Insurance steps in, offering a vital safety net that provides peace of mind and crucial financial protection against unforeseen events and claims.

This article aims to delve into the multifaceted world of Liability Cover Insurance, exploring its diverse types, critical importance, and strategic role in safeguarding individuals and businesses against the myriad risks they face in today's complex and ever-changing world.

Understanding Liability Cover Insurance: A Comprehensive Overview

Liability Cover Insurance is a specialized form of insurance that protects individuals, businesses, and organizations from financial loss resulting from claims made against them for alleged negligence or wrongdoing. It serves as a critical safeguard, offering financial coverage for legal defense costs, settlements, and damages awarded in the event of a successful claim.

This type of insurance is designed to provide broad coverage across a range of liability risks, including but not limited to:

Public Liability: Covers claims arising from bodily injury or property damage caused to third parties as a result of the insured’s business operations or activities.

Product Liability: Protects against claims arising from defects or failures in products manufactured, sold, or supplied by the insured, resulting in injury or damage to others.

Professional Liability (Errors & Omissions): Provides coverage for claims of negligence, errors, or omissions in the provision of professional services, common in industries such as consulting, healthcare, and legal services.

Employers Liability: Insures against claims made by employees for work-related injuries or illnesses, offering coverage for medical expenses and potential compensation.

Environmental Liability: Covers claims arising from environmental damage or pollution caused by the insured’s operations, including cleanup costs and potential third-party claims.

The Importance of Liability Cover Insurance: Navigating a Complex Risk Landscape

In today’s complex and interconnected world, the potential for liability claims is ever-present, with a wide range of factors contributing to the increased risk landscape:

Increasing Legal Awareness: Growing public awareness of legal rights and the willingness to pursue claims has led to a surge in litigation, making liability protection increasingly critical.

Regulatory Environment: Stringent regulations and compliance requirements across various industries, coupled with potential penalties for non-compliance, underscore the importance of robust liability coverage.

Technology & Innovation: Rapid technological advancements and the emergence of new business models introduce unique liability risks, particularly in the digital space, necessitating specialized insurance coverage.

Supply Chain Complexity: The interconnectedness of global supply chains exposes businesses to risks beyond their immediate control, underscoring the need for comprehensive liability protection.

Environmental Concerns: Growing environmental awareness and stricter environmental regulations have heightened the risk of claims related to pollution, waste management, and climate change, making environmental liability coverage essential.

Strategic Considerations for Effective Liability Cover Insurance

To ensure optimal protection and peace of mind, several key considerations come into play when selecting and tailoring Liability Cover Insurance:

Risk Assessment: Conduct a thorough assessment of potential liability risks specific to your industry, business operations, and geographic location. Identify the unique risks you face and tailor your insurance coverage accordingly.

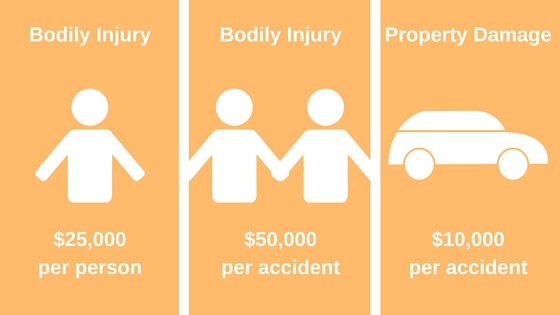

Coverage Limits: Determine the appropriate coverage limits based on the potential severity of claims you may face. Consider factors such as the size of your business, the nature of your operations, and the financial impact of a major claim.

Policy Wording: Carefully review the policy wording to ensure it aligns with your specific needs and risks. Pay close attention to exclusions and limitations to avoid any unexpected gaps in coverage.

Deductibles & Retentions: Assess your financial capacity and risk appetite when determining deductibles and retentions. A higher deductible can result in lower premiums, but it’s essential to ensure you have the financial resources to cover potential claims.

Risk Management: Implement robust risk management practices to mitigate potential liability risks. This may include employee training, safety protocols, product testing, and regular reviews of your operations and processes.

Loss Prevention: Focus on loss prevention strategies to reduce the likelihood of claims. This can involve implementing best practices, adhering to industry standards, and staying updated on regulatory changes to minimize potential exposure.

Real-World Case Studies: The Impact of Liability Cover Insurance

Liability Cover Insurance has proven its value time and again in a myriad of real-world scenarios, offering crucial protection and financial support to individuals and businesses facing significant liability claims. Here are a few illustrative examples:

Case Study 1: Product Liability in the Consumer Goods Industry

A well-known consumer goods manufacturer faced a significant product liability claim when a defect in one of its popular kitchen appliances caused fires in several households. The manufacturer, insured with comprehensive product liability coverage, was able to swiftly address the issue, recall the affected products, and manage the associated costs, including legal fees and compensation for affected consumers.

Case Study 2: Professional Liability in the Consulting Industry

A consulting firm specializing in financial services was sued for alleged negligence in its advice to a major client, resulting in substantial financial losses. The firm’s professional liability insurance coverage provided the necessary financial backing to mount a robust defense and ultimately settle the claim, minimizing the potential impact on its reputation and financial stability.

Case Study 3: Environmental Liability in the Energy Sector

An oil and gas exploration company faced a significant environmental liability claim when a pipeline leak resulted in pollution of a nearby river, impacting local wildlife and communities. The company’s environmental liability insurance coverage helped cover the substantial cleanup costs and provided financial support for potential third-party claims, allowing the company to focus on its core operations while managing the environmental impact.

The Future of Liability Cover Insurance: Evolving Trends and Innovations

As the risk landscape continues to evolve, the insurance industry is adapting and innovating to meet the changing needs of individuals and businesses. Here are some key trends shaping the future of Liability Cover Insurance:

Specialized Coverage for Emerging Risks: The development of specialized insurance products to address unique liability risks associated with emerging technologies, such as artificial intelligence, blockchain, and the Internet of Things.

Data-Driven Risk Assessment: The increasing use of advanced analytics and big data to enhance risk assessment and underwriting processes, enabling more accurate and tailored insurance solutions.

Parametric Insurance: The rise of parametric insurance, which provides rapid payouts based on predefined triggers, offering a more efficient and flexible approach to managing certain types of liability risks.

Risk Mitigation Services: Insurance providers are increasingly offering risk mitigation and loss prevention services as part of their insurance packages, helping policyholders reduce their liability exposure and enhance their overall risk management capabilities.

Collaboration & Partnerships: The insurance industry is fostering collaborations and partnerships with other sectors, such as technology and consulting, to develop innovative solutions that address complex liability risks.

Conclusion: Navigating the Future with Confidence

In an increasingly complex and uncertain world, Liability Cover Insurance serves as a vital tool for individuals and businesses to manage their exposure to liability risks. By understanding the diverse types of liability coverage, assessing their specific risks, and strategically tailoring their insurance policies, they can navigate the future with confidence, knowing they have the necessary protection in place.

As the risk landscape continues to evolve, staying abreast of emerging trends and innovations in the insurance industry will be crucial for effective risk management and long-term resilience. With the right insurance coverage and a proactive approach to risk mitigation, individuals and businesses can focus on their core objectives, secure in the knowledge that they are well-prepared to face the challenges and opportunities that lie ahead.

What is the main purpose of Liability Cover Insurance?

+Liability Cover Insurance serves as a financial safeguard, providing protection against claims made against individuals, businesses, or organizations for alleged negligence or wrongdoing. It covers legal defense costs, settlements, and damages awarded in the event of a successful claim, offering crucial financial support and peace of mind.

How do I determine the appropriate coverage limits for my Liability Cover Insurance policy?

+Determining coverage limits involves assessing the potential severity of claims you may face. Consider factors such as the size of your business, the nature of your operations, and the financial impact of a major claim. It’s essential to strike a balance between adequate coverage and affordability, ensuring you have the financial resources to cover potential claims.

What are some key risk management practices to mitigate liability risks?

+Implementing robust risk management practices is crucial for mitigating liability risks. This includes employee training on safety protocols, regular reviews of operations and processes, product testing, and staying updated on industry standards and regulations. By proactively managing risks, you can minimize the likelihood of claims and potential financial losses.