How To Find Car Insurance

Navigating the world of car insurance can be a complex task, but with the right information and guidance, you can find the best coverage to suit your needs. This comprehensive guide will take you through the essential steps and considerations when searching for car insurance, helping you make informed decisions and ultimately save money. By understanding the key factors and comparing different policies, you'll be equipped to choose the right insurance provider and secure the protection your vehicle deserves.

Understanding Your Insurance Needs

Before embarking on your car insurance journey, it's crucial to assess your specific requirements. Consider the following factors to tailor your search:

Vehicle Type and Usage

The type of vehicle you own and how you use it play a significant role in determining your insurance needs. Different vehicles have varying risk profiles, and your insurance premiums will reflect this. For instance, sports cars or high-performance vehicles often attract higher premiums due to their association with increased risk and potential for accidents. On the other hand, if you own an older, less valuable car, you may opt for more basic coverage to keep costs down.

Driver Profile

Your driving history and personal circumstances are key considerations for insurers. Factors such as your age, gender, driving experience, and even your occupation can impact your insurance rates. Younger drivers, for example, are generally considered higher-risk due to their lack of experience, resulting in higher premiums. Conversely, mature drivers with a clean driving record may benefit from more competitive rates.

Coverage Options

Car insurance policies offer a range of coverage options, each with its own benefits and costs. Understanding these options is essential to ensure you get the right protection. Here's a breakdown of some common coverage types:

- Liability Coverage: This is the most basic form of car insurance, covering damages you cause to others in an accident. It includes bodily injury liability and property damage liability.

- Collision Coverage: This option covers damages to your vehicle resulting from a collision with another vehicle or object, regardless of fault.

- Comprehensive Coverage: This type of insurance provides protection for damages caused by non-collision events, such as theft, vandalism, weather-related incidents, or collisions with animals.

- Uninsured/Underinsured Motorist Coverage: This coverage safeguards you if you're involved in an accident with a driver who has no insurance or insufficient insurance.

- Personal Injury Protection (PIP): PIP covers medical expenses and lost wages for you and your passengers, regardless of fault.

- Medical Payments Coverage: Similar to PIP, this option covers medical expenses for you and your passengers after an accident.

- Roadside Assistance: This add-on provides assistance in case of emergencies, such as flat tires, dead batteries, or running out of fuel.

It's important to note that the availability and requirements for these coverage options may vary by state and insurance provider. Understanding your state's minimum insurance requirements is essential to ensure you meet the legal obligations.

Assessing Your Risk Profile

Your risk profile is a critical factor in determining your insurance premiums. Insurers assess your risk based on various factors, including your driving history, credit score, and even the neighborhood you live in. A history of accidents or traffic violations can increase your perceived risk, leading to higher premiums. Similarly, a low credit score may also result in higher rates, as insurers often view individuals with lower credit scores as higher-risk.

By understanding your risk profile and taking steps to mitigate potential risks, you can potentially lower your insurance costs. For example, maintaining a clean driving record, improving your credit score, and installing safety features in your vehicle can all contribute to a more favorable risk assessment.

Comparing Insurance Providers and Quotes

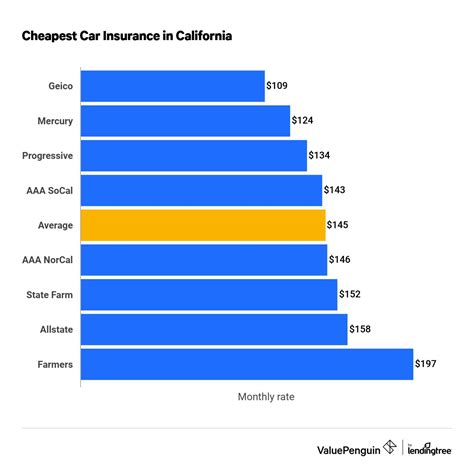

Once you have a clear understanding of your insurance needs, it's time to compare different providers and their offerings. The car insurance market is highly competitive, and insurers often differentiate themselves based on their coverage options, customer service, and pricing.

Researching Insurance Companies

Start by researching reputable insurance companies in your area. Look for providers that offer the coverage options you require and have a solid reputation for customer satisfaction. Online reviews and ratings can be helpful, but it's important to consider them alongside other factors.

Obtaining Quotes

Requesting quotes from multiple insurers is essential to finding the best deal. Many insurance companies offer online quote tools, allowing you to input your information and receive personalized estimates. Ensure you provide accurate and detailed information to get an accurate quote.

Comparing Coverage and Prices

When comparing quotes, pay attention to the coverage limits and deductibles. A lower premium may not always be the best option if it comes with reduced coverage or a higher deductible. Assess the value proposition of each quote by considering the coverage you'll receive relative to the price.

| Insurance Provider | Coverage Limits | Deductible | Annual Premium |

|---|---|---|---|

| Provider A | $100,000 / $300,000 | $500 | $1,200 |

| Provider B | $50,000 / $100,000 | $250 | $900 |

| Provider C | $200,000 / $500,000 | $1,000 | $1,500 |

In the table above, Provider A offers higher coverage limits but a higher deductible and premium compared to Provider B. Provider C, on the other hand, provides the highest coverage limits but at a higher cost. Your decision should be based on your specific needs and budget.

Bundling Policies

If you have multiple insurance needs, such as home and auto insurance, consider bundling your policies with the same provider. Many insurers offer discounts for customers who bundle multiple policies, potentially saving you a significant amount.

Negotiating and Customizing Your Policy

Once you've found a few insurers that meet your needs and offer competitive rates, it's time to negotiate and customize your policy to ensure you're getting the best value.

Negotiating Premiums

Don't be afraid to negotiate with insurance providers. Many insurers are willing to work with you to find a premium that fits your budget while still providing adequate coverage. Discuss your specific circumstances and any potential discounts you may be eligible for.

Customizing Your Coverage

Work with your insurer to customize your policy to your exact needs. Review the coverage options and limits to ensure you're not paying for coverage you don't need or want. For example, if you have an older vehicle with low resale value, you may choose to forgo collision coverage to save money.

Exploring Discounts

Insurance companies often offer a variety of discounts to attract and retain customers. Some common discounts include:

- Multi-Policy Discount: As mentioned earlier, bundling your auto insurance with other policies, such as home or renters insurance, can result in significant savings.

- Safe Driver Discount: If you have a clean driving record, you may be eligible for a safe driver discount, which can lower your premiums.

- Good Student Discount: Many insurers offer discounts to young drivers who maintain good grades in school.

- Loyalty Discount: Staying with the same insurer for an extended period may result in loyalty discounts.

- Low Mileage Discount: If you drive fewer miles annually, you may qualify for a low mileage discount.

- Safety Features Discount: Installing safety features like anti-theft devices or advanced driver-assistance systems in your vehicle can reduce your premiums.

Remember to inquire about any applicable discounts when speaking with insurance providers. These discounts can significantly reduce your overall insurance costs.

Additional Considerations and Tips

Understanding Deductibles

Deductibles are the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible typically results in a lower premium, as you’re assuming more of the financial risk. Consider your financial situation and comfort level when choosing a deductible. It’s essential to ensure you can afford the deductible in the event of an accident or claim.

Maintaining a Good Driving Record

A clean driving record is not only important for keeping your insurance premiums low but also for ensuring your safety and the safety of others on the road. Avoid speeding, distracted driving, and other risky behaviors. If you have a history of accidents or violations, work on improving your driving habits and consider taking a defensive driving course to demonstrate your commitment to safe driving.

Regularly Review and Update Your Policy

Your insurance needs may change over time, so it’s important to regularly review your policy and make updates as necessary. Life events such as getting married, having children, or purchasing a new vehicle can impact your insurance requirements. Stay informed about any changes in your circumstances and communicate them to your insurer to ensure you have the right coverage.

Seek Professional Advice

If you’re unsure about any aspect of car insurance or have complex insurance needs, consider seeking advice from an insurance professional or broker. They can provide personalized guidance based on your specific circumstances and help you navigate the often-confusing world of insurance.

Conclusion

Finding the right car insurance can be a challenging task, but with a thorough understanding of your needs, careful comparison of providers, and effective negotiation, you can secure the coverage you need at a competitive price. Remember to regularly review and update your policy to ensure it aligns with your changing circumstances. By following the steps outlined in this guide, you’ll be well-equipped to make informed decisions and protect your vehicle and yourself on the road.

How often should I review my car insurance policy?

+It’s a good practice to review your car insurance policy annually or whenever your circumstances change significantly. This ensures your coverage remains adequate and up-to-date.

Can I switch insurance providers mid-policy term?

+Yes, you can switch insurance providers at any time, but be aware that you may incur cancellation fees or have to pay a prorated amount for the remaining term of your current policy.

What should I do if I’m involved in an accident?

+If you’re involved in an accident, remain calm and follow these steps: first, ensure the safety of yourself and others; then, call the police to report the accident; exchange information with the other driver(s); and finally, notify your insurance company as soon as possible.

How can I improve my chances of getting lower insurance rates?

+To improve your chances of getting lower insurance rates, maintain a clean driving record, improve your credit score, and consider installing safety features in your vehicle. Additionally, shopping around and comparing quotes from multiple insurers can help you find the best deal.