The Number To Progressive Insurance

Progressive Insurance is a well-known name in the insurance industry, offering a wide range of coverage options to meet the diverse needs of its customers. With a focus on innovation and customer satisfaction, Progressive has become a prominent player in the market. In this article, we will delve into the details of Progressive Insurance, exploring its history, services, and the various ways to contact them, including the all-important number for customer support.

A Legacy of Innovation: Progressive Insurance’s Story

Progressive Insurance has a rich history that spans several decades, revolutionizing the insurance industry with its forward-thinking approach. Founded in 1937 by Joseph Lewis, the company began as a small, regional insurer in Ohio. However, its vision and commitment to customer-centric services soon propelled it to national prominence.

One of Progressive's key milestones was the introduction of the Pay-As-You-Drive (PAYD) insurance policy in 1998. This innovative offering allowed customers to pay premiums based on their actual driving behavior, providing a more flexible and cost-effective insurance option. This groundbreaking initiative not only disrupted the traditional insurance model but also set a new standard for personalized insurance plans.

Over the years, Progressive has continued to lead the industry with its tech-driven solutions. The company was an early adopter of telematics technology, utilizing it to provide real-time driving data and enhance the accuracy of insurance rates. This technology-first approach has not only benefited customers but has also positioned Progressive as a leader in the digital transformation of the insurance sector.

As of 2023, Progressive Insurance boasts an impressive customer base of over 20 million policyholders across the United States. Its comprehensive range of services includes auto, home, renters, and commercial insurance, along with specialty products like boat, motorcycle, and pet insurance. With a commitment to providing accessible and affordable coverage, Progressive has become a trusted partner for individuals and businesses alike.

Services and Coverage Offered by Progressive Insurance

Progressive Insurance offers a comprehensive suite of insurance services, catering to a wide range of customer needs. Here’s a detailed breakdown of their offerings:

Auto Insurance

Progressive’s auto insurance policies are designed to provide comprehensive protection for vehicles. Key features include:

- Collision Coverage: This policy option covers damages to your vehicle resulting from accidents, regardless of fault.

- Comprehensive Coverage: Provides protection against non-collision-related incidents such as theft, vandalism, or natural disasters.

- Liability Coverage: Protects you from financial losses arising from accidents you cause, including bodily injury and property damage.

- Uninsured/Underinsured Motorist Coverage: Offers protection if you’re involved in an accident with a driver who doesn’t have sufficient insurance coverage.

- Roadside Assistance: A 24⁄7 service that provides emergency support for various situations like flat tires, dead batteries, or towing needs.

Home Insurance

Progressive’s home insurance policies are tailored to protect homeowners and renters. Key features include:

- Dwelling Coverage: Provides financial protection for the structure of your home, covering damages caused by perils such as fire, wind, or vandalism.

- Personal Property Coverage: Protects the contents of your home, including furniture, electronics, and personal belongings.

- Liability Coverage: Covers legal expenses and damages if someone is injured on your property or you’re held responsible for an injury or property damage.

- Additional Living Expenses: Offers reimbursement for temporary living expenses if your home becomes uninhabitable due to a covered loss.

Renters Insurance

For renters, Progressive offers a dedicated insurance policy that provides:

- Personal Property Coverage: Protects your belongings, including furniture, electronics, and clothing, against losses due to fire, theft, or other covered perils.

- Liability Coverage: Covers legal expenses and damages if someone is injured in your rented home or you’re held responsible for property damage.

- Medical Payments to Others: Provides coverage for medical expenses if someone is injured on your rented premises, regardless of fault.

Commercial Insurance

Progressive’s commercial insurance policies are tailored to meet the unique needs of businesses. These policies cover a wide range of business types and can include:

- Business Owners Policy (BOP): A comprehensive policy that combines property and liability coverage, tailored to small and medium-sized businesses.

- General Liability Insurance: Protects businesses from third-party claims, including bodily injury and property damage.

- Professional Liability Insurance: Provides coverage for professional service providers against negligence claims.

- Workers’ Compensation Insurance: Covers medical expenses and lost wages for employees injured on the job.

Specialty Insurance

In addition to the above, Progressive offers a range of specialty insurance products, including:

- Motorcycle Insurance: Tailored coverage for motorcycle owners, including liability, collision, and comprehensive protection.

- Boat Insurance: Provides coverage for boats and personal watercraft, including liability, physical damage, and emergency assistance.

- RV Insurance: Comprehensive coverage for recreational vehicles, including liability, collision, and comprehensive protection, as well as personal belongings coverage.

- Pet Insurance: Offers medical coverage for pets, including accidents, illnesses, and routine care.

Contacting Progressive Insurance: The Number and Beyond

Progressive Insurance understands the importance of accessible customer support. Here are the various ways you can get in touch with them:

The Progressive Insurance Number

For immediate assistance, Progressive provides a dedicated customer support number. The number to call for general inquiries and policy-related matters is 1-800-PROGRESSIVE (1-800-776-4774). This number is operational 24 hours a day, 7 days a week, ensuring that customers can reach out at their convenience.

Additional Contact Methods

Apart from the customer support number, Progressive offers several other contact options:

- Online Chat: You can initiate a live chat with a Progressive representative through their website. This option is available during standard business hours.

- Email: For non-urgent inquiries, you can send an email to info@progressive.com. Please note that response times may vary.

- Social Media: Progressive is active on social media platforms like Facebook and Twitter. You can reach out to their support teams through direct messages or public posts.

- Mobile App: Progressive’s mobile app, available on iOS and Android devices, offers a convenient way to manage your policy, make payments, and contact support directly.

- Local Offices: Progressive has a network of local offices across the United States. You can locate the office nearest to you and visit for in-person assistance.

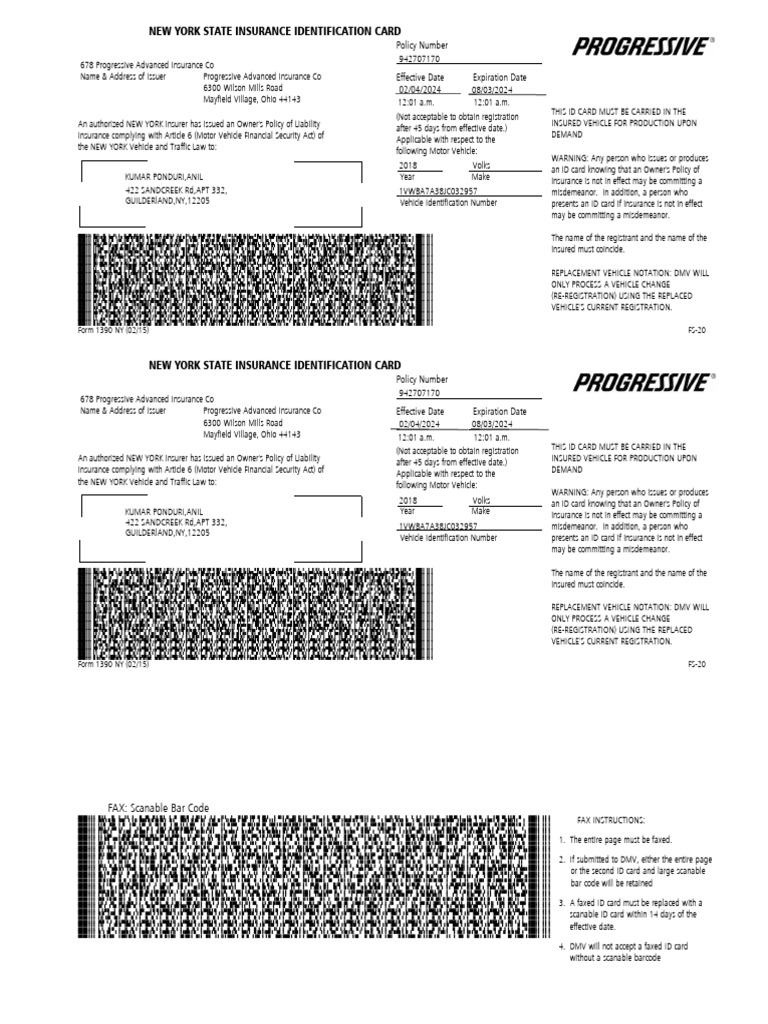

When contacting Progressive, it's beneficial to have your policy number and other relevant details handy to ensure a smooth and efficient support experience.

Conclusion: Progressive Insurance’s Customer-Centric Approach

Progressive Insurance’s commitment to innovation and customer satisfaction has solidified its position as a leading insurance provider. With a wide range of coverage options, accessible customer support, and a focus on digital transformation, Progressive continues to meet the evolving needs of its customers. Whether you’re seeking auto, home, or specialty insurance, Progressive offers tailored solutions to provide the protection you need.

How can I get a quote from Progressive Insurance?

+

Getting a quote from Progressive Insurance is straightforward. You can visit their website and use the online quote tool, which will guide you through the process of providing your personal and vehicle details. Alternatively, you can call the customer support number (1-800-PROGRESSIVE) and speak to a representative who can assist you in getting a personalized quote.

What are the key benefits of Progressive’s Pay-As-You-Drive (PAYD) insurance policy?

+

Progressive’s PAYD policy offers several benefits, including cost savings for safe drivers, real-time feedback on driving behavior, and personalized insurance rates based on actual usage. This policy provides a more flexible and tailored insurance option, allowing customers to pay premiums based on their individual driving habits.

Does Progressive Insurance offer discounts on their policies?

+

Yes, Progressive Insurance offers a range of discounts to help customers save on their insurance premiums. These discounts include multi-policy discounts (for bundling multiple policies with Progressive), safe driver discounts, good student discounts, and loyalty discounts for long-term customers. Additionally, Progressive’s Snapshot program rewards safe driving habits with potential discounts.