Louisiana Marketplace Insurance

Louisiana Marketplace Insurance, also known as the Louisiana Health Insurance Exchange, is a vital resource for residents of the state to obtain affordable health coverage. Established as part of the Patient Protection and Affordable Care Act (ACA), the exchange plays a crucial role in providing access to healthcare for individuals and families. This comprehensive guide will delve into the intricacies of Louisiana Marketplace Insurance, offering an in-depth analysis of its features, benefits, and impact on the healthcare landscape of the state.

Understanding Louisiana Marketplace Insurance

Louisiana Marketplace Insurance is an online platform that simplifies the process of comparing and purchasing health insurance plans. It is designed to offer a range of options, ensuring that residents can find coverage that suits their unique needs and budgets. The exchange operates under the guidance of the Louisiana Department of Insurance, which oversees the regulation and implementation of healthcare policies.

The key objective of Louisiana Marketplace Insurance is to increase the number of insured individuals and reduce the overall cost of healthcare. By aggregating various insurance plans, the exchange creates a competitive environment, driving down prices and making insurance more accessible. This initiative is particularly beneficial for those who may have struggled to obtain coverage due to pre-existing conditions or high costs.

Eligibility and Enrollment

Eligibility for Louisiana Marketplace Insurance is open to all Louisiana residents who are not eligible for Medicare or Medicaid. The exchange caters to individuals, families, and small businesses, offering a variety of plans to meet different healthcare needs. Enrollment periods are typically announced annually, allowing individuals to review their options and make informed decisions about their coverage.

During the open enrollment period, individuals can compare plans based on factors such as premiums, deductibles, copayments, and coverage limits. The exchange provides tools and resources to assist users in understanding their options and making choices that align with their healthcare requirements.

| Enrollment Period | Plan Types |

|---|---|

| November 1st - December 15th | Individual, Family, and Small Business Plans |

| Special Enrollment Periods | Available for qualifying life events (e.g., marriage, birth, loss of other coverage) |

Plan Options and Coverage

Louisiana Marketplace Insurance offers a diverse range of plan options, categorized into different metal tiers based on the expected cost-sharing between the insurance provider and the policyholder.

Metal Tiers

The metal tiers system is a standard classification used in health insurance marketplaces across the United States. It provides a straightforward way for individuals to understand the level of coverage and cost-sharing associated with each plan.

- Bronze Plans: These plans typically have lower premiums but higher deductibles and out-of-pocket costs. They are ideal for individuals who anticipate minimal healthcare needs or have a limited budget for insurance.

- Silver Plans: Silver plans offer a balance between premiums and out-of-pocket costs. They are a popular choice for individuals who want comprehensive coverage without breaking the bank.

- Gold Plans: Gold plans provide extensive coverage with higher premiums and lower deductibles. They are suitable for those who anticipate frequent healthcare needs or require specialized medical services.

- Platinum Plans: Platinum plans offer the most comprehensive coverage with the highest premiums and lowest out-of-pocket costs. They are designed for individuals with significant healthcare requirements or those who want the utmost peace of mind.

Covered Services

Louisiana Marketplace Insurance plans must include essential health benefits as mandated by the ACA. These benefits encompass a wide range of services, including:

- Ambulatory patient services

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative and habilitative services and devices

- Laboratory services

- Preventive and wellness services

- Pediatric services, including oral and vision care

Benefits and Impact

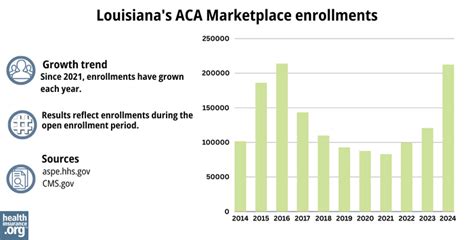

Louisiana Marketplace Insurance has had a significant positive impact on the state’s healthcare landscape. Since its inception, it has:

- Increased the number of insured individuals, reducing the uninsured rate in Louisiana.

- Provided access to affordable health coverage, especially for those with pre-existing conditions.

- Promoted competition among insurance providers, leading to more competitive pricing and plan options.

- Offered comprehensive benefits, ensuring that residents receive essential healthcare services.

- Simplified the insurance purchasing process, making it more accessible and user-friendly.

Success Stories

One notable success story is that of Sarah, a small business owner in Baton Rouge. Sarah struggled to find affordable health insurance for her and her employees due to pre-existing conditions. However, with Louisiana Marketplace Insurance, she was able to secure a group plan that provided comprehensive coverage at a reasonable cost. This not only improved her employees’ access to healthcare but also boosted morale and productivity within her business.

Navigating Louisiana Marketplace Insurance

Understanding the intricacies of Louisiana Marketplace Insurance can be a complex task, but the exchange provides various resources to guide individuals through the process.

Resources and Support

The Louisiana Department of Insurance offers a wealth of information and tools to assist residents in navigating the exchange. These resources include:

- Online Platform: The official Louisiana Marketplace Insurance website provides a user-friendly interface for comparing plans, calculating costs, and enrolling in coverage.

- Assister Programs: Certified assisters are available to provide personalized guidance and support throughout the enrollment process. These professionals can help individuals understand their options and complete the necessary paperwork.

- Community Outreach: The exchange organizes community events and workshops to raise awareness about healthcare coverage and assist individuals in finding the right plans for their needs.

- Educational Materials: A range of educational resources, including brochures, fact sheets, and videos, are available to help individuals understand the nuances of health insurance and make informed decisions.

Future Implications and Considerations

As Louisiana Marketplace Insurance continues to evolve, several key considerations come into play.

Policy Updates and Reforms

The future of Louisiana Marketplace Insurance is closely tied to healthcare policy reforms at both the state and federal levels. Ongoing discussions and legislative changes may impact the availability and affordability of insurance plans. It is crucial for individuals and businesses to stay informed about these developments to ensure they can adapt their coverage strategies accordingly.

Technological Advancements

The healthcare industry is rapidly embracing digital technologies, and Louisiana Marketplace Insurance is no exception. Ongoing investments in technological infrastructure are expected to enhance the user experience, streamline enrollment processes, and improve data security. These advancements will play a vital role in making health insurance more accessible and efficient.

Consumer Education

While Louisiana Marketplace Insurance has made significant strides in increasing access to healthcare, ongoing consumer education remains essential. Many individuals still face challenges in understanding their coverage options and utilizing their plans effectively. Continued efforts in outreach and education will be crucial to ensuring that residents make the most of their healthcare coverage.

How do I qualify for Louisiana Marketplace Insurance?

+To qualify for Louisiana Marketplace Insurance, you must be a resident of Louisiana and not eligible for Medicare or Medicaid. You can enroll during the open enrollment period, which typically occurs from November 1st to December 15th. However, you may also qualify for a special enrollment period if you experience a qualifying life event, such as marriage, birth, or loss of other coverage.

What are the benefits of using Louisiana Marketplace Insurance?

+Louisiana Marketplace Insurance offers several benefits, including a wide range of plan options to choose from, essential health benefits coverage, and access to affordable insurance plans, especially for those with pre-existing conditions. The exchange also provides resources and support to guide individuals through the enrollment process.

Can I enroll in Louisiana Marketplace Insurance outside of the open enrollment period?

+Yes, you can enroll outside of the open enrollment period if you experience a qualifying life event, such as getting married, having a baby, or losing other health coverage. These events allow you to enroll in a special enrollment period, ensuring you have continuous healthcare coverage.