Insurance Policy Business

In the world of finance and risk management, the concept of insurance has long been an essential tool for individuals and businesses alike. An insurance policy is a financial contract designed to protect policyholders from various risks and uncertainties, offering peace of mind and a safety net in times of need. This article delves into the intricate world of insurance policies, exploring their importance, the diverse types available, and the critical role they play in modern business operations.

Understanding Insurance Policies: A Comprehensive Overview

Insurance policies serve as a critical mechanism to mitigate risks and financial liabilities. At its core, an insurance policy is a legal agreement between an insurance company (the insurer) and an individual or entity (the policyholder) wherein the insurer promises to compensate the policyholder for specific losses, damages, or liabilities in exchange for regular premium payments.

The world of insurance is vast, offering a wide array of policies tailored to address different risks and industries. From health and life insurance, which provide coverage for personal well-being and financial security, to property and casualty insurance, which protect against losses related to homes, businesses, and vehicles, the range of insurance types is comprehensive.

The Significance of Insurance Policies in Modern Business

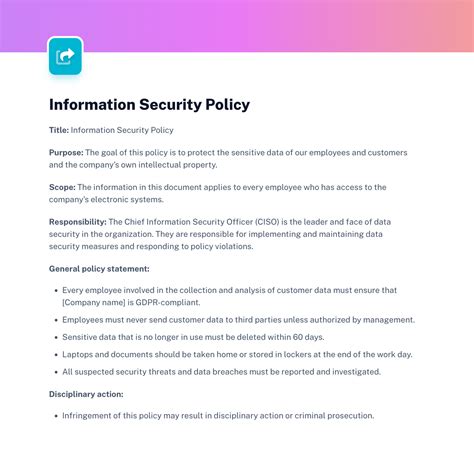

For businesses, insurance policies are an indispensable tool for risk management and financial stability. In today’s dynamic and often unpredictable business landscape, risks abound, ranging from natural disasters and cyber attacks to product liabilities and employee injuries. Insurance policies provide a critical layer of protection, helping businesses navigate these risks with confidence and resilience.

Consider, for instance, a small business owner who has invested their life savings into a retail store. Without proper insurance, a single catastrophic event, such as a fire or a major theft, could lead to devastating financial losses, potentially forcing the business to close its doors forever. However, with the right insurance policy in place, the business owner can have the assurance that their losses will be covered, allowing them to focus on rebuilding and continuing their operations.

Moreover, insurance policies are not just a safety net; they are also a strategic tool for business growth. Many insurance policies offer additional benefits and services that can enhance a business's operations and reputation. For example, some policies provide access to expert advice and resources, helping businesses improve their risk management strategies and operational efficiency.

Types of Insurance Policies and Their Applications

The insurance industry offers a plethora of policy types, each designed to address specific risks and industries. Here’s a glimpse into some of the most common insurance policies and their unique applications:

1. Property Insurance

Property insurance is a cornerstone for businesses and individuals alike. It provides coverage for losses and damages to tangible assets such as buildings, equipment, inventory, and personal belongings. For businesses, property insurance is crucial to protect against the financial fallout of events like fires, storms, theft, or vandalism.

A real-world example of property insurance in action can be seen in the aftermath of a devastating hurricane that hits a coastal town. Businesses in the area, ranging from small cafes to large manufacturing plants, can file insurance claims to cover the costs of repairing or rebuilding their premises, replacing damaged equipment, and even covering temporary relocation expenses during the recovery period.

2. Liability Insurance

Liability insurance is a critical safeguard for businesses and individuals, protecting them against claims resulting from accidents, injuries, or negligence. This type of insurance is especially important for businesses that interact directly with the public or provide professional services, as it can cover legal costs and damages in the event of a lawsuit.

For instance, imagine a restaurant owner who has invested years of hard work into building their business. A slip and fall accident occurs on their premises, and a customer sustains serious injuries. Without liability insurance, the restaurant owner could face significant financial liability, potentially leading to bankruptcy. However, with adequate liability insurance, the restaurant owner can have the peace of mind that their legal costs and settlement payments will be covered, allowing them to continue their business operations.

3. Business Interruption Insurance

Business interruption insurance is a unique type of coverage designed to protect businesses from financial losses that occur when their operations are disrupted due to events such as fires, natural disasters, or even a global pandemic. This insurance provides a vital financial lifeline, helping businesses maintain their cash flow and cover ongoing expenses until they can resume normal operations.

During the COVID-19 pandemic, many businesses around the world had to temporarily shut down or drastically reduce their operations due to government-mandated lockdowns. Business interruption insurance played a crucial role in helping these businesses stay afloat, providing them with the necessary financial support to pay rent, salaries, and other essential expenses until they could reopen their doors to the public.

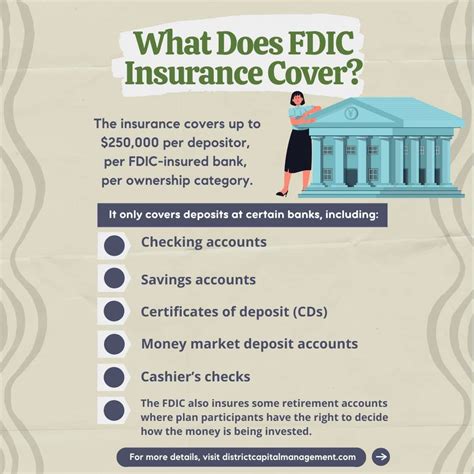

4. Cyber Insurance

In the digital age, the risks associated with cyber attacks and data breaches have become a significant concern for businesses. Cyber insurance policies are specifically designed to protect businesses from the financial fallout of these cyber incidents. They can cover a range of costs, including data recovery, system restoration, legal fees, and even customer notification expenses.

A cyber attack on a large e-commerce platform, for example, could result in a massive data breach, compromising the personal information of millions of customers. Without cyber insurance, the financial implications of such an incident could be catastrophic, potentially leading to lawsuits, regulatory fines, and irreparable damage to the company's reputation. However, with comprehensive cyber insurance coverage, the e-commerce platform can mitigate these risks and focus on restoring its systems and rebuilding customer trust.

5. Employee Benefits and Health Insurance

Providing employee benefits, including health insurance, is a critical aspect of attracting and retaining top talent. Health insurance policies offer coverage for medical expenses, ensuring that employees and their families have access to quality healthcare services. Additionally, employee benefits such as life insurance and disability coverage provide financial security and peace of mind for workers.

A thriving tech startup, for instance, may offer a comprehensive employee benefits package that includes health insurance, dental coverage, and even vision care. By providing these benefits, the startup can attract talented professionals who value comprehensive healthcare coverage. Moreover, the startup's commitment to employee well-being can foster a positive work environment, leading to increased productivity and employee satisfaction.

| Insurance Type | Key Coverage |

|---|---|

| Property Insurance | Physical assets, buildings, equipment, inventory |

| Liability Insurance | Accidents, injuries, negligence, legal costs |

| Business Interruption Insurance | Financial losses due to business disruptions |

| Cyber Insurance | Cyber attacks, data breaches, system restoration |

| Employee Benefits & Health Insurance | Medical expenses, life insurance, disability coverage |

The Future of Insurance Policies: Emerging Trends and Innovations

The insurance industry is continually evolving, driven by technological advancements, changing risk landscapes, and shifting consumer needs. Here are some key trends and innovations shaping the future of insurance policies:

1. Digital Transformation

The digital age has brought about a revolution in the way insurance policies are sold, serviced, and administered. Digital platforms and mobile apps are making it easier for consumers to compare policies, purchase coverage, and file claims. Additionally, digital tools are enabling insurers to streamline processes, improve efficiency, and enhance customer experiences.

For instance, many insurance companies now offer online portals where policyholders can access their policy details, make payments, and file claims, all from the comfort of their homes. These digital platforms often provide real-time updates, allowing policyholders to track the progress of their claims and stay informed about their coverage.

2. Data Analytics and AI

Advanced data analytics and artificial intelligence (AI) are transforming the insurance industry, enabling insurers to make more informed decisions and improve risk assessment. By analyzing vast amounts of data, insurers can identify patterns, predict future risks, and personalize insurance policies to meet individual needs.

For example, AI-powered chatbots are being used by some insurance companies to provide 24/7 customer support, answering common queries and guiding policyholders through the claims process. These chatbots can also learn from each interaction, improving their responses and enhancing the overall customer experience.

3. Parametric Insurance

Parametric insurance is an innovative approach that provides rapid payouts based on predefined parameters, such as weather conditions or seismic activity. This type of insurance is particularly useful for covering events like natural disasters, where traditional insurance claims can be complex and time-consuming.

In the case of a severe hurricane, parametric insurance policies could trigger automatic payouts to policyholders based on the storm's wind speed or rainfall intensity, providing them with immediate financial relief to start their recovery process.

4. Telematics and Usage-Based Insurance

Telematics and usage-based insurance policies are gaining popularity, especially in the auto insurance sector. These policies use real-time data from telematics devices installed in vehicles to monitor driving behavior and usage patterns. By incentivizing safe driving and rewarding low-risk behavior, these policies can lead to more affordable insurance rates for responsible drivers.

For instance, a young driver who installs a telematics device in their car may receive a discount on their insurance premium if they consistently maintain a safe driving record, demonstrating responsible behavior on the road.

5. Sustainable and Impact Insurance

As sustainability and environmental concerns rise to the forefront, the insurance industry is adapting with innovative products that support sustainable practices and address emerging risks. Sustainable insurance policies, for example, may offer incentives for businesses adopting eco-friendly practices, while impact insurance policies can help organizations manage risks associated with climate change and social responsibility.

A renewable energy company, for instance, may seek out insurance policies that specifically cater to their industry, providing coverage for risks such as equipment failure or supply chain disruptions. By partnering with an insurer committed to sustainability, the company can not only protect its operations but also contribute to a more environmentally conscious insurance market.

How do insurance policies work in practice, and what steps are involved in making a claim?

+Insurance policies operate through a well-defined process that involves several key steps. When an insured event occurs, the policyholder must first notify their insurance company about the incident. The insurer will then evaluate the claim, assessing the extent of the loss or damage and determining whether it falls within the policy’s coverage. If the claim is approved, the insurer will pay out the agreed-upon amount, either as a lump sum or through a structured payment plan. Throughout this process, policyholders can expect regular communication and guidance from their insurer to ensure a smooth claims experience.

What are some common misconceptions about insurance policies, and how can they be addressed?

+One common misconception is that insurance policies are a financial burden. However, the reality is that insurance provides invaluable protection and peace of mind. Another misconception is that all insurance policies are the same. In fact, policies can vary significantly based on the insurer, the type of coverage, and the specific needs of the policyholder. It’s essential to carefully review and understand the terms and conditions of any insurance policy to ensure it aligns with your unique circumstances and provides adequate coverage.

How can businesses leverage insurance policies to enhance their overall risk management strategies?

+Insurance policies are a critical component of any comprehensive risk management strategy. By carefully assessing their risks and identifying potential vulnerabilities, businesses can select insurance policies that provide tailored coverage. Additionally, insurance providers often offer risk management resources and expertise, helping businesses implement proactive measures to mitigate risks and reduce the likelihood of insurance claims.