Best Way To Compare Car Insurance

When it comes to choosing the right car insurance, finding the best deal and coverage can be a complex task. With numerous insurance providers offering a wide range of policies, it's essential to compare options thoroughly to ensure you get the most suitable coverage at an affordable price. This comprehensive guide will walk you through the process of comparing car insurance, highlighting the key factors to consider and providing insights to help you make an informed decision.

Understanding Your Car Insurance Needs

Before diving into the comparison process, it’s crucial to understand your specific insurance needs. Consider the following factors to tailor your search accordingly:

- Vehicle Type and Usage: The make, model, and purpose of your vehicle can impact insurance rates. For instance, sports cars or luxury vehicles often require higher premiums due to their value and potential for accidents.

- Driving History: Your driving record plays a significant role in insurance rates. A clean record with no accidents or traffic violations can lead to lower premiums, while a history of accidents or citations may result in higher costs.

- Coverage Requirements: Determine the level of coverage you need. This includes liability coverage, which is mandatory in most states, and optional coverages like collision, comprehensive, and personal injury protection (PIP) based on your preferences and state regulations.

- Budget and Deductibles: Assess your financial capabilities and decide on an insurance budget. Consider the impact of different deductible options on your premium. Higher deductibles can lead to lower premiums, but you’ll need to pay more out-of-pocket in the event of a claim.

Researching Insurance Providers

Once you have a clear understanding of your insurance needs, it’s time to research and evaluate insurance providers. Here’s a step-by-step approach to researching and comparing companies:

1. Identify Reputable Insurers

Start by identifying reputable insurance companies that offer car insurance in your area. You can do this through online searches, referrals from friends or family, or by checking with your state’s insurance department for a list of licensed providers.

2. Check Financial Stability

It’s essential to choose an insurer with a strong financial standing. This ensures they can pay out claims promptly and honor their commitments. Use independent rating agencies like A.M. Best, Moody’s, or Standard & Poor’s to assess an insurer’s financial strength and stability.

3. Review Customer Satisfaction and Claims Handling

Look for customer reviews and ratings to gauge an insurer’s reputation. Check online review platforms and industry-specific websites for insights into customer experiences. Additionally, consider the insurer’s claims handling process and response times, as this can significantly impact your satisfaction during a claim.

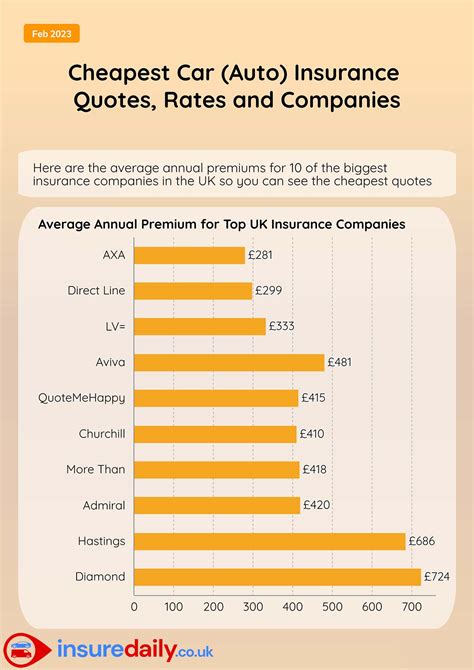

4. Compare Coverage Options and Costs

Request quotes from multiple insurers, providing accurate and detailed information about your vehicle, driving history, and desired coverage. Compare the quotes based on the coverage offered and the overall cost. Pay attention to any discounts or incentives provided by each insurer.

5. Evaluate Additional Benefits and Services

Beyond the basic coverage and cost, consider the additional benefits and services offered by insurers. This can include roadside assistance, rental car coverage, accident forgiveness, or discounts for safe driving or vehicle safety features. These extras can enhance your overall insurance experience.

Utilizing Comparison Tools and Websites

Comparison tools and websites can streamline the process of comparing car insurance options. These platforms allow you to input your details once and receive multiple quotes from different insurers, making it easier to find the best deal. Here’s how to make the most of these resources:

1. Choose Reputable Comparison Websites

Select well-known and trusted comparison websites that work with a variety of insurance providers. Check for reviews and ratings to ensure the platform is reliable and unbiased. Some popular comparison sites include InsuranceQuotes, TheZebra, and Compare.com.

2. Provide Accurate Information

When using comparison tools, be as accurate and detailed as possible when inputting your information. This ensures you receive relevant and accurate quotes. Include your vehicle details, driving history, desired coverage limits, and any applicable discounts.

3. Compare Quotes Side by Side

Use the comparison website’s features to view quotes side by side. Look for differences in coverage, deductibles, and premiums. Pay attention to any exclusions or limitations in the policy. This comprehensive view will help you identify the best overall value.

4. Consider Personalized Recommendations

Some comparison websites offer personalized recommendations based on your specific needs and preferences. These recommendations can be valuable, but always verify the details with the insurer to ensure accuracy.

Negotiating and Finalizing Your Insurance Policy

Once you’ve narrowed down your options, it’s time to negotiate and finalize your insurance policy. Here are some steps to ensure you get the best deal:

1. Negotiate Discounts and Bundles

Inquire about discounts and bundles offered by insurers. Common discounts include multi-policy discounts (bundling car and home insurance), safe driver discounts, student discounts, and loyalty discounts. Bundling policies with the same insurer can often result in significant savings.

2. Review Policy Terms and Conditions

Before finalizing your policy, carefully review the terms and conditions. Ensure you understand the coverage limits, deductibles, and any exclusions or limitations. Pay attention to the fine print to avoid surprises later.

3. Ask About Payment Options and Flexibility

Inquire about payment options and flexibility. Some insurers offer monthly or quarterly payment plans, while others may provide discounts for paying annually. Discuss any potential late fees or penalties to ensure you can manage your payments effectively.

4. Seek Professional Advice (if needed)

If you’re unsure about any aspect of the insurance policy or comparison process, consider seeking advice from an insurance professional or broker. They can provide expert guidance and help you make informed decisions based on your specific circumstances.

Monitoring and Adjusting Your Insurance Policy

Comparing car insurance isn’t a one-time task. It’s important to regularly monitor and adjust your policy to ensure you’re always getting the best coverage and value. Here’s how to stay on top of your insurance needs:

1. Review Your Policy Annually

Make it a habit to review your insurance policy annually. This allows you to assess if your coverage and premiums are still aligned with your needs and budget. It’s also an opportunity to explore new insurers or take advantage of any changes in your circumstances that may lead to lower premiums, such as a clean driving record or a new, safer vehicle.

2. Update Your Information

Keep your insurer informed of any changes in your personal or vehicle details. This includes changes in your address, marital status, or the addition of a new driver in your household. Failing to update your information can lead to inaccurate coverage or claims denials.

3. Shop Around Regularly

Don’t assume that your current insurer always offers the best rates. Regularly shop around and compare quotes to ensure you’re not overpaying. Insurance rates can change over time, and you might find better deals with other providers.

4. Stay Informed About Market Trends

Stay updated on insurance market trends and changes in regulations. This can impact the cost and availability of certain coverage options. Being aware of these changes can help you make informed decisions and take advantage of any opportunities that arise.

| Insurance Provider | Average Premium | Coverage Options |

|---|---|---|

| Provider A | $1,200 annually | Comprehensive, Collision, Liability |

| Provider B | $1,150 annually | Liability, Personal Injury Protection |

| Provider C | $1,350 annually | Full Coverage, Roadside Assistance |

What is the best way to get accurate car insurance quotes for comparison?

+

To get accurate car insurance quotes for comparison, provide detailed and accurate information about your vehicle, driving history, and desired coverage. Use reputable comparison websites and ensure you’re comparing policies with similar coverage levels. Additionally, consider speaking directly with insurance agents or brokers to get personalized quotes.

Are there any online tools to help me compare car insurance options quickly?

+

Yes, there are numerous online comparison tools and websites available. These platforms allow you to input your details once and receive multiple quotes from different insurers. Some popular options include InsuranceQuotes, TheZebra, and Compare.com. These tools can save you time and effort in the comparison process.

What should I do if I find a better car insurance deal after purchasing a policy?

+

If you find a better car insurance deal after purchasing a policy, contact your current insurer to see if they can match or beat the new offer. If they’re unable to do so, you can switch insurers. Ensure you understand the cancellation and transfer process, and be mindful of any fees or penalties associated with switching mid-policy.

How often should I compare car insurance rates to ensure I’m getting the best deal?

+

It’s recommended to compare car insurance rates annually or whenever there’s a significant change in your circumstances. This could include buying a new car, moving to a different area, or experiencing a change in your driving record. Regular comparisons ensure you’re always getting the most competitive rates and coverage.

What are some common discounts that can lower my car insurance premiums?

+

Common discounts that can lower your car insurance premiums include multi-policy discounts (bundling car and home insurance), safe driver discounts, student discounts, and loyalty discounts. Some insurers also offer discounts for vehicles equipped with safety features or for policyholders who maintain a good credit score.