Auto Home Insurance Bundle

The concept of bundling insurance policies is a strategic move by insurance providers to offer customers convenience, potential savings, and comprehensive coverage. When it comes to auto and home insurance, bundling these two policies together can provide significant benefits to policyholders. This article will delve into the intricacies of the Auto Home Insurance Bundle, exploring its advantages, how it works, and its impact on policyholders.

Understanding the Auto Home Insurance Bundle

An Auto Home Insurance Bundle, often referred to as a package policy or a multi-policy discount, is an insurance offering where an individual or household combines their auto insurance and home insurance (including renters or condo insurance) under one insurance provider. This bundling strategy is a popular approach for insurers to provide a streamlined and cost-effective solution for customers seeking coverage for their vehicles and properties.

By bundling these policies, insurers aim to simplify the insurance process for customers, offering a one-stop shop for all their insurance needs. This approach not only streamlines the insurance experience but also has the potential to result in significant cost savings for policyholders.

The Advantages of Bundling

There are several key advantages to opting for an Auto Home Insurance Bundle, which make it an appealing choice for many policyholders.

- Cost Savings: One of the most significant benefits of bundling is the potential for substantial savings. Insurers often offer discounts when customers combine multiple policies. These discounts can range from 5% to 25% or more, depending on the insurer and the specific policies involved. Over time, these savings can add up significantly, making bundling a cost-effective choice.

- Convenience: Bundling provides a convenient and efficient way to manage insurance policies. Policyholders have a single point of contact for all their insurance needs, making it easier to make payments, update policies, or file claims. This streamlined approach can save time and reduce the administrative burden of managing multiple insurance providers.

- Comprehensive Coverage: With an Auto Home Insurance Bundle, policyholders benefit from a comprehensive coverage package. This means that both their vehicles and properties are protected under one policy, providing a more cohesive and integrated approach to insurance. This can be especially beneficial for those with complex insurance needs or those who own multiple properties or vehicles.

- Tailored Policies: Many insurers offer customized bundles, allowing policyholders to tailor their coverage to their specific needs. This flexibility ensures that policyholders can choose the right level of coverage for their vehicles and properties, without paying for unnecessary extras. Customized bundles can provide a more personalized and cost-effective insurance solution.

How the Bundle Works

When a policyholder opts for an Auto Home Insurance Bundle, they are essentially combining two separate insurance policies into one comprehensive package. Here’s a breakdown of how the bundle typically works:

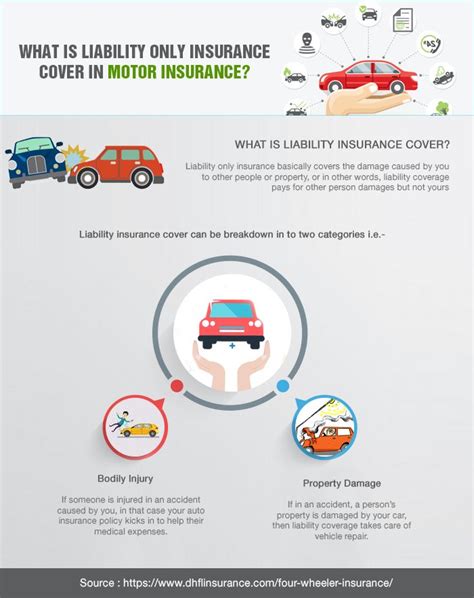

- Auto Insurance: This part of the bundle provides coverage for the policyholder's vehicles, including cars, trucks, motorcycles, and other motor vehicles. It typically includes liability coverage, collision coverage, comprehensive coverage, and additional options like rental car coverage or roadside assistance.

- Home Insurance: Depending on the policyholder's situation, this portion of the bundle can cover a range of property types. For homeowners, it provides coverage for their home and its contents, including protection against damage, theft, and liability claims. For renters or condo owners, it covers their personal belongings and provides liability protection.

- Bundling Discounts: When the two policies are combined, insurers often apply a discount to the overall premium. This discount is a reward for the policyholder's loyalty and for simplifying the insurer's administrative processes. The exact discount can vary depending on the insurer, the policies involved, and the policyholder's specific circumstances.

- Payment and Management: With a bundled policy, policyholders have the convenience of making a single payment for both their auto and home insurance. This payment can be made monthly, quarterly, or annually, depending on the policyholder's preference and the insurer's options. All policy management, including updates, renewals, and claims, can be handled through one insurer, making the process more efficient.

Performance and Real-World Impact

The Auto Home Insurance Bundle has proven to be a successful strategy for both insurers and policyholders. Insurers benefit from increased customer loyalty and reduced administrative costs, while policyholders enjoy the convenience and potential cost savings of a bundled policy.

Cost Savings in Action

The cost savings associated with bundling can be significant. For example, let’s consider a hypothetical scenario where a policyholder, John, opts for an Auto Home Insurance Bundle. John owns a home and two vehicles, and he currently pays 1,200 annually for his auto insurance and 800 for his home insurance, totaling $2,000 per year.

When John bundles his policies with a 15% discount, his new annual premium would be calculated as follows:

| Policy | Original Premium | Discounted Premium |

|---|---|---|

| Auto Insurance | $1,200 | $1,020 |

| Home Insurance | $800 | $680 |

| Total | $2,000 | $1,700 |

In this scenario, John saves $300 annually by bundling his policies, which adds up to significant savings over the long term.

Customer Satisfaction and Experience

The convenience and streamlined experience of an Auto Home Insurance Bundle have been well-received by policyholders. Many customers appreciate the simplicity of having one insurer for all their insurance needs, which can reduce confusion and make policy management more straightforward.

Additionally, the ability to customize the bundle to their specific needs has been a significant draw for policyholders. This customization ensures that they are not overpaying for coverage they don't need, further enhancing the value proposition of the bundle.

Future Implications and Considerations

As the insurance industry continues to evolve, the Auto Home Insurance Bundle is likely to remain a popular offering. Insurers will continue to refine and enhance their bundle options to meet the changing needs and expectations of policyholders.

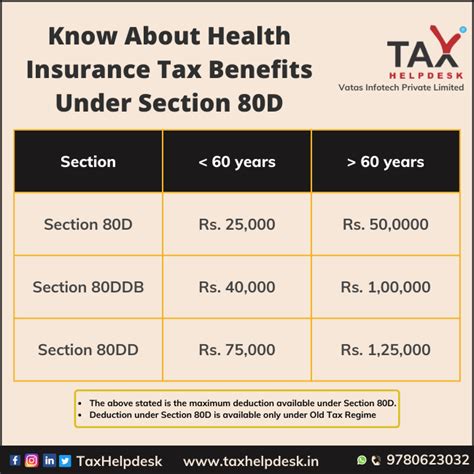

Expanding Bundle Options

Insurers may explore expanding their bundle offerings to include additional policies, such as life insurance, health insurance, or even specialty policies like pet insurance. By offering a more comprehensive range of bundled options, insurers can provide even greater convenience and cost savings to policyholders.

Digital Transformation

The digital transformation of the insurance industry is another factor that will impact the future of insurance bundles. Insurers are increasingly leveraging technology to streamline the insurance process, from policy procurement to claims management. Digital platforms and mobile apps can further enhance the convenience and efficiency of managing bundled policies, making the insurance experience even more seamless for policyholders.

Personalized Insurance

The future of insurance is moving towards more personalized and tailored coverage. Insurers will continue to develop sophisticated algorithms and data analytics to offer policyholders highly customized insurance solutions. This level of personalization can further enhance the value proposition of bundles, ensuring that policyholders receive coverage that is precisely tailored to their needs.

Conclusion

The Auto Home Insurance Bundle is a strategic and appealing offering for both insurers and policyholders. It provides a convenient, cost-effective, and comprehensive insurance solution, making it an attractive choice for those seeking to simplify their insurance experience. As the insurance industry continues to evolve, the Auto Home Insurance Bundle is likely to remain a cornerstone offering, providing value and peace of mind to policyholders.

FAQ

Can I customize my Auto Home Insurance Bundle to include additional coverage options?

+

Yes, many insurers offer customization options for their Auto Home Insurance Bundles. You can typically add additional coverage options such as rental car coverage, roadside assistance, or specialty policies like pet insurance. This allows you to create a bundle that meets your specific needs and provides comprehensive coverage.

How often do I need to review and update my Auto Home Insurance Bundle?

+

It’s a good practice to review your insurance bundle annually or whenever your circumstances change significantly. Life events such as buying a new home, getting married, or having children can impact your insurance needs. Regular reviews ensure that your bundle remains up-to-date and provides the coverage you require.

What happens if I need to file a claim under my Auto Home Insurance Bundle?

+

If you need to file a claim under your Auto Home Insurance Bundle, you can typically contact your insurer through a single point of contact. They will guide you through the claims process, which may involve providing documentation and assessing the damage. It’s important to review your policy’s terms and conditions to understand the claims process and any potential limitations or exclusions.