Rental Car Insurance United States

When it comes to traveling within the United States, renting a car is often a convenient and flexible option. However, navigating the world of rental car insurance can be a daunting task for many travelers. With various coverage options, additional fees, and specific state regulations, understanding rental car insurance is crucial to ensure a smooth and stress-free journey. In this comprehensive guide, we will delve into the intricacies of rental car insurance in the United States, offering valuable insights and expert advice to help you make informed decisions.

Understanding Rental Car Insurance

Rental car insurance provides financial protection in the event of an accident or damage to the rental vehicle. It serves as a safety net, ensuring that you are not personally responsible for covering the costs of repairs or any other related expenses. While many travelers assume that their personal auto insurance policies will cover rental cars, the reality is often more complex. Rental car companies typically offer their own insurance packages, which can be quite expensive, leading many to seek alternative options.

The insurance landscape for rental cars in the United States can be divided into several key components: Liability Coverage, Collision Damage Waiver (CDW), Loss Damage Waiver (LDW), and Personal Effects Coverage. Let's explore each of these in detail.

Liability Coverage

Liability coverage is a critical aspect of rental car insurance, as it protects you from claims made by others in the event of an accident. This coverage is essential, as it safeguards your personal assets from being used to settle any damages or injuries sustained by third parties. Most states in the US require a minimum level of liability coverage, which typically includes bodily injury liability and property damage liability.

| Bodily Injury Liability | Property Damage Liability |

|---|---|

| Covers medical expenses and compensation for injuries caused to others. | Provides coverage for damage to someone else's property, including their vehicle. |

It is important to note that liability coverage does not protect your rental car. Therefore, it is often advisable to supplement it with additional insurance options to ensure comprehensive protection.

Collision Damage Waiver (CDW) and Loss Damage Waiver (LDW)

Collision Damage Waiver (CDW) and Loss Damage Waiver (LDW) are similar coverage options that waive your financial responsibility for damage to the rental car. These waivers essentially act as a form of insurance, protecting you from paying out-of-pocket for repairs or replacement costs in the event of an accident or theft. While CDW and LDW may have slight variations in their terms and conditions, they both provide essential protection for your rental vehicle.

| CDW/LDW Coverage | Description |

|---|---|

| Waives your responsibility for damage to the rental car | In the event of an accident or theft, you won't be held financially liable for repairs or replacement. |

| Exclusions | May not cover certain types of damage, such as windshield cracks or damage to the vehicle's undercarriage. |

Personal Effects Coverage

Personal Effects Coverage, often offered as an add-on to rental car insurance packages, provides protection for your personal belongings in the event of theft or damage. This coverage is particularly valuable if you plan to carry valuable items, such as electronics or jewelry, in the rental car. While standard auto insurance policies may provide limited coverage for personal belongings, rental car companies often offer enhanced protection through this add-on.

Evaluating Your Insurance Needs

Assessing your insurance needs is a crucial step in determining the most suitable coverage for your rental car journey. Several factors come into play when evaluating your options, including your personal auto insurance policy, credit card benefits, and the specific rental car company’s policies.

Personal Auto Insurance

If you have a personal auto insurance policy, it may provide some level of coverage for rental cars. However, the extent of this coverage varies widely depending on your policy’s terms and conditions. It is essential to carefully review your personal auto insurance policy to understand the scope of its coverage, any potential limitations, and any necessary add-ons or endorsements to ensure adequate protection for rental cars.

Credit Card Benefits

Many credit card companies offer rental car insurance benefits as part of their rewards programs or premium card offerings. These benefits can provide valuable coverage, often including CDW and LDW, at no additional cost to you. However, it is crucial to understand the limitations and restrictions of these benefits. Some credit card insurance covers only specific rental car companies or certain types of vehicles, while others may have daily rental duration limits.

To maximize the benefits of your credit card insurance, consider the following:

- Check your credit card's insurance policy details, including any exclusions and limitations.

- Ensure that your rental car company and vehicle type are covered by the credit card insurance.

- Verify the daily rental duration limit and plan your rental period accordingly.

- Consider purchasing supplemental coverage if your credit card insurance has significant limitations.

Rental Car Company Policies

Rental car companies typically offer their own insurance packages, which can be quite comprehensive but often come at a significant cost. These packages may include liability coverage, CDW or LDW, and additional options such as personal accident insurance or personal effects coverage. It is essential to review the rental car company’s insurance policies and compare them with your personal auto insurance and credit card benefits to make an informed decision.

Cost-Effective Strategies

Rental car insurance can be a significant expense, especially if you opt for the rental company’s comprehensive insurance package. However, there are several cost-effective strategies you can employ to reduce your insurance costs without compromising on coverage.

Negotiating with the Rental Company

Many rental car companies offer discounts or waive certain fees if you negotiate with them. By asking for discounts or upgrades, you may be able to secure a better deal on your rental car insurance. Additionally, some companies may offer loyalty programs or membership benefits that provide exclusive insurance rates or waivers.

Using Prepaid Rental Car Insurance

Prepaid rental car insurance, also known as non-refundable insurance, is an option offered by some travel insurance companies and online platforms. This type of insurance is purchased in advance and provides coverage for a specific rental period. While it may not be as flexible as traditional insurance policies, prepaid insurance can be a cost-effective option, especially if you have a fixed travel itinerary.

Purchasing Stand-Alone Rental Car Insurance

Stand-alone rental car insurance policies are specialized insurance products designed specifically for rental cars. These policies can be purchased from insurance companies or travel insurance providers and often provide comprehensive coverage at a competitive price. By comparing quotes from different providers, you can find a policy that suits your needs and budget.

State-Specific Regulations

When renting a car in the United States, it is crucial to be aware of the specific regulations and requirements in the state where you will be driving. Each state has its own set of laws and guidelines regarding liability coverage, insurance requirements, and additional regulations that may impact your rental car insurance decisions.

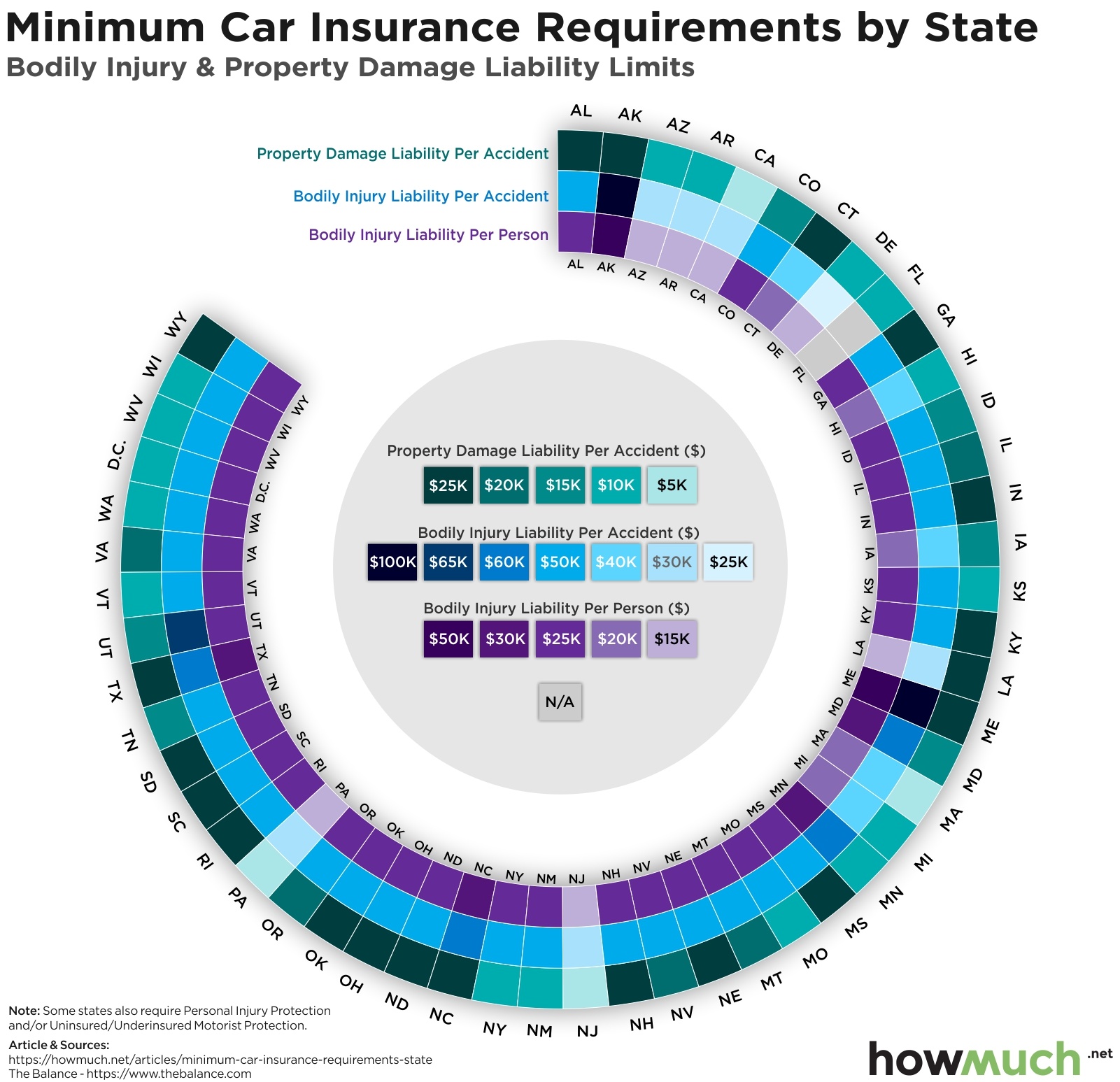

State-by-State Liability Coverage

The minimum liability coverage requirements vary across different states. While some states mandate relatively low limits, others require higher coverage amounts. Understanding the specific liability coverage requirements in your destination state is essential to ensure compliance and adequate protection.

| State | Minimum Liability Coverage |

|---|---|

| California | 15/30/5 (Bodily Injury/Property Damage) |

| New York | 25/50/10 (Bodily Injury/Property Damage) |

| Texas | 30/60/25 (Bodily Injury/Property Damage) |

| ... | ... |

Note: This table provides a snapshot of liability coverage requirements in a few states. For a comprehensive understanding, refer to the official insurance guidelines of your destination state.

Additional State Regulations

Apart from liability coverage, some states have specific regulations regarding rental car insurance. For instance, certain states may require rental car companies to offer additional insurance options, such as Personal Injury Protection (PIP) or Uninsured Motorist Coverage (UMC). Understanding these regulations can help you make informed decisions about the coverage you need.

Tips for a Smooth Rental Car Experience

Navigating the world of rental car insurance can be complex, but with careful planning and a few expert tips, you can ensure a smooth and stress-free rental car experience.

Document Your Decisions

Keep a record of all your insurance decisions, including any waivers or additional coverages you purchase. This documentation will be invaluable in case of any disputes or misunderstandings. Take photographs or screenshots of your insurance policy details and keep them readily accessible during your trip.

Inspect the Vehicle Thoroughly

Before accepting the rental car, conduct a thorough inspection of the vehicle. Look for any pre-existing damage, both interior and exterior, and document it with photographs. This step is crucial to avoid being held responsible for damage that occurred before your rental period.

Understand the Fine Print

Read the rental agreement carefully, paying close attention to the insurance section. Understand the terms and conditions, including any exclusions or limitations. If you have any doubts or questions, don’t hesitate to seek clarification from the rental car company’s customer service representatives.

Consider the Rental Car Company’s Reputation

Research the rental car company’s reputation and customer reviews before making a reservation. A reputable company is more likely to have fair and transparent insurance policies and provide better customer service in case of any issues.

Future Trends and Innovations

The rental car industry is continuously evolving, and insurance offerings are no exception. As technology advances and consumer preferences shift, we can expect to see several trends and innovations shaping the future of rental car insurance.

Digitalization and Automation

The rental car industry is increasingly embracing digitalization and automation. This trend is expected to continue, with more rental car companies adopting online booking platforms, self-service kiosks, and digital rental agreements. These advancements can streamline the insurance process, making it more efficient and convenient for customers.

Enhanced Personalization

Rental car companies are recognizing the importance of personalized insurance offerings. In the future, we can expect to see more tailored insurance packages that cater to specific customer needs and preferences. This could include customized coverage options, flexible payment plans, and personalized customer support.

Incorporating Telematics

Telematics, the use of technology to track and analyze vehicle data, is gaining traction in the rental car industry. Rental car companies may start incorporating telematics devices into their vehicles, allowing them to monitor driving behavior and offer dynamic insurance rates based on individual driving patterns. This could incentivize safer driving and reduce insurance costs for responsible drivers.

Partnerships and Integrations

Rental car companies are exploring partnerships with insurance providers and technology companies to enhance their insurance offerings. These collaborations could lead to more integrated insurance solutions, seamless claim processes, and improved customer experiences.

Conclusion

Rental car insurance in the United States is a complex yet crucial aspect of travel planning. By understanding the different coverage options, evaluating your insurance needs, and implementing cost-effective strategies, you can navigate the rental car insurance landscape with confidence. Remember to stay informed about state-specific regulations and leverage the latest trends and innovations to ensure a smooth and enjoyable rental car experience.

What is the average cost of rental car insurance in the United States?

+

The average cost of rental car insurance varies depending on several factors, including the rental car company, the duration of the rental, and the specific coverage options chosen. As a general estimate, you can expect to pay anywhere from 10 to 30 per day for basic liability coverage and additional waivers like CDW or LDW. However, these costs can vary significantly based on your location, the type of vehicle, and any add-on coverages you select.

Can I rely solely on my personal auto insurance for rental car coverage?

+

The level of coverage provided by your personal auto insurance for rental cars depends on your policy’s terms and conditions. While some policies may offer comprehensive coverage, others may have limitations or exclusions for rental cars. It is crucial to carefully review your personal auto insurance policy and, if necessary, consider purchasing additional rental car insurance to ensure adequate protection.

Are there any alternatives to rental car company insurance packages?

+

Yes, there are several alternatives to rental car company insurance packages. You can explore options such as prepaid rental car insurance, stand-alone rental car insurance policies from insurance providers, or utilize the benefits offered by your credit card’s rental car insurance coverage. Each option has its own advantages and limitations, so it’s important to compare and choose the one that best suits your needs and budget.

What should I do if I’m involved in an accident with a rental car?

+

If you’re involved in an accident with a rental car, it’s crucial to remain calm and follow these steps: first, ensure the safety of all involved parties; second, contact the police and file a report; third, notify the rental car company immediately; and fourth, take detailed notes and photographs of the accident scene, including any visible damage to the vehicles involved. These steps will help facilitate the insurance claim process and ensure a smoother resolution.