Easy Car Insurance

Finding affordable car insurance can be a daunting task, especially when you're faced with a multitude of options and complex terminology. However, with the right knowledge and a strategic approach, securing easy car insurance that meets your needs and budget is entirely achievable. In this comprehensive guide, we will delve into the world of car insurance, providing you with expert insights, real-world examples, and practical tips to navigate the process seamlessly. From understanding the basics to comparing quotes and making informed decisions, we'll ensure you're equipped with the tools to secure the best coverage at the most competitive rates.

Understanding the Fundamentals of Car Insurance

At its core, car insurance is a contract between you and an insurance provider. It offers financial protection against various risks and potential losses associated with owning and operating a vehicle. These risks can range from accidents and theft to damage caused by natural disasters or vandalism. By purchasing car insurance, you gain peace of mind, knowing that you’re covered for a wide range of unforeseen circumstances.

The specific types of coverage you require will depend on several factors, including your location, the make and model of your vehicle, and your personal preferences. Here's a breakdown of the key components of a typical car insurance policy:

Liability Coverage

Liability coverage is a fundamental aspect of car insurance, as it protects you from financial losses if you’re found legally responsible for causing damage or injury to others while driving. This coverage typically includes bodily injury liability, which covers medical expenses and lost wages for injured parties, and property damage liability, which covers the cost of repairing or replacing damaged property.

Most states have minimum liability requirements, but it's often advisable to opt for higher limits to provide more comprehensive protection. For instance, a state's minimum liability coverage might be $25,000, but increasing it to $100,000 or even $300,000 can offer significantly better protection in the event of a serious accident.

Collision and Comprehensive Coverage

Collision and comprehensive coverage are two additional types of car insurance that provide protection for your own vehicle. Collision coverage covers damages to your car resulting from collisions with other vehicles or objects, while comprehensive coverage protects against a wider range of non-collision incidents, such as theft, vandalism, fire, or damage caused by natural disasters.

While these coverages are optional, they are highly recommended, especially if you have a loan or lease on your vehicle. They ensure that you're not left with a hefty repair or replacement bill in the event of an unexpected incident.

Other Optional Coverages

Depending on your specific needs and circumstances, there are several other types of car insurance coverage you may consider adding to your policy. These include:

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Provides protection if you're involved in an accident with a driver who has little or no insurance.

- Rental Car Reimbursement: Offers coverage for rental car expenses if your vehicle is being repaired due to a covered incident.

- Gap Insurance: Covers the difference between the actual cash value of your vehicle and the amount you still owe on your loan or lease.

Assessing Your Insurance Needs

Before diving into the world of car insurance quotes, it’s crucial to assess your specific needs and circumstances. This will help you determine the type and level of coverage that’s right for you. Consider the following factors:

Vehicle Value and Usage

The make, model, and age of your vehicle play a significant role in determining your insurance rates. Newer, more expensive vehicles generally cost more to insure due to their higher replacement value and more advanced features. Additionally, the purpose for which you use your vehicle can impact your insurance needs. If you primarily use your car for commuting or personal travel, your insurance requirements may differ from someone who frequently drives for work or pleasure.

Driving History and Record

Your driving history is a critical factor in determining your insurance rates. A clean driving record with no accidents or violations typically results in lower premiums. On the other hand, if you have a history of accidents or traffic violations, you may face higher insurance costs. It’s essential to be transparent about your driving record when obtaining quotes, as any discrepancies could lead to issues with your coverage.

Financial Considerations

Your financial situation and budget play a significant role in determining the type and level of car insurance coverage you choose. While it may be tempting to opt for the cheapest option, it’s important to strike a balance between affordability and adequate coverage. Consider your ability to pay out-of-pocket expenses in the event of an accident or claim, and choose a deductible that aligns with your financial comfort level.

State-Specific Requirements

Car insurance regulations and requirements vary from state to state. Some states have mandatory minimum liability limits, while others may require additional coverages, such as personal injury protection (PIP) or uninsured motorist coverage. Familiarize yourself with your state’s specific requirements to ensure you’re meeting all necessary criteria.

Researching and Comparing Insurance Providers

With a solid understanding of your insurance needs, it’s time to start researching and comparing different insurance providers. This step is crucial as it allows you to find the best coverage at the most competitive rates. Here’s how to approach this process effectively:

Online Quotes and Comparison Tools

Start by obtaining quotes from multiple insurance providers using online comparison tools. These tools allow you to enter your information once and receive quotes from several insurers, making it easier to compare rates and coverage options. Be sure to provide accurate and detailed information to ensure you’re getting precise quotes.

Independent Insurance Agents

Consider working with an independent insurance agent who represents multiple insurance companies. These agents can provide valuable insights and guidance, helping you navigate the complex world of car insurance. They can also shop around on your behalf to find the best coverage and rates from a variety of insurers.

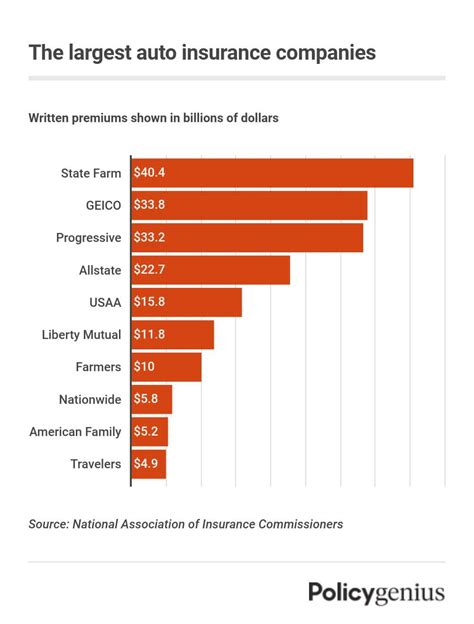

Review Insurance Company Ratings and Reviews

Before committing to an insurance provider, take the time to research their reputation and customer satisfaction. Check reputable review websites and consumer advocacy groups to gather insights into the company’s claims handling process, customer service, and overall satisfaction levels. This step is crucial, as it can provide valuable information about the insurer’s reliability and trustworthiness.

Consider Bundle Discounts and Loyalty Programs

If you have multiple insurance needs, such as home, renters, or life insurance, consider bundling your policies with the same insurer. Many providers offer significant discounts when you combine multiple policies, making it a cost-effective option. Additionally, inquire about loyalty programs or discounts for long-term customers, as these can further reduce your insurance premiums over time.

Obtaining and Evaluating Quotes

Once you’ve narrowed down your list of potential insurance providers, it’s time to obtain detailed quotes and evaluate them thoroughly. This step requires careful consideration of various factors to ensure you’re making an informed decision.

Understand the Coverage Details

When reviewing quotes, pay close attention to the specific coverage details. Ensure that the quoted policies align with your assessed needs and provide the necessary protection. Compare the limits and deductibles to understand the extent of coverage and your financial responsibility in the event of a claim.

Compare Premiums and Payment Options

Compare the annual or monthly premiums offered by each insurer. Consider whether you prefer to pay your premiums annually, semi-annually, or monthly. Some insurers offer discounts for paying in full, while others provide flexible payment plans. Choose the payment option that best suits your financial situation and preferences.

Inquire About Discounts and Special Offers

Don’t hesitate to ask about any available discounts or special offers. Many insurers offer discounts for safe driving records, certain occupations, or vehicle safety features. Additionally, inquire about loyalty discounts or promotions for new customers. These discounts can significantly reduce your insurance premiums, so it’s worth exploring all available options.

Assess the Claims Process and Customer Service

The claims process and customer service of an insurance provider are crucial factors to consider. Research the insurer’s reputation for handling claims efficiently and fairly. Look for reviews and testimonials from past customers to gauge their satisfaction with the claims process. Additionally, consider the accessibility and responsiveness of the insurer’s customer service team, as prompt and reliable support can make a significant difference during times of need.

Finalizing Your Car Insurance Decision

After careful evaluation and comparison, it’s time to make your final decision and secure your car insurance coverage. Here’s a step-by-step guide to ensure a smooth and stress-free process:

Review and Understand the Policy

Before finalizing your decision, carefully review the policy documents provided by your chosen insurer. Ensure that all the coverage details, limits, and deductibles match your expectations and needs. Pay close attention to any exclusions or limitations that may apply to your policy.

Compare the Policy with Other Quotes

Take one last look at the quotes you obtained from other insurers. Compare the coverage, premiums, and any additional benefits or discounts offered. This final comparison will help ensure that you’re making the best decision for your specific circumstances.

Read the Fine Print

Don’t skip the fine print! Carefully read through the policy documents to understand any clauses, conditions, or exclusions that may impact your coverage. This step is crucial to avoid any unexpected surprises or discrepancies in the future.

Choose the Right Payment Method

Select the payment method that aligns with your financial preferences and budget. Consider whether you want to pay your premiums annually, semi-annually, or monthly. Some insurers offer flexible payment plans or discounts for certain payment methods, so choose the option that provides the best value and convenience for you.

Secure Your Policy and Enjoy Peace of Mind

Once you’ve made your decision, finalize your car insurance policy by providing the necessary information and making the initial payment. Rest assured that you’ve taken a significant step towards protecting your vehicle, yourself, and others on the road. With the right coverage in place, you can drive with confidence, knowing that you’re prepared for any unexpected incidents.

Frequently Asked Questions

How much does car insurance typically cost?

+The cost of car insurance varies significantly based on factors such as your location, driving history, vehicle type, and coverage choices. On average, drivers can expect to pay anywhere from 500 to 1,500 per year for basic liability coverage. However, comprehensive coverage and additional options can increase the cost significantly. It’s essential to obtain multiple quotes and compare them to find the best value for your specific situation.

What factors impact car insurance rates?

+Several factors influence car insurance rates, including your age, gender, marital status, driving record, credit score, and the make and model of your vehicle. Additionally, the state you reside in and the coverage options you choose play a significant role in determining your insurance premiums. It’s important to review these factors when obtaining quotes to ensure an accurate assessment of your insurance costs.

Can I get car insurance without a driver’s license?

+Obtaining car insurance without a valid driver’s license can be challenging, as most insurers require proof of a valid license to provide coverage. However, some insurers may offer limited coverage options for individuals who do not have a license, such as comprehensive and collision coverage for the vehicle itself. It’s best to consult with insurance providers to understand their specific requirements and explore potential options.

How can I save money on car insurance?

+There are several strategies to save money on car insurance, including shopping around for quotes, bundling policies with the same insurer, maintaining a clean driving record, and exploring discounts for safe driving, good student status, or vehicle safety features. Additionally, consider increasing your deductible or adjusting your coverage limits to find the right balance between affordability and adequate protection.

What should I do if I’m involved in an accident?

+If you’re involved in an accident, it’s crucial to remain calm and follow these steps: Ensure the safety of yourself and others involved, call the police to report the accident, exchange contact and insurance information with the other party, and notify your insurance company as soon as possible. Provide accurate and detailed information to your insurer to initiate the claims process and receive the necessary assistance.